aquatarkus/iStock Editorial via Getty Images

Dear readers/subscribers,

In this article, I mean to reintroduce you to Equinor (NYSE:EQNR) and show you the company that was once called Statoil in Norway. In terms of oil/energy businesses, this might be one of the most attractive ones available in Europe – and I’ll show you why that is.

I don’t often write about oil/energy – I make a point of trying to avoid it, in fact – but in this case, I believe it is relevant due to my coverage spectrum and the upside that this company offers to investors.

Let’s get going and see what we have here.

Equinor – What is this company?

Equinor has had many names over the years. Most people, myself included, know the company as (former) Statoil. On the face of it, the company has been, and still is pretty simple, being the largest Norwegian company in the entire market.

Before renewables were fashionable, Equinor was in part a renewables company – and not just for the greenwashing either. On the larger scale of things, Equinor is impressive by the fact that it’s Norwegian, near/in the top 10 of the largest oil/gas companies in the world. The overall company structure we know today was created back in 2007 when Statoil merged with the oil/gas division of the company Norsk Hydro ASA (OTCQX:NHYDY) (yes – Norsk Hydro used to have oil/gas), another state-owned company. The company changed its name last year to Equinor, something people in Scandinavia are still getting used to. The name comes from “equi” (meaning ‘roots’) and “Nor-way” – an homage to the company’s Norwegian roots.

The company’s really old roots go back to Den Norske Stats Oljeselskap A/S, a limited company founded in the 1970s by the Norwegian government in order to safeguard and further the interest of the nation’s budding petroleum industry. Initially, this company was under complete state ownership and required to discuss any important decision with the minister of Industry at the time.

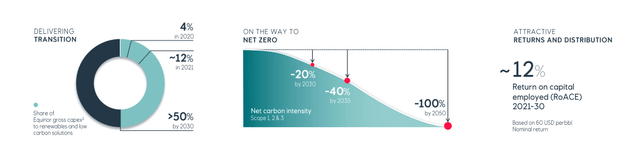

Equinor Presentation (Equinor IR)

It wasn’t actually privatized until 2001, following the trend in Norway where privatization wasn’t a thing until later than in most countries.

So, in the case of Equinor. The company is majority-owned by the Government of Norway. Only 33% of the company’s shares are publicly traded, with the rest being maintained by the Olje- og energidepartementet (Norwegian Ministry of Petroleum and Energy). This stake has been diluted by 15% over the past 20 years, being almost 80% at the time of listing.

Equinor presentation (Equinor IR)

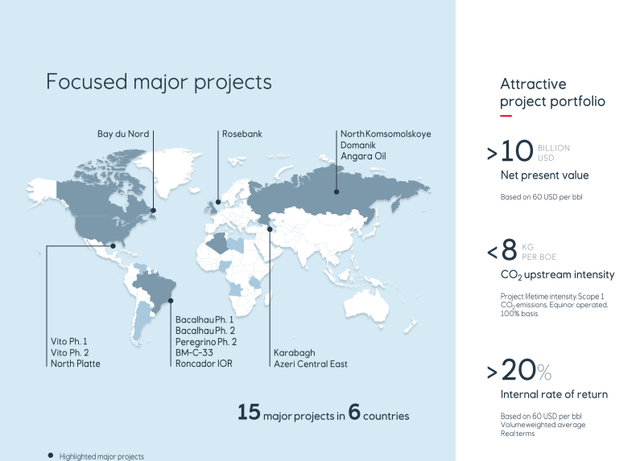

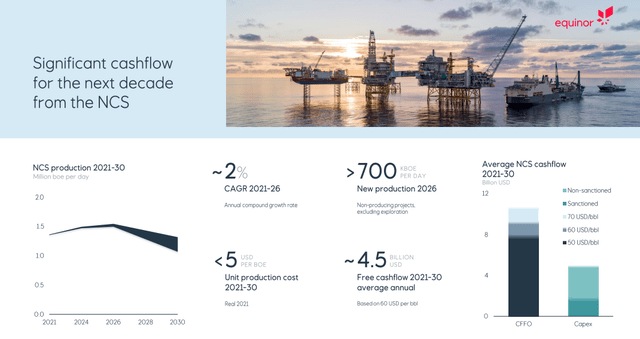

The company has production on an annual basis of 2mbpd of oil & gas, a production it expects to grow 3% per year until at least 2026. Equinor is the largest oil/gas company on the Norwegian continental shelf (NCS), and it slits between Norwegian and international operations, around a 60/40 split.

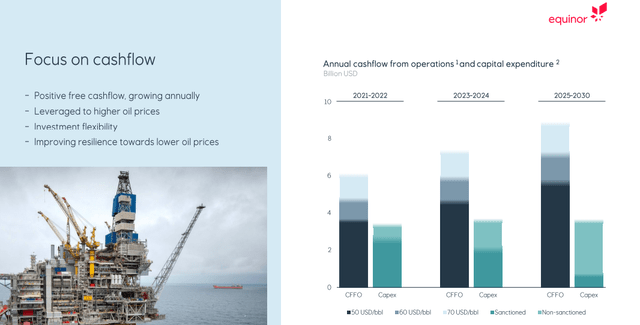

After many years of under-investment, the group engaged in higher Capex and led a robust exploration program that was successful. The revitalized Norwegian Continental Shelf can more than stabilize production thanks to technology improvements and tax incentives introduced by the country. Combined with the current massive energy shortage, there is a significant upside to these barrels.

Equinor Presentation (Equinor IR)

As a large operator, the group has been able to implement significant cost improvements across the entire NCS portfolio, bringing operating costs down to a 10-year low while increasing its efficiency by 6.5%. It managed to, at the same time, add 75k bbl to the company’s annual capacity during the oil crisis several years ago.

The company’s portfolio has an average breakeven in terms of oil price at $27/bbl, with several projects at break-even to below $20/bbl which of course puts it in an extremely favorable margin and position when looking at today’s company position. The company has a number of decent international operations, found among other regions in the arctic, the Caspian region, the US, Angola, and Brazil.

Equinor Presentation (Equinor IR)

Equinor acts as a natgas supplier to Europe, albeit a relatively small one in the larger perspective.

The company also has renewables that diversify its overall portfolio and stabilize against oil price volatility – the stabilization is of course, only minor given the company’s large oil operations. This is likely to become more important going forward. Equinor as a whole is actually more dependent on oil and gas prices than most of its close peers, ever since the sale of fuel retail, with a $10 +/- price in the bbl price for crude having a $1.5B-$2B CFO impact, and a $5/mwh gas price impact giving a $1B CFO impact in turn. The company’s Norwegian operations are the major part of the company’s cash generation.

Equinor Presentation (Equinor IR)

It was once believed that Equinor’s international operations would be a major part of its future growth in earnings – but impairments seen in the international business quickly saw these hopes dashed, even though there’s a 40% lower comparative tax rate for its non-Norwegian operations.

With more maturing oil fields in Norway, efficiency is becoming a challenge for the company, with stability being the target. Johan Sverdrup is the main argument here for 2020, which is the project that’s been seeing the break-even drop below $20/share on a project-specific basis, and a unit production cost of below $2/share – very impressive for an offshore project.

Equinor Presentation (Equinor IR)

It’s likely that Equinor will bring this experience to bear for other, future fields and projects. If Equinor can sustain a 3% growth in target production over the next couple of years, this could imply an overall post-2021 breakeven of $40/bbl or even lower, which would put Equinor in a very attractive position.

It goes without saying that the current company situation is massively appealing in terms of the oil price, as it influences earnings. It also goes without saying, for me at least, that this is a temporary situation. Once it unwinds, as I believe it will, we’re back to viewing the company in terms of more “standard” measures and profit levels.

On a high level, Equinor is a theoretically very attractive fundamental play on oil – and specifically European/Norwegian oil, which currently makes up the company’s main portfolio. It also has strong current and planned renewable operations which should help it manage some of the future. Offshore wind especially is a major boon here.

Risks to Equinor

Given the oil situation (and gas) we’re currently in, people don’t even seem to like to discuss risks to these companies at this particular time. Me, however – I’m happy to do exactly that.

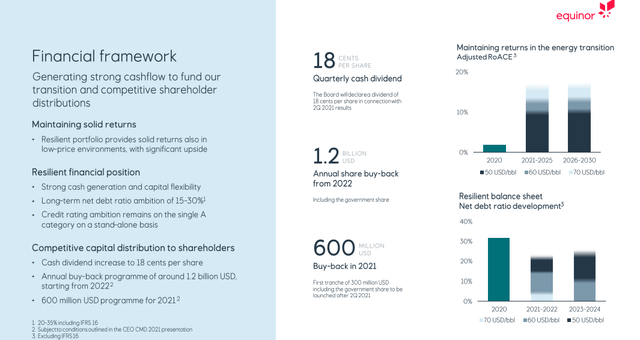

Equinor has several risks worth mentioning that could impact the company. Given its massive focus on upstream, over 85% of the company’s total earnings and higher during this situation with the oil price, this brings with it massive amounts of earnings volatility. This swung in the other way less than 2 years back, and we saw how bad things could be when the company significantly cut its 2020 dividend, only to then raise it in 2021 and again planned in 2022.

Valuation risk is very real at this point. The company’s share price has been climbing to absolutely insanely high levels given the current oil situation. I do not consider this to be something that’s sustainable in the long term. Even if you believe that the company is a good business, which it is, there is a limit to how much a good business should cost. The company has reached this level – and beyond, in my opinion, no matter what this insane environment brings.

These trends have seen Equinor being justified to see DCF target adjustments to up to 35-50% due to significant, non-recurring earnings increases. I’m working with gas estimates of €10/MWh, which is more than twice what it was a year ago, with significant impacts on FCF.

Valuation and EPS volatility risks are the way of life for Equinor investors – and if you’re looking at the company currently, I argue you’re beginning at the wrong “end” of things.

Let me show you exactly why that is.

Equinor’s Valuation

I will show you a very clear picture of this business’s valuation -and not a very flattering one. Following a massive climb to a 350+ NOK share price, the company is overvalued in virtually every context. Even if we assume a 3-5% EBITDA growth to a terminal period beyond 10 years, with a less than 2% corresponding CapEx increase, such a DCF based on a WACC of 7.1%, is no more than a 355 NOK/share price – which is below where Equinor is trading as I write this article. Forecasting higher results than this are, in my opinion, bordering on irresponsible given that we do not know how long this situation will hold. Longer than 6 months? Probably.

But 1 year? 2? 5?

It’s a difficult or downright impossible thing to forecast – and this makes things uncertain here. I choose to go the conservative route, and that means considering Equinor somewhat overvalued from a DCF perspective.

Things don’t get better in other perspectives or ways of considering the company’s valuation.

For peers, we look at local peers like Shell (SHEL), TotalEnergies (TTE), BP (BP), Eni (E), and Repsol (OTCQX:REPYY). While these companies trade relatively cheaply on P/E, they’ve recently climbed up – but Equinor is well beyond even their 7-8X P/E, and currently trades above a 10X conservative P/E. The company also has a book value multiple of close to 3X (compared to a 1X average), and a yield of around 3% normalized to its dividend (we’ll see how much more we get in 2022). In every one of these perspectives, even if we assign a deserved premium on the book value multiples for its renewables, the company is worth implied share prices of between 175 to 350 NOK – at most.

And it’s currently trading above these levels.

But what about NAV, you might ask?

Sure. We value E&P Norway at a 4-5X EBIT multiple, and other segments at high multiples of 7-9X – I don’t have an issue with that. E&P Norway by itself is more than 3X as large as any of the other ones combined. There’s Scatec Solar, of which the company has a 15.2% stake, which we use a listed valuation on. It all comes to around 130B gross, and around 106B NOK net, which comes to less than 360 NOK/share SOTP valuation.

The point I want to drive home like a nail into wood is the fact that based on any conservative valuation, Equinor is currently overvalued. Maybe not as much as tech companies were overvalued during the worst of the recent bubble, which is swiftly deflating, but still at a valuation where I’m looking and going “What?”.

Yes, oil prices are currently high. Yes, I believe they’re going to stay high, maybe even for some time.

No, that doesn’t mean I’m pushing massive amounts of energy.

I did buy energy. When? When it was dirt cheap. In both my corporate and my private portfolio, I have a 3-8% (more in the corporate) stake in oil companies, including upstream, midstream, and downstream businesses that I view as qualitative. These investments have obviously paid massive dividends in the form of excellent returns – in some cases as much as 95% inclusive of dividends in less than 13 months.

The point that I am making is that it’s not the time to buy Equinor – not as I see it, at least. The valuation, no matter what you look at, is unfavorable. Maybe if you think that $200/bbl crude is going to be a thing for the next 2-3 years or so – but I don’t think this is going to be the case here.

For these reasons, I consider Equinor a “HOLD” with a maximum share price of 320 NOK/share. Using this price, I’m below some equity analysts but other analysts are pretty much consistent with that 320-350 NOK price target. S&P Global analysts have an average overall target of around 330 NOK, which puts the company at overvaluation, and 15 analysts out of 24 are currently at a “HOLD”. I believe the question of whether to buy Equinor at this time is easily answerable.

“No”.

It’s not a good idea to “BUY” Equinor here. I’m at a “HOLD”.

Thesis

Equinor is an attractive company, but it’s also a great European play. I can understand investors being curious about it. The NYS-based EQNR ticker is attractively liquid, despite being a Norwegian 1:1 ADR. Equinor is also one of the best-rated E&P companies on earth, with an AA rating.

And investors are currently calling for the 2022 unwinding to take several years, which could infuse the company’s earnings with enough cash and profit to drive several consecutive years of good profit, despite 20% drops in EPS for 2023 and 2024.

I understand that these arguments may seem appealing, and those numbers may even materialize. But I don’t believe so. I believe the unwinding to go faster, and side with the decline forecasts seen by equity analysts on the independent side, as well as S&P Global, which forecasts declines in EPS in no less than 35-45% followed by another 15-20% in 2024, which would normalize Equinor – right along, in my view, along with its share price/valuation.

So, I believe investors in Equinor are setting themselves up for disappointment if investing in the business at this time, after a massive climb up the chain of no less than 55% in 1 year.

Am I selling yet? no, not yet. While overvalued, I don’t see the company as grotesquely overvalued enough under current contexts to sell just yet – but you can bet that I’m looking very closely at reports and the market overall, to determine when it’s time to rotate my capital in more attractively valued companies.

That time, I believe, is coming.

So the time is ripe to “HOLD” Equinor, but certainly not to “BUY” it. If you didn’t buy when the company troughed under 100 NOK back in 2020, you shouldn’t be buying now.

That’s my view – and I stick by it.

Be the first to comment