The blaring headlines about the coronavirus have given EQT Corp. (EQT) stock the flu. The headlines even go to extremes about China shutting down. Now, China is beginning the aftermath. Many of these bugs do not have the effect originally feared. Time will tell on this latest one as to exactly how the United States fares. For the time being, I will go with history and wait for definite developments that would change my view. Admittedly, there are estimates out there that go as long as 18 months. But history generally does not support that view.

However, panic or no panic, China is not going anywhere. Besides, most headline-grabbing flus fade with the increasing temperatures of Spring. Therefore, any epidemic effect will at most (likely) affect a quarter or two. A quarter or two is significant, but nowhere near as damaging as the stock price action indicates.

Effect On Natural Gas

Investors often wonder how industry extremes come about. Anyone watching the natural gas pricing downturn is about to get first-hand experience on a market going to extremes. The panic about any flu-related (or similar) illness is often misplaced. In the long-term scheme of things, this short-term disruption should be an unpleasant memory by summer. The market will be looking ahead to better times.

In the meantime, this panic will probably cause the idling of a few more rigs. That will make the bottom production levels lower than they would have been. The warm winter is likewise discouraging production and encouraging more bankruptcies. Therefore, this downturn will be more severe than many. But that severity will also make producers less likely to respond to any natural gas price rally for a while. Therefore, natural gas prices could be unexpectedly strong in the second half of the year.

Unconventional wells often decline more than 50% (easily) in the first year of production. Since those wells often produce a lot of the natural gas, its production should fall more than most expect due to the effects of unconventional well production curves. So far, the market seems to expect an unrelenting oversupply for the foreseeable future. But that is the usual market view at a cyclical bottom, because so many project more of the same. Time will tell how the current situation works out. But the latest round of pessimism from the factors above appears to point to a faster pricing recovery than one might expect.

Stock Price Action

In the meantime, the stock price has been absolutely demolished by unrestrained pessimism. One would think from the market reaction that this management would not even know how to spell profits, let alone actually produce profits. Clearly, this is a company that has “had it”.

(Source: Seeking Alpha, March 18, 2020)

On the other hand, this dry gas producer has a fair number of “levers to pull” to get through the current downturn. The stock price pessimism allows for very little upside potential and a whole lot of bad news in the future. While bad news in the immediate future is likely, the declining rig count and slowing Permian production growth point to a far brighter long-term future than Mr. Market would like to admit.

Possibly the last few days of stock price action are a realization that the end is not near for this natural gas company.

The largest potential upside comes from the newly elected Rice Team to the management of EQT Corp. at the last annual meeting. This new management team appears to be far more competitive in terms of cost control and profitability goals. That should lead to a better and more profitable company future than would have been the case with previous management.

One of the first actions by this management was a 23% workforce reduction to save about $50 million a year. Many in the industry are now taking the workforce reduction step as gas pricing continues to drop. This was part of the new management’s initial 100-day plan to increase company competitiveness. New management is quickly transforming this company into a more profitable and aggressive competitor.

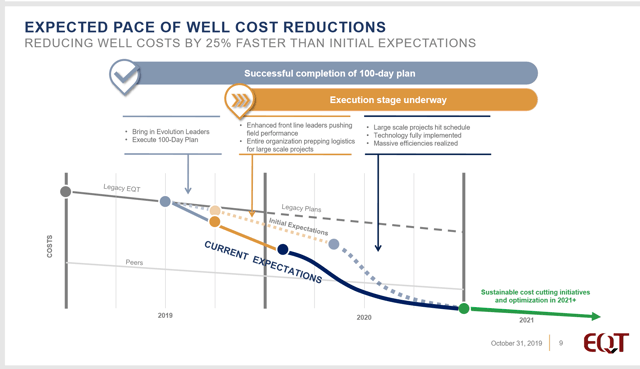

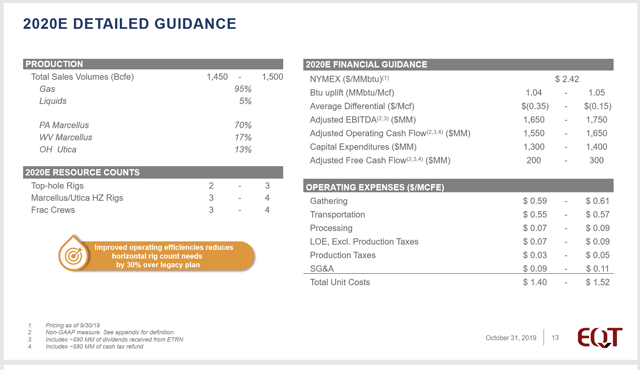

(Source: EQT Third Quarter 2019, Conference Call Slides)

Management has established far more aggressive cost-cutting expectations for the future. If the initial personnel layoffs are any hint of what is in store in the future, then investors can predict that this management intends to run this company with lower costs than many competitors. The actual accomplishment of that goal is yet to be seen. At this point, the initial cost cutting is about the same as the industry average.

But the new management appears to have a very different profitability goal than many in the industry. This new idea has to be classified as speculative until there is a track record. However, should this management succeed, there is a good chance that many cyclical downturns will not be very threatening to this company in the future.

One of the reasons that the Rice Brothers were able to win a proxy battle was the perception that the previous management settled for “good enough”.

Good acreage demonstrates low costs so many times that many managements bask in the accolades of above-average profits. But yesterday’s low costs are often tomorrow’s average or even high costs. Therefore, what once looked like comfortable profit margins has now become a temporary cash flow drought. The new management has recognized this and has begun to drastically reduce costs across the board before the company’s cash flow challenges become significant.

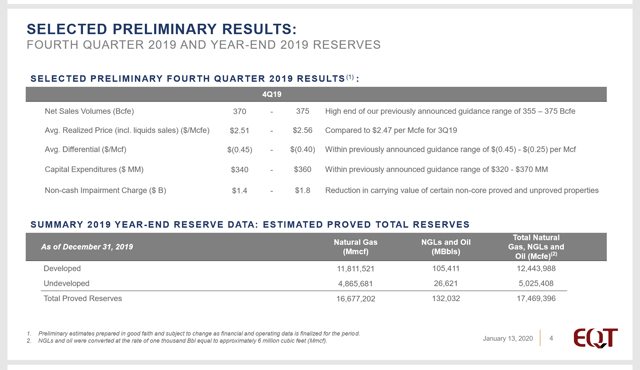

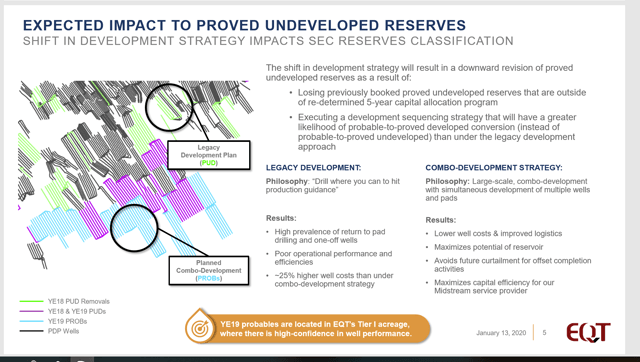

(Source: EQT Fourth Quarter Operations Update January 13, 2020)

Some preliminary results include a slight increase in realized selling prices. Given the environment of declining natural gas prices, that slight increase shows a tightening of the marketing strategy to extract a few extra pennies. It is a sign of good and hard-driving management that lets “no stone unturned”. Mr. Market is obviously looking for more than that accomplishment. Still, preliminary results would appear to indicate a far more detailed management intent upon cutting costs to the minimum (as opposed to industry-perceived low costs).

That means EQT Corp. will be a very different competitor going forward. This type of competitive focus is hard for the market to discern because management cannot eliminate all the wells and operations achieved under a different system. However, the new lower-cost structure should be demonstrated within 12 months of implementation and lead to several years of lower costs. So, by the time the inevitable industry recovery becomes apparent, this company should be showing favorable quarterly comparisons as a result of this overall cost reduction campaign.

The Future

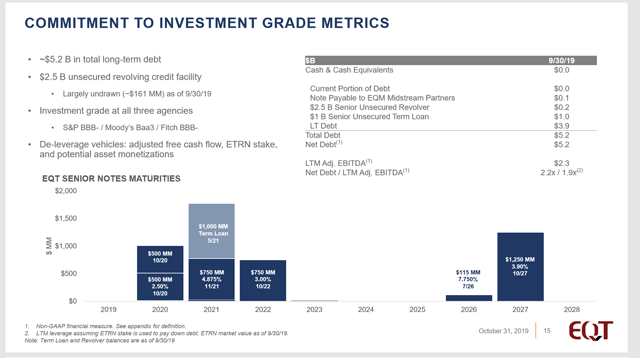

Management has also begun to deal with the debt structure. $1 billion of 6.125 notes should enable the company to significantly reduce (or eliminate) the debt due in 2020 and 2021.

(Source: EQT Third Quarter 2019, Conference Call Slides)

Clearly, the announcement of the financial ratings downgrade did not impair EQT Corp.’s ability to refinance its debt. The new interest rate will be a little bit higher. However, the company clearly has the liquidity to deal with the remaining debt that will mature. The debt markets will not be closed to EQT Corp. even after the downgrade. Prohibitively costly debt refinances are for companies that have greater problems than this one.

(Source: EQT Third Quarter 2019, Conference Call Slides)

Several companies have announced sharply lower capital budgets similar to this one. What will be interesting is the effect of the operational efficiencies management plans to execute at the same time. That will probably mean production should beat guidance.

Another budget adjustment was announced on March 16. Management appears to have squeezed another $75 million out of the capital budget. Some firm transportation capacity was also released. Management expects to decrease transportation costs by $.04 MCFE and largely offset that savings by increasing differentials. It is still projecting free cash flow. The bank line has also been paid down. That is a key to surviving the current panic. The term loan for 2021 is now at $200 million.

What is different this time around is the far slower growth predicted in basins like the Permian, where natural gas is an “extra” product that is sold or flared. Those oilier basins now will not be adding to the gas supply to the extent that they have in the past.

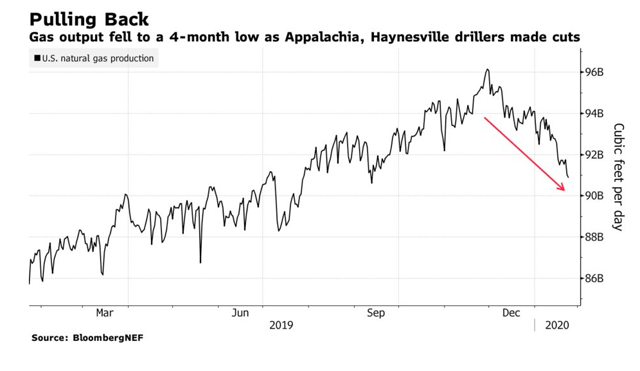

Natural gas output is already at a four-month low.

(Source: Bloomberg January 23, 2020, by Naureen S Malik)

The article itself still focuses on the excess supply of natural gas caused by the warm winter. However, potential investors need to notice the sharp production decline caused by unconventional first-year production declines of new wells drilled. The market has not seen downturns where unconventional technology dominates the decreasing supply trend. There is therefore every chance that Mr. Market will be surprised at how fast the gas supply comes into balance with growing demand from a decent economy.

The coronavirus headlines will fade relatively quickly as they have in the past. Flu-related illnesses typically decline with the arrival of Spring. So, the chances of the latest panic lasting more than a couple of months are slim. Nonetheless, there is a risk of a far longer-lasting pandemic.

However, this current panic may encourage producers to idle even more rigs than they had already planned. That could potentially make for a stronger cyclical recovery than the market currently plans. Producers will most likely have a muted response to any pricing recovery, as this downturn was unusually severe and long lasting. That could be good news for many dry gas producers.

EQT Corp. has extra reasons to do well over the coming market bottom. Its midstream holdings are worth at least $500 million, and the hedging portfolio will only gain in value. The aggressive cost-cutting campaign underway could add an extra layer of protection from long-term financial damage. New management has had a very good record of producing value for shareholders in the past. There is every reason to believe that they can do so again in the future.

I analyze oil and gas companies like EQT Corporation and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies – the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Be the first to comment