This article was coproduced with Nicholas Ward.

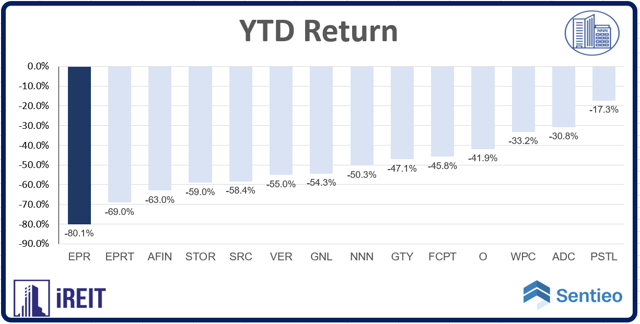

Without a doubt, this has been a terrible week for REIT investors. We’ve seen stock prices plunge across the spectrum of the REIT sector. The data center REITs have held up relatively well, but outside of that, it’s carnage, plain and simple.

REITs have become unloved because of the social distancing/shelter-in-place policies that we’ve seen governments recommend and/or enact across the country as we all attempt to make a collective effort to slow the spread of the COVID-19 virus so that our healthcare system does not become overwhelmed while we wait for the scientific community to produce therapeutics and/or a vaccine. But, we’re not hear to spread fear, but instead face the facts.

We put together a property stress test for all the property sectors as viewed below:

Source: iREIT

Some are saying that this the buying opportunity of a lifetime. With shares of blue chip REITs like Realty Income (O) down roughly 40% during the week thus far, who could blame them? (We are writing an update now on our Marketplace service.)

And while we recognize that in an efficient market, high risk comes with potentially high rewards, we’ve turned cautious on many of the REITs that we cover.

In recent weeks, we’ve moved holdings from entire sub-sectors of our coverage area to the speculative designation because frankly put no one knows how long lasting these COVID-19-related fear, policies, and ultimately, their economic impact, will last.

At iREIT, we firmly believe in the classic value investing principles of buy low and sell high. These are sound investment practices that have been making people rich for generations.

We acknowledge that there are likely many bargains in the market right now.

Babies are likely being thrown out with the bath water left and right. However, we also recognize that many of our subscribers are retirees or individuals who’re interesting in owning REITs primarily for the passive income that they generate, and not capital appreciation potential from these low levels.

We think investors need to be very careful about diving headfirst into many of the sell-offs that we’ve seen in recent weeks. We question the viability of cash flows across the REIT sector in the short term, and therefore, the sustainability of many of the dividend yields that we’re seeing.

We’ve tried to make it clear, with recent articles, that now is not the time to be chasing yield.. Now is the time to focus on quality, focus on the fundamentals, and not to ignore the unprecedented risks that many REITs are facing these days. In short, now is not the time to be a high-yield REIT investor.

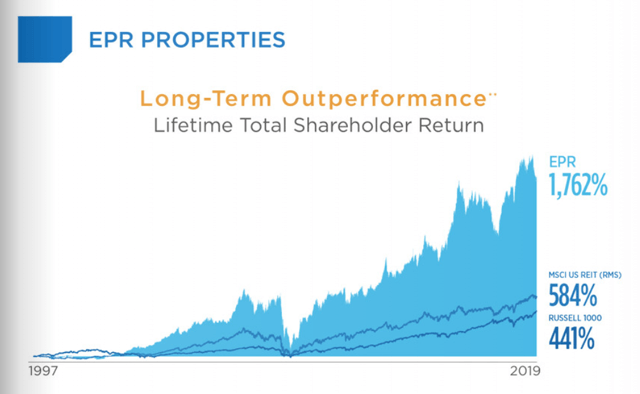

With all of that being said, we wanted to take a look at EPR Properties (EPR). This is a former market darling that has been absolutely demolished over the last month or so. Without a doubt, this stock has been a top performer since becoming public in 1997.

Source: Q4/Full-Year Investor Presentation, page 5

However, we caution investors not to make decisions in the present based purely upon past performance.

Prior to the COVID-19 pandemic, most investors believed that the biggest threat to physical retail and consumer-facing REITs was the rise of e-commerce and the digital economy. With that in mind, investors and analysts alike became extremely bullish on names like EPR that focused their efforts on properties that had to do with experiences.

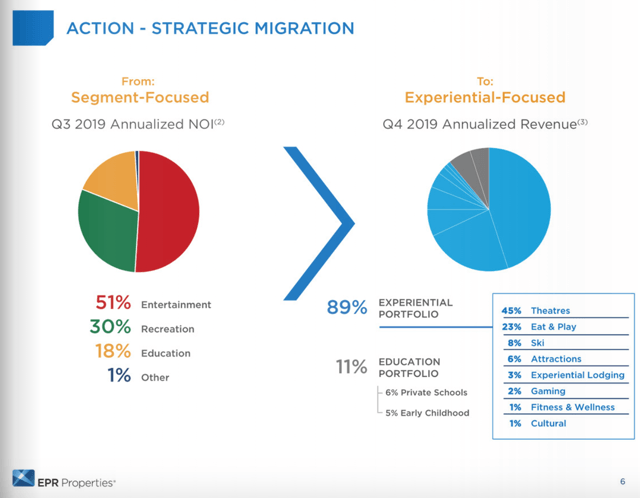

EPR markets itself as a company that focused primarily on three things: Entertainment, recreation, and education. As you can see here, on EPR’s investor relations website, the company has built out a property portfolio that consists of 370 locations across 44 states and Canada.

The company is focused on a broad array of businesses that meet the “entertainment, recreation, and education” mold, but as you can see on the graphic below, the largest piece of the pie here is movie theaters, which make up roughly 45% of EPR’s sales.

Source: Q4/Full-Year Investor Presentation, page 6

This fact alone is very concerning to us.

In recent days, we’ve seen movie theater chains completely shut down operations.

On Monday, 3/16/2020, AMC Theaters (AMC), the largest theater chain in the U.S., announced that it was limiting its theater capacity to just 50 people to allow for social distancing.

Then, later that day, Regal Cinemas, the U.S.’s second largest theater company announced that it was shutting down all locations indefinitely as a pandemic precaution.

This move appears to have forced AMC’s hand. On Tuesday, 3/17/2020, AMC announced that it was shutting down all U.S. locations for at least 6-12 weeks in an effort to comply with local, state, and federal policies being put in place with regard to slowing the community spread of COVID-19.

Since then, we’ve seen other large rivals follow suit and now we’re at the point where you’d be hard pressed to watch a film on the big screen in America.

These closures in the theater business have tricked down to the entertainments names as well. Disney (DIS), for instance, made big news this week by canceling the upcoming Black Widow launch in an effort to protect its box office earnings. This news came after disappointing news regarding this past weekend’s box office results, which were the worst numbers that we’ve seen in more than 20 years.

Disney’s animated film, “Onward,” came in first place last weekend, but it only produced $10.5m during the weekend. This figure represented a 73% week over week drop for Onward and the U.S. box office, at large, experienced a 44% week over week fall.

With all of these negative figures in mind, we cannot be anything but bearish on EPR’s prospects in the short term due to its high exposure to the theater market. We’re concerned with bankruptcies across the space and can’t help but wonder whether or not these social distancing measures will help to usher in a new normal with regard to the box office, which was already seeing a lot of pressure from the rise of streaming platforms.

Do we think that movie theaters are going to disappear? No. But, it’s likely that the COVID-19 event will prove to be yet another major hurdle for the industry and this doesn’t bode well for landlords in this space.

Furthermore, when looking at EPR’s portfolio, it’s important to note that the company owns 55 “Eat and Play” properties (think brands like Top Golf).

While these are certainly intriguing businesses over the long term because of their ability to combine experiences with social gatherings, these are not the types of places that we expect to perform well in a world where individuals are being asked to stay at home and avoid contact with individuals outside of their immediate families. The “Eat and Play” category makes up 23% of EPR’s annual revenues.

Across EPR’s entire portfolio, we see businesses that are likely to be forced to shut their doors to customers for the foreseeable future. Private schools and early childhood education centers make up a combined 11% of EPR’s sales.

Tuition fees are likely already paid for the spring semester, but there are major question marks regarding the future cash flows generates by these businesses as schools close down and parents are asked to isolate their kids at home.

Gaming is yet another part of EPR’s portfolio. Granted, the company currently only owns one property in the space which makes up only 2% of the company’s annualized revenue. However, management had plans, up until recently, to expand this exposure.

The company had previously issued guidance, which included this $1 billion gaming investment, alongside another $600m uncommitted investments across the entirely of its various industry exposures, which was expected to add approximately $0.60 in FFO once the deals were done.

However, on March 12, EPR announced that it was withdrawing plans to invest roughly $1b in a gaming venue and roughly $500m of the other investments, meaning that as of today, EPS’s 2020 investment spending is expected to amount to $100m.

By withdrawing the guidance, management made it clear that the company was likely in for a rough time moving forward. This move hurts the company’s FFO growth outlook, though management was obviously trying to do what it could to sure up its balance sheet in a time of trouble.

During the press release regarding the withdrawal from the deal, EPR’s President and CEO Greg Silvers said:

“During these unprecedented times, our decisions today reflect our long-term commitment to maintaining the strength of our balance sheet. With approximately $500.0 million in unrestricted cash, 100% availability under our $1.0 billion line of credit, low leverage and no near-term debt maturities, we believe the strength of our balance sheet will allow us to weather this period.”

This move seems prudent given the nature of the industries that EPR is exposed to, yet we don’t think it will prove to be enough. We continue to question the company’s ability to fund its dividend in the short to medium term.

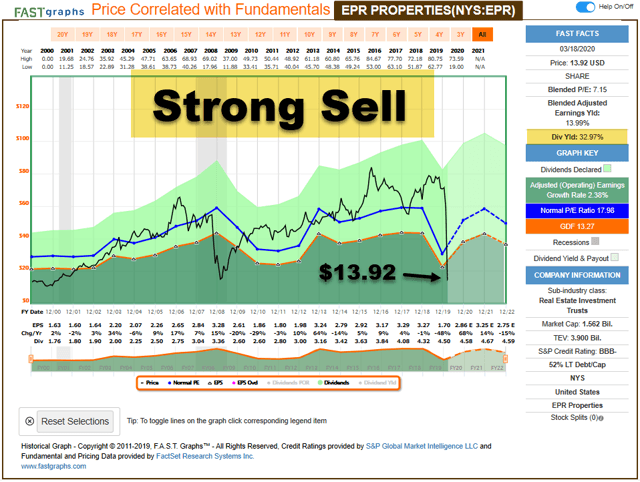

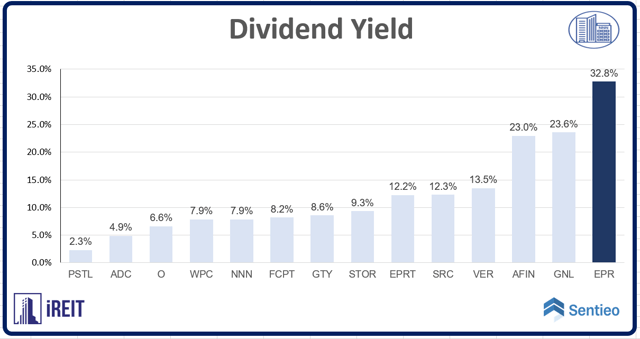

Right now, EPR shares are trading for $13.92. This means that they have fallen nearly 83% from its 52-week high of $80.75. It also means that the company’s dividend yield is 32.97%.

Obviously this type of yield is appealing to income oriented investors. However, when we see yields this high, we think that common sense needs to step in and overcome the greed associated with such large potential cash flows.

In life, when things seem too good to be true, they typically are. This ~33% yield appears to be one of them.

Sure, there’s a chance that the COVID-19 scare ends shortly. We certainly hope that the world’s scientific community comes up with a cure for the disease tomorrow so that humans no longer have to suffer, people can go back to work, and the world’s economy can get immediately back on track. In this event, it’s possible for EPR to sustainably make its payments. However, hope is not an investment strategy.

On Feb. 24, EPR issued 2020 guidance that called for adjusted FFO per share of $5.19-$5.39. This figure pointed toward negative growth relative to 2019’s $5.44 FFO result and missed analyst expectations of $5.33 at the time.

Furthermore, being that the aforementioned investments are no longer expected to close during the year, we expect the company to miss these FFO expectations.

Well, it seems obvious, at this point, that EPR is likely to experience significant FFO pains in 2020 with a large part of its tenants unable to open their doors. It’s only a matter of time before we start to see store closure’s and bankruptcies in the experiential areas that EPR focuses on.

At the mid-point of the previously given guidance, the company’s forward looking FFO payout ratio was 86.7%. This means that the company didn’t have a lot of wiggle room with regard to dividend sustainability in the first place. Getting back to the commonsense piece, we ask you to ask yourself, do you think it’s likely that EPR’s FFO falls by less than 14% in this economic environment?

Source: FAST Graphs

Simply put, we don’t, which is why we implore that conservative income investors look at EPR’s 33% yield dividend yield with distrust. At the end of the day, a dividend yield is only as good as its safety and in EPR’s case, we could certainly not sleep well at night owning shares of this company.

One last time, please avoid being a high yield REIT investor. Focus on quality!

A few charts produced by iREIT:

Source: iREIT

Source: iREIT

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment