Yasonya/iStock via Getty Images

Investment Thesis

Strong earnings growth across both traditional electric networks and renewable energy sources could lead to further long-term upside for Energias de Portugal (OTCPK:EDPFY), also known as EDP Group. It is one of the leading electric utility companies serving Portugal.

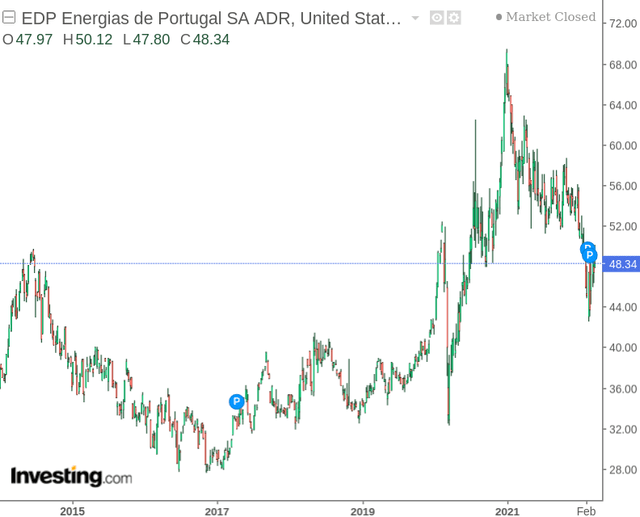

When looking at the company’s stock price, we can see that Energias de Portugal made a strong recovery up until the end of 2020 – with price seeing a significant decline since then.

The purpose of this article is to assess the potential future trajectory of the stock from here – particularly given the recent impact of the ongoing situation between Russia and Ukraine.

Portugal’s Electricity Market

While nearly two-thirds of Portugal’s energy supply comes from imported sources as of 2020, only 5% of Portuguese imported energy comes from Russia. Natural gas is a major source of electricity generation – which is one of the reasons why we are seeing substantial price hikes in electricity following on from higher gas prices.

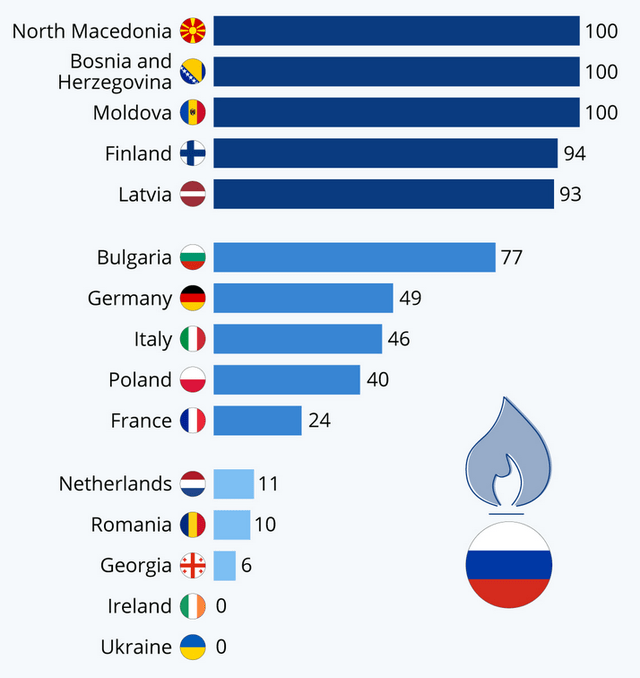

With that being said, many other countries in Europe are significantly dependent on natural gas imports from Russia to produce electricity. According to Statista, Germany and Italy both source nearly 50% of their natural gas supply from Russia.

The situation in Ukraine is ongoing, and the United States has banned Russian oil and gas imports – the U.S. benefits from a large amount of domestic reserves. However, Europe is much more dependent on energy sources from Russia. In the event that such countries decide to cease purchasing such energy sources, this will mean having to find alternative suppliers, which in turn is expected to significantly raise natural gas prices (and hence electricity prices) further.

From this standpoint, Portugal is not necessarily immune to the effects of further price rises under such a scenario.

The Portuguese electricity market is quite competitive. In a time of rising prices, we could see a situation where more customers decide to switch suppliers to take advantage of lower rates offered by a competitor.

With that being said, the EUI Florence School of Regulation reports that, even 15 years after the liberalization of energy markets in the EU, consumers across Europe as a whole show a low propensity for switching suppliers. This stifles competition in the market and allows higher prices to persist.

While it remains to be seen whether this trend will continue in an era of strong rises in energy prices, EDP continues to be a leading provider across the Portuguese market. I do not particularly see this changing as a result of the current situation. Moreover, Portugal as a whole has managed to phase out coal eight years earlier than anticipated. With investments in renewable sources up to 61% in 2021 from 39% in 2017, the country as a whole seems to be in a good position to withstand price rises across more traditional energy sources.

Performance

Concerning the performance of Energias de Portugal in particular, let’s firstly take a look at the company’s balance sheet.

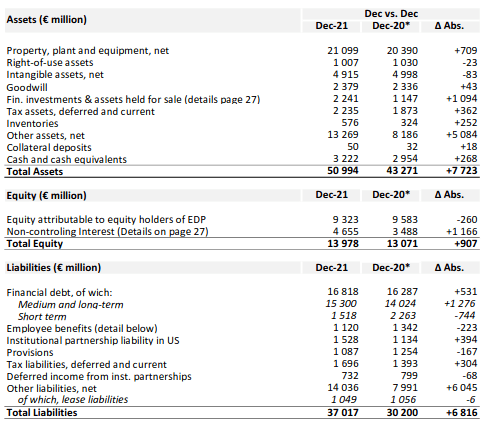

EDP 2021 Results

We can see that while the company has seen an increase of nearly 10% in long-term debt over the past year, short-term debt has fallen by just over 32%.

Moreover, we can also see that the company has more than sufficient cash reserves to cover its short-term debt, with the cash to short-term debt ratio having increased from 130% in 2020 to 212% in 2021. From this standpoint, Energias de Portugal looks like it is in a good position to cover any rise in short-term expenses that might materialize from higher energy costs.

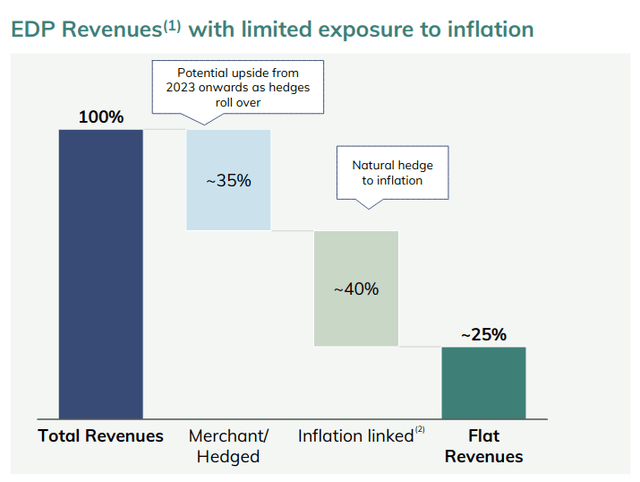

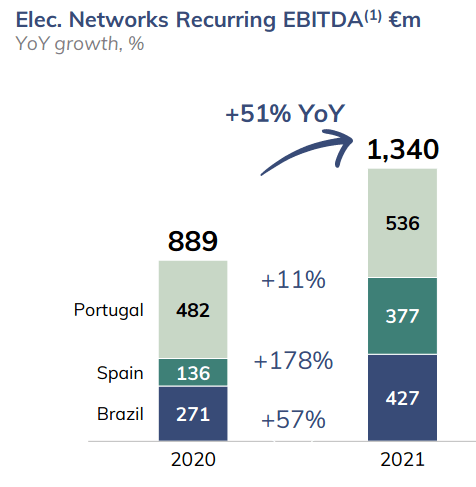

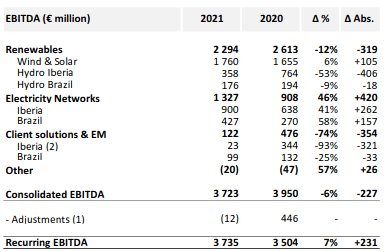

According to EDP, 40% of its revenues are also hedged from inflation – providing some protection against higher energy costs. In addition, the company saw a strong boost in EBITDA for 2021, which was driven by the integration of Viesgo in Spain as well as capital expansion in Brazil.

EDP Revenues

EDP Group: 2021 Results Presentation

EBITDA Growth

EDP Group: 2021 Results Presentation

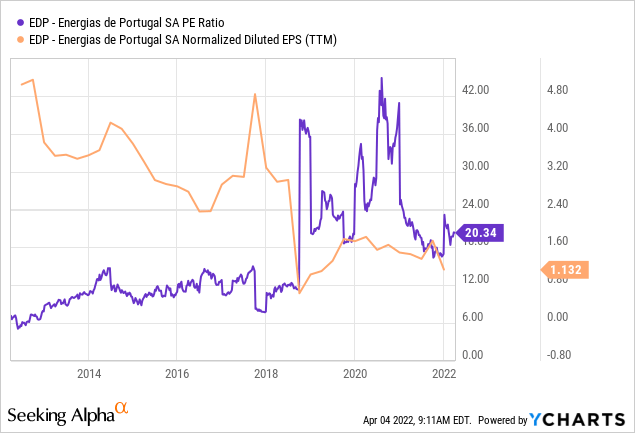

From a price standpoint, the stock does seem to have gotten more expensive over the past five years relative to earnings.

ycharts.com

However, the boost to earnings in 2021 marks a significant reversal of earnings declines over the previous five years. Should we see similar performance this year, then the stock could become more attractive from a valuation standpoint.

Looking Forward

In spite of the fact that inflation and energy prices have been on the rise – a phenomenon which was underway even before the situation in Ukraine unfolded – Energias de Portugal has shown a strong capacity to manage its short-term debt load. It continues to maintain sufficient cash to cover expenses.

In addition, the company is significantly expanding its footprint in renewable energy, with EBITDA from Wind & Solar up by 105% as compared to the previous year.

EDP Group 2021 Results

Given Portugal’s lack of dependency on the Russian market for energy as well as growth in the renewable energy sector as a whole, Energias de Portugal seems to be in a good position to withstand the short-term cost rises in traditional energy while continuing to develop its capacity in renewable energy.

Conclusion

To conclude, while rises in energy prices may place short-term pressure on costs, Energias de Portugal is in a good position to withstand these costs while remaining competitive within its market with respect to price. Additionally, the company’s growth in earnings from renewable energy sources means that Energias de Portugal could be set for longer-term upside from here.

Be the first to comment