Justin Paget/DigitalVision via Getty Images

Energy Vault (NYSE:NRGV) is a company that recently entered the public markets through a SPAC merger. The company has an interesting technology which stores energy in heavy blocks that are raised when energy is being stored, and descended when energy is to be released back to the grid. This gravity-based approach to storing energy is similar to pumped-storage where water is pumped to a reservoir to be released when the energy is needed, but with the added benefit that there is no need for a large reservoir nearby.

We believe this approach holds promise and could indeed be a game changer for grid-scale energy storage applications. Whoever finds an appropriate solution to store renewable energy when it’s not immediately needed will definitely have a large business opportunity ahead of them.

As renewable energy production increases, renewable energy storage must keep pace to prevent intermittent power outages. Among the advantages of gravity-based energy storage system is that they offer a lower expected levelized cost than any current technology available, similarly, they have advantages with respect to capex and opex. In addition, this solution appears very scalable with no geologic dependencies, so it can be built anywhere, ideally close to the renewable energy power plants.

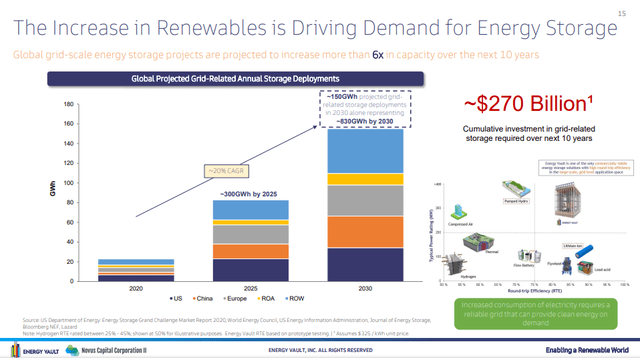

With the significant addition of renewable energy assets to the grid, especially wind and solar, the expectation is that there will be a massive need for utility scale energy storage as well. The graph below illustrates how this development is likely to unfold in the next few years, and the geographies where most of this storage is likely to be needed. We believe that if the energy storage solution is cost-effective, the numbers below might even underestimate the real size of the opportunity which we think is enormous.

Energy Vault Investor Presentation

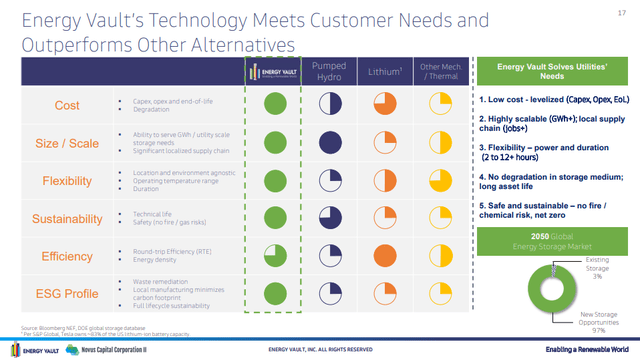

Also note in the Cartesian diagram how Energy Vault is by itself in the upper right corner, meaning it is according to the company the only solution having both a high round-trip efficiency and large-scale grid-level power rating. If the company is right about this, it should be able to win a large part of the expected ~$270 billion in grid-related energy storage in the next 10 years.

In our opinion, while round-trip efficiency is an important metric, we believe that a few percentage points there are not as important as scalability of the solution and cost per MW/h of storage capacity, as well as the potential power rating scale. With this in mind, we really see pumped-storage as the main competitor to Energy Vault’s solution. However, it is important to remember that pumped-storage usually requires a reservoir nearby.

Energy Vault Investor Presentation

As can be seen in the previous slide, the attributes where Energy Vault is inferior to Lithium-ion batteries are round-trip efficiency and energy density, however, it is presented as a superior option with respect to the rest of the characteristics, and overall, it should have a lower levelized cost of operation, be more scalable, and more environmentally friendly.

To develop this technology, the company made use of several advancements in AI and computer vision, such as advanced trajectory computation, and material science for the creation of heavy and durable blocks, using cutting-edge material science in partnership with Caltech and CEMEX (CX).

This R&D efforts have resulted in 4 issued patents in the US for the company, and 20 pending patents, 18 of which are international. The patents primarily focus on the use of heavy blocks to store energy, generating electricity by lowering the blocks, the grabbing/lifting/lowering mechanisms, and the damped self-centering mechanism. The strategy the company is following is to try to protect the visible components, and the AI software to keep it as a proprietary trade secret.

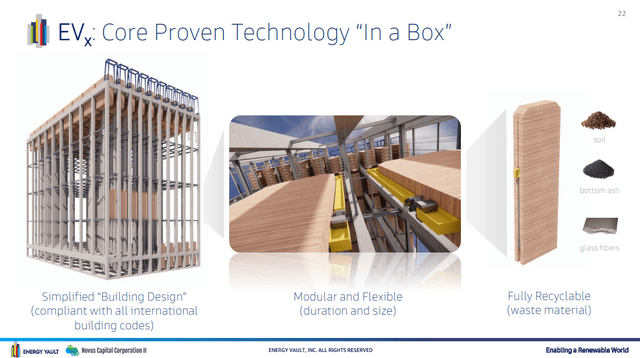

The company has completed its first commercial scale system in Switzerland, which validated the foundational technology. This first system called EV1 connected to the Swiss national grid in July 2020. Since then, the company has made further improvements and now has a new improved system called EVx, which is highly modular and flexible, and whose weights are made out of fully recyclable waste material such as glass fibers, soil, and ash. While EV1 attained a round-trip efficiency of 75.3%, it is expected that EVx will achieve 80-85%, making it a nice improvement.

Energy Vault Investor Presentation

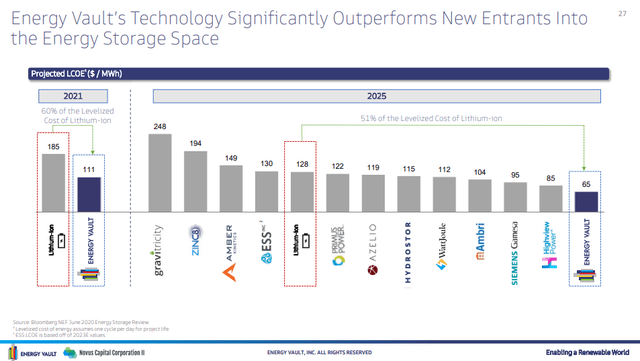

By 2025, the company expects the levelized cost of operation to be almost half that of lithium-ion. If this is indeed the case, we can expect the company to dominate new grid-scale storage projects. The slide below summarizes where the company believes itself to be positioned compared to the most common grid-storage solutions. If the company’s estimates are accurate, we believe Energy Vault should command a huge portion of the future grid-storage projects.

Energy Vault Investor Presentation

In addition to the lower cost, Energy Vault’s solution has the benefit of not posing risk of fire or hazardous gases, and it experiences no significant degradation with time. These should be long operational assets with considerable lifespan, low carbon footprint, and should be able to serve high power needs at both shorter and longer durations (2 – 12+ hours). It is expected that the solution will be resilient to harsh conditions and high ambient operating temperatures with no material increases in opex. Unlike lithium chemical batteries, potential energy at height and block composites have no storage capacity loss over time.

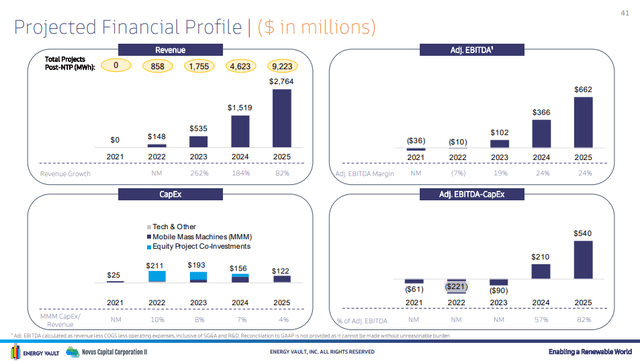

Energy Vault financials

The company is considering combining two business models to go to market. It plans to offer the systems, with an expected 20-30% gross margin, and it is also considering owning some of the systems and leasing them to customers aiming for a 16% unlevered rate of return. We like that the company is willing to experiment what the best go-to-market approach is, and hopefully at least one of them will prove wildly successful. We personally prefer the straightforward approach of selling the systems, and maybe offering maintenance and software contracts in order to add a recurring revenue component. This would be similar to how wind turbine manufacturers sell the turbines, but usually get the customer to sign multi-year maintenance contracts that bring attractive recurring revenue.

The biggest risk we see with an investment in Energy Vault is the fact that so far it has not generated revenue. It has a pipeline of prospective customers, with hundreds of engagements and 8 customers with letters of intent or executed agreements. So there are some signs that the company is getting some sales traction. It expects some revenue in 2022, but really the ramp-up is not expected until 2024-2025. As such, we would caution potential investors that this remains a highly risky speculative investment, and that while the share price could go up multiples of the current price if successful, it is also quite possible that it goes to zero. The company is projecting positive adj. EBITDA until 2023 and positive free cash flow until 2024. In our experience, the further out the projections, the less reliable they tend to be.

Energy Vault Investor Presentation

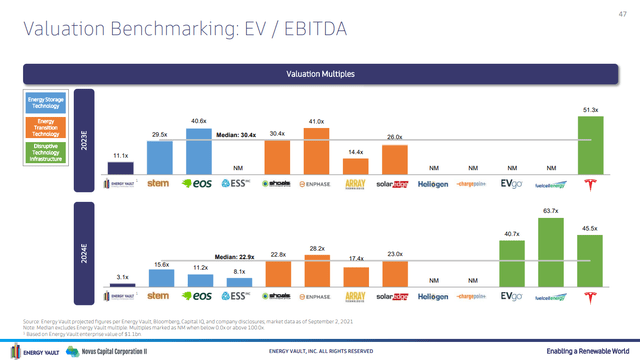

NRGV stock valuation

The valuation multiples for Energy Vault, based on the expected EBITDA for 2023 and 2024 are, in our opinion, quite reasonable. They compare favorably to other technology companies in their industry, such as Enphase (ENPH) and SolarEdge (SEDG). Even with shares trading above the $10 value when they merged with the SPAC.

Of course, this EBITDA projections rest on the assumption that there will be significant demand for the systems from customers, and that is something that until sales take place we cannot be fully confident in. What we’ll say is that there is significant risk, but also significant opportunity should the company deliver. It is our opinion that shares are trading at a fair price given the opportunity but also the risks that exist.

Energy Vault Investor Presentation

Conclusion

Energy Vault is working on an extraordinarily important problem, and they seem to have come up with a really good solution. If their systems work as well as the company is saying it does and they manage to mass produce it in a cost-effective way, this could be a game changer for grid storage technology. Shares could increase to a multiple of the current price, but there is also the risk that the company fails to commercialize the systems, in which case an investment in the company could very well go to zero. Still, we strongly believe this is one of the most interesting opportunities in the renewable energy space available today.

Be the first to comment