Vertigo3d

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on August 4th, 2022.

I’ve been one of the authors that have been pretty consistently covering Eaton Vance Tax-Advantaged Global Dividend Income Fund (NYSE:ETG). I’ve either been bullish on the name or fairly neutral. After all these years, I have to say that I’m fairly cautious about ETG going forward. The reason being is the valuation.

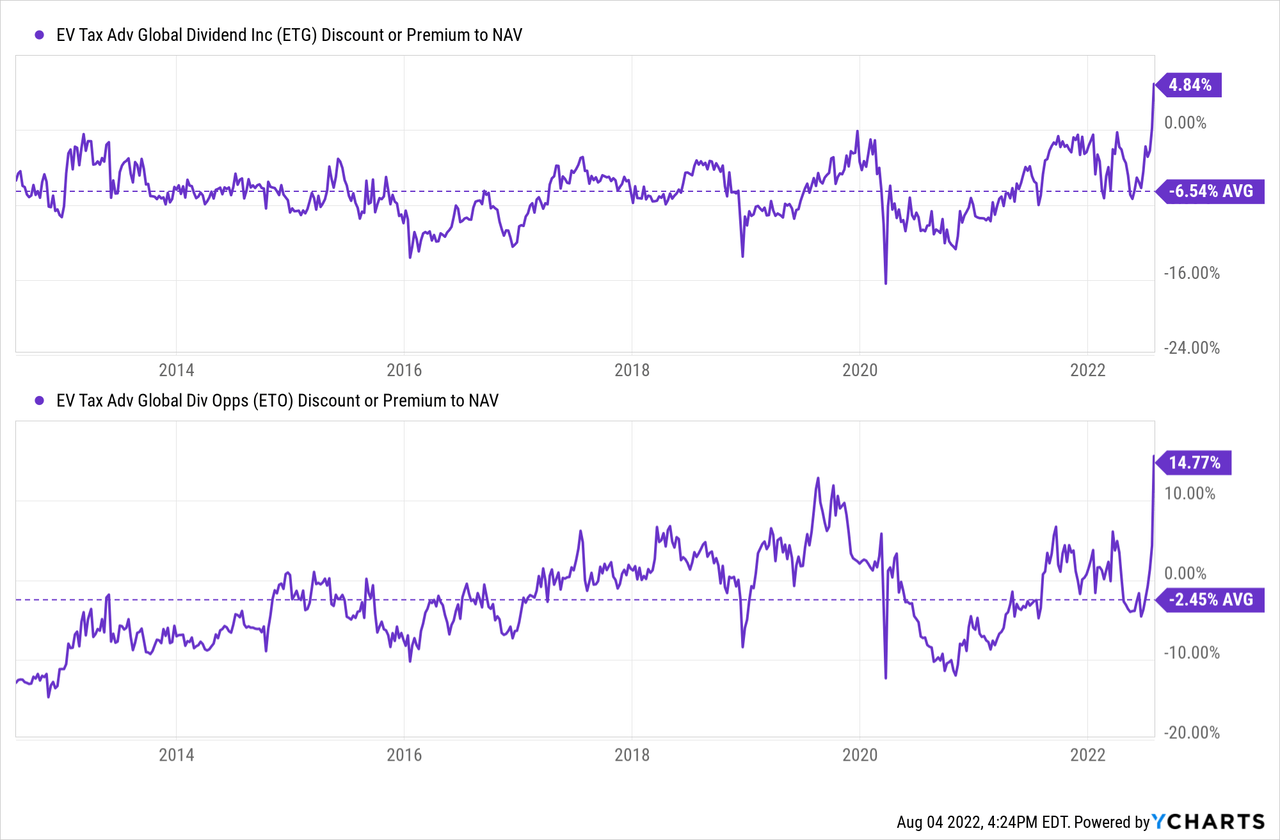

Since my last post only a few months ago, the fund traded lower before blasting higher. Unfortunately, in this case, some of the increase was the fund going from a discount to a premium. It wasn’t actually a strong performance in the underlying portfolio. The fund was at a 6.26% discount when that article was posted. As of August 3rd, 2022, the fund closed at a 4.84% premium.

ETG Performance (Seeking Alpha)

This fund has traded at a discount since it launched. There was a small premium shortly after the inception of the fund. This is an older fund, so back in that time, the fund would launch and the expenses to launch the fund would be taken out of the net asset value.

That means the fund launched at a $20 share price, but the NAV per share on the first day was $19.10. Not a great situation for a closed-end fund to be in. Thankfully, this practice has ended with CEFs around 2018 to today launching with the fund sponsors covering the expenses.

TINA And Overall Market Slump

All of this being said, I’m not planning on cutting this fund out of my portfolio.

At this point, I realize I’m being pretty hypocritical. I’ve made comments in the past about “letting valuation guide your investing.” So I think it’s only fair that I discuss why this time is a bit different and explain myself.

One of the reasons is that “there is no alternative.” It has a sister fund that is quite similar. That is the Eaton Vance Tax-Advantaged Global Dividend Opportunity Fund (ETO). However, that fund is at an even more outrageous premium.

Ycharts

Both of these funds are well above their decade-long average discounts. ETO is more egregiously above its average than ETG, even factoring that ETO often trades at a shallow discount.

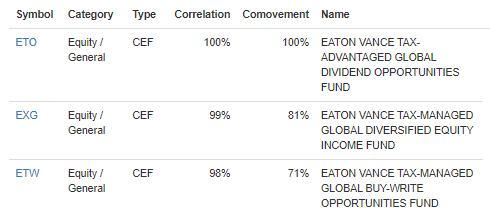

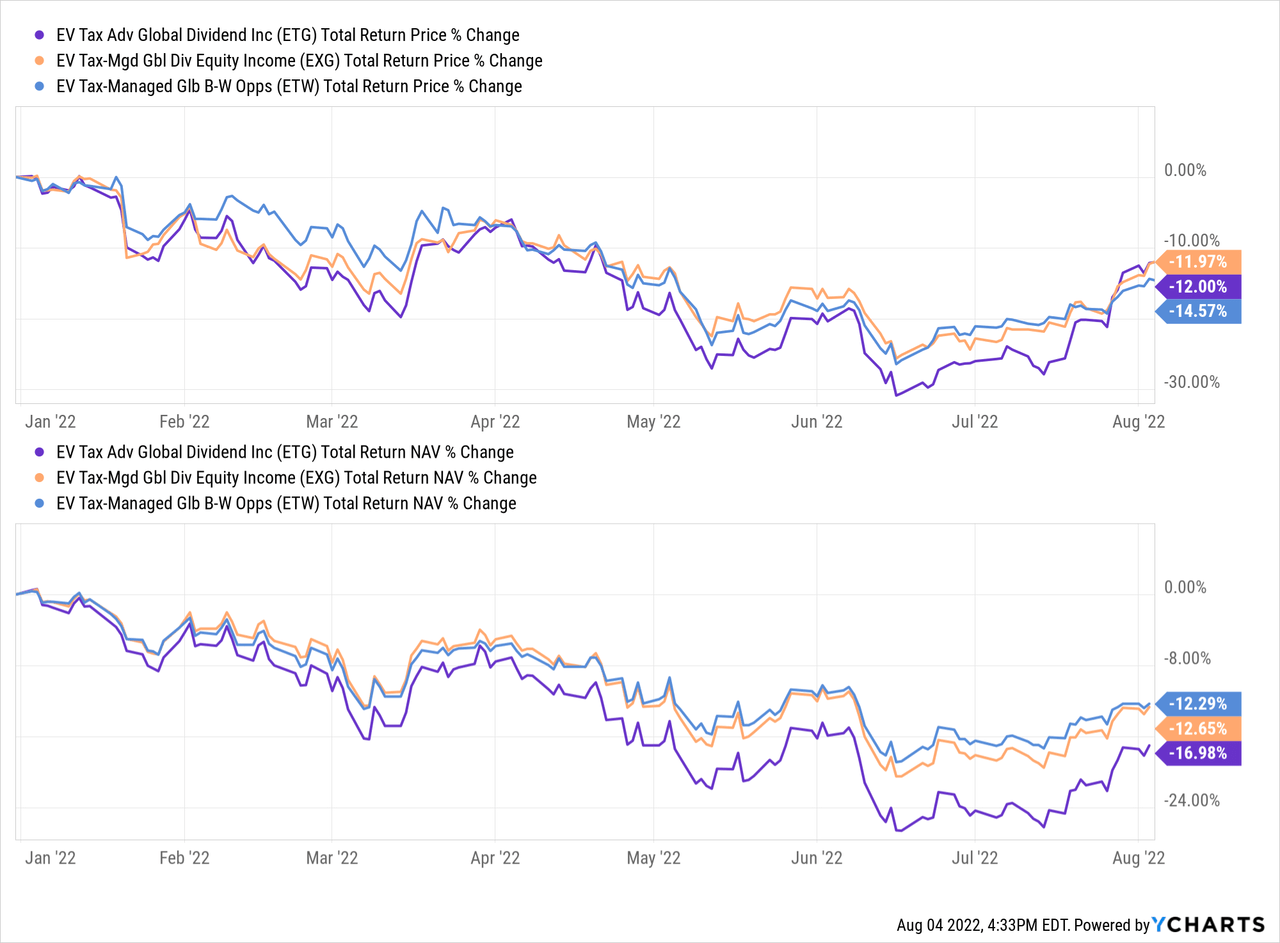

There are a couple of other funds that have shown a higher correlation. Eaton Vance Tax-Managed Global Diversified Equity Income Fund (EXG) and Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund (ETW). However, despite the higher correlation of these funds, they have performed worse over the longer run.

ETG Correlation (CEFAnalyzer)

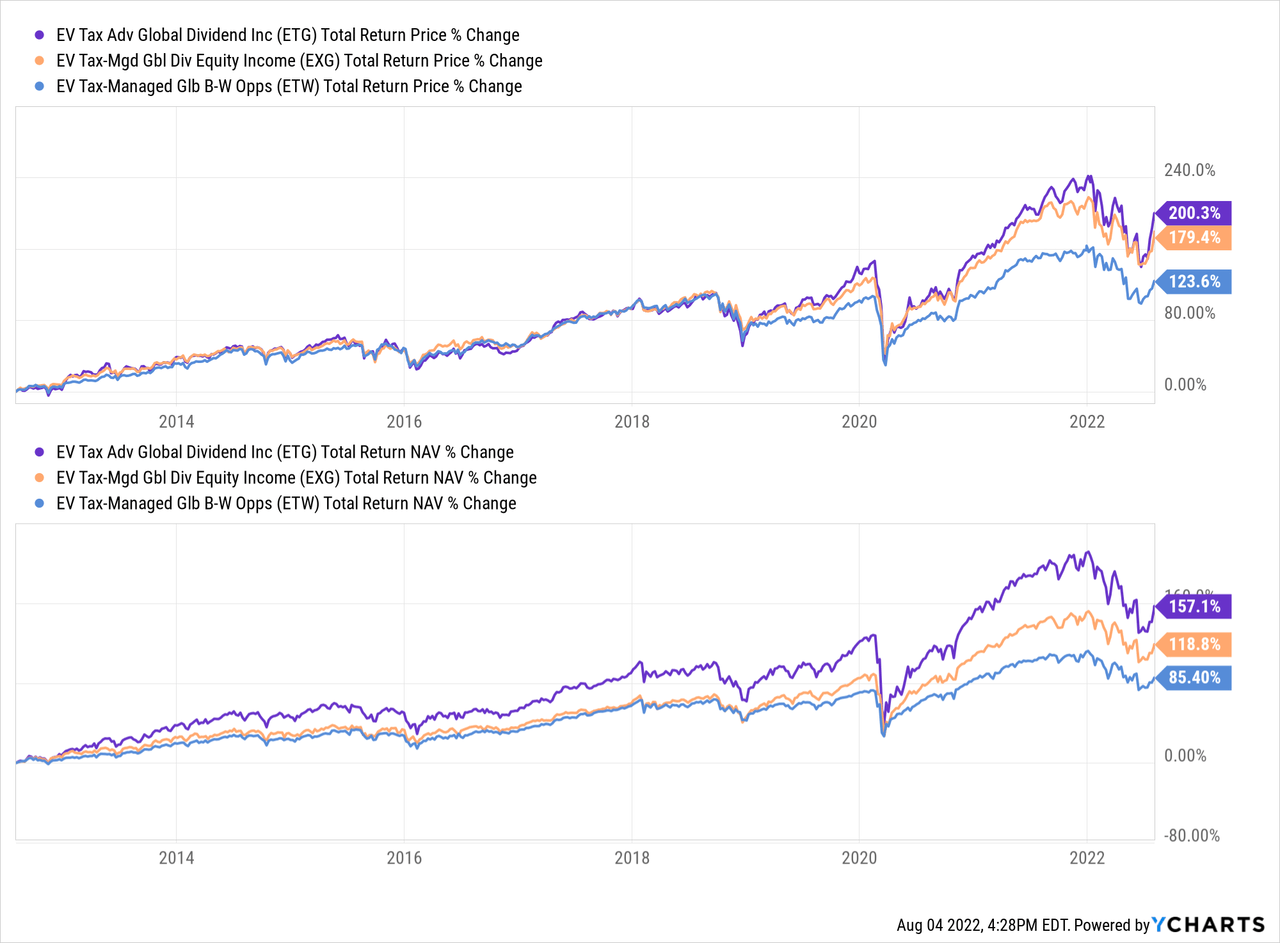

The primary reason for this is the fact that ETG (as well as ETO) are leveraged funds. These sister funds that also carry a global tilt are index option writing funds. In a bull market, options funds will tend to lag their counterparts but can also provide some benefits in a sideways market. In a sideways market, they can still generate capital gains by collecting option premiums.

Ycharts

Therefore, as we see above in the performance, the outcomes can differ between the funds quite materially. The leverage has paid off in the strong bull market, where most years in the last decade have been up. If we look at more recent performance, it hasn’t performed as well in the bear market as we would expect.

Here’s a look on a YTD basis.

Ycharts

That brings me to the other reason why I’m still holding onto the fund. Despite the fund’s premium, stocks are still down fairly significantly on a YTD basis. I think that the returns going forward could be more muted from ETG. They could even be negative if the fund reverts back to its historical average discount, and that would happen even if equities stay flat from here.

However, if the market continues to rally from here since we basically have from June, then ETG can still provide fairly attractive returns. That isn’t to say that this isn’t a bear market rally, and things could reverse again. However, it was a different overall situation in the markets. In the article about letting valuation guide your investing, the market was in bull mode. Now, I want to stay invested while prices are lower.

If Not Now, When? And What?

Even though ETG is a core position for me, there would be a point when I would consider selling the fund. If it continues to push to a higher premium, such as a 10% or more level, I would consider shifting into a different fund – it would be temporary until ETG’s valuation came back down to earth. The first places I’d look at are those already mentioned, ETO, EXG and ETW.

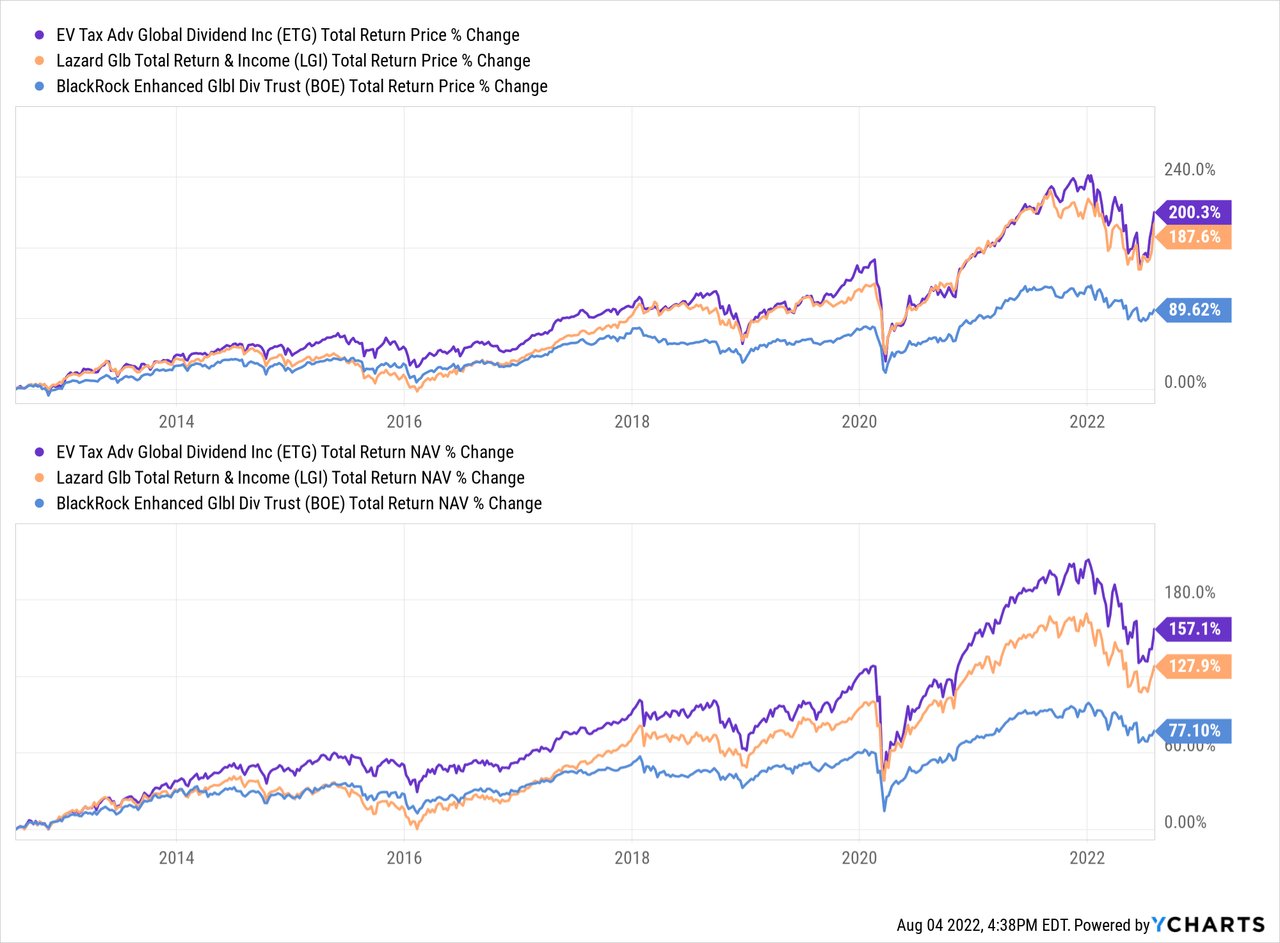

Some other alternatives could include Lazard Global Total Return and Income (LGI) or BlackRock Enhanced Global Dividend Trust (BOE). BOE and ETW are names I already own, for the record.

In this case, we once again see that historically LGI and BOE have been inferior. Past performance is no guarantee of future returns, as is always said. However, there is a pretty clear track record that ETG is a consistent performer.

Ycharts

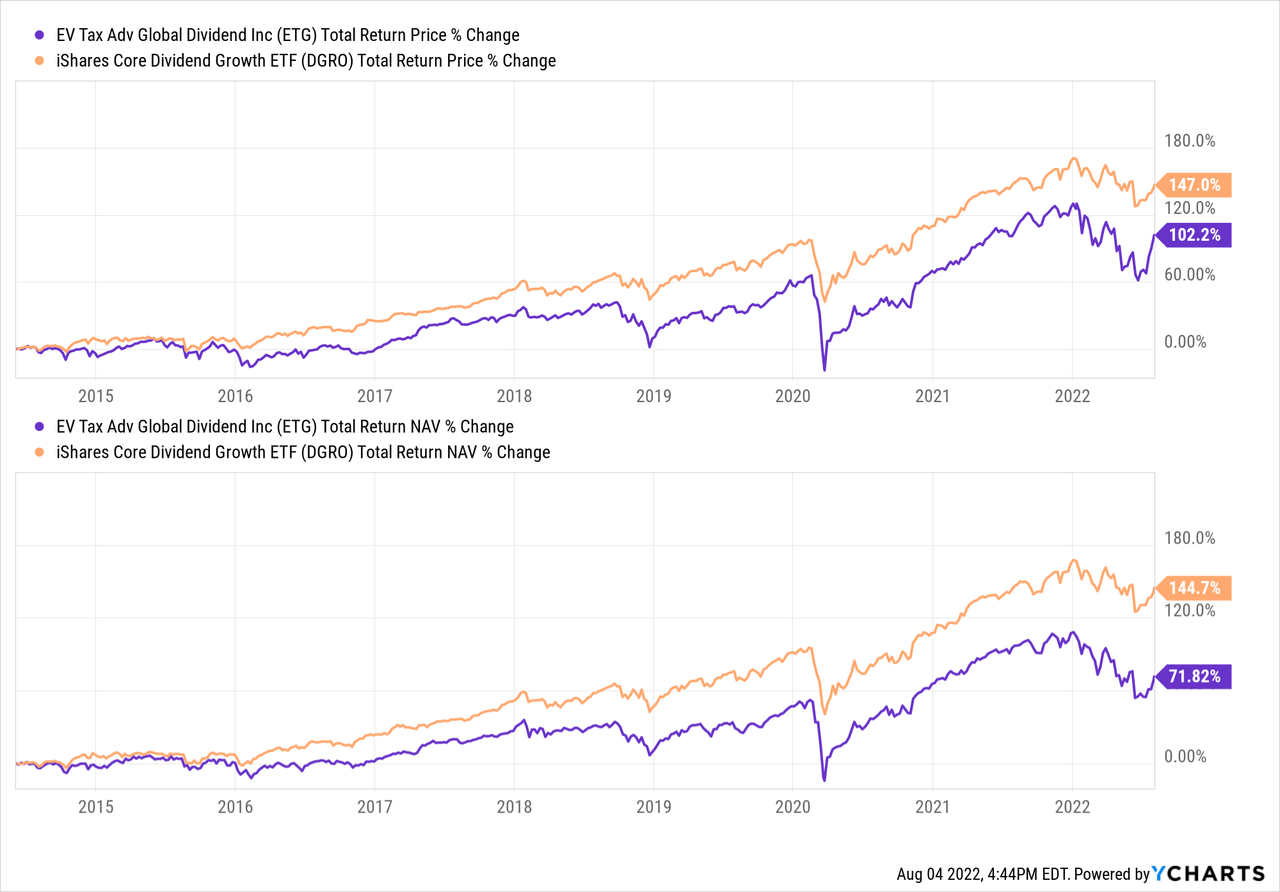

Another consideration would be simply going the ETF route. I have done this in the past when funds get too egregiously priced, and I can’t decide where to move the capital. In the case of ETFs, they trade almost with no discounts or premiums in most cases. This, too, would be a temporary shelter if the fund starts pushing into the 10%+ premium area.

iShares Core Dividend Growth ETF (DGRO). This is a name I also already hold a position in. In this case, I would lose out on the global exposure that ETG carries. However, over the longer run, it has shown that DGRO has outperformed ETG since DGRO’s launch in June of 2014.

Ycharts

This performance isn’t too much of a surprise for a couple of reasons. First, DGRO has no global exposure. Over the last decade, U.S. stocks have outperformed quite significantly. This is a discussion we’ve had many times, with the latest in a recent article on BOE itself.

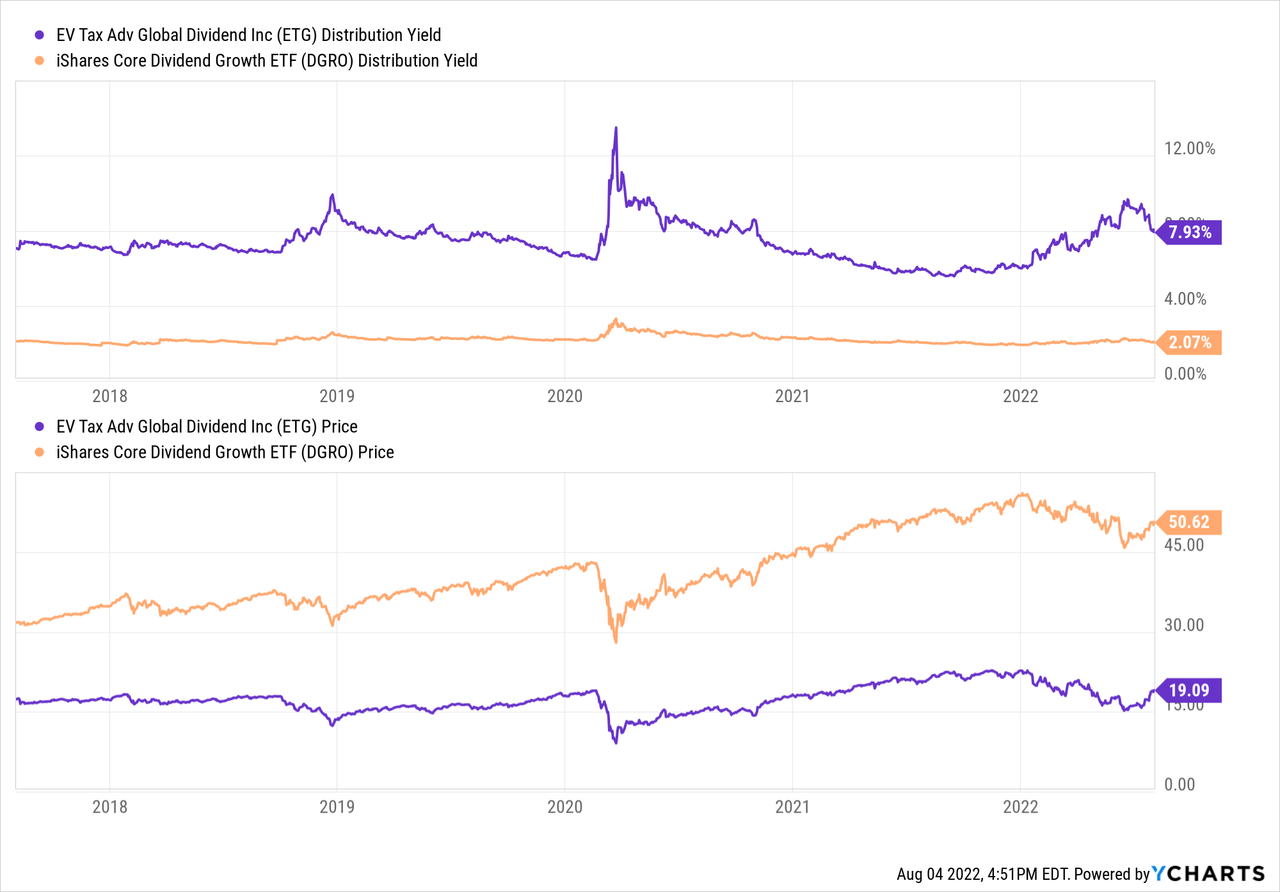

Additionally, ETG is an income vehicle, and DRGO is an income and growth vehicle. This is shown by the distribution yield comparisons over the last five years as well as the share prices. The actual share price of ETG has stayed mostly flat as they pay out almost all their capital gains and income. Whereas DGRO pays out only the income, it receives from its underlying holdings.

Ycharts

Conclusion

ETG has been running higher, and now I’m going to have a fairly cautious outlook going forward. A very drastic change from the fact that I was touting this fund as a buying opportunity only a very short while ago and was actually making purchases myself in May. That’s about what is to be expected in this type of volatile environment. With CEFs having discounts and premiums, as well as leverage, they are much more volatile. This is simply just one example that we see in action.

I’ll continue to keep a fairly close watch on ETG going forward to see if a trade needs to be made. I view it as a core holding, but at a certain point, even a core holding has a limit in terms of its valuation. For now, I’ll continue to enjoy the monthly distributions.

Be the first to comment