onurdongel

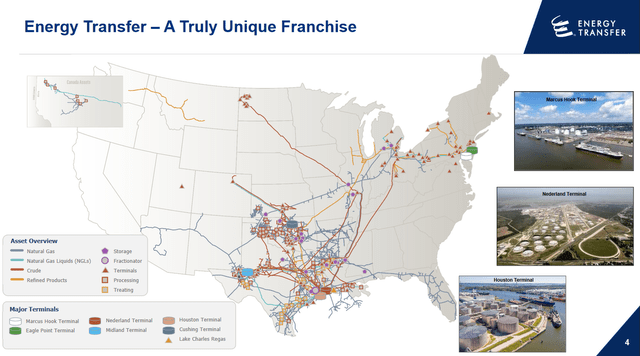

Energy Transfer LP (NYSE:ET) is one of the largest and most well-known midstream companies in the nation, boasting an extensive network of infrastructure that stretches across much of the country. It also tends to be one of the more controversial names in the investment community due to some of the decisions that have been made by management over the past few years.

The company’s units have also underperformed the broader energy sector, as they are actually down 7.60% over the past twelve months compared to the stellar capital gains that some other energy investments have delivered. Fortunately, Energy Transfer does have a very attractive 8.10% yield and some solid growth prospects. Thus, despite the company’s less-than-stellar reputation, there may be some reasons to consider it for a portfolio.

About Energy Transfer

As stated in the introduction, Energy Transfer is one of the largest midstream companies in the United States. The company boasts an impressive network of natural gas and liquids pipelines along with supporting infrastructure that stretches across much of the eastern United States:

One of the first things that we notice here is that Energy Transfer’s network extends to most of the basins in which fossil fuels are produced. This includes the Marcellus Shale, which makes Energy Transfer one of the few midstream firms that have operations in this region. This is a good position for the company to be in because each of these basins has somewhat different characteristics.

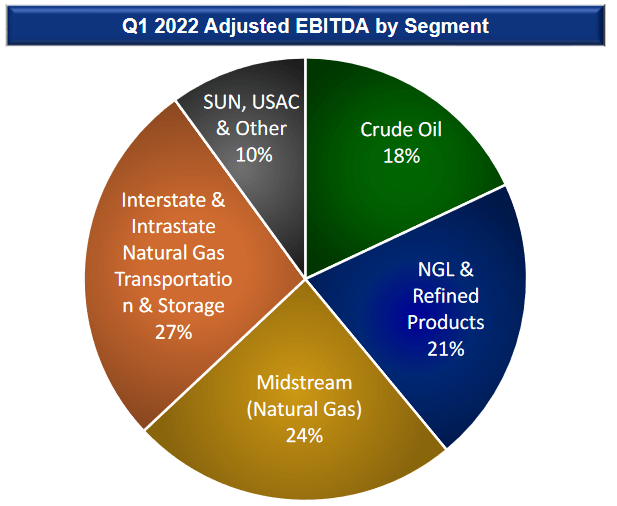

For example, it is cheaper to produce in the Permian Basin than in the Bakken Shale. The Marcellus Shale, meanwhile, produces mostly natural gas and natural gas liquids. As we might expect, this overall provides Energy Transfer with a great deal of diversity. Indeed, in the first quarter of 2022, the company’s adjusted EBITDA (a proxy for pre-tax cash flow) was almost evenly split between natural gas and liquids:

Energy Transfer

This could be beneficial as well since the fundamentals for crude oil and natural gas are quite different. Most importantly, natural gas has overall stronger fundamentals, which is quite different from a few years ago when the compound was frequently flared off as a waste product. Natural gas has also risen somewhat more than crude oil over the past year as well, with natural gas being up 49.19% over the period while West Texas Intermediate crude oil rose a somewhat more moderate 32.38%.

Energy Transfer does not particularly benefit from changes in resource prices, however. This is because of the business model that the company uses. Basically, what Energy Transfer does is enter into long-term (five to ten years in length, typically) contracts with its customers under which Energy Transfer provides transportation of the customer’s resources through its pipelines and is compensated by the customer based on the volume of the resources being handled, not their value. In addition to this, the contracts typically include minimum volume commitments that specify a certain minimum volume of resources that must be sent through the company’s pipelines or paid for anyway. This provides Energy Transfer with remarkably stable cash flows no matter what is going on in the macro-economic environment. We can see this by looking at the company’s adjusted EBITDA over the past three full-year periods:

| 2019 | 2020 | 2021 | |

| Adjusted EBITDA | $11,140 | $10,531 | $13,046 |

(all figures in millions of US dollars)

In the first quarter of 2022, Energy Transfer had an adjusted EBITDA of $3.340 billion, which was fairly similar to what the company had in most quarters of 2021:

| Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | |

| Adjusted EBITDA | $5,040 | $2,616 | $2,579 | $2,811 | $3,340 |

(all figures in millions of US dollars)

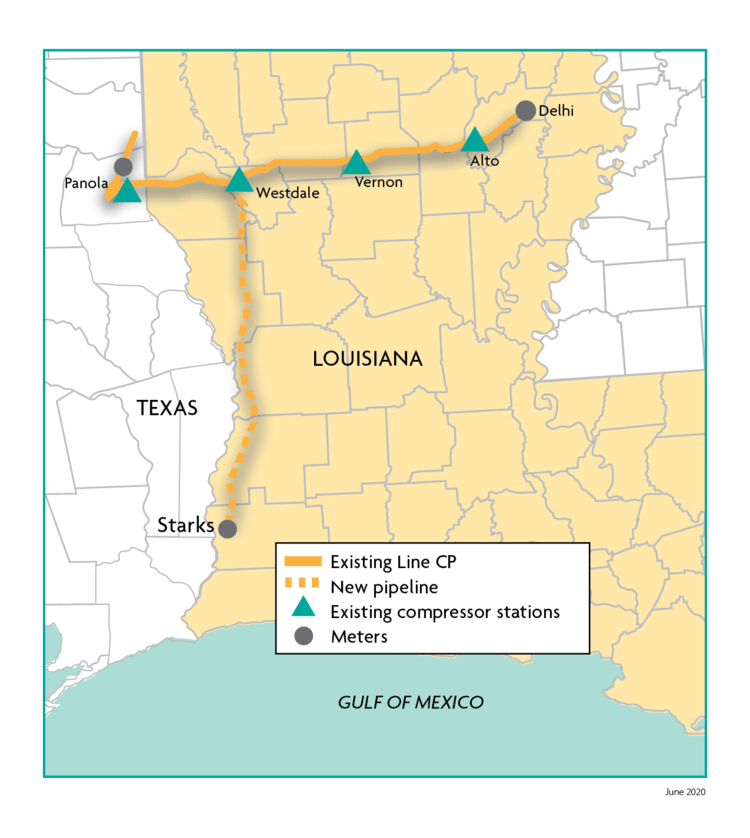

Fortunately, investors in Energy Transfer do not have to be content with mere stability. In fact, Energy Transfer boasts some significant growth prospects. One of these is the Gulf Run Pipeline project, which Energy Transfer took control of when it purchased Enable Midstream last year. The project includes the construction of a new 135-mile natural gas pipeline running from Westdale, Louisiana to Starks, Louisiana:

gulfrunpipeline.com

The pipeline will be capable of carrying approximately 1.65 billion cubic feet of natural gas per day, which is intended to support the burgeoning and rapidly growing liquefied natural gas export market. In fact, Golden Pass LNG, which is a joint venture between Qatar Petroleum and Exxon Mobil (XOM) has already committed to paying for the transit of 1.1 billion cubic feet of natural gas per day through the pipeline in order for the plant to convert it into natural gas. This is a twenty-year contract, which is quite nice to see because it guarantees that the company will generate both revenue and cash flow from this project for an extended period of time.

We also notice though that the pipeline itself will not be fully utilized by this single contract. However, the area being served by the pipeline will be home to a number of liquefaction plants so it is quite conceivable that one of these will ultimately purchase the remainder of the pipeline’s capacity. It is also quite possible that Golden Pass LNG will end up expanding and utilizing the rest of this capacity. This thus could result in more growth than the pipeline will already provide for Energy Transfer once it comes online. With that said, the already existing contract is sufficient to provide Energy Transfer with a profit from the pipeline.

Energy Transfer has not stated exactly how profitable the pipeline will be but it is typical for projects like this to pay for themselves in four to six years so that would be a reasonable guess. Energy Transfer started construction on the pipeline during the first quarter and it is expected to be complete around the end of the year. We should thus expect to see the impact of this project as we enter the new year.

This pipeline is far from Energy Transfer’s only growth project, either. In fact, the company will spend a total of $1.8 billion to $2.2 billion this year on various growth projects:

Admittedly though, this does not mean that all of these projects will come online this year. Indeed, many of them will not. Thus, ultimately we probably have several years of growth represented here. This is something that is quite nice to see, since it probably means that the company’s distribution will probably increase over time, which would be nice considering the thrashing that Energy Transfer’s management gave income investors back in 2020.

Midstream Fundamentals

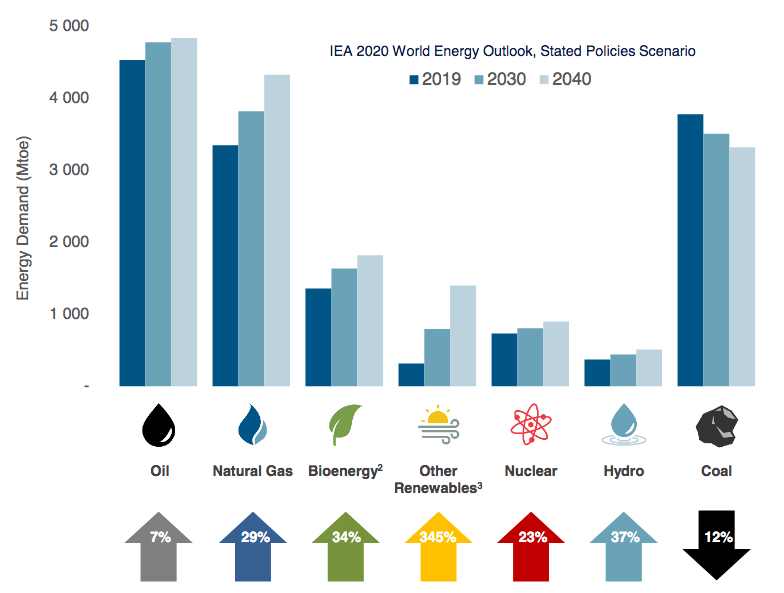

As we have already seen, Energy Transfer’s product mix is almost evenly split between natural gas and crude oil. This is nice because each of these products has very different fundamentals. In particular, natural gas has much more forward growth potential than crude oil. This is at least partly because of global concerns about climate change. These concerns have caused many governments around the world to enact various policies meant to reduce the carbon emissions of their nations. One of these is to encourage the retirement of coal-fired power plants in favor of renewable energy instead.

However, renewable sources of energy are not reliable enough to maintain a modern electric grid. Thus, the usual solution is to supplement the renewables with natural gas turbines, which are reliable enough and still produce far fewer carbon emissions than other fossil fuels. This is why natural gas is often called a “transitional fuel,” as it provides a way to maintain the reliability of a modern grid while still reducing carbon emissions. According to the International Energy Agency, the global demand for natural gas will increase by 29% over the next twenty years as a result of this trend:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

This is one of the biggest reasons why liquefied natural gas has become so popular as it is the only way to transport natural gas across large bodies of water, such as the ocean. The United States has an incredible amount of natural gas reserves due to the wealth of regions such as the Marcellus Shale. This is why Energy Transfer’s operations in this area are so important since it positions the company quite well to generate growth as the liquefied natural gas industry continues to grow and prosper. This is because the demand for natural gas from this industry will require someone to transport the natural gas to the liquefaction plants. Energy Transfer’s operations in the Marcellus Shale position it very well to be one of the suppliers of this transportation as the gas wealth of the region sets it up to be a significant source of the required natural gas.

Financial Considerations

It is always critical that we analyze the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. This might result in a company’s interest costs increasing when the debt matures and it has to do a rollover. In addition, a company must make regular payments on its debt if it is to remain solvent so a decline in cash flows could push the company into insolvency if it has too much debt. While Energy Transfer has remarkably stable cash flow, that is still a risk that we should consider.

The usual way that we analyze a midstream company’s debt load is by looking at its leverage ratio, which is also called the net debt-to-training twelve-month adjusted EBITDA ratio. In short, this ratio tells us how many years it would take the company to completely pay off its debt if it were to devote all its pre-tax cash flow to that task. At the end of the first quarter of 2022, Energy Transfer had a leverage ratio of 3.55x based on its trailing twelve-month adjusted EBITDA. This is quite a reasonable ratio that is well below the 5.0x that analysts usually consider acceptable. It is also below the 4.0x maximum that I usually consider to be reasonable. Energy Transfer states that it is committed to maintaining its ratio at about this level so we can assume that it will do so. Overall, there does not appear to be anything to worry about with respect to the company’s debt load.

Distribution Analysis

One of the biggest reasons why people invest in companies like Energy Transfer is because of the enormous distribution yields that they tend to possess. This is also one of the reasons why Energy Transfer has a lukewarm reputation among some investors, as the company drastically cut its distribution back in 2020. While it has begun to raise it recently, the current payout remains well below the levels that the firm had prior to the pandemic:

With that said though, anyone buying the stock today will receive the current yield and not necessarily have to worry about what the company had in the past. As of the time of writing, Energy Transfer yields 8.10%, which is well above the 1.57% current yield of the S&P 500 index (SPY) and by itself represents a reasonable return even if the units remain flat going forward. As is always the case, though, it is critical that we determine whether or not the company can actually maintain the current distribution. After all, we do not want to be the victims of another distribution cut that reduces our income and leads to more capital losses!

The usual way that we analyze a midstream company’s ability to maintain its distribution is by looking at its distributable cash flow. Distributable cash flow is a non-GAAP figure that theoretically tells us the amount of cash that is generated by a company’s ordinary operations and is available to be paid out to the limited partners. In the first quarter of 2022, Energy Transfer reported a distributable cash flow of $2.08 billion. The company currently has 3.0847 billion common units outstanding, which means that the current $0.20 quarterly distribution costs the company $616.94 million. That gives Energy Transfer a distribution coverage of 3.37x, which is easily one of the highest ratios in the industry. Analysts generally consider anything over 1.20x to be reasonable and sustainable so it appears apparent that the company can easily afford to maintain the current distribution.

With that said though, the company did have a very high distribution coverage ratio prior to the distribution cut in 2020 so it is still possible that management will reverse course. However, Energy Transfer is much stronger financially now, particularly in terms of leverage, so it seems unlikely that we will see management reverse course. Overall, the distribution is probably pretty safe.

Conclusion

In conclusion, Energy Transfer is a somewhat controversial name due to its management team, which may explain the disappointing performance that it has delivered in the market over the past several months. However, it does have a lot of potential, especially in the natural gas space. As the demand for natural gas is poised to grow rapidly as the liquefied natural gas market takes off, Energy Transfer’s commanding midstream position in gas-rich basins could allow it to profit handily. The company also boasts a strong balance sheet and a very substantial distribution that appears to be quite sustainable. Energy Transfer may be worth considering for anyone’s portfolio today, especially someone that is seeking income.

Be the first to comment