anouchka

Co-produced with Treading Softly

Do you know what the best part of a sale is? Its limited duration. They do not go on indefinitely. You have a short amount of time to make a decision, because indecision may result in you having to pay more in the end.

It’s why stores have rolling sales in different departments and for different seasons. Sales naturally work as a reason or motivation to drive shoppers into action. If an item is always 10% off, there really isn’t a sale – that’s just its new price.

The market has its volatility. I liken it to the ocean. From the shore, the ocean often looks flat and calm. Sure a storm kicks up the waves now and again, but overall it looks “flat as a pancake”. Yet sailors and mariners know that the open ocean is far from calm and flat. It is tumultuous and lively. Sailors must be ever on the lookout for rogue waves that move opposite the others and threaten to capsize even the largest of vessels.

The market also offers its own sales at times, like we are seeing now. When I get a private message asking me what someone should do who is down 20% this year, I always try to remind them that so is the rest of the market. As the ocean’s waves move all boats, so does the market most portfolios. As an income investor, we may be matching the market’s price movements but we get paid a much better rate to wait. Furthermore, reinvesting in a down market rapidly boosts our income as each dollar now produces more dollars than it did even a few months ago.

This means it’s offering us a limited-time sale, and we best act to maximize our income per dollar – also known as yield.

Let’s look at two excellent places to do just that.

Pick #1: PDI – Yield 13.9%

I can’t repeat it enough: lower bond prices lead to higher returns and higher income for bond investors. Low bond prices cause higher income, high bond prices reduce income.

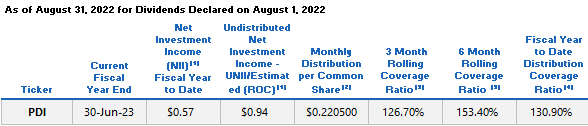

PIMCO Dynamic Income Fund (PDI) share price and NAV are both close to all-time lows. Yet when we look at PDI’s cash flow, it is as strong as ever. PDI’s UNII (undistributed net investment income) stands at $0.94, implying that investors can anticipate a special dividend for Christmas.

PDI’s distribution coverage for the past six months was over 150%!

PDI UNII Report

This compares to February 2022, before the Fed started hiking and interest rates shot up, PDI was covering its distribution by only 110%. Since February, PDI’s NAV has fallen 20%, but its earnings have increased from an average of $0.24/month over 6 months to $0.33/month.

Call me crazy, but when a fund I invest in is earning more money, I’m not likely to sell it.

PDI is a diversified debt fund, with an emphasis on non-agency mortgages. PIMCO made a huge bet on non-agency MBS during the Great Financial Crisis when all other investors were running away with their hair on fire. MBS issued prior to 2009 make up a little over 30% of PDI’s portfolio.

In addition to that base, PDI invests in high-yield corporate credit and non-USD debt carrying both long and short positions and making frequent use of hedges.

PIMCO has a sterling track record of creating value for shareholders. They are, in my opinion, the best bond fund manager in the market today. So when a quality PIMCO fund like PDI is offering me a double-digit yield, I’m happy to take advantage of it.

In the short term, there is a lot of volatility around rates. The uncertainty over what the Fed will do and every word said by the Fed will have an impact on bond prices and, therefore, on PDI’s NAV. Yet PDI is easily covering its distribution, and will likely have a special dividend later this year, and with coverage at 150%, a cut is nowhere on the horizon. I can’t tell you whether PDI will outperform the market next month. I can be very confident that getting a 13%+ yield from PDI with the potential for even higher dividends will beat the market in the long run.

Pick #2: CSWC – Yield 12.2%

Capital Southwest Corp. (CSWC) gave us a preview of upcoming earnings, and they are looking good. CSWC expects pre-tax NII (net investment income) of $0.52-$0.54 and reports a NAV of $16.45 to $16.60 as of September 30th, this compares to $0.50 NII last quarter and the NAV of $16.54.

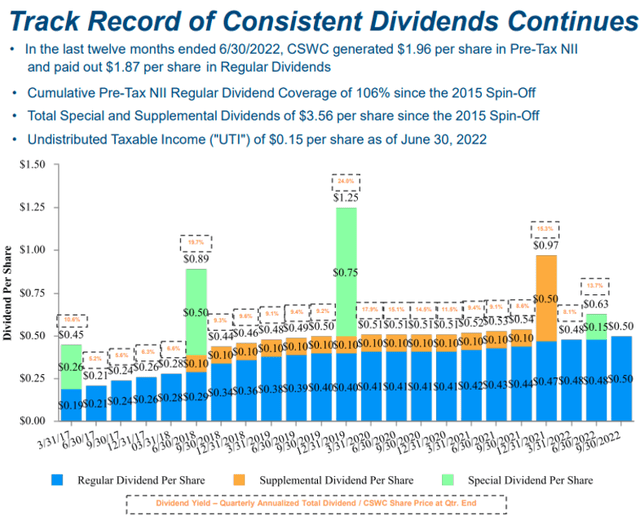

In short, CSWC will report its best quarter ever for NII and little to no change in their NAV. In response to such news, our neighbors in the market decided to start selling CSWC at 52-week lows. I appreciate their generosity in allowing me to buy income at such a low price. CSWC has hiked its regular dividend twice this year, from $0.48 in March to $0.52, payable in December. It added a $0.15 special dividend in June. The regular dividend remains covered by NII, and we may see more hikes next year.

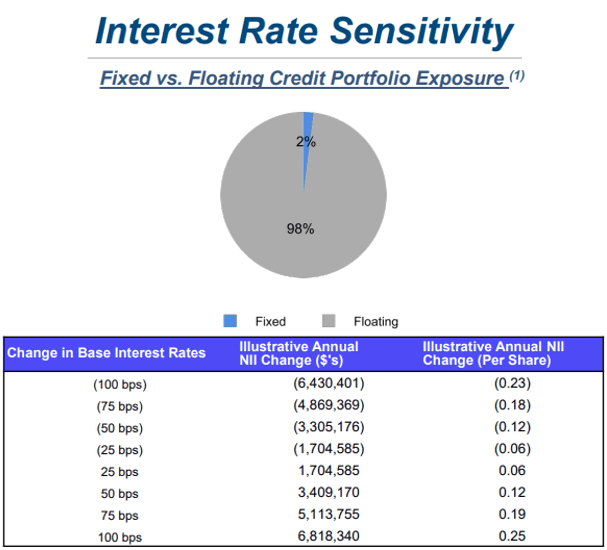

As a BDC (business development corporation) CSWC’s business model is to borrow fixed-rate debt and lend floating-rate loans. We are hard-pressed to imagine a better business model when the Fed is hiking at the fastest pace in 40 years. In June, CSWC was modest, they projected that a 100 bps increase in 3-month LIBOR would result in an additional $0.25/share in annual NII. (Source: Q1 2023, Earnings Presentation)

Q1 2023, Earnings Presentation

At that time, the 3-month LIBOR was 2.29%. Today, the 3-month LIBOR is 4.19% and will likely continue climbing. CSWC projected an increase of 100bps, and as of today, it is up 190 bps. CSWC saw approximately $0.03/quarter increase last quarter, we can expect that momentum will carry on and we will see this quarter set another record.

CSWC is hiking its dividend, NAV is stable, earnings are climbing and the company has a great history of rewarding shareholders with sizable special and supplemental dividends.

Q1 2023, Earnings Presentation

When my neighbors sell a company this friendly to income investors at 52-week lows, who am I to say no? This is a business with growing cash flow, a growing dividend, and a bright future. I want to own more of it.

Don’t worry, I’m not heartless. When my neighbor is hanging his head, depressed that he sold CSWC at such low prices, I’ll use some of my dividends to buy him a cup of coffee.

Conclusion

With CSWC and PDI, we get high quality and, in CSWC’s case, growing income. Furthermore, the market has put it on sale! I picture someone standing outside of a store holding up a sign advertising a major sale “everything must go!”. I would happily peruse the various offerings and take what I want, or leave it all alone if nothing interests me.

In this market, there are so many opportunities to take advantage of. If you don’t like these two ideas, look around and you’re bound to find others!

I want to hear all about how your income has grown by being an investor of action, not inaction. The income I buy today will pay me next month and the month after, and so on. If you do nothing, I’ll have even more income rolling in due to reinvestment while you stand still unmoved. Me, I keep piling on the “winning” every time I boost my annual income, even by a few pennies.

In retirement, you often lived on a fixed budget. Make sure to set some money aside each month to keep your portfolio’s income generation growing. You have dreams and plans still, let your portfolio help propel you to them!

That’s the beauty of being an income investor! That’s the heart of our Income Method.

Be the first to comment