Enterprise Products Partners (NYSE: EPD), at the current time, is the largest publicly traded midstream company in the world with a dividend yield of more than 12%. The company has recently provided some additional guidance to shareholders, highlighting its secure dividend and ability to generate shareholder rewards. As we’ll see throughout this article, the company’ strong yield makes it a secure long-term investment.

(Enterprise Products Partners – Fortune)

Business Update and Handling the Crash

Enterprise Products Partners recently took the chance to update shareholders about the company’s business productions.

(Enterprise Products Partners Recent Updates – Company Shareholder Update)

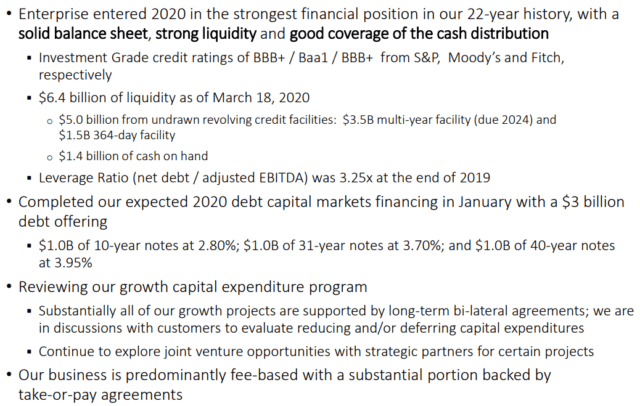

The first thing worth highlighting is that Enterprise Products Partners entered 2020 with the strongest financial position in its 22-year history. The company maintains its investment grade credit rating and has a strong balance sheet and liquidity, while continuing to cover a yield that’s currently more than 12%. That’s a significant dividend that’s coverable.

Enterprise Products Partners has $6.4 billion of liquidity and $1.4 billion of cash on hand. It’s important to note that the liquidity is enough, by itself, to cover almost 2 years of the company’s dividend. Its leverage ratio (net debt / adjusted EBITDA) was a very manageable 3.25x at YE 2019. One other thing worth noting that is incredibly important to highlight is the company had a well-timed January 2020 debt offering.

The company issued $3 billion in debt including $1 billion in 40-year notes at <4%. That’s some cheap and incredibly well priced long-term debt that highlights its financial strength. At the same time, Enterprise Products Partners has strong fee-based capital and is reviewing its capital expenditure program. That combination of factors highlights how well-positioned the company is.

(Enterprise Products Partners Customer Composition – Company Shareholder Update)

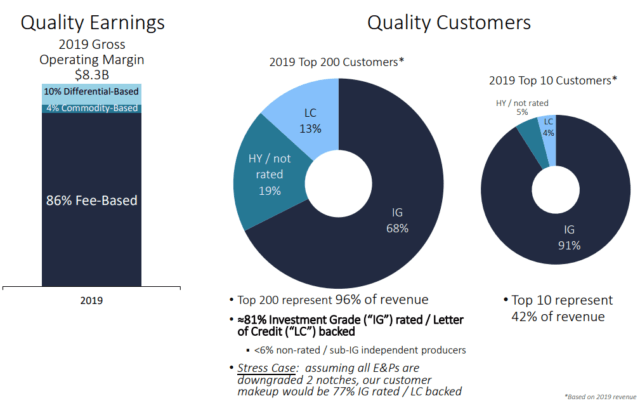

At the same time, Enterprise Products Partners has a very secure portfolio of revenue and cash, minimizing its need to access this liquidity. It has $8.3 billion in 2019 gross operating margins. 86% of that is fee-based, meaning in a difficult scenario, the company would lose $1.4 billion in EBITDA. The company earns $6.5 billion in DCF, so this EBITDA decline would decrease DCF by $0.9 billion.

At the same time, the chance of this commodity-based and differential-based cash flow disappearing is incredibly low. I would give a worst-case scenario of seeing the 4% in commodity-based EBITDA disappearing. However, the 10% in differential-based EBITDA could actually remain strong, as some refiners are expected to do quite well in the current markets.

There is some bankruptcy risk from the company’s customers too in a difficult environment. Enterprise Products Partners’ top 200 customers are 81% investment grade rated, and its top 10 customers (42% of revenue) are 91% investment grade rated. In a stress case, the company would still be 77% investment grade rated, showing that most of its customers aren’t on the cusp of success.

Asset Overview

Enterprise Products Partners has an impressive base of assets that have significant potential and are important to the U.S. energy industry.

(Enterprise Products Partners Asset Overview – Company Investor Presentation)

The company backs up its cash flow forecast with an incredibly strong portfolio of assets. It has a massive 50 thousand miles of pipelines between every major oil play in the United States, along with significant shipping assets. The company also has 260 million barrels of storage plants and a significant portfolio of export facilities and various processing plants.

There are several important things worth paying attention to here. The first is that not only is Enterprise Products Partners connected to multiple asset plays, it’s connected to them at multiple different stages. The average molecule touches the company’s assets 5-7 times as it moves throughout the system. More importantly for the company, it gets paid each time this happens.

Shareholder Return Potential

Putting together Enterprise Products Partners’ impressive portfolio of assets and its recent shareholder update, we can see the company’s impressive shareholder return potential.

(Enterprise Products Partners Growth Potential – Company Investor Presentation)

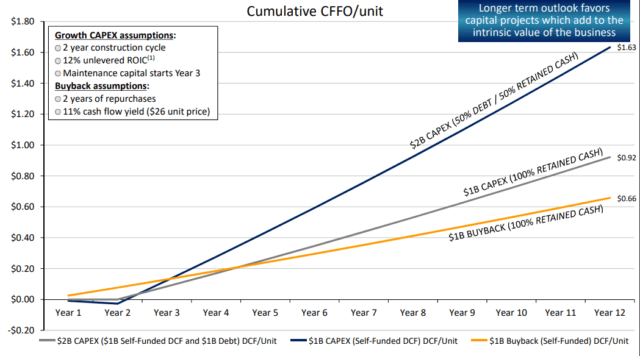

The above image shows the cumulative CFFO / unit growth. The company highlights a number of different assumptions, including various repurchase plans etc. However, there are several other things worth noting, for example, the company could be repurchasing shares right now and be getting a double-digit yield for them.

Though, the long-term plan, in a stable market, is that the company could use $1 billion in capital spending with $1 billion in buybacks to increase CFFO / unit to $1.58. That could push Enterprise Products Partners’ CFFO total per unit to $4.5 / share by 2030. Given its $14.5 / share price, the company would provide those who invest today a 33% CFFO yield by 2030.

That CFFO could generate significant shareholder returns Enterprise Products Partners. That potential for shareholder returns is incredibly significant. It highlights the company’s shareholder reward potential.

Company’s Detailed Financials

We also discussed this to some extent above, but it’s important to take a deeper look into Enterprise Products Partners’ financials.

(Enterprise Products Partners Financials – Company Investor Presentation)

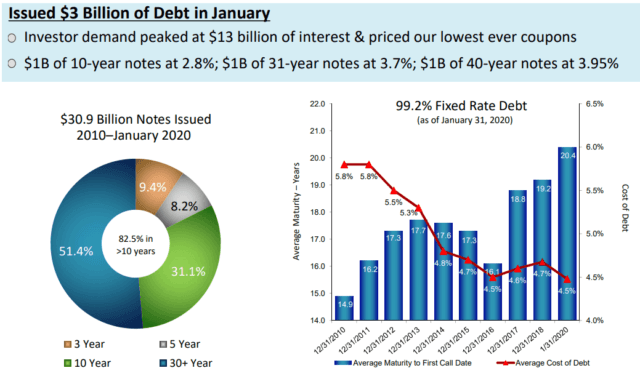

The company issued $30.9 billion in notes from 2010 to January 2020. Its current debt is $27.8 billion, roughly $3 billion of debt which has gone through the company’s recent note pricing. It’s important to note that while it was before the current crash, it was still at a difficult time for oil. Demand for these notes was a very substantial $13 billion.

One other thing noting is Enterprise Products Partners is immune to any interest rate changes with a 4.5% average cost of debt and an average maturity to first call date of an astounding 20.4 years. With significant recent demand for its debt, the company has the room to increase its debt further / borrow money if it needs to. This shows its overall strong financial position, as an extension of the above.

Risk

There is one significant risk for Enterprise Products Partners shareholders to pay attention to.

The company faces the risk of a long-term downturn in oil prices. In the short term, its fee-based capital enables it to more than manage the current downturn. The company also has ample liquidity to handle the downturn. However, COVID-19 has shown that that the unexpected can always happen. If something causes a longer downturn, the company could have trouble rolling over cash flow, which could hurt earnings.

This is a risk worth paying attention to.

Conclusion

Enterprise Products Partners has an impressive portfolio of assets with an incredibly strong dividend yield. The company has more than enough earning potential and liquidity to not only handle the oil downturn, but to continue paying out dividends throughout the downturn. Its 12% dividend means that investors don’t even need capital appreciation.

Enterprise Products Partners has manageable capital expenditures. Not only does it have an impressive asset portfolio, but this asset portfolio has the potential for significant growth. The company does have some risk of a longer-term downturn hurting its ability to gain new contracts. However, despite that, this is still a long-term investment.

The Energy Forum can help you build and generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing quickly, and you can be a part of this exciting trend.

The Energy Forum provides:

- Managed model portfolio to generate you high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic overviews of the oil market.

- Technical buy and sell alerts.

Disclosure: I am/we are long EPD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment