BalkansCat

Thesis

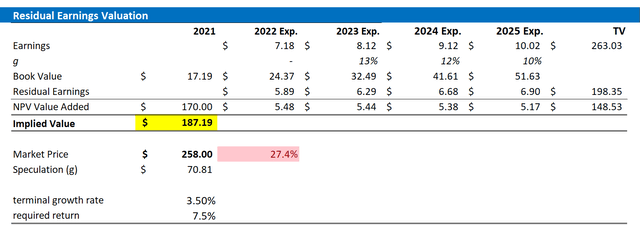

Estee Lauder (NYSE:EL) is a quality company with strong brand equity and a solid competitive industry position. However, the company’s valuation is arguably stretched too far. Personally, I value EL at $187.19/share. I anchor my valuation on a residual earnings framework and EPS analyst consensus estimates. Thus, I see almost 30% downside for the stock before the risk/reward becomes balanced.

About Estee Lauder

Estee Lauder is a leading conglomerate in luxury beauty. The company develops, produces and markets high-end products relating to skin care, makeup, fragrance, and hair care. Most notably, Estee Lauder owns some truly outstanding brands, including Estee Lauder, Clinique, M.A.C., Too Faced, La Mer, Origins, Aramis, Jo Malone, Aveda, Bobbi Brown, Smashbox, and more. As of 2021, skin care, including makeup, accounts for approximately 85% of the group’s sales.

Geographically, Estée Lauder operates worldwide in some 150 countries: The EMEA is Estee Lauder’s most important market accounting for approximately 45% of total sale, followed by the NAM region with about 30% of sales and Asia Pacific with slightly more than 25% of total sales.

A Solid Business Case

Estee Lauder has seen accelerating demand for its products, as the global consumer increasingly appreciated high-quality self-care products. Beauty trends, as advertised on social media for example, certainly aided consumer awareness and Estee Lauder’s branding efforts. Thus, it should come as no surprise that the company’s revenues have steadily increased over the past few years. More precisely, from 2018 to 2021, Estee Lauder’s total sales jumped from $13.7 billion in 2018 to $16.2 billion in 2021, representing a 3-year CAGR of about 7%. Respectively, net-income increased from $1.7 billion to about $2.3 billion (14.5% margin).

Estee Lauder’s balance sheet appears healthy. As of March 2022, the company held $3.8 billion of cash and cash equivalents and $7.8 billion of total debt. If we consider that the company’s cash-flow from operations was about $3.6 billion in 2021 and the company’s equity is valued at about $88 billion, the $4 billion of net-debt should not cause any worries for shareholders.

According to the Bloomberg Terminal, as of July 22nd 2022, analysts see Estee Lauder’s revenues in 2022, 2023 and 2024 at $17.7 billion, $19.3 billion and $20.8 billion. This would equal a 3-year CAGR of about 7.6%. Respectively EPS are estimated at $7.18, $8.12 and $9.14 for the same period.

Overstretched Valuation

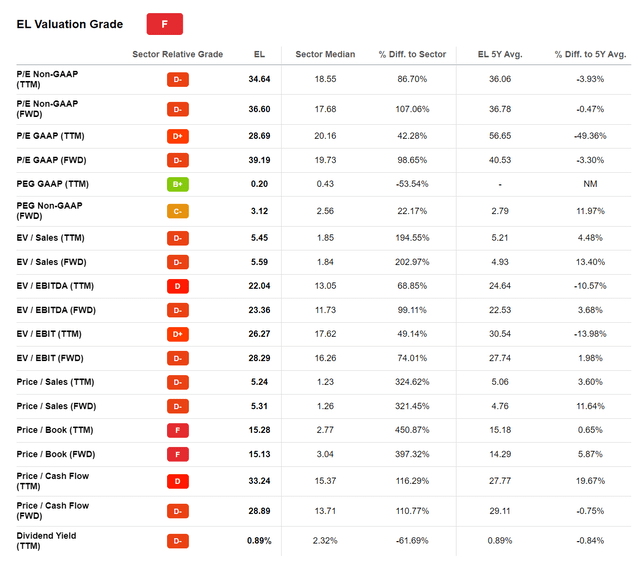

While I like Estee Lauder’s strong industry position and while I appreciate the steady business growth and value accumulation, I view the company’s stock as overvalued. Investors should consider that EL is currently trading at a P/E > x30, P/B of about x14 and EV/revenue of about x5. Estimating that Estee lauder will grow at approximately 7% CAGR going forward, the business would need about 10 years to grow into a x15 P/E that is in line with the broad market. That said, I believe the current market provides much more favourable risk/reward (bargain) opportunities for investors. Especially as market sentiment is driven by rising interest rates, Estee Lauder’s rich multiples appear vulnerable to a contraction. Notably, as highlighted by the comparative analysis by Seeking Alpha, EL trades at an approximately 100% premium with reference to almost all valuation metrics.

Residual Earnings Model

Let us now look at the valuation. What could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 22, 2022. My calculation indicates a fair required return of about 8%. In my valuation, I deduct 0.5 percentage point to account for Estee Lauder’s quality business fundamentals.

- To derive EL’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply 3.5 percentage points, which I think is reasonable.

Based on the above assumptions, my calculation returns a base-case target price for EL of $187.19/share, implying material downside of almost 30%.

Analyst Consensus; Author’s Calculations

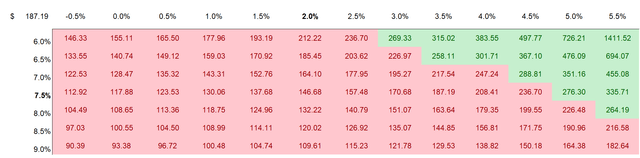

I understand that investors might have different assumptions with regards to EL’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Risks To My Thesis

The major risk to my thesis is, in my opinion, that the market re-discovers his appetite for high-multiple stocks, or in other words long duration assets. However, since this risk would be closely associated with falling interest rates and lower real yields, I do not see this risk as a major anti-argument for my thesis. Or at least, I don’t see these scenarios playing out within the next 6-12 months. Other than that, I do not see explosive upside potential for Estee Lauder. The stock might, however, outperform the broad market on a long term timeline (+5 years).

Conclusion

I like Estee Lauder. In my opinion, it is a quality company and I am confident to claim that this is a well-managed business with secular growth potential. However, the company’s valuation is simply too rich for investors to justify a sensible investment case, in my opinion. That said, I see almost 30% downside based on a residual earnings model. My valuation is anchored on analyst consensus EPS. Despite the downside, I would not short this stock. This article is not directed to short-sellers but to prospective buyers, who might want to buy EL stock at a balanced risk/reward ratio. I see this level at 187.19/share.

Be the first to comment