TerryJ/E+ via Getty Images

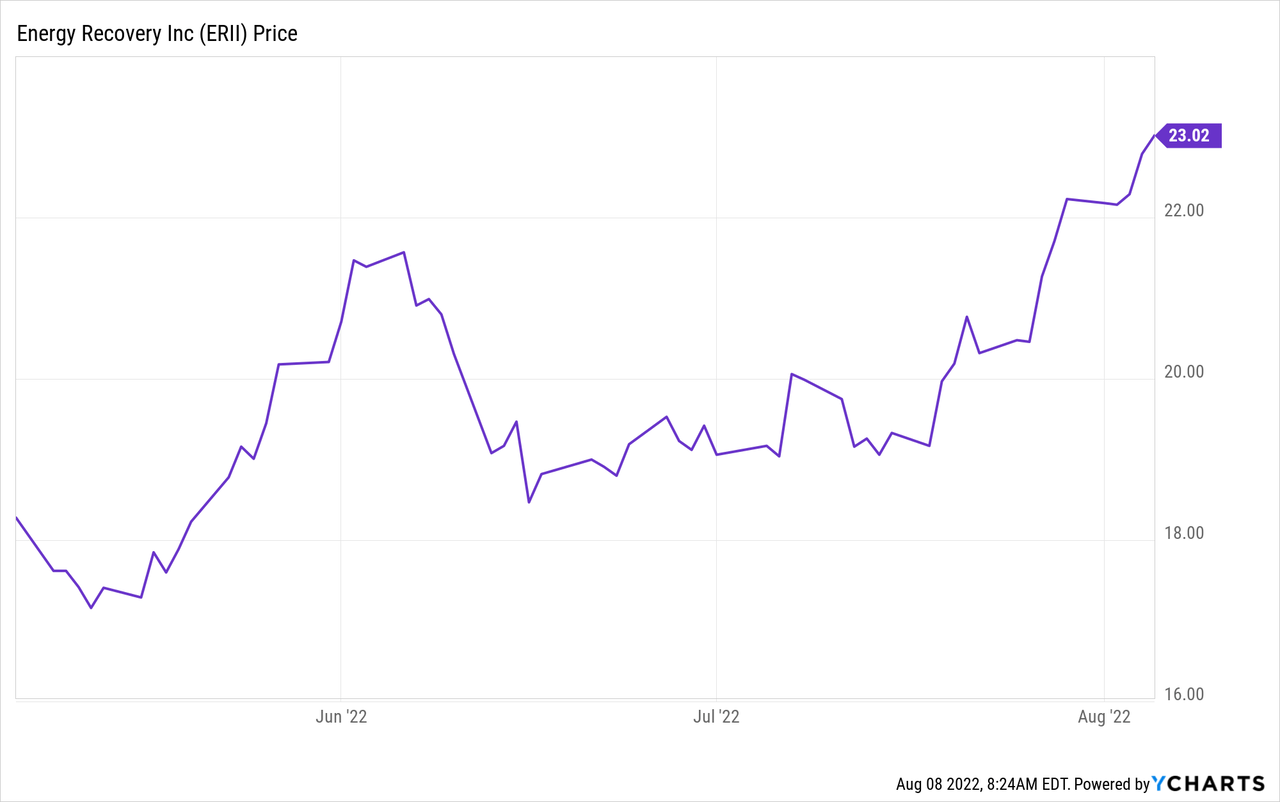

After years of investment, multiple CEOs, and never realized promises, Energy Recovery (NASDAQ:ERII) finally pulled the plug on VorTeq – the system that was supposed to revolutionize shale fracking (but never did). This is great news for ERII investors because it will enable the company to focus on its core strength, SWRO, and a new emerging market that actually has excellent potential: CO2 refrigeration. Meantime, the stock has been strong of late (see graphic below) due to Democrats passing the Schumer/Manchin bill, the so-called IRA Act. That’s because the IRA Act is the United States’ largest investment ever to address global warming and to support clean-energy supply chains. Considering ERII is a leading ESG company, that’s a bullish tailwind. Meantime, and despite a tepid Q2, ERII has a heavily loaded back-end of the year and is on track to generate record revenue of $130 million this year (+25% yoy).

Investment Thesis

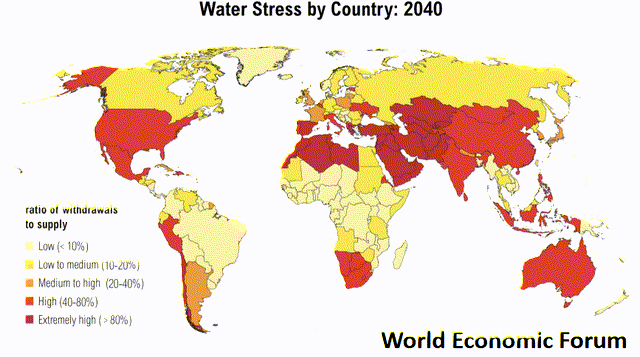

As noted in my previous Seeking Alpha article on ERII, there’s a global water crisis. And for those Americans who think it doesn’t apply to the United States, they couldn’t be more wrong. Indeed, two of America’s largest storage reservoirs – Lake Mead and Lake Powell – are at record lows. The situation is so dire that one proposal is to pay Mexico to build a desalination plant in order to keep more of the Colorado River’s water in the United States. No matter how you look at the global water crisis (see graphic below), it plays right into ERII’s primary business: salt-water reverse osmosis using its patented “PX” device technology.

Earnings

From a financial perspective, I readily admit that ERII’s Q2 EPS report was less than inspiring. Revenue of $20.3 million was flat as compared to the year-earlier period. The company swung to a net loss of $0.04/share as compared to a profit of $0.02/share in Q2 of last year.

However, there was plenty of good news:

- CEO and Chairman Robert Mao finally announced the company would finally pull-the-plug on its efforts to commercialize VorTeq.

- On July 1, 2022 the company completed its March 2021 share repurchase authorization by purchasing 1 million shares during the quarter for $18.6 million (an average of $18.6/share).

- Unlike many companies that execute share buyback programs, ERII’s fully diluted share-count actually went down yoy: 56.2 million shares as compared to 59.0 million shares (a reduction of ~4.8%).

- The company ended Q2 with no-debt and cash and investments of $86.5 million ($1.53/share).

The company also reported that IR Magazine awarded Energy Recovery the winner of the “Best ESG Reporting (small to mid-cap company)” and “Best ESG Communications” for its 2020 ESG Report and active engagement with the investment community on that topic. Indeed, ERII’s MSCI ESG rating was upgraded to “AA” in April. That’s ERII’s second upgrade over the past two years.

Going Forward

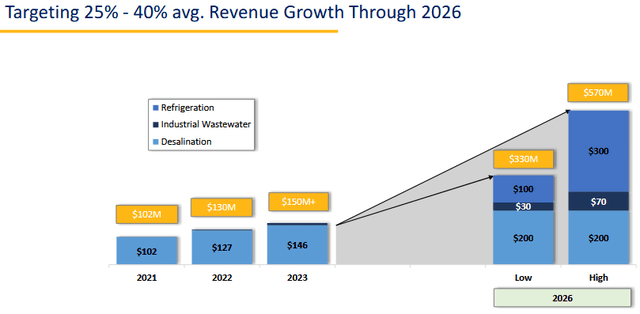

The good news continued on a go-forward basis. ERRI reiterated its full-year revenue guidance of $130 million – that would be up 25% on a year-over-year basis and is the result of a heavily loaded back-end of the year due to the timing of big mega-project shipments. In addition, on the Q2 conference call, CFO Joshua Ballard reported that “Total OEM revenue for the year includes $1.6 million in industrial wastewater sales.” In my opinion, and as I reported in previous articles on ERII, industrial wastewater also has much better potential than VorTeq because it’s much closer use-case as compared to the company’s core competency in using PX devices for SWRO.

Based on its order-flow and market research, ERII is quite bullish on its future revenue growth potential:

However, long-time shareholders know that ERII management has been famous over the years for making over-optimistic revenue projections (often based on mega-project shipments and assumptions of VorTeq success) that never materialized. The good news now is that VorTeq has been taken out of the equation – but has replaced by expectations of CO2 refrigeration growth, and to a lesser extent, industrial wastewater.

On that front, Chairman Mao (sorry, I couldn’t help myself…) also reported great news on ERII’s efforts to diversify into CO2 refrigeration, a new and exciting business:

In a key milestone for our CO 2 business, we successfully commissioned our PX G1300 with our partner in a new supermarket in southern Europe in late June and are very encouraged by its strong initial performance. We also entered into a second joint-development agreement with a U.S. refrigeration rack manufacturer in early July and are continuing discussions with several others. This new partnership should lead to a second supermarket installation in the U.S. and is another important milestone as we prove the value of our PX technology to help the refrigeration industry transition to more climate-friendly, natural refrigerants.

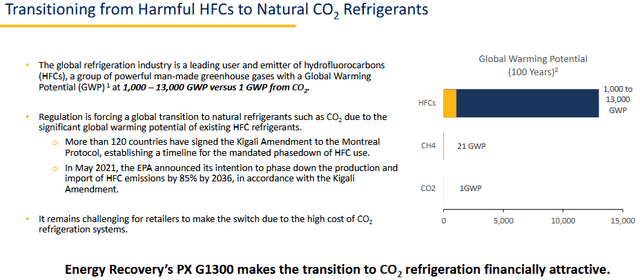

ERII projects that CO2 refrigeration will represent a $1 billion annual TAM by 2030 due to the need (indeed, regulation enforced in some regions) to reduce the hydro-fluorocarbon (“HFC”) emissions:

Source: June Presentation

Risks

In my opinion, the risks of investing in ERII have dropped considerably with the news that the company will no-longer be throwing good-money after bad on the ill-fated VorTeq initiative. As I have been saying for years in my Seeking Alpha articles on ERII, this move was long overdue.

With no-debt and a relatively large cash position for a company ERII’s size, there is no liquidity issue here.

In my opinion, the biggest risk is that CO2 refrigeration turns into another money-draining VorTeq initiative. However, I do not expect that to be the case. First, one cannot compare the extreme operating conditions of VorTeq (i.e. high pressure fracking) to the CO2 refrigeration effort, which is a process much closer to ERII’s existing core PX-competency in SWRO. Secondly, the commercialization challenges for CO2 refrigeration will be much easier, and much less costly, as compared to VorTeq. Thirdly, though VorTeq was a failure, ERII’s engineering team no doubt learned a lot about its PX devices (and their limitations…).

ERII currently trades with a forward P/E of 47x and has a market cap of $1.3 billion. However, that valuation level seems quite reasonable given the company’s strong balance sheet, high gross margins (68% in FY21), free-cash-flow generation potential, and excellent potential going forward in SWRO, CO2 refrigeration, and industrial wastewater applications.

Summary and Conclusion

Despite ERII’s tepid Q2 results, in my opinion it was the best quarter for the company in years. I say that because ERII was finally pragmatic enough to pull-the-plug on VorTeq, appears to be making great progress in CO2 refrigeration, and reiterated full-year 2022 revenue of $130 million, which would be an all-time record for the company and would be up 25% yoy. ERII is a BUY.

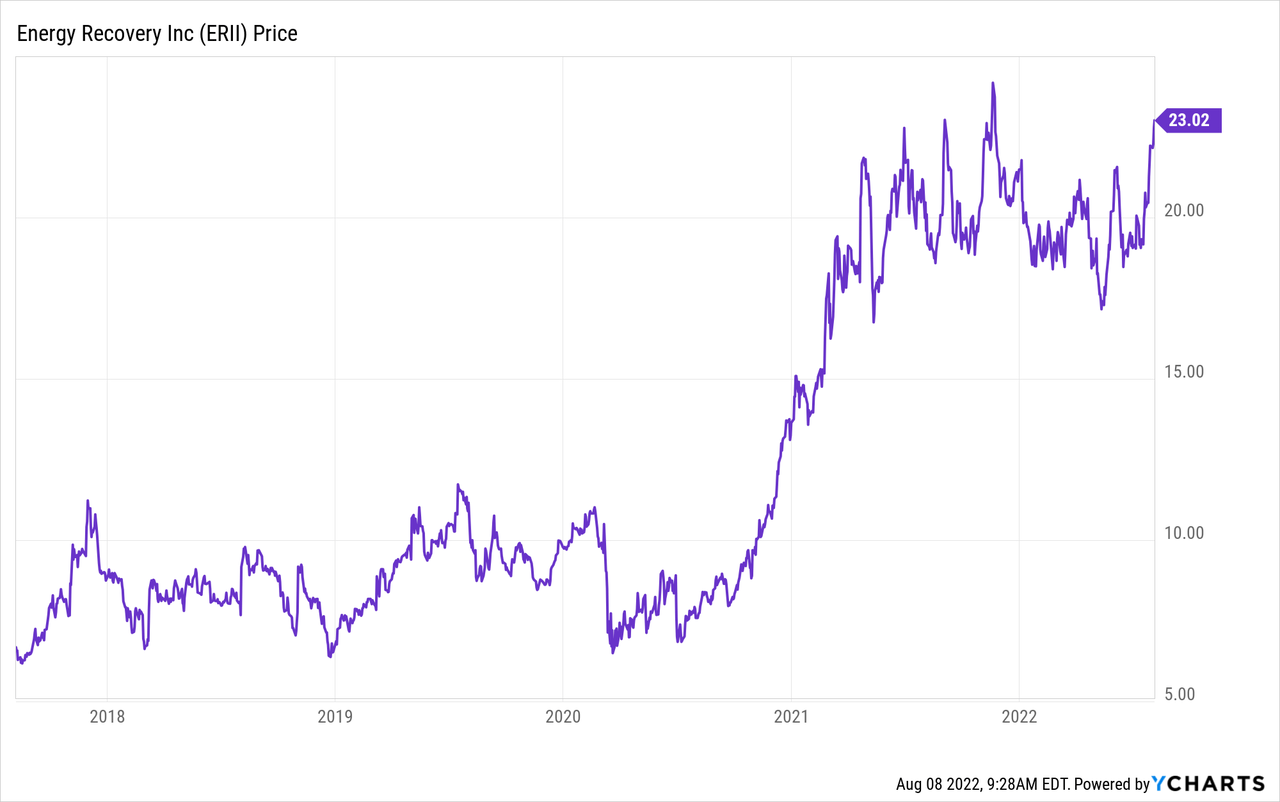

I’ll end with a five-year stock price chart and note that ERRI looks poised to break out to the upside prior to what should be very strong EPS reports in Q3 and Q4:

Be the first to comment