Sundry Photography

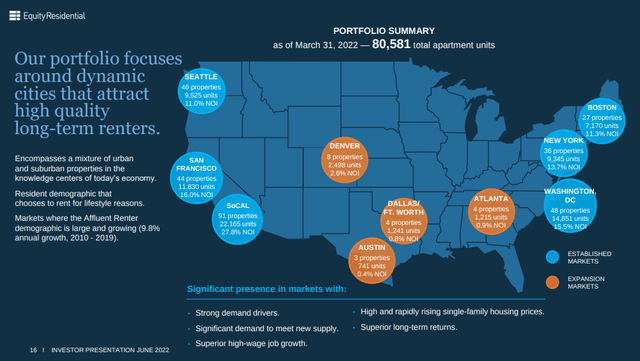

While many REITs boast about having long leases lasting many years, sometimes decades, this is not always an advantage. Especially during times of high inflation, because even if there are rent escalators in these leases, they usually fail to make up for inflation. In a high inflationary environment, you want to be able to adjust your rents often, and that is where apartment REITs shine. One we particularly like is Equity Residential (NYSE:EQR), which is one of the nation’s largest publicly traded owners and operators of high-quality rental apartment properties. In other words, they buy, build and manage multifamily properties, with a focus on affluent long-term renters. It has about 311 communities, with a total of 80,581 units, in 12 markets. As can be seen in the slide below, it tends to operate in very dynamic markets, where the affluent renter demographic tends to be large and growing. This includes both urban and suburban properties.

Equity Residential Investor Presentation

Equity Residential’s affluent resident tends to work in the highest earnings sectors of the economy and is not rent burdened, which create the ability to raise rents more readily in good economic times, and reduces non-payment risk during downturns. The average EQR resident spends 19.5% of income in rent as of 2022.

So far this year, EQR is beating inflation. The pricing trend, which is the net effective price of its units inclusive of concessions, has grown almost 10% since the beginning of the year, well above the 6% range that historically characterizes a very good year. The current net effective loss to lease, which represents the amount of money that EQR is losing by not charging market rents, is currently ~13.5%. This means that there are still gains to be had as leases expire and are renewed closer to the market average.

From the most recent earnings call, we particularly liked an answer CEO Mark Parrell gave in relation to EQR’s ability to beat inflation and deliver a real return:

So the way we’re feeling about it is that we’re going to be able to provide a pretty good margin to whatever the inflation numbers are especially as we expect them to sort of settle down. There is also this little bit of a circular reference thing where rent is something like third of the CPI. So we feed into that number, and that number feeds into our number. And so there is a little bit of that as well. But I think you should expect that apartments, especially our portfolio, are optimized in a way with our pricing engine that we can continue to have a real return that exceeds the rate of inflation.

The company should also be able to continue performing well thanks to the benefit of good supply and demand dynamics, including excellent job growth and household formation. Housing alternatives also remain expensive and in low supply. Single-family home prices reached record levels in 2022 while rising mortgage rates have further stressed affordability, particularly for first-time home-buyers. Additionally, single-family housing starts are declining.

The near-term apartment supply picture also remains favorable. Starts within close proximity to EQR’s properties in its coastal markets are still at or below pre-pandemic levels. In addition, it seems likely that over the next few quarters new apartment starts should decline due to higher pricing of construction and financing, and continued supply chain disruptions.

EQR’s affluent renter base should be able to weather rising inflation in part due to lower relative rent-to-income ratios, and higher amounts of disposable income. As in the past, if inflation does persist, EQR’s business should continue to perform relatively well.

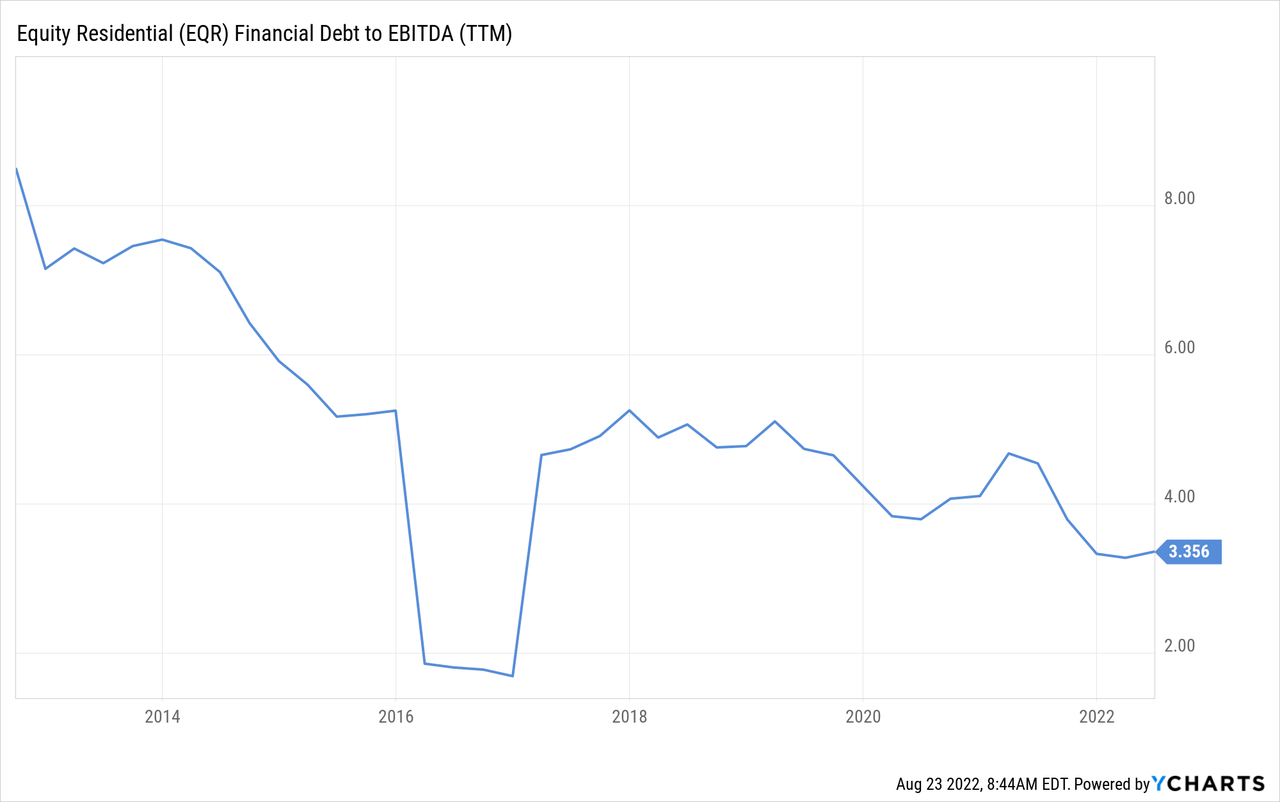

Balance Sheet

Equity Residential continues to have one of the strongest balance sheets in the REIT sector, with low floating rate exposure and a long weighted average maturity. EQR also has relatively low leverage and has strong credit ratings (A-/A3).

2Q 2022 Results

The 2Q results for Equity Residential were somewhat better than expected. Same-store occupancy improved to 96.7% while same-store revenue increased 13.6% year over year. Same-store expense growth continued to remain in check at 3.1%.

Equity Residential reported normalized funds from operations of $0.89 per share, well ahead of the $0.72 the company reported in Q2 2021.

Guidance

The strong quarter led management to raise its full-year guidance. Management boosted its same-store revenue growth projections by 1.5%, at the midpoint, to a new range of between 10% and 11%. It guided normalized FFO for the year to a new range of between $3.48 and $3.58.

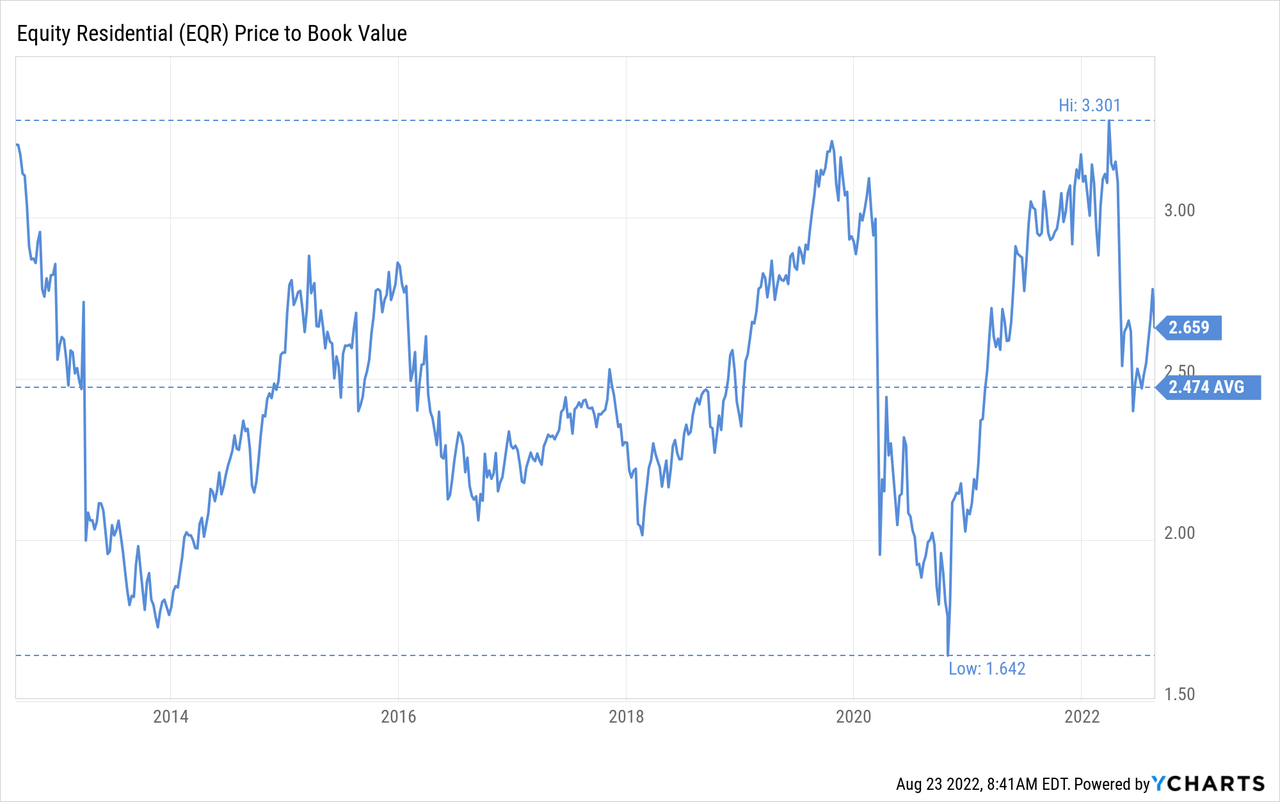

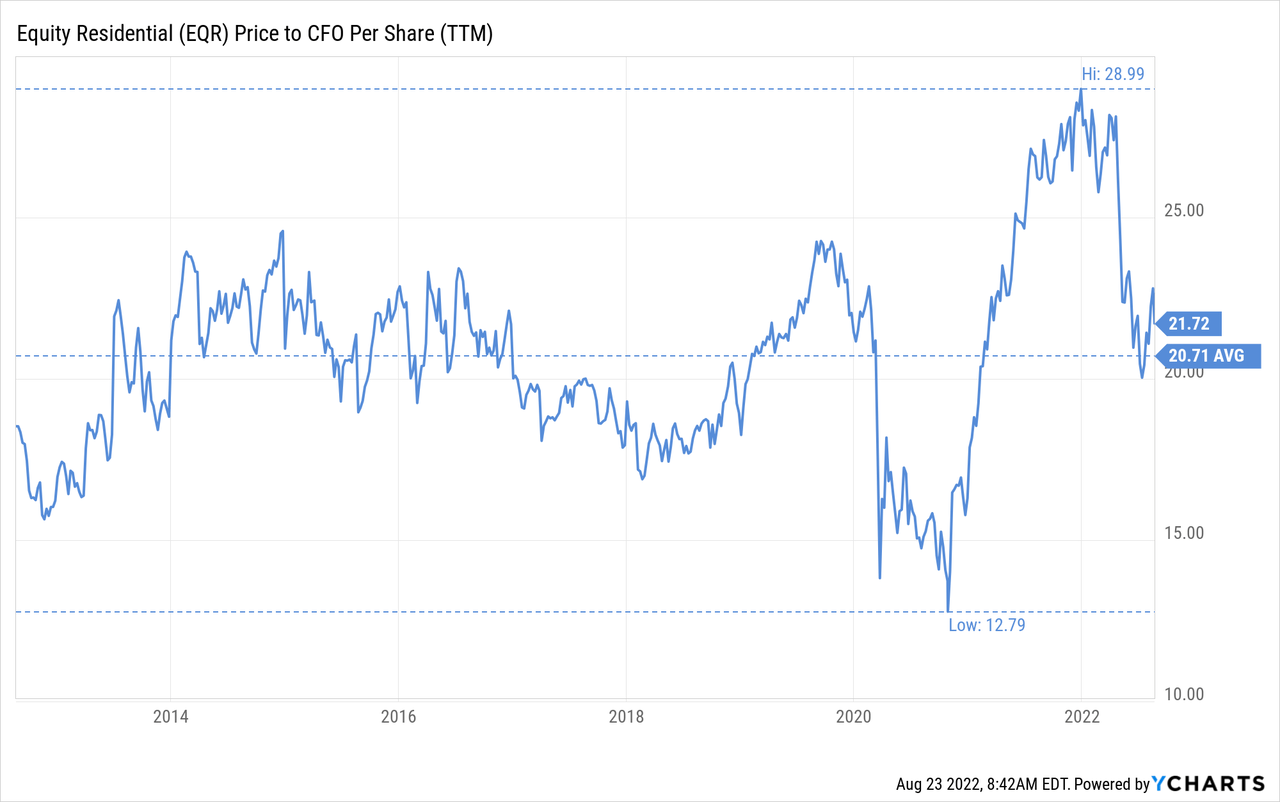

Valuation

We currently view shares as fairly valued, trading not that far from the ten-year average price/book value of ~2.4x.

At a price/cash flow of ~21.7x, shares are a little bit above the ten-year average of ~20.7x, but not by much. This reaffirms our belief that, compared to its historical valuation, shares are fairly valued, and we do not see why it should trade much higher or lower at this time.

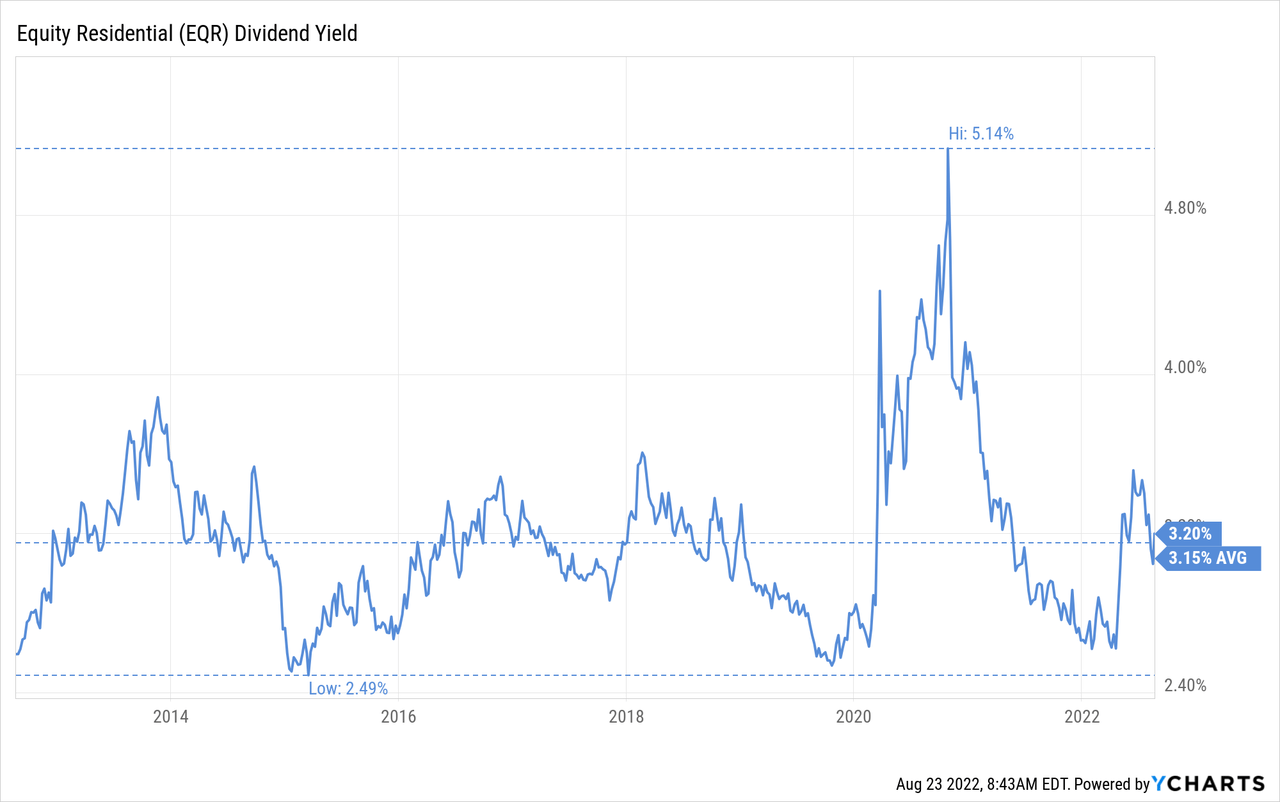

Similarly, the dividend yield is extremely close to the ten-year average. All of these indicators point to a reasonable valuation.

Risks

The main risk we see with an investment in EQR is that the supply-demand balance deteriorates meaningfully either due to less demand, which could be caused by a recession and the corresponding job losses, or an oversupply of units by developers building more than what these rental markets can absorb.

Conclusion

The thing we like most about apartment REITs is their ability to adjust rents quickly, which can be very positive in an inflationary environment as the one we are currently in. Our favorite apartment REIT is EQR, in large part due to a focus on a more affluent demographic. Recent earnings results were positive, and management even increased guidance. We view shares as fairly valued, trading at close to their average valuation multiples on a number of indicators.

Be the first to comment