ThitareeSarmkasat/iStock via Getty Images

Endava (NYSE:DAVA) has grown on the back of M&A and strong demand for digital consulting pieces. However, the company’s significant headcount vs revenue and exposure to Central Europe potentially make the stock a risky bet. In addition, while the market sentiment has led to lofty valuations, the ongoing war is likely to lead to a correction in the stock’s price.

Business

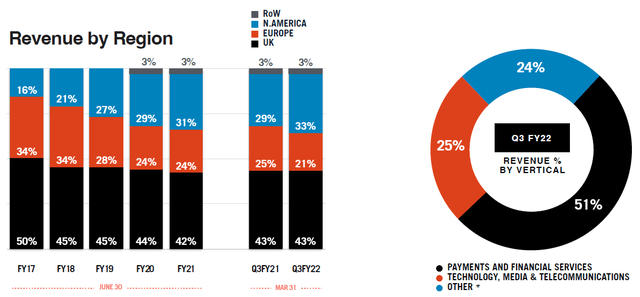

Endava is a UK-based IT services company primarily focused on the payments, financial services and the TMT space. While the UK is the most significant contributor to the company’s revenue, Endava generates substantial revenue from the US and Europe.

Company filings

Per the management, the company’s total addressable market is reasonably large, with expected annualized growth of 15.5% between 2020-2023 to reach $6.8 trillion.

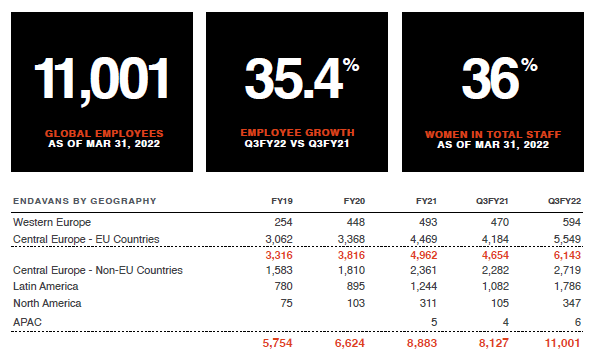

In addition to the diversity in geographies where Endava gets its revenue, the company’s operating delivery base is well-diversified across the US, Europe and Latin America, with plans to explore more in Asia.

Company filings

Considering the demand environment, the company expects to see a sustained level of hiring – closer to its target of 30%.

I think as we said, we tend to view the upper limit as being about 30% for us in terms of recruiting quality candidates into the business.

We’re saying that that 30% head count growth should convert to slightly higher than that in terms of revenue growth, just because of the price increases that we’re also able to add here on it.

Source: Q3 2022 Endava Earnings Call

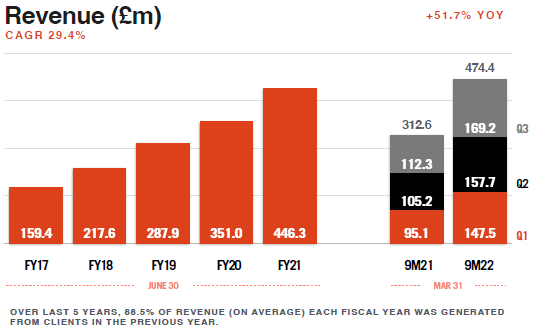

In addition to robust hiring, Endava’s growth has also been driven by M&A. As a result, the company’s revenue has grown at a CAGR of 29% between 2017 and 2021.

Company filings

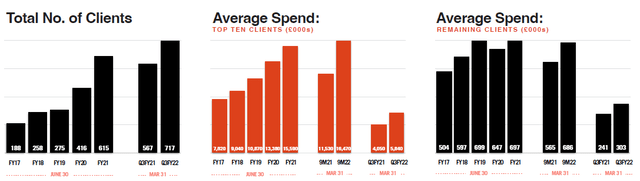

A key contributor to this growth has been a growing client base, both organically and through acquisitions.

Company filings

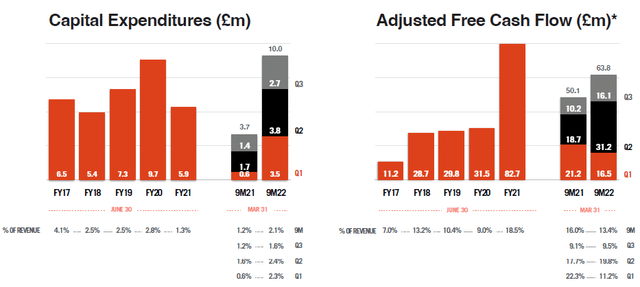

Furthermore, the company has no significant debt and has been generating positive FCFs.

Company filings

Readers should remember that Endava reports in GBP, so an exchange rate conversion factor of 1.2 must be applied. Thus, for fiscal 2021, the company generated $99 million of FCF. Similarly, for 9M2021, the company did $60 million, and for 9M2022, $75.6 million.

Investment Rationale

We find Endava a relatively strong revenue growth play, with expectations of 30%+ revenue growth going forward. However, we do see some challenges with the story:

- Headcount and revenue per employee are lower than many peers

- European focus to generate revenues could impede growth should the Euro area witness greater than expected weakness

- Challenges to business continuity in light of the Russia – Ukraine conflict

- Elevated valuations do not provide any room for errors

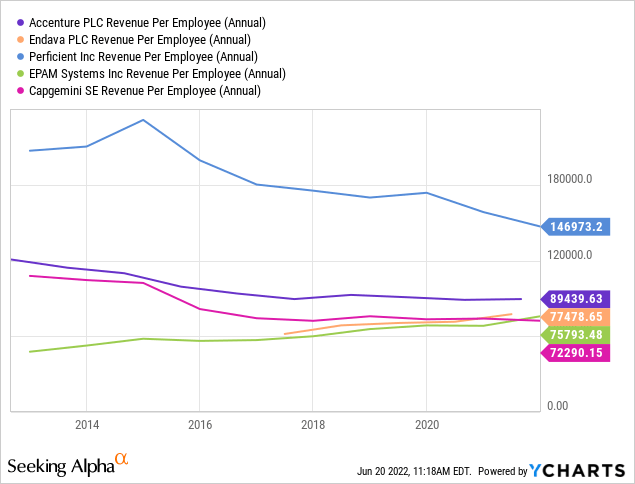

Headcount And Revenue Per Employee Is Lower Than Many Peers

Endava has possibly one of the lowest revenue per employee metrics. While it is not the only measure of an IT services company’s health, it speaks volumes about the average pricing that Endava can command. Let us not forget that the company has no deferred revenue and thus is a pure-play services play. Part of the reason could be the geographic mix of revenues, close to 60% of which come from the Euro area. With the company’s operating philosophy of charging the clients a bit more to achieve revenue growth faster than the employee count, we do not draw much comfort from Endava’s claim of generating 88-89% of revenue from clients in the previous year.

European Focus To Generate Revenues Could Impede Growth Should The Euro Area Witness Greater Than Expected Weakness

Endava is a bet on Europe, with some exposure to the US. The ECB and the IMF have been concerned about the Euro area for a while.

the Governing Council decided to end net asset purchases under its asset purchase programme (APP) as of 1 July 2022. The Governing Council intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates and, in any case, for as long as necessary to maintain ample liquidity conditions and an appropriate monetary policy stance.

Source: ECB

Compared to the US, Europe continues to be fragile, as evident from the difference in the stance of the central banks. While the US Fed has gone on record to say that the economy is resilient and has been turning hawkish to rein in demand-fuelled inflation, the ECB still has a somewhat dovish stance. We note that the Russia – Ukraine conflict has further conflagrated concerns of an imminent recession in Europe, which could take longer than anticipated to resolve.

The moot point is, why invest in a market likely to be marred by economic uncertainty for a prolonged period? Endava’s US exposure may not be enough to help it wade through the challenges of the European slowdown, given that’s where Endava’s focus remains.

Challenges To Business Continuity In Light Of The Russia – Ukraine Conflict

The bulk of the company’s workforce is spread across Central Europe.

Company filings

Endava has also worked out a business continuity plan, or BCP, should the war spill over to one of the countries where the company has delivery centres. For example, the company makes around 9% of its revenue from Moldova.

We have our Ukraine situation task force, so monitoring this on a twice a day, morning and evening basis, and we have plans in place which includes the possibility of relocation of our teams in Moldova.

So for instance, in Moldova, 96% of our people are working for clients, but whom we also deliver from another location. Which means that if we do need to relocate them, we can relocate them into officers and infrastructures that already exist for those clients in other countries. Now, in terms of relocation, one of the things that we wanted to highlight is the higher portion of our staff in Moldova, have e-passport, either Romanian and or Bulgarian passport

Source: Q3 2022 Endava Earnings Call

Despite the BCP, we think, Endava is running a considerable risk. NATO has expressed the possibility of the Ukraine – Russia conflict dragging on for years. In this context, today, it could be Moldova, and anyone’s guess is as good as ours as to where the war will go next.

While finding many companies without this risk may not be possible, we would instead put our money where this geopolitical risk is minimal.

Elevated Valuations Do Not Provide Any Room For Errors

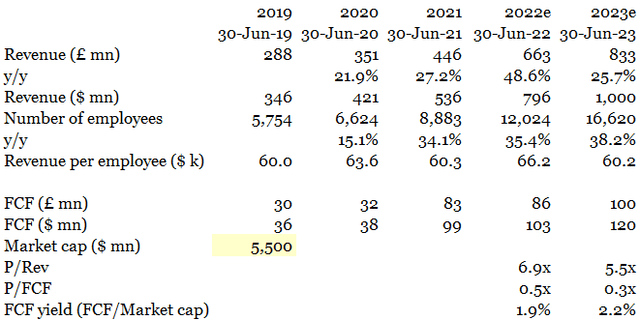

IT services companies are considered relatively stable, especially in the digital transformation. We thus value the company on an FCF basis.

While our revenue estimates for the company are robust, we cannot see how the current prices can be supported.

Company filings, Seeking Alpha, Author’s analysis

On a one-year forward basis also, the FCF yield of the company is lower than the US 10 yr – so do the investors believe that Endava is more stable than the US government? The answer is an obvious no. Endava’s strategy for solid revenue growth has sidelined concerns around profitability. While the strong revenue growth does deserve a premium, we find the current levels unjustifiably elevated.

Another discount to valuation should be from the intrinsic business model risk, which focuses on Europe. While not wanting to overlook the company’s strong growth, we do not think a 2023e FCF yield of less than 5% is what the stock should trade at. This would imply the stock price to be half from the current levels.

Risks To Our Thesis

We have a negative view of Endava, and the risks to our thesis or some potential upside factors could be:

- Structural strength in the Euro: The Euro has been long touted as an alternative reserve currency to the US dollar. Should the Euro become more substantial, the European region could prosper and see an acceleration in demand for digitization and payments. However, we see this as an unlikely scenario due to the strained relationships between major states due to various issues ranging from support to weaker states to immigration reforms.

- M&A: Endava has grown on the back of an aggressive inorganic strategy. A meaningful acquisition to diversify its revenue and cost base away from Europe could give a significant fillip to the company’s stock price. While the management remains opportunistic, we see no visible signs of any transformational M&A planned over the foreseeable future. Endava must continue its M&A to sustain the elevated growth rates witnessed in the past. As the company grows, integration issues could surface, leading to margin challenges.

- Endava getting acquired by a larger player: The likes of Accenture, Infosys and others have been on the prowl to buy out good quality assets in the current environment. Therefore, such a proposal for Endava could provide some upside from current levels. However, considering the company’s weak revenue per employee metric, we do not think many larger players would want to take on additional funding to buy Endava.

Conclusion

Endava is a play on payments and broad digital transformation in Europe. The company has a demonstrated record of growth, leading to valuations running ahead of fundamentals. Furthermore, the market has overlooked the geopolitical risk of operations in Europe. As a result, we think the company’s stock price could see a significant correction.

Be the first to comment