Alex Wong/Getty Images News

Energy Transfer LP (ET) is never far from a controversy. Whether it is environmental concerns, a legal challenge or another acquisition, ET has given news channels more excitement than any other midstream firm. While the common shares have been quite volatile, the preferred shares have been rather steady performers over the last 12 months. We had highlighted these a year back as a good place for income for the investor who prefers to sleep at night with both eyes closed. We review where these stand and tell you which one is our favorite.

The Preferred Shares

ET’s three listed preferred shares that we had highlighted are as follows.

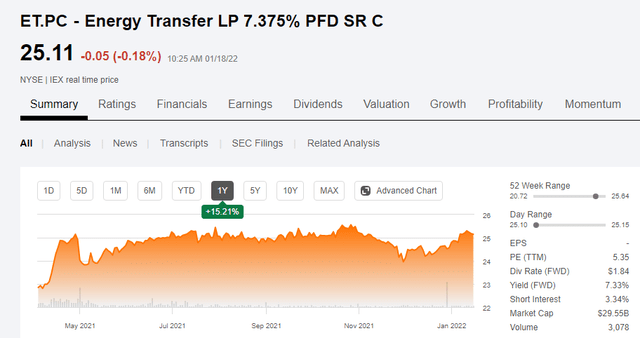

1) Energy Transfer LP 7.375% PFD SR C (ET.PC)

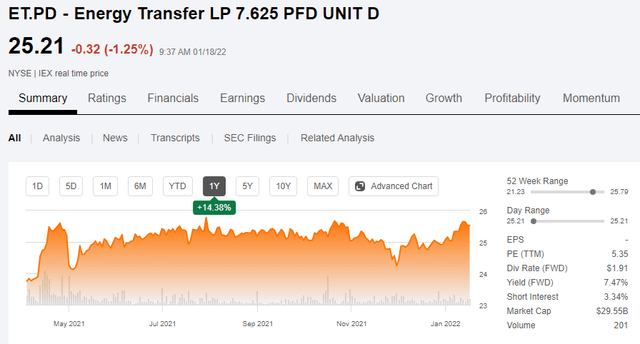

2) Energy Transfer LP 7.625% PFD UNIT D (ET.PD)

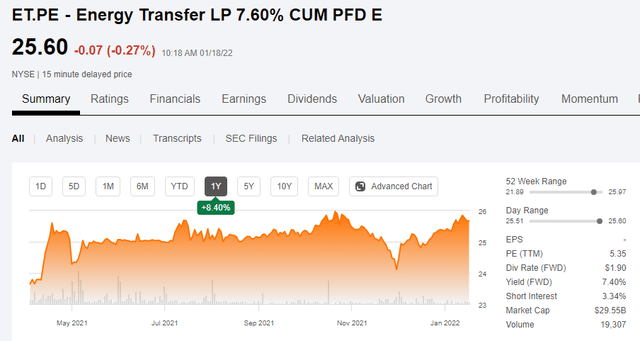

3) Energy Transfer LP 7.60% CUM PFD E (ET.PE)

All three have moved up substantially from year-ago levels. ET.PC has benefitted the most with total returns approaching 30%. Those returns are about half as much as the common equity but are noteworthy considering the far lower risk and volatility levels.

Current Yields

All three pay distributions four times a year and the nearest ex-distribution date is very close (end of January). ET.PC still trades below par when we strip out the 39 cents accumulated distributions.

Energy Transfer Preferred Shares C

ET.PD is in a similar position as well once we remove the 40 cents of accumulated distributions.

Energy Transfer Preferred Shares D

ET.PE trades a shade over par, but there are good reasons for this. We go into that below.

Energy Transfer Preferred Shares E

All three are callable with Series C having the earliest date. All three will also have distribution resets at those dates, if not called.

On and after May 15, 2023, distributions on the Series C Preferred Units will accumulate for each distribution period at a percentage of the $25.00 liquidation preference equal to an annual floating rate of the three-month LIBOR plus a spread of 4.530% per annum.

On and after August 15, 2023, distributions on the Series D Preferred Units will accumulate for each distribution period at a percentage of the $25.00 liquidation preference equal to an annual floating rate of the three-month LIBOR plus a spread of 4.738% per annum.

On and after May 15, 2024, distributions on the Series E Preferred Units will accumulate for each distribution period at a percentage of the $25.00 liquidation preference equal to an annual floating rate of the three-month LIBOR plus a spread of 5.161% per annum.

Source: Preferred Stock Channel

Based on the current price, even assuming that the Federal Reserve hikes short-term rates to 2.0% by May 2023, ET.PE appears to be the better bet based on its higher coupon and “fixed for longer” nature. Considering the resets that will occur, ET.PE is also most likely to be called in the future, and that will pin its value near par. This is our choice today, despite the slightly higher price. ET.PC can outperform if short-term rates are raised extremely aggressively such that ET.PC’s floating rate is an advantage in May 2023. This is not our baseline scenario.

Fundamentals

ET got the main plot correct in 2021 with a focus on deleveraging. It also benefitted substantially from the Texas storm with a large EBITDA bump from that one-off event. The purchase of Enable Midstream was iffy in our books and fit with the long-standing policy of empire building. Management has shown little restraint in buying assets and this was no different. That said, it was leverage positive or neutral at worst. We will only learn the exact nature of it down the line when we see how contracts roll off on Enable’s side.

Volumes for US oil and natural gas production have risen over the last year and this bodes well for ET’s pipeline assets. Storage is another matter though as the strong backwardation and tight markets have drained storage levels. We see midstream performing well in the coming year as the extreme cheap levels of common equity benefit from modest deleveraging. This should also form a support level under the preferred shares and even a sharp decline in commodity markets will likely not impact them. We see ET preferred shares continuing to provide good income even though the capital gains are now in the rearview mirror.

Verdict

The preferred shares are a good holding for income. They should remain safe and their perceived safety should improve on even modest levels of deleveraging in 2022. Key risk remains another acquisition which increases leverage ratios. We think this is a very low risk at present but might increase as ET common shares rise. Those remain undervalued at present and we are increasing our price target for 2022 to $12.00 from $11.00 the last time we covered this stock.

Energy Transfer Rating

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment