putilich/iStock via Getty Images

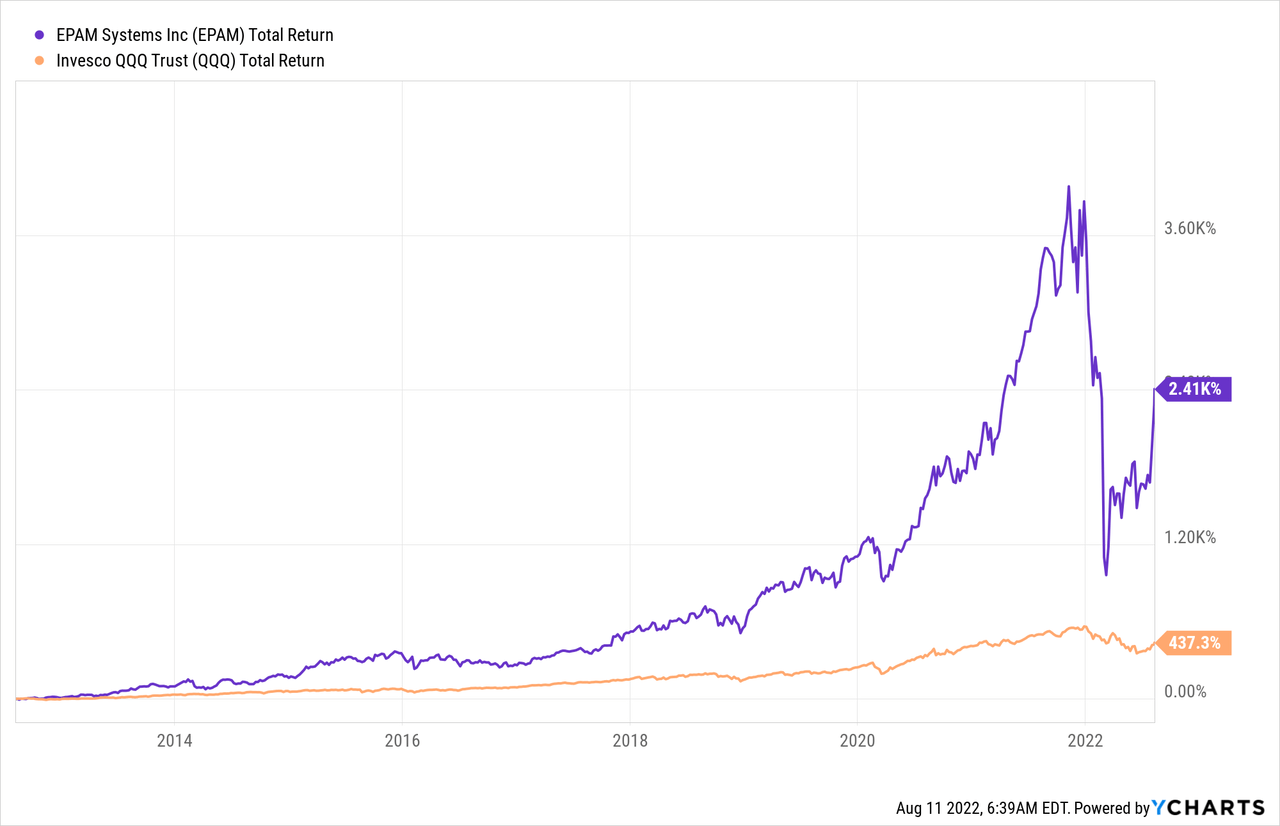

EPAM Systems (NYSE:EPAM) is a digital transformation and software engineering company that since its IPO in 2012 has smashed and beaten all major American Indices, as you can see in the following graph.

The company has grown its revenues at a rate of 27% annually, while their Free Cash Flow has grown at a rate of 28.5% in the same period. The company has used no debt to fund its increasing operations and I personally believe that the future will be even better, as digitalization and the adoption of more software-oriented services will rapidly increase over the following years.

Business description

EPAM is a leading IT services company specialized in providing digital engineering services alongside the globe. The company provides critical software infrastructure for companies in different economic sectors. The sector in which it mainly operates are:

- Financial Services: the main clients that EPAM serves are global investment banks, commercial & retail institutions and other fintech companies, such as payment and card companies. They represent the biggest share of revenues and account for 22.6% of the revenue they make.

- Travel and Consumer: some of their clients are the world’s leading airlines, global hotel brands and online travel agencies. They make up 19.7% of the revenues made by EPAM.

- Software & Hi-Tech: the company provides critical software development services for companies such as Equifax, helping them make data-driven decisions. They represent 17.7% of the revenues made by the company.

- Business Information: they build products and solutions for all modern platforms including web media streaming, mobile information delivery and information discovery and search. An important client of theirs is Wolters Kluwer, and this segment makes up 17.7% of their revenue.

- Life Sciences & Healthcare: they deliver sophisticated scientific informatics and innovative enterprise technology solutions for healthcare and pharmaceutical companies. They make up 10.4% of their revenue.

- Emerging Verticals: they serve diverse technology needs of customers in the energy, telecommunications, real estate, automotive and various manufacturing industries, as well as government customers. This makes up 11.9% of their revenue. An important client of theirs is Marathon Oil.

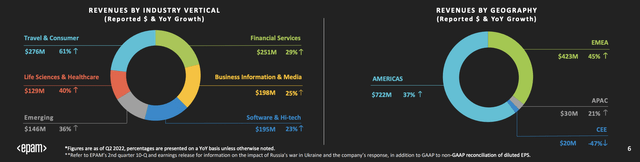

In addition to these markets to which the company serves, it must also be stressed out that the company has also carried out an intense diversification among its clients. In 2021, the top 10 customers only accounted for 25.7% of the revenue they generated, thus making the company less vulnerable to potential client attrition. The following graph shows how EPAM’s last quarter revenue alongside the different verticals and the different geographies.

Last Q Revenue along different verticals and different geographies (EPAM Investor Presentation)

Taking a look at the results presented by the company, it can be seen that there is indeed an increase in billing and profits in all the geographies in which the company operates, except in the case of Russia. The small weight of the APAC geography is very striking, where the company has a lot of growth potential, since digitization is still in the early stages of development.

Another key element in EPAM success is the human capital they have been able to acquire over the last decade. One of the essential keys of the IT sector is related to the training and technical level of its employees. These companies are usually not very capital intensive and the main expense they incur is engineers, who are the people in charge of developing the software that they are going to sell to the companies that are their clients. The key for this type of business to prosper is that they hire a large number of engineers at low cost and sell their services in regions where they can charge a reasonable amount. In this type of company, the management of the costs of the engineers is fundamental to obtain benefits and that the employees have a high level of satisfaction.

In addition to all this, EPAM was supposedly going to be negatively impacted by the Russian invasion of Ukraine since a huge number of their employees were located in Russia, Belarus and Ukraine. Although the company’s profits have fallen (due to extraordinary expenses related to the relocation of employees to other regions of Eastern & Southern Europe), they are already generating higher sales and operating profit than they did before the invasion. Indeed, the conflict has not entailed a great cost for the company and shows the resilience of the business and the predictability of the cash flows they generate.

EPAM’s latest results

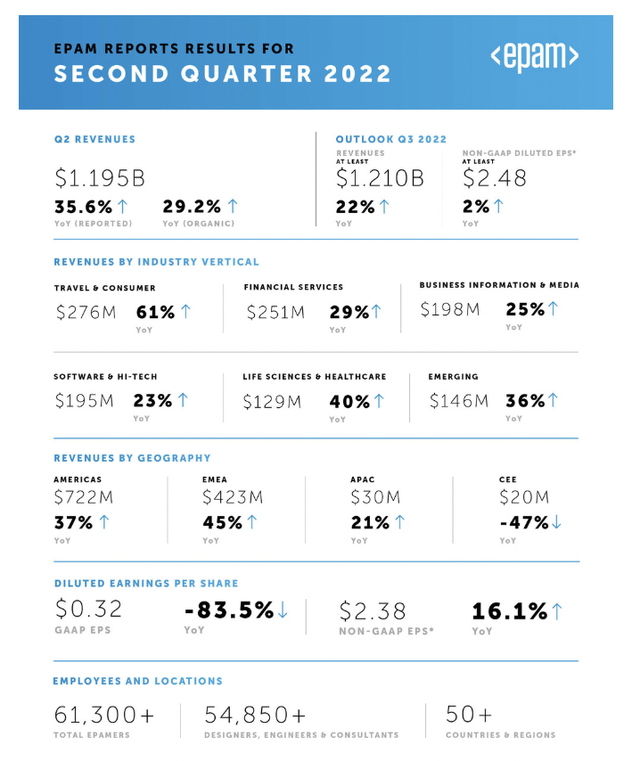

In August 11, the company presented its Q2 2022 results, that were indeed very positive. The following points summarize the main drivers of growth of EPAM:

- Revenue went up 35.6% YoY, of which 29.2% was reported to be organic growth, which shows the strong demand that exists for these type of services. The increase was intense in all the verticals operated by the company, as well as in the different geographies operated by them, with the sole exception of Russia, where they have begun to divest and exit that market.

- EPS went down 85% due to negative impacts related to appreciation of the Russian ruble, humanitarian expenditures, expenses related to accelerated staff relocations and costs related to the exit of their Russian operations. Operating income, which is a better measure of the evolution of the business showed growth of 14.2% in a difficult context for the company.

Q2 2022 Results (EPAM Investor Relations)

These results show that the company has not seen its fundamentals change and that they have been able to adapt perfectly to the new market conditions. The vast majority of its workers are already in secure locations within Ukraine, or relocated to other EPAM hubs in Eastern Europe. The company estimates that for the next quarter revenues will grow 22% and that the company’s EPS is no longer negatively impacted by the conflict and will grow 2%. Generally, the company tends to be conservative in its guidance, which always produces positive surprises in the presentation of results. If this does not happen, a drop in price to values close to $250 would become an attractive opportunity to buy shares of the company.

Addressable market

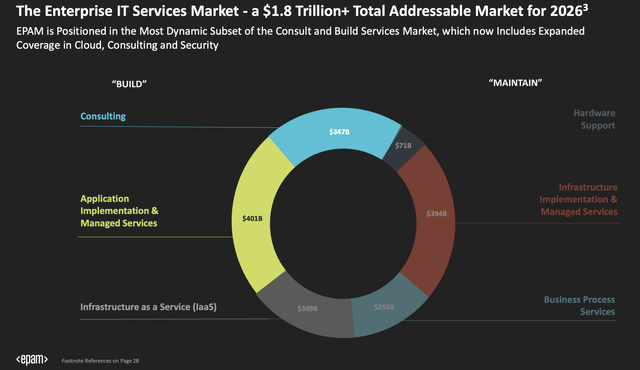

The company operates in the vertical software development, computer engineering and digital transformation markets. All of these markets have strong tailwinds that will fuel their growth in the coming decade. It is estimated that EPAM’s potential market is close to trillions and its market share is currently less than $5 billion, so the potential for growth is frankly high.

In addition to all the potential market that the company has ahead of it, its growth plans include reinvesting the cash flows it generates to expand its operations and reach $10 billion in sales in the coming years. In their own words:

And obviously, it’s what we hope will continue to propel us to the $10 billion revenue target that EPAM talked about and Ark specifically talked about this morning.

These numbers are not imaginations and speculations made by the company. It is estimated that the software and digital engineering market can grow at a rate of 7% in the coming years, while the real gold mine lies in the digitalization of companies. Growth in this niche market is estimated at over 20% per year until at least 2030.

TAM of EPAM (Investor Presentation)

The company estimates that the Enterprise IT Services Market will be worth more than $1.8 trillion by 2026, and the company is positioned in Consulting and Application-Implementation, the two main elements of the IT building ecosystem. Perhaps EPAM should begin to invest in more recurring nature services to benefit from more predictable and stable cash flows in a more mature phase of development.

Financials

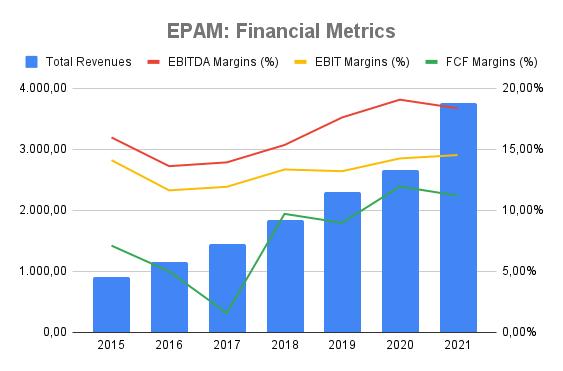

EPAM is known to have had an extraordinary growth over the last years in addition to being a profitable company. Since 2014, revenues have grown at an average rate of 27%, while other operational metrics such as Free Cash Flow (FCF) have grown at higher rates, at 35% per annum. In terms of FCF per share, growth has been smaller due to an increase of the number of shares in the same period to compensate the employees with stock options.

Financial Metrics of EPAM (Own Models)

One of the main points that investors frequently use against EPAM is that the company will disappear due to its proximity to Russia and due to the fact that lots of their engineers are based in Ukraine. The fear of the market translated into a sudden drop of 45% that plunged the stock 71% from its all-time-highs. But, has the company actually been affected by the Russian conflict? Despite EPAM cancelled the guidance for 2022, the results of Q1 2022 have been extraordinarily good. Revenues have gone up in all geographies, with intense growth in Europe, America and the Asia Pacific Region. Cash Flow from Operations went down to negative numbers due to the impact of negative change in accounts receivables, meaning companies that were not able to pay EPAM for their services. The company had extraordinary expenditures as it had to relocate most of their employees, but they continued to generate positive EPS and showed strong resilience.

In addition to these extraordinary metrics, it is important to note that the company has no debt, which has allowed it to handle the relocation of its employees due to the Russian invasion of Ukraine without showing short-term liquidity problems.

Management

Over my short investment career, I have come to realize that management is a key component in determining the long-term performance of a company. I have come across terrible managements that ruined good companies and great managements that made normal companies amazing. I believe that Arkadiy Dobkin is the kind of person that has been focused on making EPAM a great business and has a long-term focus that will make the company succeed over time.

Mr. Dobkin founded the company in 1993 and, ever since that day, he has been running it and has always been focused on growth, customer satisfaction and employee satisfaction among any other internal metrics. He believes that this philosophy potentiates a virtuous cycle in which employees produce better results, this leads to high customer satisfaction which is then translated into customer retention and long term relationships with companies that increase bonds of trust. As stated by the company in their last 10-K report:

Our focus on delivering quality service is reflected in established relationships with many of our customers, with 53.8% and 26.5% of our revenues in 2021 coming from customers that had used our services for at least five and ten years, respectively.

In addition, Mr. Dobkin is highly aligned with shareholders, as he has shares that have a market value of more than $600 million at EPAM’s current prices. His net worth in shares of EPAM is almost 1,000 times bigger than his current salary.

Valuation

As I always comment in all the articles that I have published so far, I believe that the valuation is especially important and determines the returns that a long-term investor will have. EPAM is a company that has historically given few entry opportunities, since investors know its quality and are not willing to sell the company’s shares except on rare occasions.

Over the last few years, EPAM’s growth has been solid and intense, supported by the digital transformation of companies in all geographies and all verticals. This has produced outstanding returns for the company, which has increased profits as we have discussed in previous articles. I personally believe that growth in the markets in which the company operates will be intense, but their bigger size will make M&A less attractive and they will have to try to grow organically to increase the value of equity holders. I estimate that growth of revenues will be around 20% in the coming years and it is quite likely that the company will be generating around $17 of EPS for 2026 if that scenario truly happens.

Stock-Based-Compensation is another thing that worries me because it implies dilution for shareholders and it is a cash outflow that should be considered as negative for their Free Cash Flow generation. Nevertheless, dilution is not that important at this stage because the company is focused on retaining talent for growth and delivering value increases for shareholders. Perhaps in a more mature phase when the company is not able to deliver growth, it should focus more on rewarding shareholders through buybacks or special dividends, but I believe that lots of years need to pass in order for this to happen.

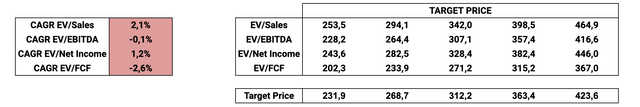

In a conservative scenario, where growth happens but valuation multiples go down to more adequate levels (such as 25x EV/FCF and 15x EV/EBITDA), the company would offer no possible entry opportunity at current prices. I aggressively bought EPAM at $250 when my own estimations assumed that the company could yield an annual rate of return of around 12%. The target prices for the coming years that I have calculated within this conservative scenario are the following.

EPAM’s target prices (Own Models)

I believe that we won’t see EPAM trading at pandemic multiples again due to the tightening of monetary policy and the following valuation compression. I am a long-term holder of EPAM, and I won’t sell, but I would not buy at these crazy prices the market is currently demanding. Below $250 the company would be a really interesting buy for the long-term.

Risks

I believe that the biggest risk the stock is facing right now is, without doubt, valuation. Investors’ expectations have suddenly changed and what 6 months ago was considered to be a non-investable company, now is one of the greatest companies of all times. Investors are guided by price fluctuations, and that is why a long-term investor should weigh into the equation the two main things that are going to determine the performance of an investment over the course of time: business quality (where I include: ability to reinvest cash flows at high rates, incentivized and honest management team, low debt policy…) and valuation. And right now, EPAM does not satisfy the latter. Potential risks that the company may face in the long term are the following: difficulties in keeping engineers due to increased labor costs and reduced competitiveness, inability to continue growing due to market depletion or reduced margins due to competitive pressures.

Conclusions

I believe EPAM is a fantastic business operating in a market which will be able to grow in the coming years due to the tailwinds of digitalization and the adoption of software technologies for a huge percentage of businesses out there. The company is well run, has high-quality engineers and is in a leading position that will enable them to continue outperforming for the following years. Despite all these good traits, EPAM is trading at very high multiples right now and I would not buy right now because expected returns for the coming 5 years would be below what I consider reasonable. Nevertheless, I will not sell EPAM and I would be interested in loading up more should the company fall below $250.

Be the first to comment