Svitlana Hulko/iStock via Getty Images

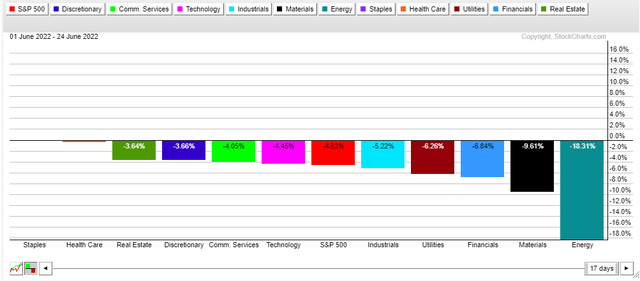

Defensive sectors have led the way recently. Health Care, Staples, and Utilities are seen as safe havens amid June’s stock market swoon. Last week’s snapback was welcome news for investors, but once again defensive niches continued to show decent relative strength.

Defensive Sector Outperforming in June

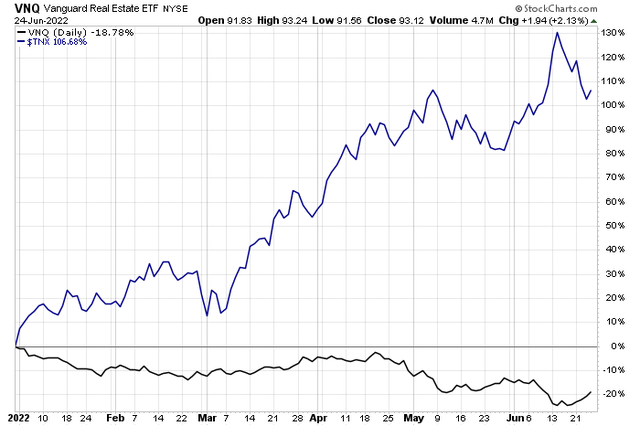

One area that has performed much better versus its drubbing in May is Real Estate. REITs, in particular, have bounced as interest rates pared their gains.

REITs Rebound As Rates Retreat

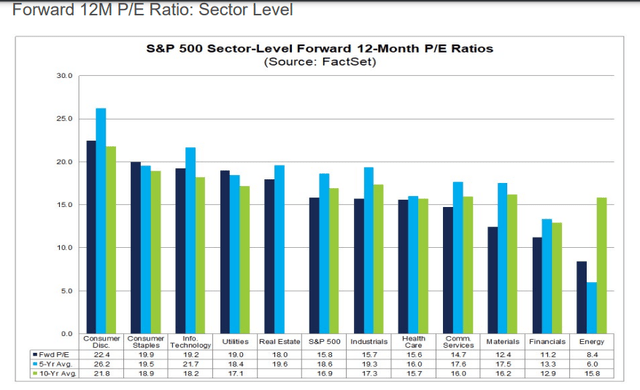

Real Estate trades almost 10% cheaper than its five-year average forward price-to-earnings multiple, according to the weekly John Butters S&P 500 earnings report from FactSet.

Real Estate Trades at a Slight Discount to its Historical Average P/E

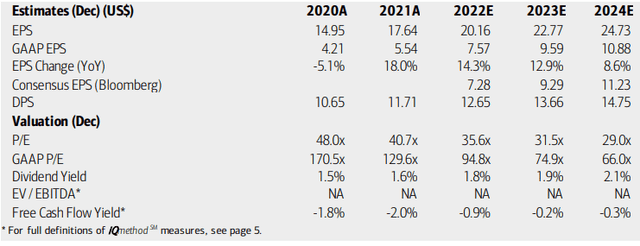

Let’s home in on one real estate play, Equinix, Inc (NASDAQ:EQIX). According to Bank of America Global Research, Equinix is the premier global data center operator offering service to large enterprises, content providers, and telecom carriers. The company manages 100 network-neutral data centers in 31 markets across the Americas, EMEA, and Asia. As the fourth-largest holding in the Real Estate Select Sector SPDR Fund (XLRE), it’s a big player in a small sector.

Colocation is a key driver of future earnings growth for the real estate company. BofA analysts expect EPS to jump from under $18 last year to nearly $25 by 2024. Its dividend yield is seen as increasing to above 2% by then, too. Still, free cash flow is negative. The company is a growth story within a sector popular among dividend investors.

Earnings, Valuation, and Dividend Outlook

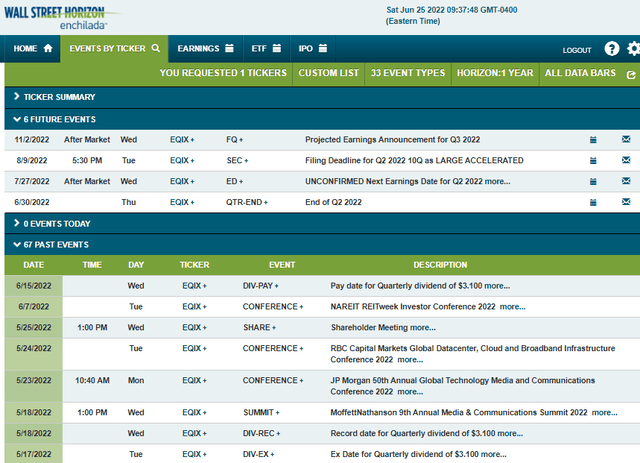

Looking ahead, EQIX reports earnings in about a month. According to Wall Street Horizon, the company’s Q2 results are unconfirmed to hit the tape on July 27 AMC.

EQIX Corporate Event Calendar

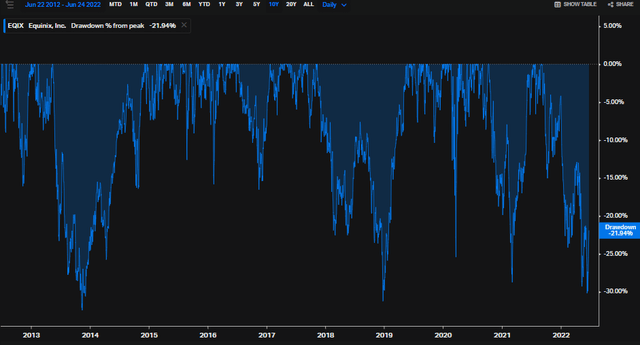

Turning to price history and trends, EQIX is a stock ripe with volatility. Notice in the drawdown chart below that 30% pullbacks are common over the last 10 years. This is one piece of evidence suggesting that now’s a good time to buy shares on the dip.

EQIX Historical Drawdowns: Buy When Dips Hit 30%

The Technical Take

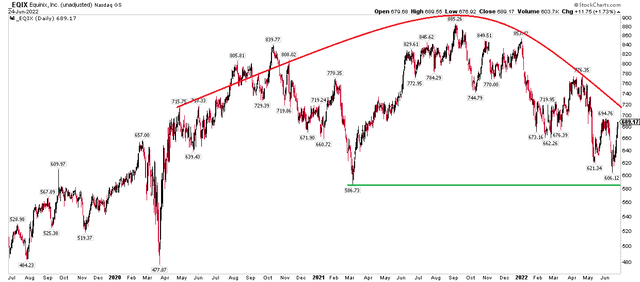

But what does price say? I see a rounded top on EQIX with key support in the $586-$606 area. A long position right now makes sense with a stop under $580. Near-term, climbing above the May-June 2022 peak at $695 is important. A recent rally, along with many other REITs, has brought the stock more than 10% off its June low. Still, there significant bearish overhead supply from about $660 to $850, particularly above $775 – from the trading range of late last year.

EQIX Chart: Rounded Topping Pattern with Support

The Bottom Line

Whenever you analyze a stock, there are bullish and bearish factors. In this case, it’s a mixed bag, but weighing all the evidence, I believe a bullish stance is warranted. Strong EPS outlooks and a historical tendency to pullback 30% then rally big tells me that more upside is in the cards. Bearish factors include a lofty valuation and a downtrend off the Q3 2021 high. I suggest a long position with a stop under the early 2021 low. A near-term target of $775 is in play.

Be the first to comment