ismagilov/iStock via Getty Images

Equity Residential (NYSE:EQR) is a S&P 500 component and real estate investment trust (“REIT”) that earns their revenues through the rental of residential properties to a targeted demographic of affluent long-term renters that reside around densely populated urban environments.

The company has benefited in recent periods from strong occupancy rates and soaring rental rates due to factors such as affordability constraints on outright ownership, a chronic undersupply of housing, and continuous wage growth in their operating markets.

Rate growth, however, peaked in the middle of this year and has since moderated, though they remain elevated. In addition, price sensitivity is beginning to increase, which is resulting in increased turnover. A subdued market resulting from challenges in price discovery is also sending participants to the sidelines. While implicit growth rates in underlying metrics provide some visibility into 2023, uncertainties do remain. Management, accordingly, expects less than stellar results compared to 2022.

If key participants are staying on the sidelines, it would benefit prospective investors to follow their lead.

Consistent Portfolio With Minimal Transaction Activity

As of September 30, 2022, the company had an interest in just over 300 properties with 80K apartment units. The property count is down two from last quarter due to dispositions in their New York and Washington D.C. markets. These two sales brought in a combined total of +$481M and generated an unlevered internal rate of return (“IRR”) of 4.6%.

This brings their total property sales in the year to just three properties. Similarly, the company has been quiet in the acquisition market, with no purchases in the current quarter and just one so far during the year. In lieu of acquisitions, the company did enter into two separate joint ventures with Toll Brothers to develop vacant land parcels in suburban Texas and Boston, MA.

Double-Digit SSNOI Growth On Strong Occupancy Levels But Some Apparent Pushback From Tenants

For the quarter, same-store net operating income (“SSNOI”) was up 16.2% from the same period last year, led by average rental rates that were up 12.3%. This is a moderation from the second quarter, where NOI was up 19.1% YOY on rental rates that were up 13%. Still, average rental rates were up 2.4% from last quarter.

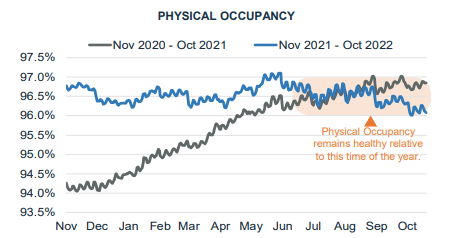

Overall occupancy remains above 96%, though it is down slightly YOY and from last quarter. Turnover, on the other hand, is up to 14%, which is 280 basis points (“bps”) higher than Q2. Driving turnover in the current quarter were their Boston markets, which was up 5.7%, and their expansion markets, excluding Denver, which were up 4.8%.

Q3FY22 Earnings Presentation – Chart Of Physical Occupancy Trends

Though rental rate growth was one aspect of the move-outs, it was not entirely to blame. In their expansion markets, excluding Denver, for example, average rental rates were down 30bps. And in Boston, though rates were up, the increases were lower than in their New York market, which reported average rate growth of 6.8% from last quarter but had a turnover rate half that reported in Boston.

Despite the higher turnover levels, operating metrics in most individual markets remains strong. Leading the way is the Southern California region, which is their largest market, representing approximately 30% of total NOI, and New York, who both are leading in same-store revenue growth in overall pricing fundamentals.

Laggard Markets And Implicit Growth Rates Provide Visibility Into 2023

Two laggards continue to be Seattle and San Francisco, both of whom trail in total occupancy, with weighted levels below 96% at period end. Looking ahead, these two markets provide attractive growth opportunities as both markets are currently under housed and have generally good job prospects. In the case of San Francisco, the opportunity is even better due to their higher average rental rates, which at above $3K, is a modest premium over the portfolio average.

In addition to improvements in these two markets, EQR is also expecting to benefit from a forecasted embedded growth rate of 4.5%, which is well above their historical average of 1%. Furthermore, their loss-to-lease stood at approximately 5% at quarter end. Though this is down from the 12% reported in the prior quarter, it is still above the rate one would expect at the end of a non-recessionary year, which is about 50bps, according to management.

Market Is Likely To Moderate, But Balance Sheet Is Equipped To Capitalize On Newly Created Opportunities

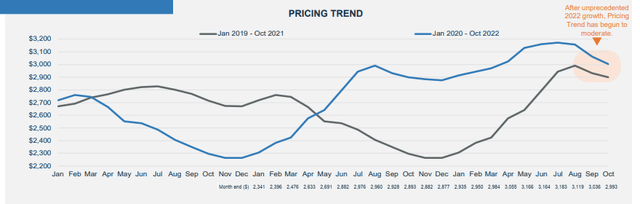

Though current embedded growth and loss-to-lease rates provide some visibility into 2023, actual market rent growth is more uncertain, given current market conditions. Management did note that rates peaked in August and were likely to see moderation in the periods ahead. As such, 2023 is unlikely to be as robust as 2022.

Q3FY22 Earnings Presentation – Chart Of Current Pricing Trends

The transaction market is also expected to be subdued due to ongoing price discovery challenges between buyers and sellers. Higher hurdle rates stemming from rising interest rates and construction costs also provides a headwind against both the acquisition and development market.

Management is, however, expecting the acquisition market to be more available to them in the coming months. And when that opportunity presents itself, EQR’s balance sheet is well positioned to capitalize on it.

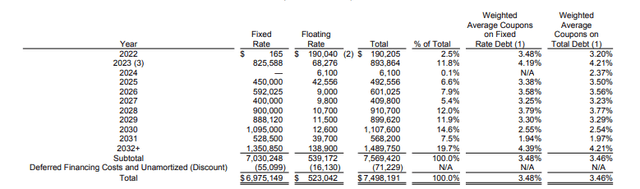

At quarter end, leverage stood at record low levels, with a debt multiple of normalized EBITDAre of just 4.5x. Though they do have one large maturity in 2023, management expects to refinance it in the secured market at favorable rates with minimal challenges.

Q3FY22 Investor Supplement – Debt Maturity Schedule

Post-Earnings Insights

EQR’s third quarter results were solid, marked by portfolio metrics that remain above historical trends and continued double-digit SSNOI growth in the face of a macroeconomic environment that is becoming increasingly difficult for everyday households.

This is due in part to their market demographics, which skew towards more affluent tenants in knowledge-based industries with more durable incomes and employment prospects. As such, their tenant base is more insulated from inflationary impacts.

The average income of those who signed new leases in the past 12 months, for example, was reported to be $174K, which is 12% above the group that signed with them in the prior 12 months. In addition, as a percentage of income, rent still accounts for a burden of less than 20%, which is consistent with prior years, despite rental rates that continue to grow, albeit at moderated rates.

This is not to say the group is totally immune to the negative effects of the current market environment. Turnover increased notably in the current period, which resulted in a downward tick in occupancy. This was despite moderation in rate growth from prior periods, which experienced a peak in August.

Declining home prices is one potential factor. Over the past two years, out-priced prospective buyers were in a perpetual TINA (“There Is No Alternative”) state to rentals due to the run-up in home prices. Now that prices are beginning to decline, some prospective buyers may find the transition into ownership more appealing than continuing to absorb higher rental rates.

In certain markets, particularly in the Sunbelt, there has also been an increasing amount of housing supply entering the market, which has pressured home prices. Since this region has been a focal point of EQR’s recent expansion, it could provide an attractive opportunity to acquire assets at reasonable prices. On the other hand, it can also place downward pressure on rents if the company were to lose tenants to ownership.

In fact, this is what appears to have happened during Q3. In their expansion markets, excluding Denver, physical occupancy was down 120bps on a 480bps increase in turnover, despite rental rates that were down 30bps.

Moving forward, the company does have a viable path for continued earnings growth through improvement opportunities in their Seattle and San Francisco markets and further bridging in their loss-to-lease, which stood at about 5% at quarter end. But whether this is enough to materially move the share price is one consideration that appears doubtful at this point in time.

Moderating Rents And Declining Home Prices Will Result In A Less Than Stellar 2023

Though EQR benefits from an affluent tenant base, they are not fully sheltered from market realities. Turnover increased during the quarter, perhaps due to declining home prices, which is suddenly giving tenants an alternative to renting into perpetuity.

Rent growth is also slowing from peak levels reached this past August. While there is some visibility into future growth from implicit growth rates and improving bad debts, management generally agrees 2023 will be less robust than 2022.

Higher hurdle rates on acquisitions and developments are also resulting in a general pause in the market environment. If key participants are moving to the sidelines, it would make sense for investors to follow their lead. While attractive opportunities will present themselves to EQR, it may not be enough to materially drive the share price, at least in the near-medium term. As such, it is best to remain on hold until there is further clarity in the market.

Be the first to comment