SimoneN

(This was originally published on the morning of October 27, 2022, before the opening bell, for Second Wind Capital members. Stock prices have been adjusted to reflect yesterday’s closing price).

Encore Wire Built A Better Mousetrap

Based in McKinney, Texas, Encore Wire Corp. (NASDAQ:WIRE) is a low-cost manufacturer of electrical building wire and cable. These products are widely used in the commercial and industrial buildings, residential buildings, apartments, and data centers. The company is a major copper and aluminum wire supplier to wholesale electrical distributors, who in turn sell the products to electrical contractors.

The company has built an exceptional business, by building a better mousetrap than its peers. A unique combination of low cost production, exceptional customer service, product innovation, smartly reinvesting in its large single site campus, and a highly motivated workforce all come together in concert, and are its secret sauce.

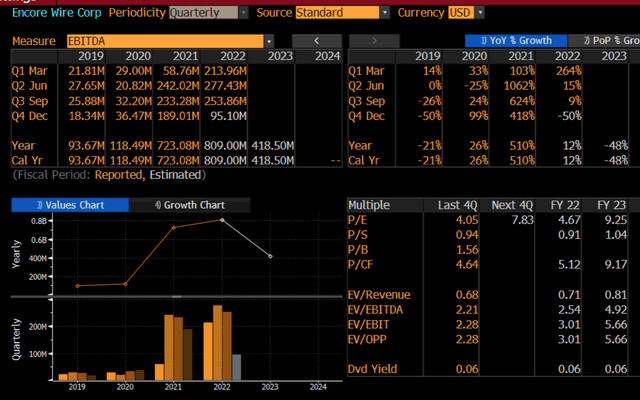

The company has posted explosive EBITDA growth, which is the culmination of very favorable tightness in the copper market, strong underlying demand, and by building and maintaining strong relationships with its customers, such that they are willing to pay a little more, as they value the availability of product, in the quantities and specifications required, and strong customer service levels.

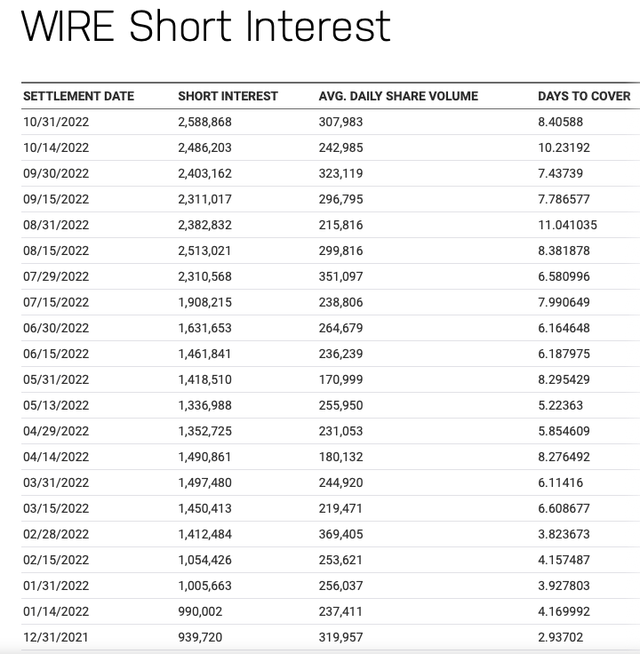

Despite a big leg-up in the stock, which is more or less tracking the hockey stick leg up in its EPS and EBITDA, we aren’t talking about multiple expansion. Therefore, I would argue the stock is still too cheap, and mis-priced. Perceptions that its business is tied to residential housing (less than 29% of its copper business) and perhaps lazy assumptions on mean reversion appear to be the shorts’ thesis. Speaking of the shorts, the short interest here has steadily climbed from 940K shares sold short, as of December 31, 2021 to 2.59 million shares sold short, as of October 31, 2022. And for perspective, the WIRE’s management team has been aggressively buying back its shares, with its bumper free cash flow. From the time of its FY 2021 10-K filing, in February 2022, WIRE’s total shares outstanding have gone from 20.2 million shares to 18.3 million shares, as of its Q3 FY 2022 10-Q filing. In other words, the short interest has gone from under 5% to 14.1%.

The Numbers and The Setup

The stock trades super cheap, as clearly no one on the street thinks $800 million or $900 million of FY 2022 Adj. EBITDA is normalized. The day after WIRE reported its Q3 FY 2022 results, enclosed below, please find the Bloomberg consensus estimates for Q4 FY 2022 EBITDA of $95 million and $418.5 million, in FY 2023.

To be clear, and the reason why I’m long the stock, is I’m in the camp of ‘I’ll take the over’, as in WIRE’s FY 2023 actual EBITDA will be north of $418.5 million. If you are a sophisticated buy sider, your job is 1) understand the business and 2) are you taking the ‘over’ or ‘under’ on the $418.5 million in FY 2023 consensus estimates for EBITDA.

Secondly, enclosed below, please find WIRE’s historical valuation multiples to next year’s Adj. EBITDA (or the next twelve month Adj. EBITDA estimates). As you can see, going back to 2016, this is the lowest EV/ Forward TTM Adj. EBITDA valuation WIRE shares have traded at!

In other words, ($2.1 billion enterprise value / $418 million next twelve month Adj. EBITDA estimates) gets you pretty close to the 4.93X figure in the chart enclosed below.

Back to mousetraps and understanding this business and why the company has been so successful.

Why This Opportunity Exists and Why I don’t Think It’s A Value Trap

1) Copper Spreads

If you take a step back, WIRE buys various grades of copper and there are four other raw materials used in the production of its finished goods. In this business, there is something call a ‘copper spread’, which is WIRE’s cost to acquire the underlying raw material or copper in this case, used to produce the finished goods. As management alluded to on the Q3 FY 2023 call, copper spreads actually peaked in June 2021 and have gradually receded since then. That said, copper spreads are still very healthy and much higher than a few years back.

See this below during a lengthy analyst Q&A session.

WIRE’s Q3 FY 2022 Conference Call WIRE’s Q3 FY 2022 Conference Call WIRE’s Q3 FY 2022 Conference Call

2) This business is about price and service.

Because WIRE has such large market share, great relationships built over decades, and a knowledgeable, motivated, and skilled work force, not to mention has made a series of really smart and incremental Capex investments, the company has become the low cost integrated producer. And the really tight global copper market ensures the fundamentals are the business will remain strong for longer than many people might think.

Moreover, if you’re looking for the smoking gun, as to how WIRE has put up these monsters EBITDA numbers, look no further than its great relationships. These relationships are so strong, some contracts don’t even go out to competitive bid!

This team has built an amazing and better mousetrap!

It’s a response in the market for them to, I guess, move some type of pounds or volume or something and what I can’t pretend to know what they’re trying to do or not do. It makes no sense. But demand is still there. There’s more emphasis still through Q3 on the delivery side and the service side than there is on significant pricing pressures from the competition. There’s good competitors, and there are some that are not as good at doing those things. But again, we’re doing our thing. Our model is very resilient for this type of market that we’re in. We have a lot of flexibility in our production capacity, as we’re talking about earlier. We can flex from one plant to the other. They have a primary purpose, but we’ve set them all up to be able to support one another and flex with that demand.

And so there’s still only a couple of things to sell building wire, it’s price and delivery. And we spend the majority of our time focused on the delivery side, and we’re able to charge for that service. We’re able to create relationships to move with some of the demand that is — maybe doesn’t go out into the market for bid. We’re able to have that repeat business and sharing those successes with those end users and our distributor customers. And as we mentioned in the prepared statement, we certainly couldn’t do that without the fantastic vendors that we have. And it’s not that they’re — the challenges aren’t there on the raw materials, they’re certainly there. But we’ve got relationships that go way back with these — with our suppliers and vendors. And we’re able to execute really, really extremely well in this market that rewards you for services, which is what we’re after.

(Source: WIRE’s Q3 FY 2022 Conference Call)

3) There is a lot of nuance here, in terms of the quality and shape of the copper to be able to get the rods to run the mills efficiently.

Check this out…

So, yes, there are 8 competitors in the U.S. and 4 or 5 inclusive of Canada or Mexico, but because of the relationships WIRE has built, and the scale with which they run their operations, they can source the right copper shapes to efficiently run their campus and capacity optimally. And since they are the best at converting the raw material into finished products, with the faster speed to market, this is a huge point differentiation!

WIRE’s Q3 FY 2022 Conference Call WIRE’s Q3 FY 2022 Conference Call

4) The short thesis rests on a collapse in residential housing. Upon further investigations, that short thesis appears weak.

There were multiple questions on the percentage of the copper business tied directly to residential housing. WIRE’s CFO was very candid and ‘Johny on the spot’, with the data. As you can see, demand has come off a touch, on the residential housing side, but it hasn’t collapsed like the bears have hypothesized!

WIRE’s Q3 FY 2022 Conference Call

5) Copper Is the Tightest since 1995 / 1996!!! This means the cycle is likely to last longer than everyone thinks and that’s why I’m taking the over on FY 2023 Adj. EBITDA estimates of $418 million ; )

WIRE’s Q3 FY 2022 Conference Call

6) This team is smart, as there is switching, due to cost, from copper to aluminum, depending on the industry, when copper trades higher in price. Therefore, WIRE’s aluminum business has bolstered results and offers some EBITDA diversification.

Net income for the 9 months ended September 30, 2022, was $563.8 million versus $399.8 million in the 9 months ended September 30, 2021. Fully diluted earnings per common share were $28.57 in the 9 months ended September 30, 2022 versus $19.31 in the 9 months ended September 30, 2021. Aluminum wire represented 17.4% and 14.7%, respectively, of our net sales in the quarter and 9 months ended September 30, 2022.

Aluminum wire volumes and spreads have increased for both the quarter and 9 months ended September 30, 2022, compared to the commensurate period in the prior year. Results through the third quarter ended September 30, 2022, where were driven by stable demand for our products. And as Daniel said, the general inability of the sector to meet demand for the timely delivery of finished goods. Persistent tightness in the availability of certain raw materials, ongoing global uncertainties and suppressed availability of skilled labor kept overall spreads strong through the third quarter of 2022. This marks the sixth consecutive quarter of elevated margins and spreads.

(Source: WIRE’s Q3 FY 2022 Conference Call)

Other Things To Consider

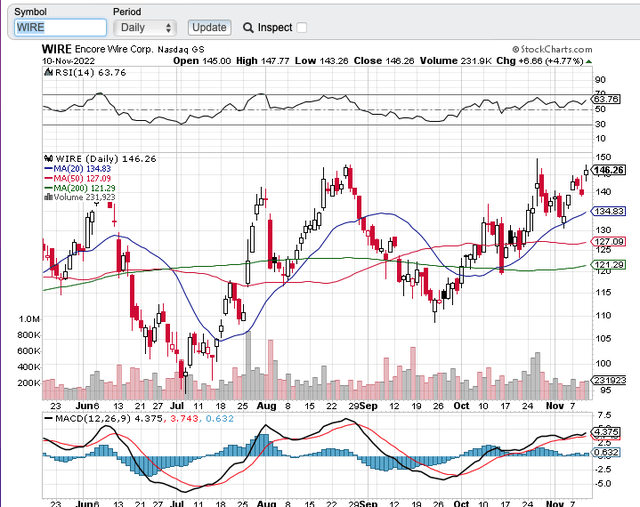

From a technical perspective, WIRE’s all-time high stock price was set back on November 23, 2021, at $151.64. Since then, the stock has been super volatile and bounced as low as just under $100 to as high as $149.50, on October 26, 2022, the day of its Q3 FY 2022 earnings, and before profit taking (or perhaps short selling) picked up.

See here:

Short Interest

Nothing excites the senses like a great fundamental story that is misunderstood by Wall Street and that trades at a compelling valuation. The cherry on top is that there is a decent amount of short interest here.

As of October 31, 2022, we’re talking about 2.589 million shares / 18.343 million shares outstanding. That is 14.1%. And as Encore Wire is a relatively thinly traded stock, covering 2.6 million shares will not be easy.

Putting It All Together

With WIRE shares closing at $146.26, yesterday, if you are long this stock, you are simply betting that FY 2023 consensus Adj. EBITDA of $418 million is too low. WIRE’s market capitalization is $2.682 billion and its enterprise value is $2.1 billion. So its EV/ Consensus Estimates for FY 2023 EBITDA = 5X.

If like me, you’re in the camp of taking the over, and think $500 million is achievable (and possibly higher) then I would argue that we get another leg up and WIRE should take out its all-time high. If it gets through its all-time high, who knows how high it goes given the high short interest on a relatively thinly traded stock. Good luck to short if this stock ‘gets loose’.

And from a business perspective, this business is about great customer service, running very efficiently at scale, having great relationships, formed over decades, both in terms of vendors and end customers! And because copper inventories are so tight, the tightest since 1995/ 1996, said by a CEO that has been doing this for a long time and that is a straight shooter, the fundamentals for elevated and healthy copper spreads are intact. Not to mention the Aluminum business is another growth driver and smart ancillary business. Furthermore, there are big secular growth tailwinds for copper demand in Data Centers, Hospitals, Utilities (upgrading the grid), electric vehicles, green energy, and industrial and commercial applications. Yes, residential housing is 28.3% of the business, as of Q3 FY 2022, but WIRE’s factories are so dynamic that they can quickly flex to the market and build other finished goods to meet the strong demand in other sectors. And if you understand the nuance of the shapes of copper required to do this at scale, you can’t simply replicate this business. Not to mention that there is skilled labor (which is also in short supply).

To make a long story short, I’m really excited about this idea. Look for all-time highs and possibly a shot at a move to $200.

Be the first to comment