imaginima

A notable bright spot

In what has been an otherwise difficult year for stock investors, one sector has stolen the upside spotlight. After years of languishing in the performance cellar during much of the 2010s, the energy sector surged to the top of the total returns table in 2021. And its upside performance has been even more differentiated and pronounced thus far in 2022. Despite this recently strong performance, the outlook for the energy sector remains appealing for the rest of 2022 and into 2023.

Dominant absolute and relative performance

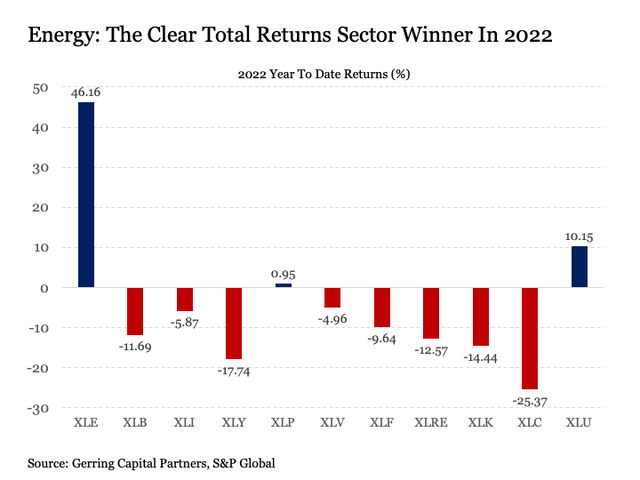

The performance of the energy sector relative to its sector peers thus far in 2022 speaks for itself. The following chart shows the total return for 2022 year-to-date by sector as measured by the Select Sector SPDRs through August 19.

Overall, the energy sector has posted a +46% return thus far in 2022, which stands in stark contrast to the overall market as measured by the S&P 500 Index that is still down by more than -10% even after its summertime surge. Making this sector performance all the more notable is the fact that only two other sectors are even in positive territory for 2022, which are safe haven utilities at just over +10% and also defensive consumer staples that are barely across the zero line.

Powered by fundamentals

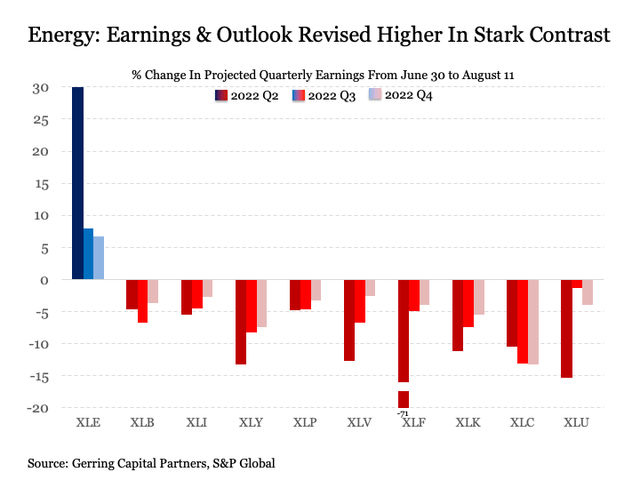

Stock price performance is not the only way in which energy stocks are striking a stark contrast to the rest of the market. While all other market sectors have been slashing their quarterly earnings and outlook for much of the year, the energy sector has seen its earnings results and projections revised meaningfully higher. As shown in the chart below based on operating earnings data from S&P Global, this includes through the 2022 Q2 earnings season, where the energy sector had earnings come in +30% above expectations and revised its collective earnings outlook upward by high single-digits through the remainder of the year. As for every other stock market sector, earnings for 2022 Q2 came in meaningfully below initial estimates as of June 30 and forecasts for the remainder of the year were also measurably ratcheted down.

The spark to continue market leadership

Given that the energy sector is meaningfully outperforming both on an absolute and relative performance basis for the second calendar year in a row, it is reasonable to consider whether energy can maintain this leadership going forward. As the summer months draw to a close, the outlook for the sector remains constructive over the next 12 to 18 months.

Before going any further, it is worth noting that the energy space is more unpredictable given that its fate is tied in part to more volatile energy related commodities such as oil and natural gas.

Nonetheless, the underlying market fundamentals remain supportive for the energy sector going forward for several reasons.

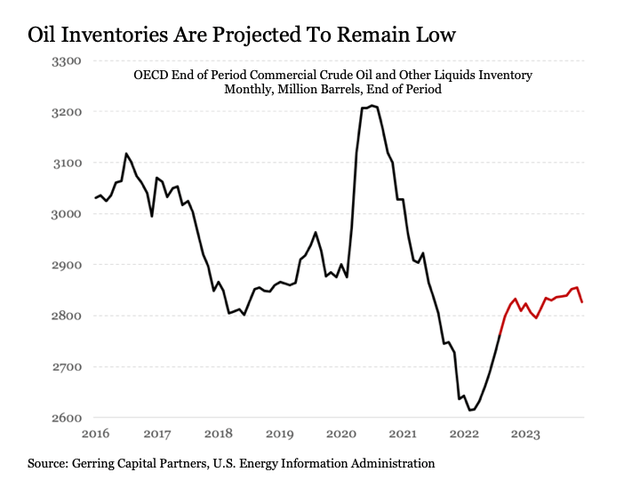

First, oil inventories remain low relative to recent history. While the picture has improved somewhat from deeper levels earlier this year, inventory levels remain low relative to their five-year historical average.

U.S. Energy Information Administration (EIA)

Next, the supply/demand fundamentals for the oil space are biased toward higher prices over the coming year. Even though demand has come in weaker than expected during the summer months in the Northern Hemisphere amid a weakening global economy, global oil producers continue to have limited spare capacity to increase production further from current levels. This includes OPEC+, where much of the remaining spare capacity currently resides, as the group of oil-producing nations are exercising caution against utilizing this spare capacity to provide a cushion against unexpected supply shocks.

Speaking of unexpected supply shocks, the ongoing conflict between Russia and Ukraine continues to have a meaningful impact on the energy market. This is particularly true in the European Union, where consumer energy costs are projected to skyrocket anywhere between 400% to 1,000% this winter as the embargo on Russian crude oil goes into full effect by February 2023. While Russia’s supply to the global oil market has been greater than originally forecasted due to the rerouting of production to countries that are still willing to receive their product, it still represents a measurable net decline in total supply. And given the increasingly tenuous global geopolitical landscape, the potential for new unexpected shocks that could drive oil prices unexpectedly higher should also be considered.

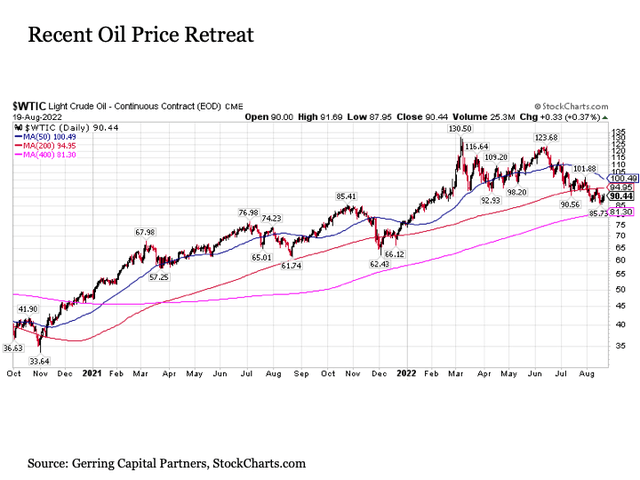

Recent weakness may offer opportunity. As mentioned previously, concerns over the economic outlook coupled with rising oil inventories, albeit from notably low levels from a recent history perspective, have helped push oil prices measurably lower this summer. After peaking at over $123 per barrel in June, oil prices as measured by West Texas Intermediate Crude have fallen by more than -30% peak to trough so far this summer.

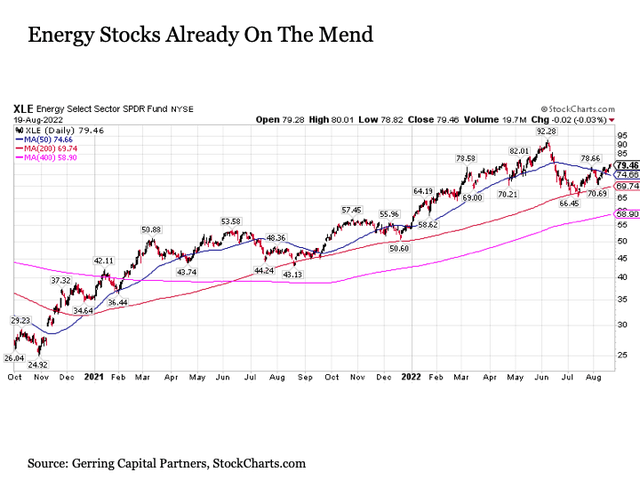

This oil price decline has had its impact on energy stocks, as would be expected. But unlike oil prices that continue to fade, energy stocks suffered a sharp -28% decline from their June peaks to their early July lows. Since that time, energy stocks have rebounded by +20%.

This likely reflects expectations that the recent economic slowdown will soon abate or that oil prices may resume their ascent in the near-term or both. Nonetheless, energy stock prices still remain -14% below their June highs even after the strong price recovery, thus implying a still potentially more attractive entry point versus a few months ago for those considering an allocation to the sector.

I prefer emphasizing quality with my energy sector overweight

A logical possibility for those investors considering an allocation to energy would be to purchase the XLE itself or another comparable sector ETF. My preference, however, is to select the most established and well known individual stock names from the sector as a risk control alternative.

Consider Exxon Mobil (XOM) and Chevron (CVX) in this context. Now it should be noted at the outset that if one were to buy XLE, they would be getting a major slug of both oil majors, as Exxon Mobil makes up just under 23% of the ETF weighting while Chevron constitutes another 21%. Putting this together, more than 44% of your XLE allocation would be made up of these two giants.

Nonetheless, I opt to own Exxon Mobil and Chevron individually instead of owning the ETF. This is due in part to the fact that Exxon Mobil and Chevron individually boast better financial health, superior earnings predictability, and lower stock price volatility than the broader ETF as a whole. For example, the stock price volatility for Exxon Mobil since 1999 as measured by annualized standard deviation is 15% less than that of the XLE. For Chevron, it is nearly 10% less over the same time period. Adding an extra spark to the pot for Exxon Mobil and Chevron is the fact that an equal weighted allocation to these two stocks since 1999 would have also outperformed the XLE by 80 basis points annually. Higher total annualized returns with measurably less risk is a combination that I like over any period of time.

Bottom line

Despite recently strong absolute and relative performance over the last couple of years, the fundamental outlook for the energy sector remains favorable going forward. For those investors considering an allocation to the energy space, they may wish to consider focusing on selected leading names within the sector to better manage against downside risk while also maintaining the ability to outperform the broader energy sector over time.

Be the first to comment