curraheeshutter/iStock via Getty Images

The current economic environment can be summed up into one that is suffering on account of an insufficient productivity frontier. Oil taps are actually running pretty fast, and spare capacity in the oil industry isn’t all that much as OPEC readily admits. High prices of commodities are partially a consequence of supply chain disintegration and speculation, but also because the consumption levels we are used to cannot be sustained on the current base of energy production, with renewables clearly not carrying the weight that would have been taken up by oil had the stranded asset risk not been exaggerated this last decade. Rates will rise and that will cause unemployment and loss in economic growth, putting downward pressure on inflation, but this effective austerity measure will not be popular or effective, and hopefully the Fed and other authorities will realise soon.

What needs to be done is for the most fundamental commodities to be produced in greater quantities, including oil. With energy security being a strategic interest in the face of Russian sanctions, and offshore oil sufficiently uncontroversial, investing into the heralds of greater energy availability is the way to go, leading us to Subsea 7 (OTCPK:SUBCY). Coming out of a longstanding depression, the price and multiples are still low, and with strategic interests backing demand, and the economics of the business providing substantial visibility, the fundamentals should be supportive for years to come at relatively minimal capital risk. New projects are coming in at better prices, and a commanding market share in a relatively uncompetitive market puts Subsea 7 in a strong position. With the economics of the business only poised to improve, we see it as an essential investment in the current environment.

Understanding the Business

Subsea 7 is capable of adding value all the way from the design of an offshore installation (subsea umbilicals, risers and flowlines a.k.a SURF) to its maintenance, with procurement and engineering in between. The objective of the company is to engage with the project from as early a stage as possible because it leads to a higher probability of the company being awarded EPCI contracts, which are lump sum contracts paid upfront and mean that Subsea is involved for the whole process. 60% of contracts awarded started off at early engagement points for 2021, and the company currently commands about 75% of the market in terms of value.

Margins are highest towards the tail end of a project which will usually last three years, and involves later stage activities like pipelaying. These more routine tasks are more profitable because it allows for higher utilisation of the fleet of support vessels dedicated for that task.

Fleet (Q1 2022 Pres)

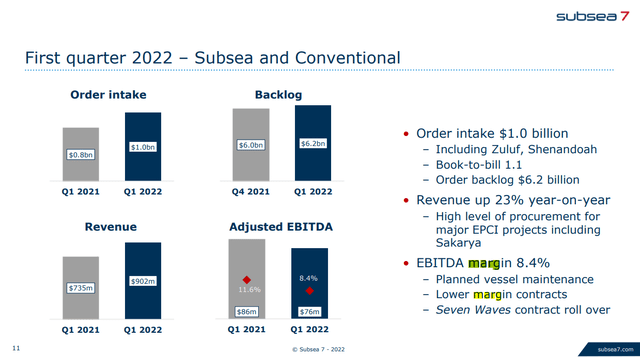

These support vessels are critical at various stages of a contract, it’s just the latter stage activities tend to be more efficient and profitable, which means that the margins tend to rise as projects mature. Because of a drought in contracts in 2020, the backlog is burgeoning with early stage work that has played a part in bringing down the margins, which should reverse to even higher than previously normalised levels due to improvements in the pricing environment. Revenues are up substantially due to higher rates of contract awards and executions even from pre-COVID levels. The effects of improved pricing have not yet been observed as the company is still working through lower margin contracts, contributing to incrementally weaker margins.

Q1 Financial Highlights (Q1 2022 Pres)

These contracts are coming substantially from Brazil’s Petrobras (PBR), which is less beholden to politics around green energy, and Norway which has instituted tax breaks recently in order to incentivise more development of oil and gas installations. This incentive should only grow for the west and west-allies as energy security becomes related to national security in the wake of the Russian sanctions and economic disintegration.

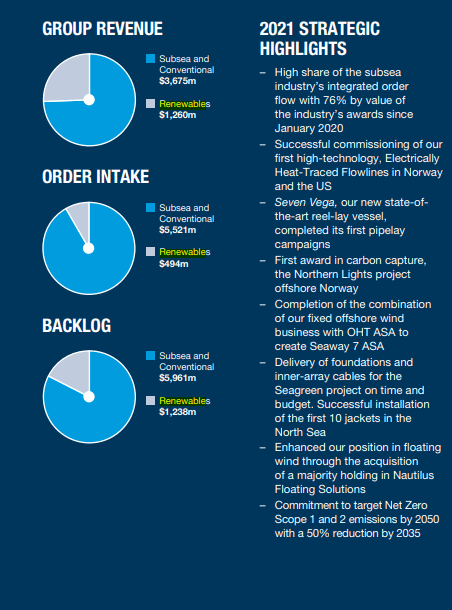

The company also has a renewables segment called Seaway 7 which technically operates separately after it was merged with OHT but is still consolidated due to Subsea’s majority ownership. This is a growing revenue area but has been hampered by delays in bidding processes in the UK, which is one of the early adopters of offshore wind, and the infancy of the industry means that vessels haven’t been focused in any particular area yet, thus keeping the segment relatively unprofitable due to lacklustre utilisation.

Revenue Breakdown (Annual Report 2021)

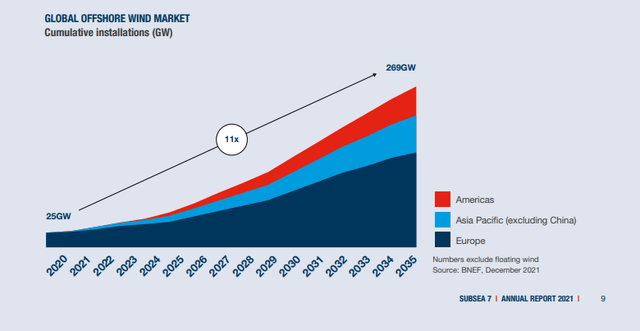

Offshore wind and floating wind, the latter being even more nascent, are industries that should grow relatively quickly with developers like Orsted (OTCPK:DOGEF) really leading the way. The potential is quite big for floating wind as well for countries with deep waters. This future-proofs the overall business.

Offshore Wind Opportunity (Annual Report 2021)

Subsea is On Theme

With the economy being what it is, we see that energy productivity is a key issue in being able to sustain current levels of consumption. The rate hikes are precisely because credit cycles have meant we’ve become extended beyond what productivity can support in terms of consumption, with oil capacity actually having little to spare to ease energy prices (around 7% more). The productivity that has been lost came with the disintegration of economic cooperation with Russia, whose energy the west relied upon substantially. Oil prices are supported on the supply side, and while the demand will contract as we enter a recession, the growing backlog of contracts will be a bladder whose high visibility stream will grow with margin expansion over the coming years, mitigating a possible slowdown in order intake as commodity prices fall. However, even with falling commodity prices, a focus on energy security may actually sustain order intake even in a less economical environment, as the need for shoring energy production takes precedence over the hard economics of petroleum and gas developments. Moreover, as the offshore wind opportunity matures, the company should see greater contribution from that segment. Because the company charges on a cost-plus basis, its contracts actually don’t typically carry any inflation or input cost risks. Recent contracts have required some concessions on Subsea’s part due to the sheer unpredictability of supply chains, but the business remains largely immune to inflation effects as well, should inflation continue. Finally, on the matter of rates, Subsea holds a substantial cash position that renders net debt small at only $50 million, meaning there is negligible balance sheet-derived effect of interest rates on earnings.

Valuation and Conclusions

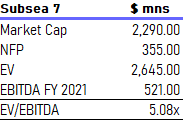

Using the 2021 EBITDA and considering the value of non-controlling interest, we get the following valuation.

Valuation (VTS)

The EBITDA should improve incrementally as a greater share of the revenue becomes derived from later stage activities, where lower margin early stage activities are currently bulging. These newer contracts have also been awarded in a more favourable pricing environment. Moreover, the renewable segment is hoped to become a larger contributor to the operating profit of the business. So the 5x multiple should already by underestimating earnings power of the business.

While there are commodity risks in that oil prices falling could render these developments less profitable, most major growth areas operate in regions with sufficiently low breakeven points where the loss of Russian oil from the bloc should reasonably assure positive economics. Brazilian breakevens in the attractive pre-salt layer are $20 per barrel, while developments on the Norwegian Continental Shelf are usually less than $20 per barrel. These are relatively low breakeven costs by international standards, where shale oil is usually around $36-$40 per barrel. The Brazilian situation remains especially attractive since the liberalisation of foreign operation in that continental shelf is quite recent and the government is favourable. Overall, with the low multiples, we see Subsea as another attractive exposure for us to consider for the portfolio.

Be the first to comment