DarrelCamden-Smith/iStock via Getty Images

The Q4 Earnings Season is finally underway for the Gold Miners Index (GDX), and one of the first companies to report its results is Equinox Gold (EQX). While the company trounced its peers in the growth department, growing production 26%, its costs rose at an even quicker pace, coming in 20% above the industry average at $1,350/oz. Given higher fuel prices and inflationary pressures (labor, consumables, materials), costs will remain elevated in 2022/2023, partially offsetting EQX’s attractiveness as an industry-leading growth story. Based on what I believe to be a conservative fair value for EQX of ~$8.60, I see limited upside from current levels.

Equinox Gold Operations (Company Website)

Equinox Gold released its Q4 and FY2021 results last month and had a strong finish to the year, reporting record quarterly production of ~210,400 ounces. This was helped by a massive quarter from Mesquite (~66,900 ounces), a solid quarter at Los Filos, and a strong finish to the year at Aurizona. These strong performances helped Equinox to surpass the 600,000-ounce mark for the first time, with annual production coming in at ~602,100 ounces, up 26% year-over-year. Let’s take a closer look at the results below:

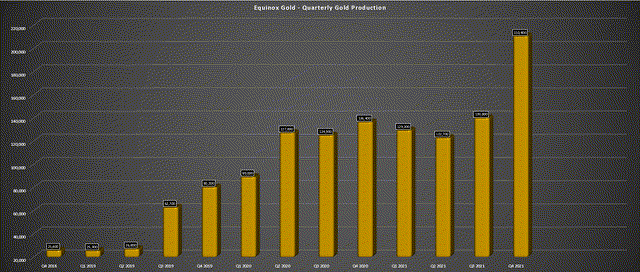

Equinox Gold – Quarterly Production (Company Filings, Author’s Chart)

As shown in the chart above, Equinox has not had any trouble with growth, managing to more than double production on a two-year basis following the merger with Leagold in early 2020. Despite divestments (Pilar, Mercedes), this growth is expected to continue in 2022, with the company guiding for production of 668,000 ounces at the mid-point, translating to 11% growth year-over-year.

This is phenomenal after a year of 26% growth, especially when we consider the difficult year-over-year comps. These difficult comps are related to lapping strong growth in 2021 and the fact that Equinox will see limited contribution from Mercedes/no contribution from Pilar, which both contributed last year. However, while the production growth has been impressive, inflationary pressures have taken a toll on costs. It doesn’t help that Equinox moves a significant amount of material at its operations, being a low-grade producer.

Some miners like Yamana Gold (AUY) have seen relatively muted increases in operating costs helped by operating massive mines (Malartic) or high-grade underground operations (Jacobina, Cerro Moro, El Penon, Minera Florida). However, with relatively low-grade operations (Castle Mountain, Mesquite, RDM) that don’t benefit from economies of scale to the extent that a major mine like Detour Lake or Malartic would, it’s been difficult to control costs. The continued rise in fuel prices is not helping this, nor is the fact that Equinox operates several mines in Brazil, which has one of the highest inflation rates globally.

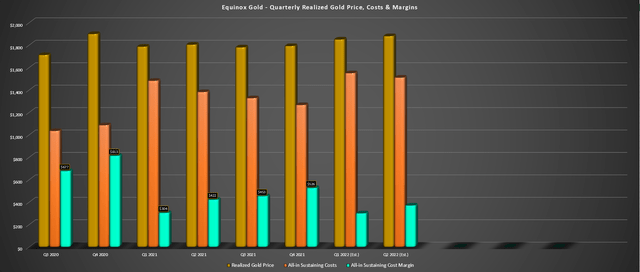

Equinox – Quarterly Gold Price, All-in Sustaining Costs & Margins (Company Filings, Author’s Chart & Estimates)

If we look at Equinox’s all-in sustaining costs, average realized gold price, and margins in the above chart, we can see that Equinox’s margins declined sharply on a year-over-year basis in Q4, from $813/oz to $526/oz. Some investors might be anxious to see the Q1/Q2 2022 results with the benefit of rising gold prices. Still, with all-in sustaining costs expected to come in above $1,500/oz in H1 2022, I would expect to see further margin compression sequentially (H1 2022 vs. Q4 2021) even with the help from the gold price.

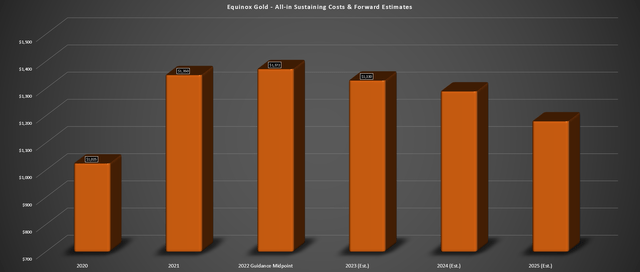

Equinox Gold – All-in Sustaining Costs & Forward Estimates (Company Filings, Author’s Chart & Estimates)

It is important to note that Equinox will see an improvement in costs in H2 2022 and that this is a higher-cost year for the company due to stripping campaigns and deferred development at Los Filos. However, while this is leading to slightly higher costs this year, much of the cost increases that Equinox has seen are not going to suddenly roll off like elevated stripping costs, and I would not expect to see costs decline sharply in 2023. Instead, I think it’s more likely that we’ll see costs of ~$1,330/oz in 2023 which would still place Equinox’s costs well above the industry average (~$1,090/oz).

So, why is this relevant?

This is important because while many of Equinox’s peers will enjoy margin expansion in 2022 due to rising gold prices, Equinox may see more muted margin expansion, especially in H1 2022. This is because it is expecting to see an increase in costs year-over-year based on its guidance mid-point of ~$1,372/oz, and I believe it’s likely we’ll see costs well above this cost guidance mid-point. Hence, even if the gold price does average $1,880/oz in H2 2022 (~$90/oz improvement year-over-year), Equinox’s costs could rise $60/oz ($1,410/oz vs. $1,350/oz).

Generally, I prefer high-margin producers with rising margins, and Equinox is the opposite of this, a high-cost producer with only a slight improvement expected in margins, with the possibility of margin contraction in H1 2022. Meanwhile, with limited free cash flow generation due to high capex over the next 24 months, I do not expect to see Equinox return value to shareholders through dividends or share buybacks. I think this is the right move given that its priority should be growth, but this is a small slight against the stock on a relative basis.

The reason is that some producers are returning significant value to shareholders, with 2%+ share buyback programs and 2.5%+ dividend yields, and they are also undervalued. So, while EQX may rise in concert with a higher gold price, its peers are also rising, but investors are getting a bonus 4% return from a total return standpoint. Given these generous dividends and buyback programs, as well as more meaningful margin expansion in other names, it’s harder to argue for owning Equinox relative to peers.

Valuation

Equinox currently has ~334 million fully diluted shares, translating to a fully diluted market cap of ~$2.62 billion at $7.85. If we compare this figure with its estimated net asset value of ~$3.2 billion, the stock trades at approximately 0.82x net asset value. This multiple may appear cheap compared to multi-million-ounce producers like Newmont (NEM) and Barrick (GOLD) at ~1.20x P/NAV. However, Equinox deserves a discounted multiple, given that it’s a smaller producer with costs well above the industry average and more than one-fourth of its net asset value comes from a Tier-2 jurisdiction: Guerrero State, Mexico.

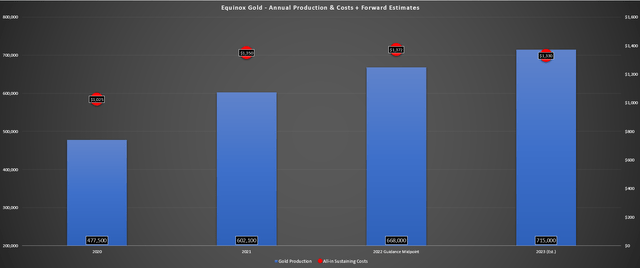

Some investors will argue that Equinox’s growth should place it in an elite class of miners with a premium multiple, and there’s no arguing that Equinox is a top-10 growth story sector-wide. However, while some producers like Wesdome (OTCQX:WDOFF) and Karora (OTCQX:KRRGF) are seeing meaningful production growth at flat to declining costs, Equinox has seen its costs soar as production has increased. This is evidenced by the below chart, which shows a production profile that’s expected to grow 48% from FY2020 to FY2023 (~715,000 ounces vs. ~478,000 ounces) offset by a 30% increase in costs (FY2023 estimates: $1,330/oz).

Equinox Gold – Historical Production/Costs & Forward Guidance/Estimates (Company Filings/Guidance, Author’s Chart & Estimates)

It’s important to note that this is still very respectable growth, but I see Equinox as a much lower-quality growth story for this reason. It also doesn’t help that a significant portion of the company’s net asset value is tied to Los Filos, which has had challenges, combined with its neighboring El Limon-Guajes Mines. These challenges have included illegal blockades, with more serious issues being kidnappings and the murder of workers when Goldcorp previously operated the mine. While we haven’t seen recent kidnappings, Equinox has had to suspend operations twice in the past two years alone, materially affecting production.

The good news is that Los Filos will be diluted from a production and net asset value (operating) standpoint once Greenstone comes online. However, even with a full year of contribution from Greenstone in 2025, I still expect Equinox to be a high-cost producer relative to peers. This is based on my belief that the projected $618/oz all-in sustaining costs [AISC] are far too ambitious and the fact that Equinox’s existing portfolio (ex-Greenstone) will continue to see average costs above $1,250/oz on a consolidated basis.

Given this mixed outlook for Equinox (high growth, but also high costs), I believe a fair multiple for 2022 is 0.90x P/NAV, which translates to a fair value of ~$8.60 per share on a fully diluted basis. This points to a limited upside from current levels and doesn’t offer much of a margin of safety, based on my minimum requirement of a 30% discount to fair value for sector laggards. Obviously, a rising tide (gold price) will lift all boats, but with EQX trading near conservative fair value after its recent rally, I don’t see any reason to pay up for the stock here near $8.00 per share.

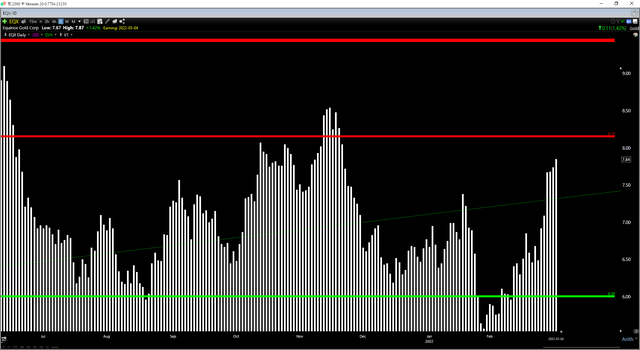

Technical Picture

Moving to the technical picture, we can see that Equinox Gold has enjoyed a strong rally over the past two months. While this rally has shifted momentum to the upside, it’s also led to a degradation in EQX’s reward/risk profile. This is because EQX has now found itself within 5% of short-term resistance at $8.15 and more than 25% above support at $6.00. Based on just $0.30 in potential upside to resistance and $1.85 in potential downside to support, Equinox currently has an unfavorable reward/risk ratio of 0.16 to 1.0. The current reward/risk ratio is nowhere near the 4 to 1 reward/risk ratio I require to justify entering new positions.

As noted previously, a rising tide could lift all boats, and I would not be surprised if EQX rallied past the $8.50 level at some point this year, given that it is one of the more beaten-up names sector-wide. However, I don’t see any margin of safety at current levels from a valuation standpoint, and I have never found that it’s paid to chase sector laggards when they’re overbought short term. Therefore, I don’t see any way to justify paying above $8.00 for EQX. In fact, I would view any rallies in EQX above $8.95 before May as an opportunity to book some profits.

Equinox Gold Operations (Company Presentation)

Equinox continues to be a favorite among many gold-focused investors due to its growth, but I continue to see the stock as inferior relative to peers, with the company having a much harder time controlling costs than its peer group. Some investors may argue that in periods of rising gold prices, it’s exactly when one should own the high-cost producers.

I disagree with owning a lower-margin business based on the assumption that a commodity should trade higher. In the case that this thesis is wrong (higher gold prices), one is left owning an already low-margin business in an inflationary environment. If one wanted to employ this strategy, the time to do it was when Equinox was at $6.20 and trading in a low-risk buy zone, not when it’s 27% higher. To summarize, I think there are far more attractive places to park one’s money in this sector.

Be the first to comment