jimfeng/E+ via Getty Images

Real estate and housing are important drivers of economic activity in many developed economies. The past few years have seen a housing boom which will take time to be digested by the market. As a result, economic activity related to housing is likely to be depressed for a significant period and will act as a headwind to economic growth. The rapid rise in mortgage rates will potentially bring this situation to a head in coming months, a possibility already being reflected in markets (lumber and home builders). There’s little evidence of the financial excesses associated with the 2008 crash though and hence it’s not clear whether house prices will decline or merely stagnate.

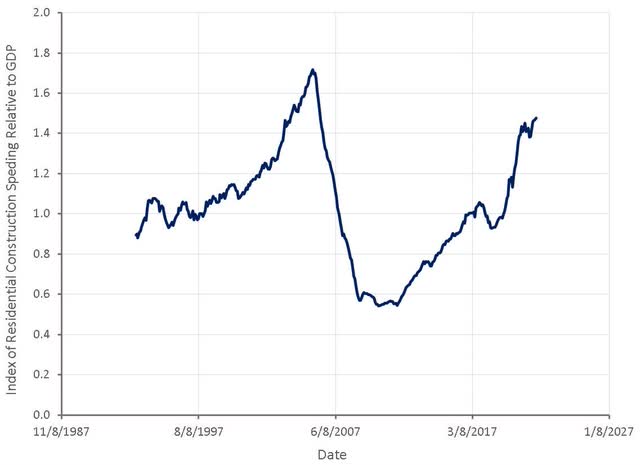

Total private residential construction spending relative to GDP is an indicator of the amount of economic activity being directed toward housing. This figure exploded during the pandemic and is approaching levels not seen since 2005, a period of clear excess. While some of this could be considered compensation for the relatively weak housing market between 2007 and 2017, construction has now likely overshot demand.

Figure 1: Total Private Residential Construction Spending (source: Created by author using data from The Federal Reserve)

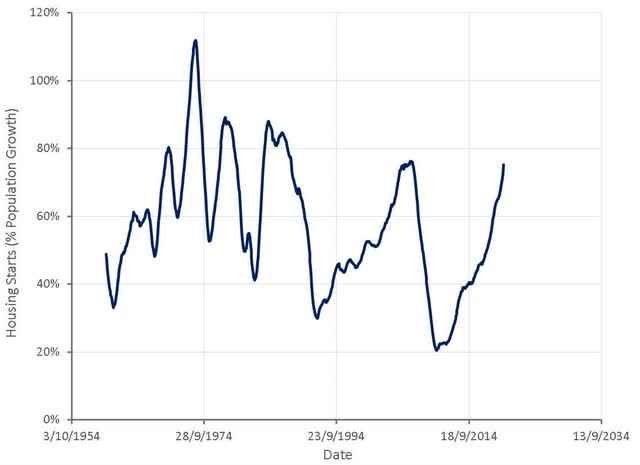

This situation is reflected in housing starts, which have been strong relative to weak population growth. Housing starts relative to population growth are approaching levels not seen since 2006, which also points toward an oversupply and slowdown in housing activity going forward.

Figure 2: Housing Starts Relative to Population Growth (source: Created by author using data from The Federal Reserve)

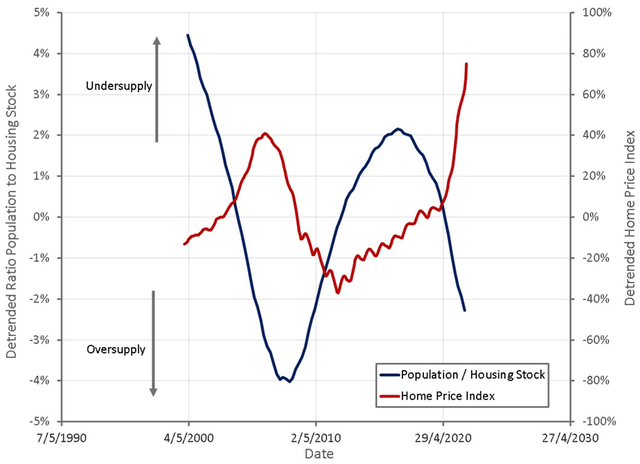

The housing stock relative to the total population also points toward an oversupply, although this is difficult to assess as household sizes are generally becoming smaller and housing is a localized market (supply/demand must be considered on a geographic basis). The housing stock makes it clear that supply only really becomes important at the extremes. Home prices can rise rapidly, even as an over supply is forming, as housing is a financial asset that exhibits momentum.

Figure 3: Housing Stock and Home Prices (source: Created by author using data from The Federal Reserve)

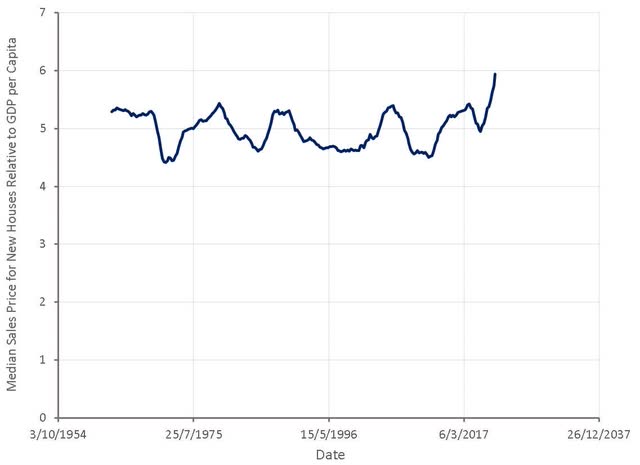

Home prices are now in relatively uncharted territory for the US, although are necessarily that high by international standards. It’s not clear whether home prices will decline, stagnate for a number of years as GDP continues to grow or if this is a new paradigm where Americans commit to a greater financial burden as the result of permanently higher home prices.

Figure 4: Median Sales Price for New Houses Relative to GDP per Capita (source: Created by author using data from The Federal Reserve)

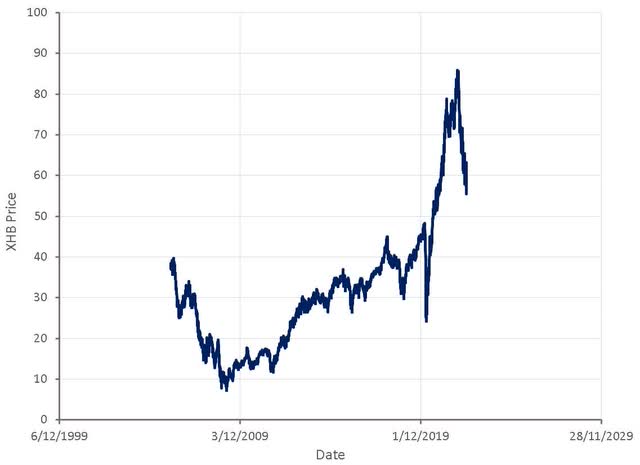

The stocks of home construction companies are already reflecting a return to some sort of pre-COVID normal, but it’s not clear that they are pricing in a significant slowdown. Given the rate at which financial conditions are tightening and the likely oversupply of housing, companies with exposure to housing have a large amount of downside risk.

Figure 5: XHB ETF Prices (source: Created by author using data from Yahoo Finance)

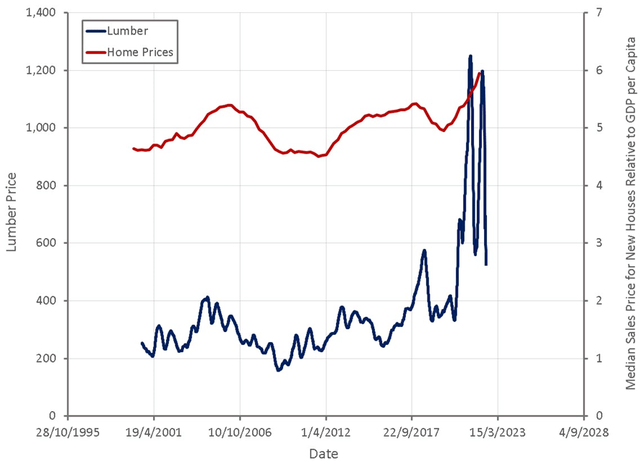

Lumber prices may also be returning to a normal pre-COVID trading range, reflecting a normalization of supply and housing construction. In the past lumber prices have tended to lead home prices, hence a continued decline in lumber prices may point towards a future decline in home prices.

Figure 6: Lumber Prices (source: Created by author using data from Yahoo Finance and The Federal Reserve)

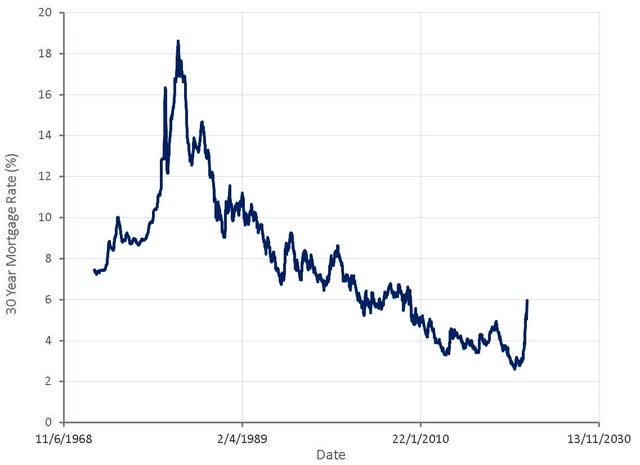

The Fed is trying to engineer a slowdown in the economy to reduce inflation, and while they may be able to influence the economy, they cannot control it. There’s a fine line between a slowdown and a recession and the pace at which financial conditions are tightening could be problematic. The US housing market is somewhat insulated from rising rates by the fact that most people have fixed rate mortgages but new buyers will be priced out. If mortgage rates and home prices stay at current levels or continue to rise, buyer demand for housing is likely to be weak.

Figure 7: 30 Year Mortgage Rate (source: Created by author using data from The Federal Reserve)

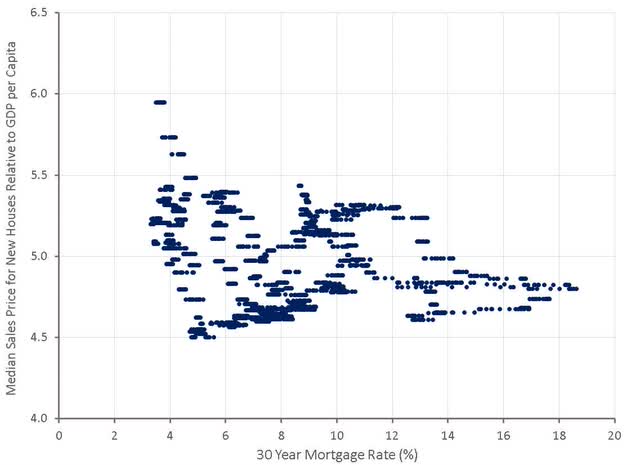

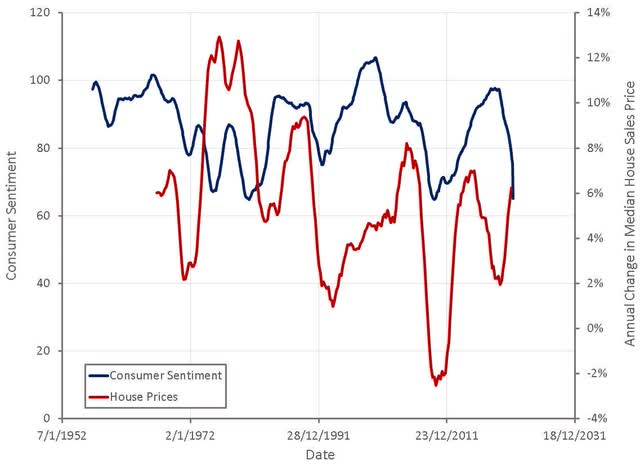

The current combination of home prices relative to income and mortgage rates is unprecedented in the US and does not appear sustainable. This is concerning as a drop in house prices along with elevated inflation will likely destroy consumer confidence and spending.

Figure 8: Mortgage Rates and Home Prices (source: Created by author using data from The Federal Reserve)

Figure 9: Consumer Sentiment and House Prices (source: Created by author using data from The Federal Reserve)

House prices tend to be sticky and they are the largest purchase most people will make in their lives. There may be a reluctance to take a loss but not all people have a choice. Home prices will ultimately reflect the balance of supply and demand under the current financial conditions. With a looming oversupply, rising interest rates and record home prices, the housing market presents a serious risk to the economy. Whether home prices fall or merely stagnate for an extended period of time may not matter too much. A large decline in construction activity, along with the impact on adjacent markets, will present a large headwind to the economy in the not-too-distant future.

Be the first to comment