Torsten Asmus

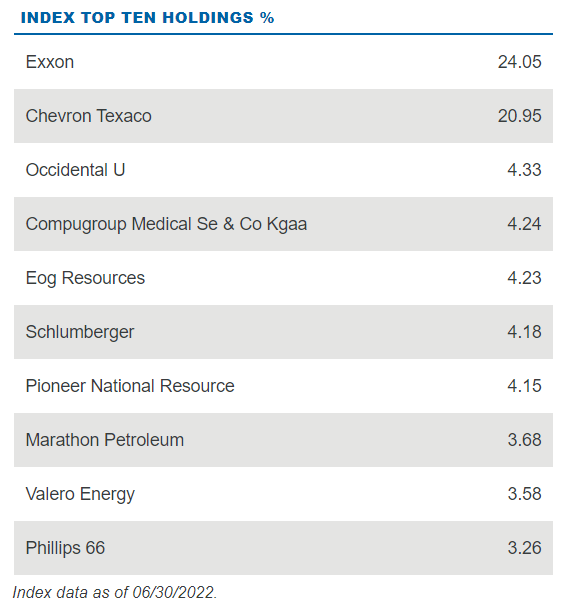

The Direxion Daily Energy Bull 2x Shares (NYSEARCA:ERX) has a combined exposure of 45% to Exxon Mobil (XOM) and Chevron Corp (CVX) as shown in the table below. This is an unusually high percentage and given that these two stocks have already appreciated significantly, in line with the rising price of oil and gas (O&G), ERX can be used to invest in them indirectly as I will show in this thesis.

ERX’s holdings (www.direxion.com)

Another advantage of ERX is that it pays quarterly dividends, but, it is important to provide investors with all the details about this leveraged ETF before they can make an investment decision.

I start by looking into the dynamics around the demand and supply of O&G.

Dynamics around Demand and Supply

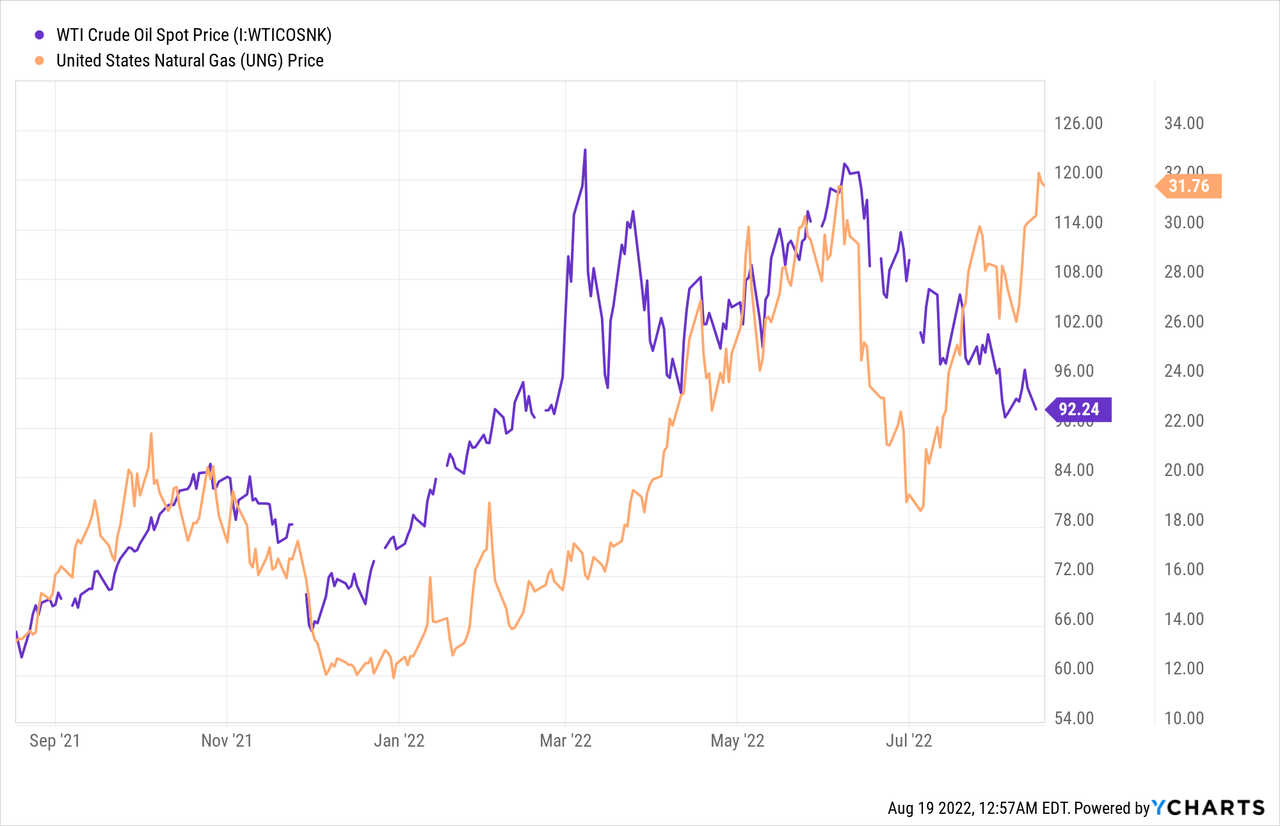

The price of a barrel of WTI as shown in the blue chart below is down by more than 25% since the first week of June as the slowdown in the Chinese economy weighed on global oil demand. At the same time, there were more pronounced talks of recession in the Western world while markets digested the possibility of an upcoming Iranian nuclear deal likely to increase supply by 1 million barrels per day. As a result, prices adjusted according to the new demand-supply dynamics of the crude oil market.

This is in sharp contrast with the first quarter of 2022 when prices had soared, supported by the recovery in demand with the end of the lockdowns in many parts of the world and the start of the Ukraine conflict seen as detrimental to supply.

However, ERX which tracks the Energy Select Sector Index (IXETR) not only includes oil companies but also gas companies. This is the reason I included the U.S. Natural Gas (UNG) price in the orange chart above whose uptrend contrasts sharply with oil’s downtrend.

The price of gas surged reaching its highest level in six months at the beginning of this week in Europe, where a reduction in the flow of natural gas by Russian authorities to Germany has resulted in a drastic fall in supply. Despite the summer, demand has remained upbeat since the Germans have to fill up storage tanks in anticipation of the winter. Europe is importing not only more natural gas from the U.S., but also more diesel as its factories have no alternative but to switch from clean fuel to oil if they want to stay open. However, switching over from natural gas to oil does not work seamlessly and should take time, therefore impacting the ETF’s price action.

The Price Action, Comparison with XLE, and Risks

Now, ERX’s holdings also produce natural gas in addition to crude oil, with the United States being one of the world’s largest producers. Consequently, as the price of gas goes up, companies like Exxon and Chevron make more profits.

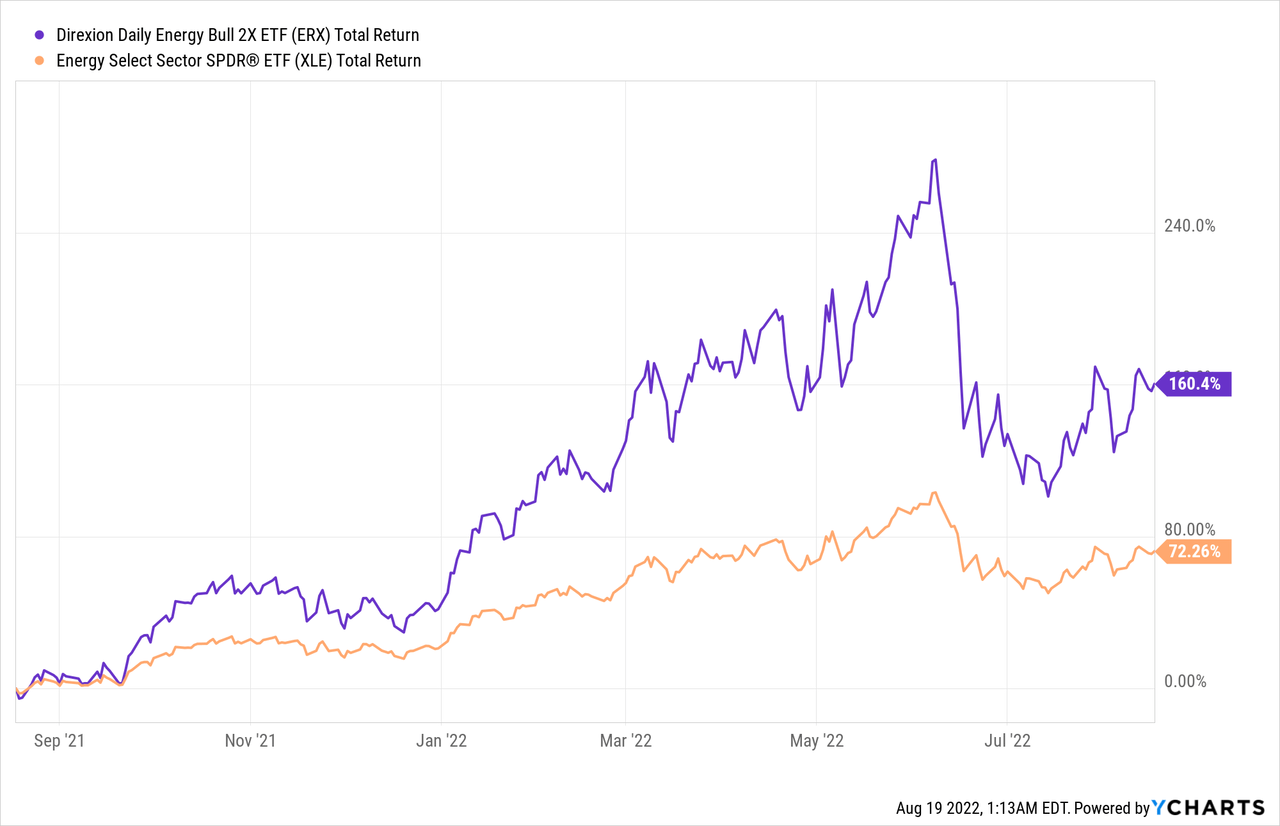

As a result of the variation in oil and gas commodity prices, ERX has delivered a 160% gain during the last year as shown in the blue chart below. This is more than two times that of the Energy Select Sector SPDR ETF (XLE), one of the most popular ETFs for those wishing to invest in a diversified way in O&G. Here, investors will note that I have provided the total return which includes the price performance plus the dividends in case these are reinvested. For this matter, XRE pays dividends at a yield of 1.93% while it is 3.53% for XLE.

These whopping gains of 160% are made possible by the fact that ERX is a leveraged ETF that seeks daily investment results (before fees and expenses) of two times (200%) the performance of the IXETR I mentioned previously. This includes domestic companies from the oil, gas, and consumable fuels industries.

Now leveraged ETFs which permit such levels of gains come at a cost: they make use of futures contracts and swaps which are subject to market risks and, thus, unlike buy-and-hold stocks, they have to be traded cautiously. This is normally within the realms of aggressive investor profiles, namely traders who place trades over a period of a day or a week at the maximum and can stay glued to their stockbroker’s screens for hours in a day while scanning news updates hitting the energy sector. These traders typically work on small profits of 5% to 10% and must be ready to exit with a loss.

Moreover, as exemplified by XRE’s vertiginous fall from June 8 to 17 when it lost over 100% of its value over a one-week period as shown in the above chart, investors willing to profit from this ETF must be willing to accept substantial losses for short periods of time. Such losses may be hard to stomach for some, thereby making it crucial to constantly manage one’s position in view of how the fund is performing amid abruptly changing market conditions.

Elaborating a strategy Using the Energy Outlook

For those who are prepared to stomach such risks and envisage a longer time span of 1-3 months, ERX pays quarterly distributions which can to a certain extent amortize the value lost during downsides. Also, there are certain developments in the energy demand-supply dynamics that point to prices likely to remain elevated at least till the end of this year.

First, demand should continually be impacted by a slowdown in the Chinese economy, due to the effects of its strict zero-Covid policy which severely impacts the movement of people. Additionally, the deterioration of financial conditions is also due to issues in the real estate sector and prompted China’s central bank to announce a rate cut on Sunday in order to boost liquidity, which can be positive in stimulating economic activity. For investors, the world’s second-largest economy consumes a significant part of the world’s crude oil and thus, any weakness or strength in the Chinese economy weighs on oil.

On the other hand, reserves for the world’s largest economy shrank by 7.1 million barrels last week, while analysts had forecasted a slight increase. Also, thanks to more people traveling (whether be it by air or on the roads) and the succession of robust macroeconomic indicators, demand for petroleum should be high in the second half of the year, according to oil refiners and pipeline operators. At the same time, there is skepticism about the imminence of an Iranian nuclear deal and even if there was one, it would take up to one year for the country to ramp up supplies.

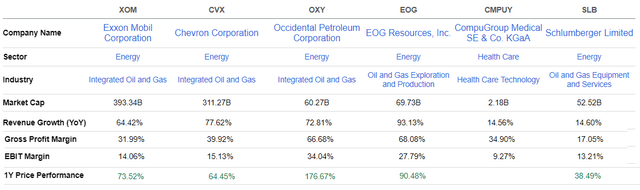

In these circumstances, prices of O&G should be sustained throughout 2022, which means that there is less risk for XRE to suffer from a drop similar to June. Also, for those who are already invested in XOM and CVX or Occidental Petroleum (OXY) and who are now hesitating to add more to their holdings after the individual stocks appreciated by 60%-176%, more diversified exposure to O&G through the ETF option makes better sense.

Comparison of key metrics for holdings (www.seekingalpha.com)

Conclusion

Against the backdrop of less Russian gas reaching Europe and increasing demand from the U.S. offsetting the slow down in China, commodity prices should remain on the high side. This is further confirmed by OPEC’s new chief who expects “a high risk of a supply squeeze” this year as there is a drop in spare production capacity.

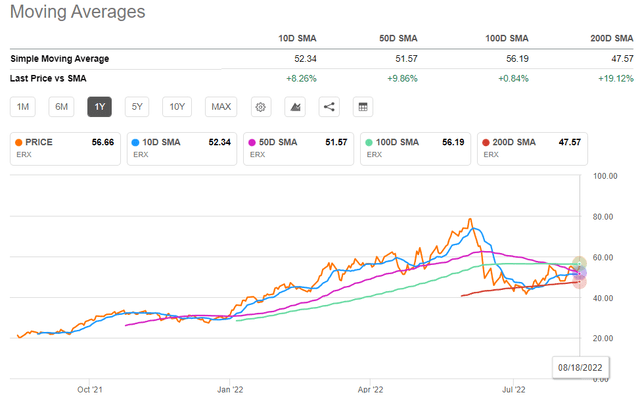

Thus, in view of the accelerated pace at which it provides gains, XRE is a buy, but this is only for those who are investing on a short-term horizon of one to three months, as the ETF carries a higher volatility risk than XLE. To support my bullish view, momentum factors show that the unit price is higher than both the 10-day and 50-day moving averages (see chart below), with SA’s Quant having a “strong buy” position on ERX too.

Momentum Factors (www.seekingalpha.com)

However, the 100-day SMA at $56.19 is only slightly lower than the unit price ($56.66) which signifies that three is no guarantee that ERX will rise after three months or roughly 100 days. Finally, for those investing in this ETF for the first time, it is a good idea to put a stop loss in light of investment objectives.

Be the first to comment