onurdongel/E+ via Getty Images

(Note: This article has been updated with current information from the original article posted in my marketplace newsletter on April 26, 2022.)

Epsilon Energy (NASDAQ:EPSN) began as a dry gas producer with some excellent Marcellus acreage. For long time followers, Chesapeake Energy (CHK) is the operator of that acreage. Now the company has acquired acreage in Oklahoma. Like many in the industry, the liquids rich section of the acreage provides maximum flexibility to profit from shifting industry pricing. So there has been an increase in liquids rich production. However, the rest of the acreage will likely have “it’s time in the sun” as pricing relationships shift very fast to allow many strategies to work sooner or later.

The company also has a significant interest in midstream operations that provides a constant income throughout the industry cycle. Despite the small size of the company, the strong balance sheet and the midstream interest make this common stock far less volatile than many in the industry.

Oklahoma Acreage

The company has a similar model to the Marcellus in that it does not operate the acreage. Management does determine if it wants to participate in wells drilled (or not). Most of the time, management does elect to participate.

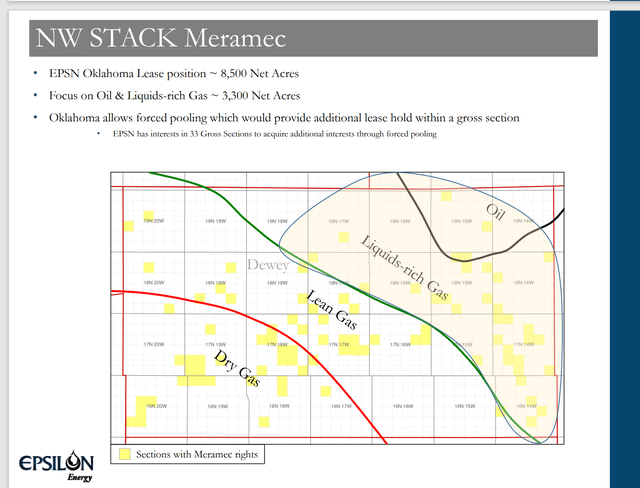

Epsilon Energy NW Stack Meramec Holdings (Epsilon Energy November 2021, Corporate Presentation)

In some ways the company has a strategy that is similar to a lot of royalty companies in that the company typically takes a minority interest in a lot of acreage that is “spread out” to reduce the risk of an unfavorable outcome. Therefore, any one well is unlikely to “make or break” the company. Instead, several wells are needed for results to be material to production.

Now there have been periods of obvious growth and of course periods of no or little activity on the company acreage. The Meramec itself is an emerging basin that has been on the industry radar for years. But the new completion methods have revolutionized the play “overnight”. This is leading to a production revival that some thought they would never see.

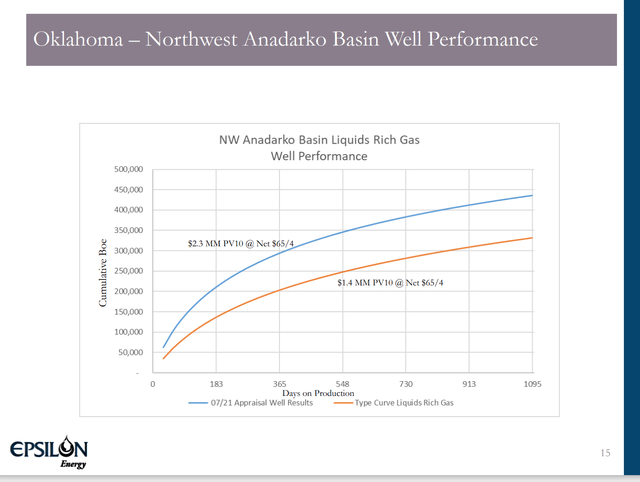

Epsilon Energy Oklahoma Well Performance (Epsilon Energy November 2021, Corporate Presentation)

Any well that produces that much of nearly any product is going to be extremely profitable at current prices. Most operators will use the current environment to get the drilling costs back and hedge if necessary to assure a reasonable profit. Then the well produces as long as positive cash flow can be produced.

Management announced during the first quarter that the latest two wells were “encouraging” as in they probably continue to produce above the type curve shown above. Management further announced that current prices are above the prices used to determine potential well profitability. This bodes very well for future activity and continuing cash flow growth.

These leases in Oklahoma will be the target of future growth. Either high prices or better than expected performance are likely to result in significant production growth. Right now, management sees both. Therefore, this debt free company could grow production substantially while the industry cycle provides for robust profits.

The cash balance will likely remain at extremely conservative levels so that management can just sit back and cash checks during the next industry downturn.

Some of these wells as they get older are shut-in during periods of weak commodity prices to allow the pressure to build up. They are then brought back into production during times of strong commodity prices before they are permanently plugged and abandoned. In any event, most wells brought onto production in the current environment will make the owners a lot of money.

Marcellus

The company’s Marcellus acreage currently provides most of the income and cash flow.

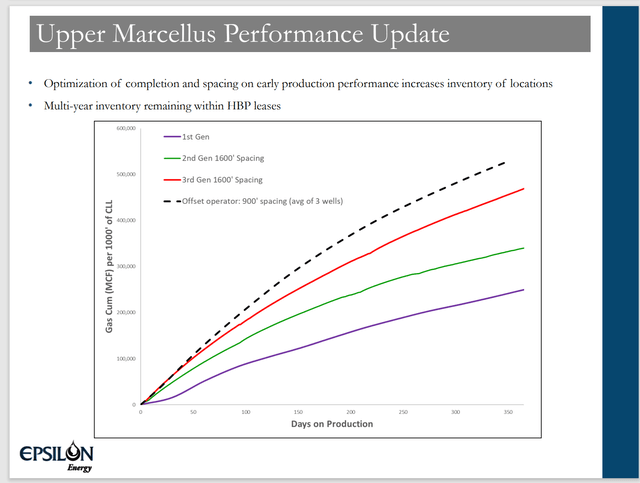

Epsilon Energy Upper Marcellus (new interval) Well Performance (Epsilon Energy November 2021, Corporate Presentation.)

In the meantime, the company has far less acreage in Pennsylvania. But that acreage is in a prime location and the company has rights to the stacked play. In contrast, the Oklahoma acreage is basically the Meramec. Now, as the chart above shows, the industry is now developing the Upper Marcellus after several years of focus on the lower Marcellus. That has the effect of increasing the possible well locations because there are now two commercially profitable zones whereas before the industry focused upon one zone.

A potential area of growth would be further improvement in recovery rates. The unconventional business is relatively young. That means that there should be potential for greater recovery rates as technology advances. Secondary recovery techniques in tight oil formations are a relatively new idea as well. Should the industry become proficient at secondary recovery in the unconventional business, that could provide still more possibilities for this acreage.

Finances

Management traditionally operates with a debt free balance sheet and a big cash balance. This is an extremely important cushion for industry downturns. Management does not operate the acreage itself. Therefore, a strong balance sheet is necessary for the company to have maximum flexibility during industry downturns.

The company ended the year with $26 million in cash. In the first quarter, that cash balance grew to $30 million while the company substantially increased production in Oklahoma. That amount is more than $1 per share outstanding. Management has been repurchasing shares with the extra free cash flow (and the cash on hand still increased). There is enough cash on hand to handle all the liabilities and still have cash left over. That is a very rare feat in this industry.

Back in 2017, the company had announced a successful rights offering. That rights offering and cash on hand was used to acquire the Oklahoma acreage while repaying debt. In the years since then, management has largely reacquired the shares issued for that acreage. The remaining dilution is a fraction of what it once was. This and the paragraph before demonstrating an extremely conservative financial strategy that is seldom seen in this industry. As a result, this company has far lower risk than is the case in the upstream industry even though it is a small company.

This year management will continue to reacquire shares with cash flow and followed through with the initiation of a dividend. The initiation of a dividend is a very optimistic outlook by one of the more conservative managements of the industry. In the past, during the extended pricing downturn of natural gas, this management opted for periodic stock repurchases.

Therefore, investors should not look at the dividend as “here to stay”. This management will not hesitate to cut that dividend as company finances remain a priority. An income investor that needs the income would need to look elsewhere. The common is best analyzed as a variable distribution entity.

Similarly, there was a time when development of the Oklahoma acreage slowed or was even delayed until prices supported the currently robust development pace.

The Future

Investors should likely expect continued conservative balance sheet management with a strong cash balance. That is consistent with allowing operators to develop the acreage as needed.

Typically, this management will contractually involve itself in acreage development. This is different from actually operating the acreage. Therefore, the company is not as passive as one might anticipate when the company is not the operator.

Right now, the current atmosphere argues for a robust development of all of the company acreage. Therefore, growth will likely depend upon the company participation (which can vary widely) for the well locations chosen for development and completion. While that choice can lead to widely varying results each year, the current robust industry environment probably will lead to an extended production growth phase.

The sizable cash balance will cushion any downward pressure on the stock price. Further cushioning happens because this management does not encourage institutional investment. Therefore, this stock is not nearly as volatile as many in the industry. This is another safety factor for the risk averse investor that is not typical of small companies.

The continuing growth of the company will increase the value of the company to the point where institutions will become interested. But for now, this company is suitable for those that want less than average stock price volatility inherent in the industry.

This management simply waits out industry downturns because it has no long term debt to service. Meanwhile the cash balance cushions any weak industry pricing until the next recovery begins. Investors should expect the cautious growth strategy to continue in the future.

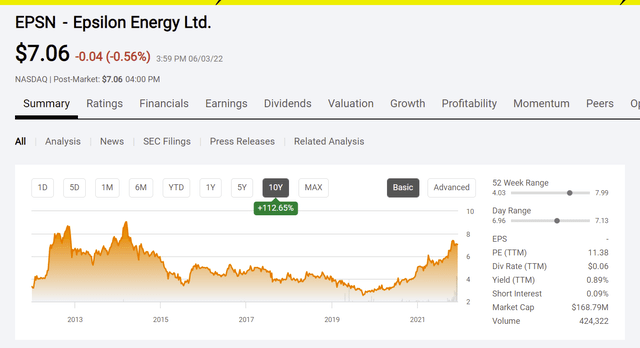

Epsilon Energy Common Stock Price History and Key Valuation Metrics (Seeking Alpha Website June 5, 2022.)

The total return may be lower than many in the industry. But so was the risk taken by management. The risk adjusted return will be adequate for many that like to be involved in the oil and gas industry without all that volatility that frequently follows risk taking management.

The stock is far less volatile than many in the industry. This is likely due to a lack of management participation in conferences, no quarterly conference calls, and of course the occasional presentation. Management does provide a good deal of information. But company promotion in the traditional “roadshow” sense is not there.

This, as shown above, makes the stock far less volatile than many in the industry. Clearly, the stock did decline, for example, in fiscal year 2020. But the stock was not pounded nearly to the extent of the companies that institutions ran away from that I follow.

Combine that management strategy with the presence of a midstream operation and a very conservative balance sheet. Now you have a small company whose stock behaves in a far less risky fashion over time than many pure upstream companies. It is a stock that risk averse investors can consider.

As the company continues to grow, more opportunities will become available for growth. Eventually a company like this one could be purchased by one of its partners. There is a lot here for an acquirer to like.

Be the first to comment