Alistair Berg/DigitalVision via Getty Images

Investment Thesis

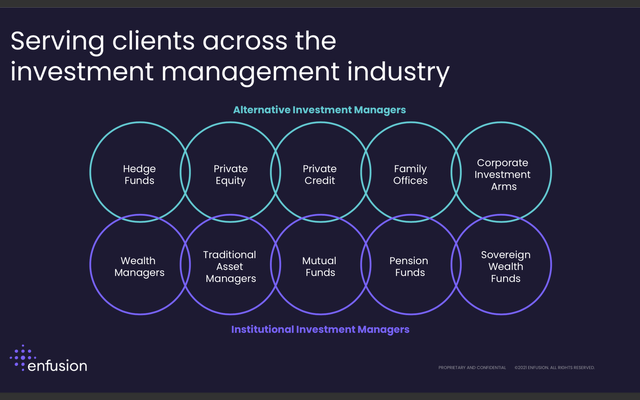

Enfusion (NYSE:ENFN) is a financial software company that went public last year quietly. Like most other growth stocks, Enfusion got caught in the broad market sell-off and shares are now down over 60% from its all-time high last year. Enfusion operates as a SaaS (software as a service) company in the finance industry and provides investment management software to customers such as private equity, hedge funds, and family offices. The current existing investment management systems are very fragmented and hard to use, therefore the company is trying to disrupt the industry by providing a much more streamlined end-to-end solution for asset managers. After the massive drop in share price, the company is now trading at a discounted valuation. It is a disruptor in the space and is growing quickly. The TAM (total addressable market) for investment management software is large and the company also has an attractive business model. Therefore, I believe Enfusion is a buy at the current price.

Market Opportunity

The TAM for investment management software is large and the number of investment firms and AUM has been increasing over the past few years. It is also disrupting the legacy market and taking market shares from competitors. According to Enfusion, the global AUM increased by 40% from 2015 to 2020. It is forecasted to further grow at a 6% CAGR (compounded annual growth rate) to $145 trillion in 2025. The current TAM for the company is estimated to be over $19 billion. Software & IT Services from investment management alone has a TAM of $11.5 billion.

It is also benefiting from the rise of alternative investment firms, which are forecasted to grow AUM at 8% CAGR. For example, the company recently announced that leading crypto trading firm Coinbase (COIN) decided to integrate Enfusion’s solution into their system for cryptocurrency trades. I believe these partnerships will continue to fuel growth going forward. The company is also looking to expand internationally into Asia-Pacific, Europe, and Latin America, which will open up more market growth opportunities.

A Revamped Solution

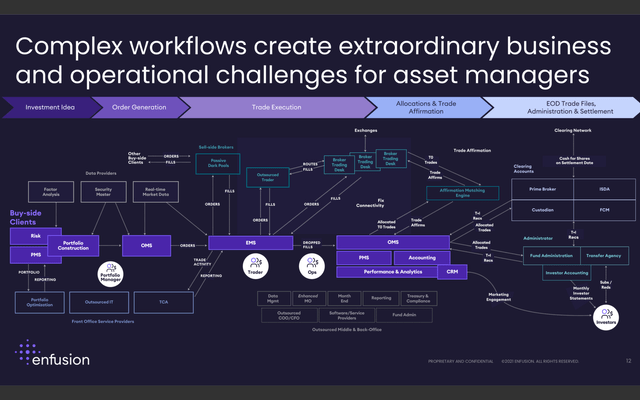

Investment management is an industry with a very complicated workflow. A lot is happening behind the scenes when managers are generating an order, executing a trade, or dealing with administration and settlements. The landscape is getting more complex with increasing regulatory and investor requirements, demand for more better accessibility and efficiency, etc. Enfusion is trying to disrupt to the industry by offering a purpose-built end-to-end solution. It is able to provide real-time analytics, accounting, portfolio management, order execution management, and more.

Datasets from these services are unified and keep the whole organization in sync. Compliance officers, traders, or executives are able to access specific data at any time. It can be accessed anywhere unlike legacy solutions which only allow on-prem or desktop access. It also has automatic updates that address ever-changing customer needs. Enfusion’s revamped solution is able to provide much better agility and efficiency compared to the legacy solution and it is seeing huge success. Its number of clients increased 180% from 2018 to 2021 and its revenue churn rate is only at 0.9%. I believe the company will continue to grab market share from competitors as its solution has much stronger capabilities.

Financials and Valuation

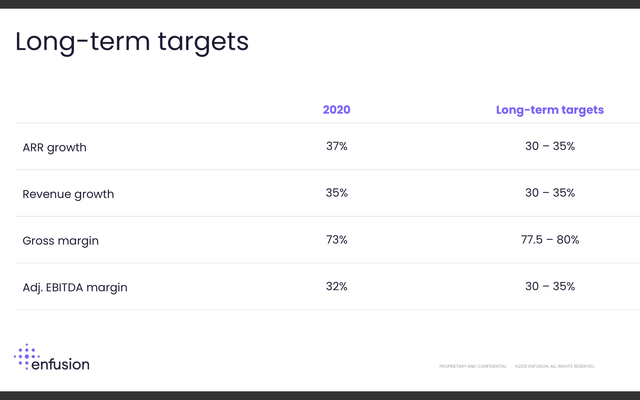

Enfusion announced its first-quarter earnings in May. The company reported revenue of $34.1 million, up 40% YoY (year over year) from $24.4 million. Platform subscriptions revenue was $31.6 million, or 92.7% of total revenue. While managed services revenue was $2.2 million, representing 6.5% of total revenue. ARR (annual recurring revenue) was $137.6 million, up 37% YoY. The growth is driven by its international expansion, with growth in EMEA and APAC regions up 59% and 47% respectively. It is also seeing an increase in spending from existing customers, with a net dollar retention rate of 118%.

Despite being a high-growth stock, Enfusion already has a positive adjusted EBITDA. The adjusted EBITDA for the quarter was $2.1 million, or 6.2% of total revenue. However, it is posting a negative cash flow of $(41) million. This is largely due to the stock-based compensation expense related to its IPO. The company guided revenue and adjusted EBITDA of around $149.5million and $18.2 million, representing revenue growth of 33.8% with an adjusted EBITDA margin of 12.2%. It ended the quarter with a very healthy balance sheet of $56.2 million in cash and only $11.9 million in debt.

Thomas Kim, CEO, on Q1 result:

The strong results give us confidence in the long runway opportunity we see in 2022. Our underlying business fundamentals remain resilient even in higher market volatility and macro uncertainty. I’m pleased that we expanded our base of larger fund manager and institutional asset manager clients as evidenced by two seven-figure fund manager wins and four additional institutional asset manager wins, and overall accelerating adoption of our Order and Execution Management System (OEMS).

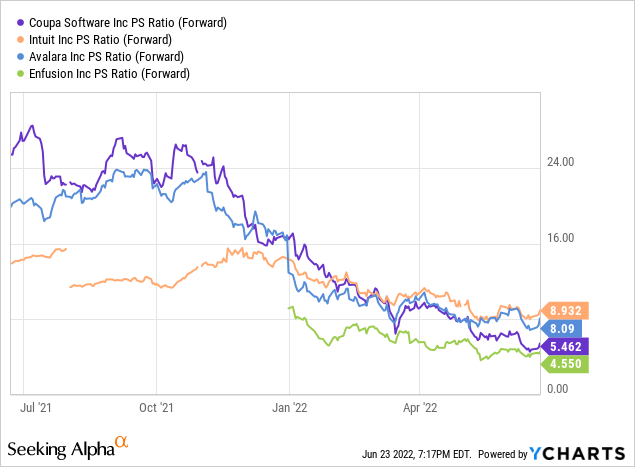

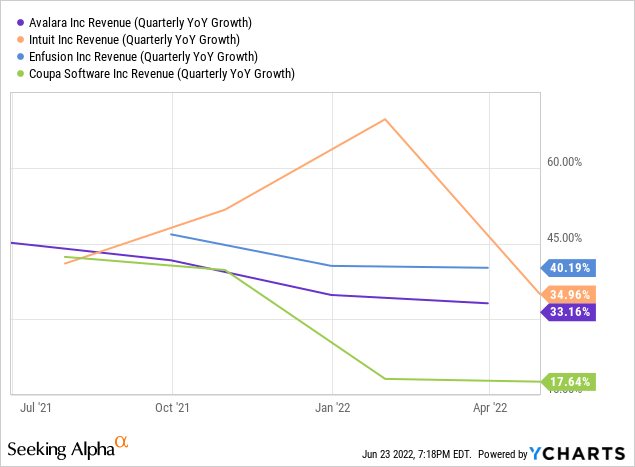

After the drop since its IPO, Enfusion is now trading at a very reasonable valuation. Rule of 40 is a benchmark often used to value a software company. It is calculated by adding the company’s revenue growth rate and EBITDA margin to see whether it is over 40. Over 40 means a company is performing well. Currently, Enfusion’s revenue growth and EBITDA margins are 40% and 6.5% respectively. Adding them together gives us 46.5% which indicates a strong performance. If we value the company using an fwd PS ratio, it is currently trading at 4.55x 2022 revenue, which is very compelling in my opinion. As shown in the first chart, its valuation is much lower than other financial software companies such as Avalara (AVLR), Intuit (INTU), and Coupa (COUP), which are all trading at a 20%+ premium. Intuit is even almost trading at a 100% premium. From the second chart, you can see that despite the cheaper valuation, it is growing at the fastest rate compared to its peers. It also has a huge opportunity ahead of them which will continue to fuel its growth rate. Therefore, I believe Enfusion is currently undervalued.

Risks

Enfusion is relatively immune to the macro environment as investment management software is essential to all asset managers. However, there are still some underlying risks. The company generates a platform subscription revenue for access to its solutions and generates other service revenue based on the number of users, trading volume, data usage, etc. During an economic downturn, funds might see a decrease in clients and AUM (asset under management) as investors are more reluctant to invest. This will decrease the company’s service revenue as it is mostly usage-based. If a recession happens, there may be a huge drop in all asset prices and some funds and firms might get liquidated, as seen in the great financial crisis back in 2008/2009. This will significantly decrease the number of clients using Enfusion’s solution and hurt its subscription revenue. I think the chance of these risks happening is relatively low but it is something investors should keep an eye on.

Conclusion

In conclusion, I believe Enfusion has a huge opportunity in the investment management software space. The TAM is estimated to be over $11 billion yet Enfusion’s market cap is currently only around $1.2 billion. Increasing AUM and the number of firms and funds are providing a strong tailwind for the company. It is also seeing further growth opportunities from international expansion. Its purpose-built end-to-end software is able to integrate all workflow seamlessly and provide a much more agile and efficient solution for clients. Its revamped solution is disrupting the industry and the company is onboarding clients quickly, including companies like Coinbase. Enfusion is growing revenue quickly while posting a positive adjusted EBITDA. Its guidance also indicates strong continuous growth and improving profitability. It is now trading at a discounted valuation compared to financial software peers while growing at a faster rate. Therefore, I rate Enfusion as a buy at the current price.

Be the first to comment