onurdongel

What Happened?

Oil has crashed 20% over the last month.

The primary reason has been attributed to recession fears. Oil market participants seem to be selling first and asking questions later. Plus, the strength in the U.S. dollar has been a huge drag on commodities in general.

Furthermore, there is the old saying that often rings true, the cure to higher oil prices, is higher oil prices. That is why I took profits on my Exxon Mobil (XOM) position at the peak of the rally while up 200%. I wrote an article about it in late May, you can read it here. This was in the midst of the spike. I took a lot of guff for the move at the time, which now appears to have been quite prescient.

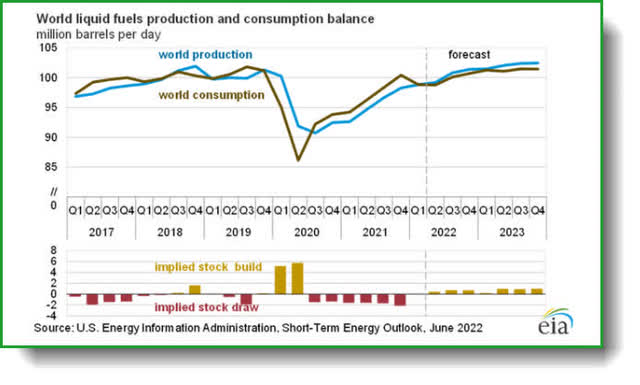

Nonetheless, I posit the recent sell off is patently unjustified. The long-term story for oil’s strength remains intact. The supply/demand imbalance dilemma remains without a solution in my book. Moreover, some of the shorter-term factors driving oil’s price down, such as the one million barrels per day the SPR release is providing, will soon come to an abrupt end.

Casualties in the oil and gas space have been many, with names from all three segments down substantially. Nonetheless, I am on the hunt for a high yielder to add to my SWAN dividend income portfolio and see the selloff as an excellent buying opportunity. I have chosen the midstream segment to find the proverbial “golden” needle in the haystack! This is due to the fact the MLP operators in the midstream segment provide the most stable and predictable cash flows in the oil and gas industry.

MLPs are tax advantaged pass-through organizations (partnerships)

The MLP model is most preferred by retirees looking for income due to the promise of stable, tax-advantaged income streams. They are partnerships and therefore are not taxed at the entity level. Moreover, the cash distributions are treats as a return of capital to unitholders, so they are tax free as well until you recoup your entire initial outlay. What’s more, MLP contracts are not based on the price of oil. Let me explain.

MLP revenues not based on commodity price

These businesses are somewhat decoupled from the price of oil due to take or pay fixed fee contracts regardless of oil’s price or the volume shipped. Although these contacts are subject to renegotiation in times of severe market duress. Further, the Exploration and production supplier may simply declare bankruptcy negating the entire deal. This is precisely what happened with the onset of the Great Recession, I’m not simply riffing here. Nevertheless, that is not my base case at this juncture. In fact, the Energy Information Administration (“EIA”) recently released its estimates that oil and gas is set for continued production growth.

EIA Short term Oil Growth estimate (EIA)

So, let’s take a look at two of the top MLP oil pipeline midstream segment contenders and see if we can determine which is the best of the best.

Midstream MLP segment contenders

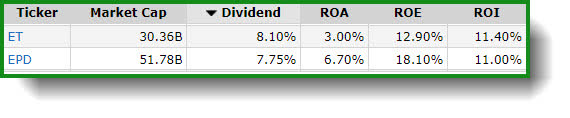

The midstream segment MLP contenders I have chosen to review for this article are the following: Energy Transfer LP (NYSE:ET); and Enterprise Products Partners L.P. (NYSE:EPD). We will begin by comparing their valuations.

MLP Stats (Finviz)

Valuation Comparison

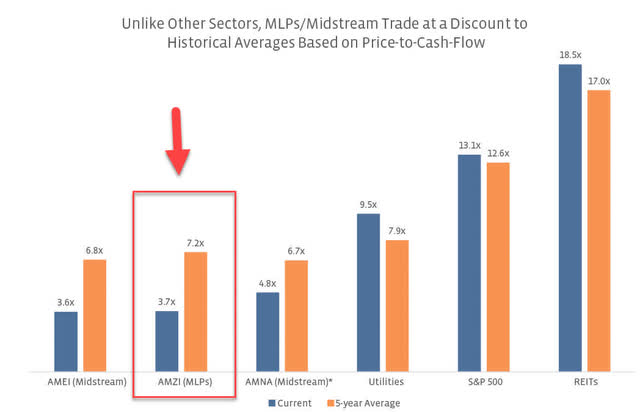

Before I begin to compare the valuations between the two contenders, I’d like to point out the MLP sector presently provides some of the best values across most other income generating segments of the market to include the S&P 500, Utilities, and REITs. See chart below.

The standard metric for valuing MLPs is Unit Price divided by Distributable Cash Flow (P/DCF). Energy Transfer wins the valuation competition hands down trading for a Price/DCF ratio of 6.2 when compared to Enterprise Products Partners L.P which trades for a Price/DCF ratio of 7.8. Nonetheless, they are both trading at significant discounts at present. A price to distributable cash flow ratio of above 15-16 is considered high or expensive for MLPs. Now let’s turn our attention to the growth prospects.

Growth prospects comparison

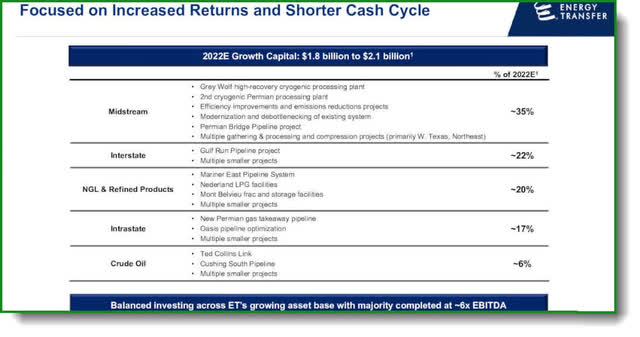

Energy Transfer growth plans

ET Current Chart

Energy Transfer has a robust plan for future growth currently in place. Below is a slide from the MLP’s most recent earnings presentation.

ET Growth Prospects (ET Earnings Presentation)

In March, ET announced that they entered into two 20-year LNG sale and purchase agreements for the Lake Charles LNG project with ENN Natural Gas and ENN Energy Holdings Limited. Under the 2 SPAs, ET LNG is expected to supply 1.8 million tonnes per annum of LNG to ENN Natural Gas and 0.9 million tonnes per annum of LNG to ENN Energy. What’s more, the signing of a 20-year LNG purchase and sell agreement with a subsidiary of Gunvor Group for 2 million tonnes of LNG per annum was also announced along with the signing of another long-term LNG offtake agreement with SK Gas, an affiliate of the Korean conglomerate SK, for 0.4 metric tonnes per annum for a term of 18 years. CEO Tom Long stated:

“The purchase price for all these agreements is indexed to the Henry Hub benchmark plus a fixed liquefaction charge and the LNG will be delivered on a free on-board basis. The SPAs will become fully effective upon the satisfaction of the condition’s precedent by ET LNG, including reaching FID. We are also in active negotiations with a number of other high qualified customers, and we expect to make an announcement of additional offtake agreements in the weeks ahead.”

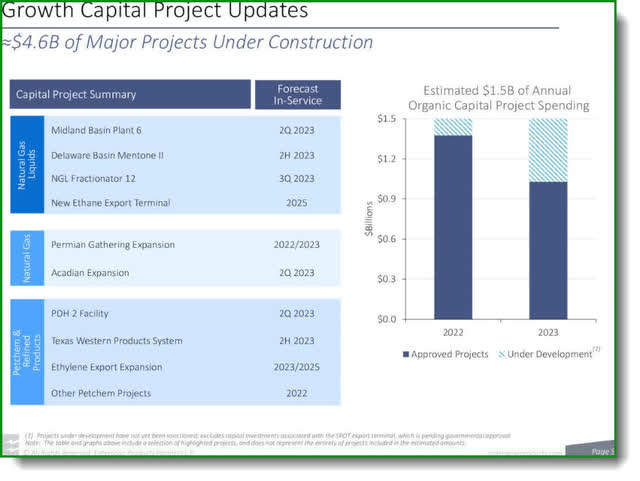

Enterprise Products Partners L.P. growth plans

EPD Current Chart

Jim Teague, EPD CEO, announced seven new projects at their latest analyst meeting.

EPD Growth Prospects (EPD Earnings Presentation)

CEO Jim Teague stated on the latest earnings call:

“And going into that analyst meeting, notwithstanding the invasion of Ukraine, we were bullish from both a supply and demand perspective for U.S. oil natural gas and NGOs, and we’re planning for growth. During our meeting, we announced seven growth projects related to both supply and demand. We’re going to build our sixth processing plant in the Midland Basin. That’s the assets we bought from Navitas. In the Delaware, we’re going to build our second plant at Mentone. In Louisiana, we’re expanding our Acadian Haynesville natural gas pipeline by 400 million cubic foot a day. In Texas, we’re reversing our Chaparral NGL Pipeline and a portion of our Mid-America Pipeline to move refined products from the Gulf Coast to West Texas, New Mexico, Colorado, and Utah.”

On top of all that, the MLP is planning to build its 12th NGL fractionation train just outside of Mont Belvieu, but still in Chambers County. What’s more, EPD announced it is going to build an ethane export terminal at a site to be determined on the Louisiana, Texas, Gulf Coast, doubling their ethylene export capacity. So EPD has a robust growth plan they are executing on at present as well.

Based on the fact both MLPs seemingly have highly robust growth prospects going forward, I have to call it a draw when it comes to who wins the growth prospect battle. Now let’s turn our attention to the potential downside risks of these types of investments and then wrap this up.

Downside Risks

No investment ever comes without risks. The following are the current downside risks as I see them for the oil and gas midstream segment.

- Regulatory risks related to Products Pipeline FERC/CPUC cases, Natural Gas FERC rate cases, and potential legislative and regulatory changes.

- Upstream operator crude oil production volume uncertainty

- Commodity price uncertainty

- An economic downturn

- Rising interest rates.

The Wrap Up

Income potential will likely always be one of the primary attractions to an investment in midstream energy infrastructure MLPs such as ET and EPD given their stable cash flow profiles and high relative payouts. MLPs often return the majority of their distributable cash flow to unitholders. It’s a pass-through organization (a master limited partnership), that offers an increased yield based on the fact the profits are not taxed at the entity level.

The unitholding limited partners also receive tax-favored distributions, as they’re considered a return of capital until your initial investment is reached. I actually sold partnership units in Texas oil ventures as a FINRA Registered Securities Broker to accredited investors at one point in time during my career.

So, for example, if the MLP you buy yields 10%, you may not get hit with any taxes for 10 years. The downside of MLPs is they are partnerships which can create significant tax issues if held within a tax favored account such as an IRA or 401K plan. I’m not a tax expert, but based on my own research, I do not hold my personal MLP positions within a tax favored retirement account. Besides, the distributions from the MLP are already tax favored, so I would be wasting the benefits, as it were.

With ET holding the slight edge on valuation, a higher distributable cash flow coverage ratio of 3.4x versus 2.2x for EPD, and a higher yield of 8.10% versus 7.75% presently, I have to declare ET the winner between these two MLPs. Even so, in my efforts to find the MLP that offers the most bang for your buck presently, there was an MLP with units sporting a well covered 10% yield with substantial and stable growth prospects which I feel offers income investors the complete package. I have chosen this one to add to my Winter Warrior Investor service SWAN income portfolio. Can you guess which one it is?

Final Note

There’s a fine art to investing during highly volatile markets such as these. It entails layering into new positions over time to reduce risk. You will want to have plenty of dry powder if the stock you’re interested in continues lower. As a Veteran Winter Warrior of the U.S. Army’s 10th Mountain Division, the attributes of patience and perseverance were instilled in me, hence my investing motto “patience equals profits.”

Mountain Warfare Training Ft. Ethan Allen, Vermont (Personal)

Take your time and build new positions slowly, dollar cost averaging in over a long period of time. Moreover, use articles such as these as a starting point for your own due diligence before putting your hard-earned money at risk. Those are my thoughts on the matter, I look forward to reading yours.

Your Input Is Required!

The true value of my articles is provided by the prescient remarks from Seeking Alpha members in the comments section below. What is your top pick for income generation in the midstream oil and gas segment? Thank you in advance for your participation.

Be the first to comment