Dejan Marjanovic

I recently wrote an article on T. Rowe Price (TROW), explaining why I was looking at the company as a potential replacement for STORE Capital (STOR) after its recent acquisition agreement. For investors looking for a more direct replacement in the net lease REIT sector, one potential alternative is Essential Properties Realty Trust (NYSE:EPRT), which just released its Q3 earnings.

Investment Thesis

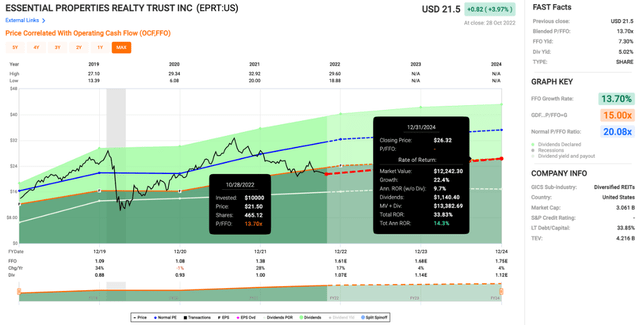

EPRT is one of the newer net lease REITs available to public investors and it continues to grow at a solid clip. The REIT has gone from expensive a year ago to a much more attractive starting valuation today. After peaking above $32 about a year ago, shares now sit in the low-$20s. This puts shares at a 13.7x price/FFO today, which is a turn below the standard 15x multiple and well below its average multiple of 20.1x.

The company has a solid dividend track record, and the recent history has been a one penny raise every couple of quarters. The yield currently sits at 5%, so shares currently provide an interesting mix of current income and expected dividend growth. When shares were trading a bit below $20 recently, I sold a cash secured put, which could be an interesting option for investors familiar with options. If the shares don’t get assigned, I expect I will start a long position in the shares at some point in the near future.

Overview

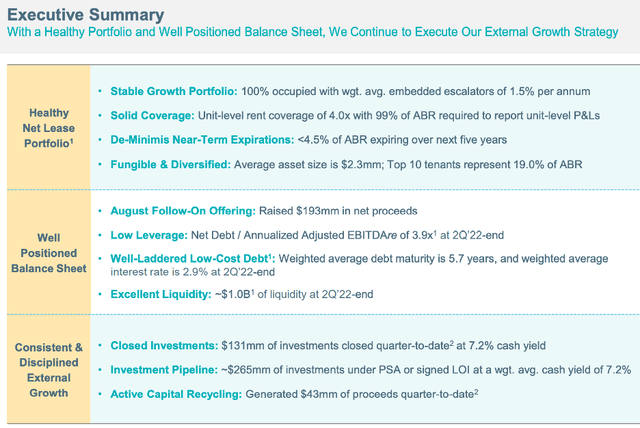

EPRT typically focuses on smaller properties and has a well-diversified portfolio. They don’t have a ton of debt on the balance sheet, and the debt they do have has a weighted interest rate below 3%. While they don’t get quite the same cap rates that STORE was getting before it was acquired, they aren’t far behind. Their recent investments are above a cash yield of 7%, and they continue to grow the portfolio at a decent rate. Below is a summary of EPRT from a recent investor presentation.

EPRT Summary (Essential Properties)

One thing I noticed from reading the recent 10-Q is that the share sales slowed significantly in Q3 (compared to last year as well as the first two quarters of this year), which is good for shareholders. This is where the valuation comes into play. A cheaper share price provides a better entry point for new investors, but if the share price stays depressed for an extended period of time, it makes equity issuances unappealing and could lead to slower growth.

Valuation

While I don’t think EPRT is a pound the table buy today, I think it is a solid buy and it has rarely been this cheap. Since going public, EPRT has only spent one quarter below a 15x multiple, and that was the COVID panic induced selloff in the spring of 2020. Shares now sit at a 13.7x price/FFO multiple, which is attractive considering the multiple usually assigned to EPRT by the market.

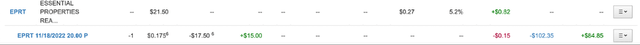

While the broader markets have been bumpy, I think double digit returns aren’t too far out of reach for EPRT. I recently sold a cash secured put on EPRT with a strike price of $20, when shares were slightly below $20. It expires in a couple weeks, but it doesn’t look like the shares will get assigned. For REITs like EPRT, cash secured puts are an interesting strategy to increase income.

There are two ways a trade like this plays out. The first option is that EPRT stays above $20, and I make a little over 5% for a month-long trade. If shares go below $20, I buy 100 shares of EPRT, which would yield well over 5% at that point and likely lead to double digit returns (or covered calls). While cash secured puts aren’t the flashiest options strategy, I like the win-win situations available to investors and I plan to use the strategy more going forward. The other part that will drive returns is the 5% dividend.

The Dividend

EPRT doesn’t fall in the category of Realty Income (O) or Agree Realty (ADC) who have longer track records of dividend increases, but the portfolio strategy and balance sheet make me think they could reach that level someday. I’m expecting another dividend raise in the next quarter, and the company provides investors with an interesting mix of current yield (5%) and potential for dividend growth.

Conclusion

While EPRT doesn’t have a long operating history as a public company, I like what I have seen so far. They focus on smaller properties, have attractive cap rates, and sport a solid balance sheet. The valuation is attractive today at 13.7x price/FFO, which is well below the average 20.1x multiple. EPRT hasn’t spent much time below a 15x multiple since going public, so I wouldn’t be surprised if we see double digit returns when you factor in the 5% yield. While I was frustrated when STORE was taken out (below fair value in my opinion), EPRT could be a similar replacement with more long-term growth potential due to its smaller size.

Be the first to comment