grandriver

EOG Resources, Inc. (NYSE:EOG) is an American independent exploration and production company that focuses on developing high-quality acreage in a few separate basins in North America and Trinidad. This is slightly unusual, as there are very few energy companies that are operating in Trinidad, let alone independent ones. The company has long been one of the more high-quality operators in the industry, which allows it to secure higher margins than many of its peers. Although all energy companies in general have been reasonably popular investments over the past year due to strong price performance in the crude oil market, this could make EOG Resources one of the more appealing companies in the sector. When we combine this with an incredibly strong balance sheet and a very reasonable valuation, EOG Resources appears to have a lot to like.

About EOG Resources

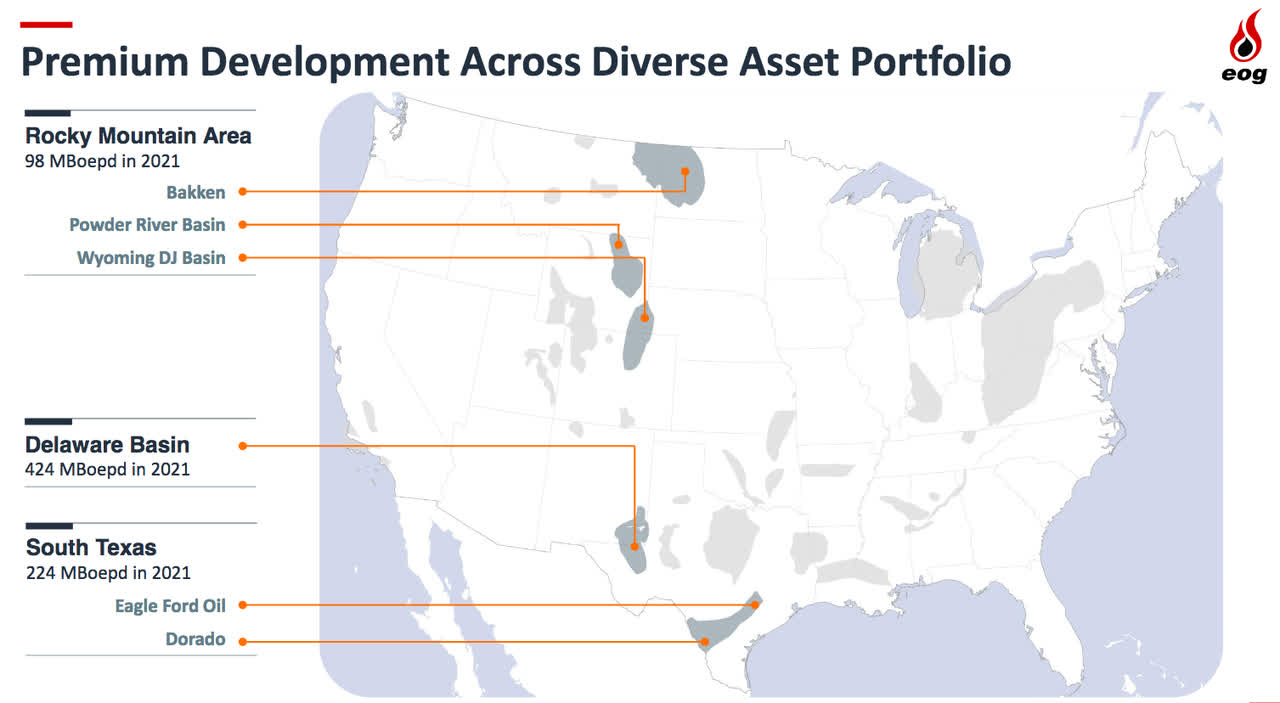

As mentioned in the introduction, EOG Resources is an independent exploration and production company that produces throughout the United States and Trinidad. The company has operations in five American hydrocarbon-producing basins, which are the Permian, the Bakken Shale, the Powder River Basin, the Eagle Ford Shale, and the DJ Basin:

EOG Resources

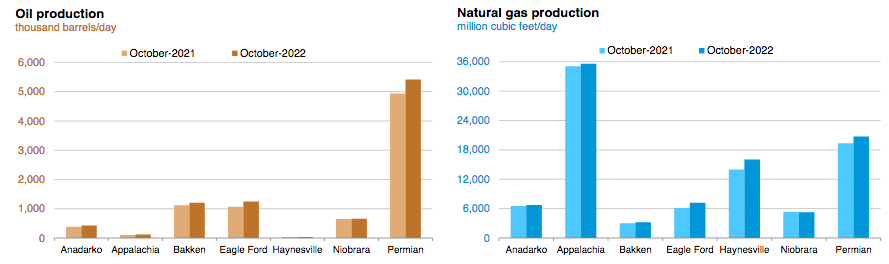

A few of these basins are certainly well-known to anyone that has followed the American energy industry for a reasonable amount of time. In particular, the Permian and the Bakken Shale have been two of the most important basins in America’s energy boom over the past decade. However, the Power River Basin is somewhat less familiar to many. It is still an incredibly resource-rich area, however. Although the U.S. Energy Information Administration does not provide specific production figures for the Powder River Basin, the Niobrara region as a whole (which contains both the Powder River and DJ Basins) produces about 657,000 barrels of crude oil and 5.238 billion cubic feet of natural gas per day, which represents a slight increase over the September figures. It is notable that all of the basins in which EOG Resources operates currently have significantly higher production than at this time last year:

United States Energy Information Administration

EOG Resources itself was one of the contributors to this production growth. During the second quarter of 2022, the company reported that it achieved an average production level of 920,700 barrels of oil equivalents per day, which was 4.2% above last year’s numbers. This is in line with the company’s guidance of growing its production at a 4% rate in both 2022 and 2023. This is nice to see as increasing production is one of two ways that an exploration and production company can grow its revenues and profits. After all, if the company’s production increases then it will have more products to sell and generate revenues off of. This is also the only method of growing earnings over which the company has any control. After all, EOG Resources does not nearly produce enough resources to exhibit any control over energy prices.

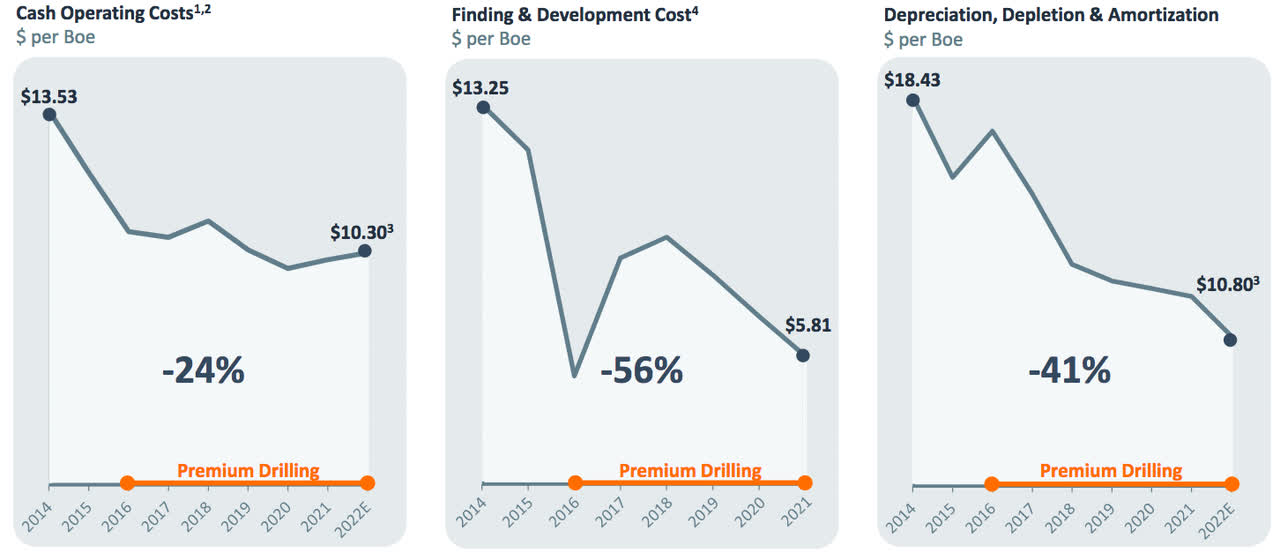

The price of West Texas Intermediate crude oil has risen 16.75% and the price of natural gas at Henry Hub has risen 21.18% over the past twelve months. We saw this exert a positive effect on EOG Resources’ second quarter 2022 results as the company’s net income increased 146.97% compared to the prior-year quarter. The company’s higher production and increased energy prices were not the only things that contributed to this tremendous earnings increase, however. As stated in the introduction, EOG Resources prides itself in having high-quality drilling operations. The firm is highly dedicated to keeping its costs down as a result. As we can clearly see here, EOG Resources has been steadily reducing its costs in all areas since 2014, which is expected to continue this year:

EOG Resources

One thing that we do note, however, is that the company’s cash operating costs are not expected to significantly decline this year. This is not something that is really a problem though as it affects every company in the industry. As I pointed out in a few recent articles, steel and diesel prices have risen substantially this year, which has caused drilling and other production costs to rise relative to the previous year. This may not be a significant problem, however, as the cost reductions elsewhere help to offset this. The most important thing for our purposes is the company’s total costs per barrel of oil equivalent produced. This figure stood at $28.20 as of 2021 (the company has not released more current figures).

This is obviously well below today’s price of crude oil, which should provide us with some degree of confidence as the nation enters into a recession. This is because crude oil prices usually decline during recessions so the cheaper the company can produce its products, the lower energy prices can go until the firm is no longer profitable.

As I discussed in various previous articles, such as this one, though, any decrease in energy prices is likely to be short-lived and it seems very unlikely that oil prices will go below $28.20 per barrel equivalent even in a recession. Thus, it seems likely that EOG Resources should be quite well positioned no matter what happens in the near future. When we consider the company’s past track record too, it appears likely that it will be attempting to continue to reduce costs and thus improve margins even should energy prices remain static. Overall then, EOG Resources appears likely to produce earnings growth going forward.

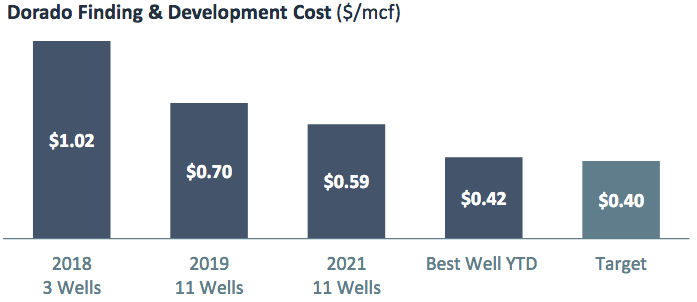

EOG Resources is expanding its production into new markets beyond its traditional focus on crude oil. This expansion began back in 2020 when the company revealed that it has discovered a massive natural gas field in South Texas. This field, dubbed Durado, contains an estimated 21 trillion cubic feet of natural gas and has relatively high-quality geology, which should allow for relatively cheap development costs. Indeed, the company is aiming to achieve production costs of only $0.40 per thousand cubic feet of natural gas produced, although it has not managed to get that low yet:

EOG Resources

Admittedly, the company’s total costs will be somewhat higher than this figure since it has to pay for midstream transportation costs, general & administrative costs, and various other things. The company still stated back in 2020 that it should be able to achieve total production costs of only $2.50 per thousand cubic feet of natural gas produced in the region. As of the time of writing, the price of natural gas at Henry Hub is $6.85 per thousand cubic feet so the company should be able to achieve impressive margins, especially if it gets these costs down further.

The position of this field also offers some very impressive opportunities for EOG Resources. This comes from the field’s position near the Gulf Coast. In a previous article, I discussed how the global demand for liquefied natural gas is likely to surge over the coming decade as various countries in Asia seek to increase their imports in a bid to reduce their smog problems. In Europe, the Russian-Ukraine war continues to wage on and there are very real signs that the European Union will have insufficient natural gas to meet its heating and other needs this winter, which has caused that continent to attempt to secure resources from elsewhere. That “elsewhere” has been importing liquefied natural gas from the United States.

The American energy industry has been responding to this demand by constructing liquefied natural gas plants across the country, although many of them have been in the Gulf Coast area. The fact that the Dorado field is located very close to the location of some of these planned or in-development facilities positions EOG Resources quite well to supply this emerging industry with natural gas. When we consider the incredible demand growth projections here, this could represent a long-term growth opportunity for the company.

Financial Considerations

It is always critical that we examine the way that a company finances itself before investing in it. This is because debt is a riskier way to finance a business than equity because debt must be repaid. This is usually accomplished by issuing new debt in order to repay the maturing debt. This can cause a company’s expenses to increase should it need to pay a higher interest rate on the new debt. In addition to this, a company needs to make regular payments in order to remain solvent. Thus, an event that causes a decline in cash flow could push a company into financial distress if it has too much debt. This can be an incredibly big concern with respect to a company like EOG Resources due to the volatility of commodity prices.

One metric that we can use to analyze a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which the company is relying on debt to finance its operations as opposed to wholly-owned funds. It also tells us how well the company’s equity can cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important.

As of June 30, 2022 (the most recent date for which data is available), EOG Resources had a net debt of $2.234 billion compared to $22.312 billion worth of shareholders’ equity. This gives the company a net debt-to-equity ratio of 0.10, which is one of the lowest ratios in the industry. We can see this by comparing the company’s ratio to that of some of its peers:

|

Company |

Net Debt-to-Equity |

|

EOG Resources |

0.10 |

|

Diamondback Energy (FANG) |

0.22 |

|

Continental Resources (CLR) |

0.61 |

|

Matador Resources (MTDR) |

0.40 |

|

Pioneer Natural Resources (PXD) |

0.12 |

As we can see, EOG Resources is relying less on debt to finance its operations than most of its peers. This is a good sign, as it indicates that the company is certainly using an appropriate amount of debt and it should not pose an outsized risk with respect to its peers. Overall, then, the company does appear somewhat less risky than its peers in the event of a steep decline in energy prices that reduces its cash flow.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. One method that we can use to value an independent exploration and production company like EOG Resources is using a ratio known as the price-to-earnings growth ratio. This ratio is similar to the more familiar price-to-earnings ratio except that it takes a company’s forward earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its forward earnings per share growth and vice versa.

However, as I have pointed out before, pretty much everything in the traditional energy industry appears to be dramatically undervalued right now. Thus, the way to use this ratio is to compare the company’s ratio against that of its peers in order to determine which stock offers the most attractive relative valuation.

According to Zacks Investment Research, EOG Resources will grow its earnings per share at a 30.20% rate over the next three to five years. This gives the stock a price-to-earnings growth ratio of 0.27 at the current price. Here is how that compares to the company’s peer group:

|

Company |

PEG Ratio |

|

EOG Resources |

0.27 |

|

Diamondback Energy |

0.25 |

|

Continental Resources |

0.17 |

|

Matador Resources |

NA |

|

Pioneer Natural Resources |

0.92 |

Admittedly, EOG Resources does not have the absolute lowest ratio here but it is reasonably in line with that of its most attractive peers. However, as we have just seen, EOG Resources is somewhat better financed than both of the companies that appear cheaper than it using this ratio. This could allow EOG Resources to present the best risk-reward tradeoff, particularly if energy prices decline in the near term as a result of a recession. Overall, this company’s stock certainly appears that it should not particularly disappoint investors that buy today.

Conclusion

In conclusion, EOG Resources appears to have a lot to offer an investor today. The company is aggressively growing its production while making an excellent effort to keep its costs down and thus enjoy remarkably high margins in the current environment. The company is also well-positioned to weather a temporary decline in energy prices, which may accompany a recession. Finally, the firm may have a new opportunity with its Dorado play as the demand for liquefied natural gas surges over the coming years. When we combine this with a strong balance sheet and reasonably attractive valuation, the stock may be worth buying today.

Be the first to comment