Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

Enphase Energy, Inc. (NASDAQ:ENPH) has seen tremendous interest from solar investors and ETF managers in recent weeks as the tragedies in Ukraine intensified. Russia’s invasion of its western neighbor has highlighted Western Europe’s dependence on its energy resources. However, the scope and scale of Russian President Vladimir Putin’s invasion have caused the EU to consider ripping apart their reliance on Russian energy. Given that Europe imports 40% of its gas consumption from Russia, the “divorce” will not be straightforward.

Therefore, the Russia-Ukraine conflict could push Europe to press on with its policies and momentum towards renewable energy. As a result, solar leaders such as Enphase stock have also risen significantly. In addition, ENPH stock is up close to 58% since we revised our rating from Hold to Buy in January.

We will continue to hold on to the stock, given its colossal market opportunity and solid fundamentals. However, we believe the recent recovery has been too fast too furious. Therefore, we do not encourage investors to add new exposure. Instead, we suggest investors wait patiently for its current momentum spike to be digested first. As such, we revise our rating on ENPH stock from Buy to Hold.

ENPH Stock Key Metrics

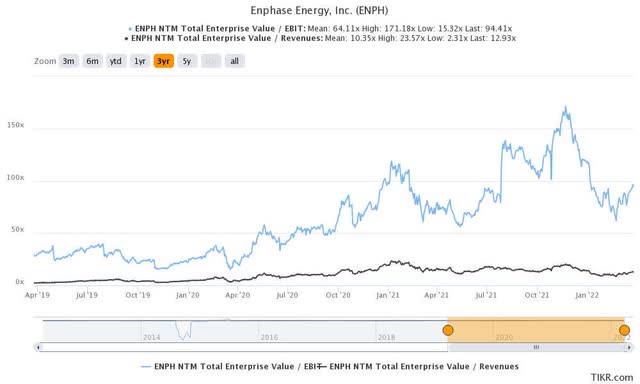

ENPH stock NTM Revenue & NTM EBIT valuation (TIKR) ENPH stock NTM FCF yield % (TIKR)

Enphase stock’s NTM revenue multiple has also increased significantly above its 3Y mean of 10.4x. It’s currently trading at 12.9x NTM revenue, at a 24% premium against its mean. Furthermore, its NTM EBIT multiple of 94.4x should be evident that ENPH stock attracts a substantial growth premium. Notably, the company is still expected to continue its robust topline growth moving forward. Management also raised its guidance in its recent earnings card as Enphase resolved its supply chain issues.

Consensus revenue estimates suggest a 45% YoY increase in FY22 and a 30.1% YoY rise in FY23. Therefore, the increase hasn’t been material from our observation post-FQ4, before the start of the Russian invasion. As a result, despite the surging optimism recently, we do not expect material upside to Enphase’s revenue guidance in FY22.

In addition, Enphase is FCF profitable. But, its NTM FCF yield also seems to have priced in a significant amount of bullishness. Notably, its FCF yield has fallen well below its 2% mean, to 1.46%.

Where is Enphase Heading in 2022?

We remain confident of the company’s long-term opportunities. ENPH stock is currently the #1 holding of Invesco Solar Portfolio ETF (TAN). Therefore, we believe that Enphase investors can continue holding onto the profitable Solar leader over the long term.

Furthermore, management still has $200M from its previous $500M stock repurchase authorization. It had spent about $300M in the December quarter buying back stock at an average price of $196.98. ENPH stock last traded at $193.81 at writing. Therefore, we believe that management at least considers the current price level as fair. We are confident that ENPH stock will continue to receive significant attention from buyers at prices 15-20% below the current level to defend the stock.

Furthermore, the EU plans to hasten its solar energy deployment following the Russian invasion. Its plans include constructing 420 GWh of solar power by 2030. In addition, solar power projects can also be built much faster than other renewable alternatives, improving the appeal of solar deployment. Bloomberg Intelligence added (edited): “Wind and solar projects can be deployed more quickly than competing alternatives, and we see the potential for strong above-consensus demand growth from such technologies in 2022-25.”

Hence, investors can expect potentially higher revenue guidance by Enphase at its next earnings call. Nevertheless, we mentioned that we think the near-term guidance increase (if any) has been priced in. Therefore, investors could set themselves up for potential disappointment if the revenue upside is not communicated moving forward.

In addition, Europe can also depend on the US in the near term for LNG imports. The EU intends to wind down two-thirds of its gas imports from Russia by the end of 2022. Therefore, we don’t think solar deployment can be built fast enough to meet Europe’s near-term demand. The EU would most definitely have to depend on the US for assistance meanwhile.

Barron’s reported that the US is “set to become the largest LNG producer by the end of this year.” Therefore, the US is undoubtedly well-positioned to help out its allies. While there are technical challenges relating to the transport and distribution of LNG, we think LNG would be what Europe needs in the near term. But, solar deployment would be critical for its energy security moving forward.

Is ENPH Stock A Buy, Sell, Or Hold?

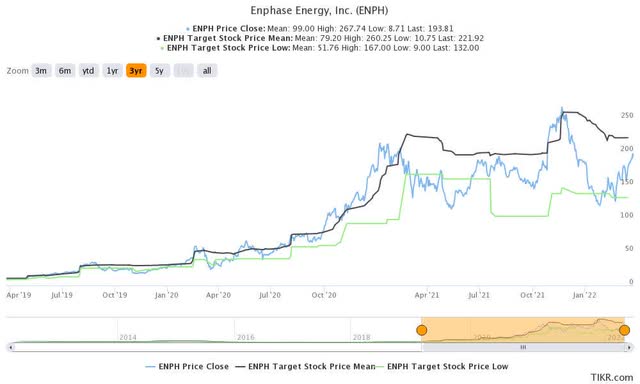

ENPH stock consensus price targets Vs. stock performance (TIKR)

Enphase stock has moved well above its most conservative price targets (PTs), which coincided with our January buy call. Therefore, we don’t think the near-term risk/reward profile is constructive to add new exposure to ENPH stock.

Consequently, we revise our rating on ENPH stock from Buy to Hold.

Be the first to comment