gorodenkoff/iStock via Getty Images

Thesis

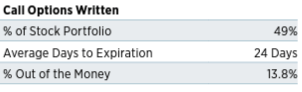

Eaton Vance Enhanced Equity Income Fund II (NYSE:EOS) is an equity buy-write closed end fund from the Eaton Vance family of funds. The vehicle does not have any leverage, and utilizes the CEF wrapper to hold a portfolio of equities (56 names) with overlayed written call options for half the names. The fund employs a monthly systematic option roll strategy, with a large upside left for equity gains (13.8% “out-of-the-money” percentage).

The CEF counts the Russell 1000 Growth Index as its benchmark, with a 43% allocation to technology stocks. EOS is down -22% this year, but has managed to outperform its index and the Nasdaq. Think of EOS as a dividend take on the Russell 1000 Growth Index. Through its buy-write strategy and CEF wrapper, EOS is able to offer individual investors a constant dividend stream from the Russell 1000 Growth Index.

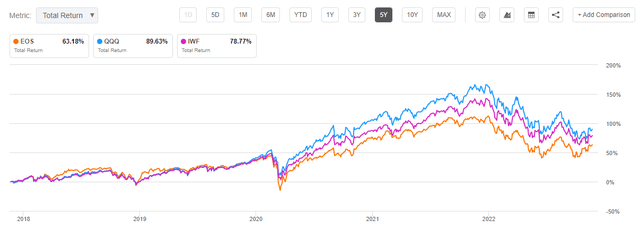

In explosive up markets such as 2020/2021, EOS will lag because it gives away a significant portion of its upside. In range bound or down markets, the CEF will outperform given the income stream generated by its written options. We are not huge fans of buy-write funds in the growth space, because by definition growth stocks are marked by violent run-ups and run-downs. As a point in case, on a 5-year basis EOS is up only 63%, while QQQ is up 89% and IWF is up 78%. That does not make EOS a bad fund by any means, we are just contextualizing its structure, especially on the upside.

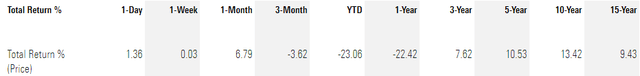

EOS has been rewarding nonetheless for long-term buy-and-hold investors, with a long-term annualized total return close to 10%:

Annualized Total Return (Morningstar)

Going forward, a subdued performance in growth stocks will actually benefit the CEF, with its options providing for income without being triggered. The fund is currently trading at a 5% premium to NAV, which has fluctuated with the risk-on moves in the markets. We expect this level to come down to 0% as the next bear market leg develops.

EOS is a solid long term buy-and-hold instrument. The CEF focuses on large capitalization technology stocks and overlays call options on half of the portfolio. Existing shareholders should keep in mind that this year’s negative performance is due to the overvaluation of tech coming into the year, and that a lower growth rate for this sector is actually beneficial to the EOS performance going forward given its written call option strategy.

Holdings

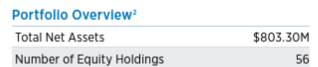

The fund holds only 56 equity names:

Portfolio Description (Fund Fact Sheet)

The top equities in the portfolio are well known large cap technology names:

Top 10 Holdings (Fund Fact Sheet)

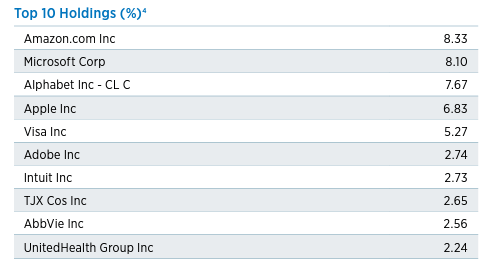

The top 10 names account for over 45% of the portfolio, with members of the FAANG cohort taking the top spots. The vehicle has a very technology oriented focus:

Sectors (Fund Fact Sheet)

We can see from the sectoral parsing above that over 43% of the portfolio is invested in information technology. The fund aims to capture the return profile of the Russell 1000 Growth Index via its composition.

EOS is a buy-write fund, thus it employs a written call strategy to extract income from the portfolio and to mitigate risks:

Call Options (Fund Fact Sheet)

The CEF currently overwrites 49% of its portfolio with a 13.8% “out-of-the-money” percentage. This simply means that the fund gives itself ample upside through its written call option strategy. The lower the “% Out of the Money” number, the higher the likelihood the options are going to be triggered and the fund will not participate in the entire upside of the portfolio. By having roughly a monthly roll (24 days expiration period for the options) the fund employs a systematic strategy here, which is attractive. The market tends to reward systematic strategies via premiums to NAV.

Performance

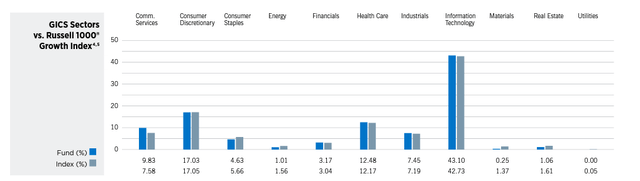

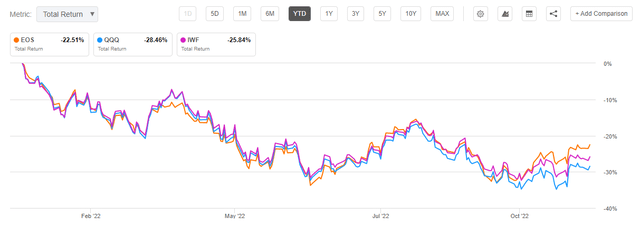

The fund is down significantly in 2022, but outperforms its index:

Total Return (Seeking Alpha)

We can see EOS being down -22% this year, outperforming the ETF proxy for the index, namely IWF. The Nasdaq has the worst performance in the cohort, handily beating the rest of the cohort components.

On a longer time frame the story is different:

Total Return (Seeking Alpha)

EOS tends to do well versus the indices when the market is range bound or moves higher in small increments. When growth stocks explode higher EOS is hampered by its written call options which cap the upside in the portfolio. We see this type of return profile in the 2020-2021 period when technology equities experienced a parabolic rise, with the EOS written calls being constantly triggered. In a sustained rising market EOS is not the best choice since it will always underperform the index ETF.

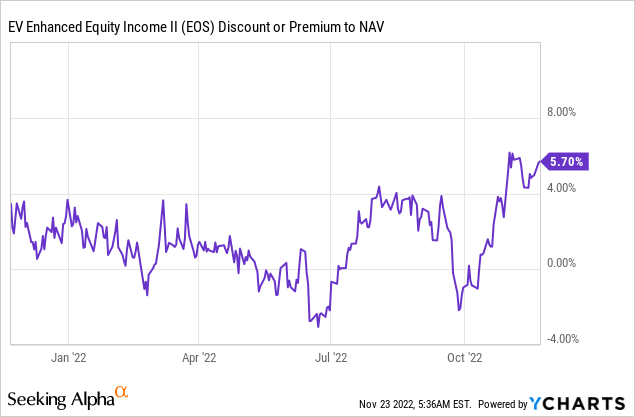

Premium/Discount to NAV

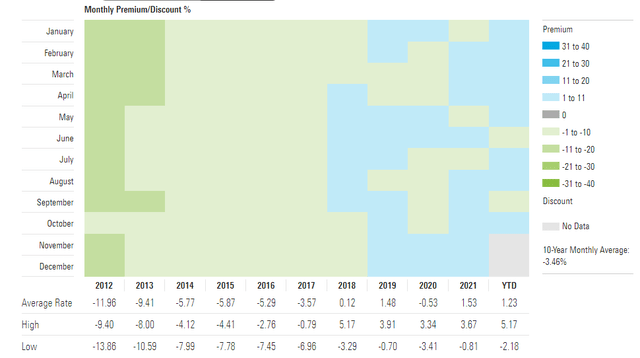

As technology became popular, so did EOS:

Premium / Discount to NAV (Morningstar)

We can see the CEF trading at a discount to NAV up to 2018 when it flipped to premiums. The fund has been consistently trading at a premium to NAV since, with some small gaps.

This year the premium to NAV has had an interesting development:

As with other buy-write funds, the CEF has moved to a premium to NAV with market risk-on moves. Market participants see value in the short vol position taken via the written call options and assigned the fund a premium. We think we are stretched here at 5.7%, and expect this level to move towards 0% as the next leg in this bear market develops.

Conclusion

EOS is a buy-write fund from Eaton Vance. The CEF focuses on technology stocks (43% of the portfolio is tech), and has the Russell 1000 Growth Index as its benchmark. The fund writes call options on approximately 50% of its portfolio, but leaves a large margin for upside capture (13.8% “out-of-the-money” percentage). The vehicle has been pummeled this year, together with the entire tech sector, being down over -22%.

While the fund has slightly outperformed its index in 2022, it has not managed to make up for its underperformance during the violent rise up in prices during 2020/2021. EOS is a solid buy-and-hold instrument that transforms the Russell 1000 Growth Index returns into dividends, and it will be well served going forward by a more subdued return profile in growth equities, which will allow its options to expire more often without being triggered.

Be the first to comment