Maks_Lab/iStock via Getty Images

Elevator Pitch

I upgrade my investment rating for Envestnet, Inc.’s (NYSE:ENV) shares from a Hold to a Buy. I previously wrote about ENV in an article published on October 8, 2021, where I discussed the company’s revenue and profitability outlook.

This article is focused on the potential realization of an event-driven catalyst for Envestnet, more specifically, private equity firms acquiring the company.

In my opinion, there is a high probability that ENV will be successfully sold to private equity firms, considering factors such value-add by private equity, peers being owned by private equity players, and prior offers made for the company. With regards to valuation, an acquisition consideration for Envestnet pegged to a high-teens EV/EBITDA multiple appears to be realistic, which translates into a mid-teens investment return based on ENV’s last traded share price. This makes Envestnet a Buy, in my view.

Potential Takeover

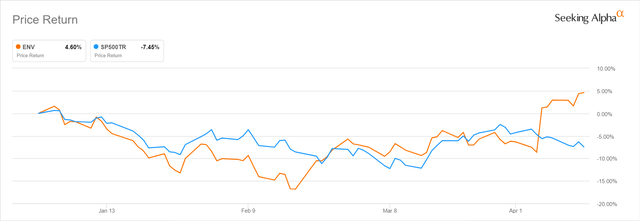

ENV’s share price has been tracking the S&P 500 in the first three months of this year as per the chart below. But Envestnet’s shares started to outperform the market in early-April, which coincided with news of a potential takeover.

Envestnet’s 2022 Year-to-date Stock Price Performance

Envestnet’s stock price increased by +11% from $72.48 as of April 5, 2022 to $80.31 as of April 6, 2022. It was reported that “Advent International and Warburg Pincus are the final bidders for ENV” in a “sales process” based on an April 6, 2022 Seeking Alpha News article which cited a report from Citywire. Earlier in late-February 2022, Seeking Alpha News also made reference to a Bloomberg report which noted that Envestnet was “exploring its options after receiving takeover interest.” ENV’s shares eventually rose by an additional +3% in the next one week to close at $82.99 as of April 14, 2022.

There are a number of reasons why I think that the interest from private equity firms is genuine, and I see a good chance of the acquisition deal going through.

Firstly, Envestnet has been open to the possibility of partial or complete divestment of its businesses and assets in the past, and there has been takeover interest in the company previously as well.

In my February 9, 2021 initiation article for ENV, I noted that “Envestnet had expressed an interest in selling the Yodlee business,” which is a company it bought over in 2015 that was “part of Envestnet’s loss-making Data & Analytics business segment.” Separately, Envestnet was reported to have received acquisition offers for the company “two years ago” according to Jefferies (JEF).

Secondly, private equity firms are keen on buying companies in the portfolio management solutions space that Envestnet operates in. This is evidenced by the fact that Orion Advisor Solutions, one of ENV’s peers, is majority-owned by private equity firms, TA Associates and Genstar Capital.

Thirdly, there is room for private equity firms to add value if they acquire Envestnet. In the case of Orion Advisor Solutions, private equity owners pushed for its merger with an investment management company, Brinker Capital.

For ENV, I highlighted in my October 8, 2021 update that “the key downside risk for Envestnet is weaker-than-expected profitability in FY 2022 as a result of greater-than-expected investment spending.” This implies that ENV needs to cut unnecessary costs and divert capital to fund expenses needed to support long-term growth. This is an area where private equity firms have a lot of experience. At the company’s Q4 2021 earnings call on February 24, 2022, Envestnet emphasized that it is “absolutely considering our real estate footprint” when asked about areas where the company can reduce expenses. Private equity firms could assist in identifying areas for cost reduction, such as having less office space going forward.

More importantly, it might be better for Envestnet to be taken private by a private equity firm, so that ENV does not have to be subject to quarterly earnings pressure in its pursuit of long-term value creation.

In a nutshell, I am of the view that it is very likely that Envestnet will be acquired or taken over by a private equity firm.

ENV Valuation

The most important question for Envestnet’s investors is the potential upside for the company’s shares in a takeover scenario. The sell-side analyst from Jefferies covering ENV holds the opinion that the stock “may be worth $90-$95 in a possible sale.” This translates into an upside of as much as +14% compared with Envestnet’s last done price of $82.99 as of April 14, 2022. A mid-teens percentage return in possibly less than a year (based on the estimation of the timeline for deal closure) warrants a Buy rating.

There should be considerable upside for Envestnet based on a comparison of its valuations against history and peers.

ENV is currently valued by the market at consensus forward fiscal 2023 and FY 2024 EV/EBITDA multiples of 14.1 times and 11.2 times, respectively as per S&P Capital IQ. In comparison, Envestnet’s 10-year mean forward EV/EBITDA multiple was relatively higher at 17.9 times. Separately, a recent March 2022 Raymond James (RJF) research report highlighted that the market values listed companies in the “vertical software” segment (which ENV is categorized in) at a median forward FY 2023 EV/EBITDA multiple of 18.1 times.

I apply an 18 times (pegged to peers and trading history) forward EV/EBITDA multiple to Envestnet’s consensus fiscal 2023 EBITDA of $327 million and deduct the company’s current net debt of slightly more than half a billion dollars in valuing ENV. This will lead me to a price target of $96.90 for Envestnet, which is very close to what the Jefferies analyst is projecting. A target price of $96.90 is equivalent to a capital appreciation potential of close to +17%.

Bottom Line

Consensus financial forecasts from S&P Capital IQ suggest that Envestnet is expected to grow its EBITDA and normalized EPS by CAGRs of +17.1% and +17.0% for the FY 2022-2026 period. The decent outlook for ENV is validated by the growth opportunities that the company has. I mentioned in my October 2021 article for ENV that “taxes, managed accounts, and direct indexing are incremental revenue growth opportunities each worth more than $100 million.”

Envestnet’s valuations are below historical averages and that of its software peers as I highlighted in the current article. The potential takeover by private equity firms serves as a re-rating catalyst for ENV’s shares. Even if this event-driven catalyst does not materialize as expected, Envestnet’s valuations should eventually re-rate higher as the company delivers on its growth in the intermediate to long term. As such, I have decided to rate Envestnet’s shares as a Buy.

Be the first to comment