Minakryn Ruslan

Thesis

Encore Wire Corporation (NASDAQ:WIRE) is a strong buy despite some bearish cases on short-term copper prices. Through a diverse product line, they reach multiple high growth industries and are extremely cheap through a conservative discounted cash flow (“DCF”) analysis. Furthermore, they have zero debt, share repurchases, perfect financials, fundamentals, and are outperforming competition. Risks are present, but there are too many positives going for them.

Company

Encore Wire Corporation is a low-cost manufacturer of electrical building wire and cable with a significant supply base for interior electrical wiring in commercial, industrial buildings, homes, apartments, manufactured housing, and data centers. Primary customers are distributors and contractors with three whom represent slightly more than ten percent of sales. They pride themselves on customer service with industry-leading fill rate and product innovation by bringing new ideas to copper commodities, including patented SmartColor ID® system, PullPro®, and Reel Payoff® solutions. They also exhibit low-cost production with efficient plant design and an incentivized work force. They are around a thousand employees-strong with majority hourly wage recipients, in which the company focuses heavily on employee compensation. Raw material inputs include copper cathode, copper scrap, PVC thermoplastic compounds, XLPE compounds, aluminum, steel, paper and nylon with the majority of dollar value compounds coming from copper. Insulation raw materials are comprised of pvc resin, clay, and plasticizer. Competitors include Southwire Company, Cerro Wire LLC, General Cable (a company of the Prysmian Group) and AFC Cable Systems, Inc.

The company operates in a cyclical industry in residential, commercial, and industrial construction, noting that remodeling activity trends up as new construction slows down. A small company with a small percentage of salary employees means they rely heavily on senior management with no assurance the company will retain key managerial positions. Furthermore, a small number of stockholders own a third of the company, which means a massive selloff could disrupt stock price. Overall, WIRE is bringing a modernized approach to a “boring” industry with further analysis proving it is working perfectly and extremely undervalued.

Industry

A macro level outlook of copper commodities seems bleak in the short term, but will see excellent growth in the next ten years due to the several different industries demanding these materials. WIRE highlights six key industries in which their product will be used: Data Centers, Renewables, Healthcare, Commercial, Industrial, and Residential with heavy focus on Solar, EV, Petrochemical, Water Waste, and Battery Storage markets. There is no need to overcomplicate the demand for such products, since copper’s physical properties and applications aren’t quite matched by other materials. Though cyclical in nature, I don’t see copper being phased out within ten years and expect to see great demand with such markets over the long term.

Financials

WIRE valuation metrics are unmatched besides a pretty much nonexistent dividend. However, this is a value and growth play in my opinion, so dividends are not on my radar. Earnings have blasted through expectations, and value compared to similar companies is winning by a landslide. Profits and financials are unparalleled, and even their balance sheet contains no debt and they continue to buy back shares. From a strictly numbers standpoint, this company couldn’t be performing any better.

Valuation

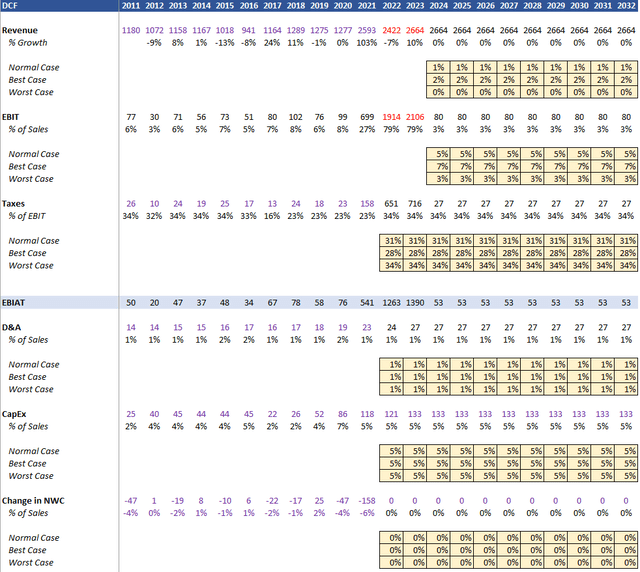

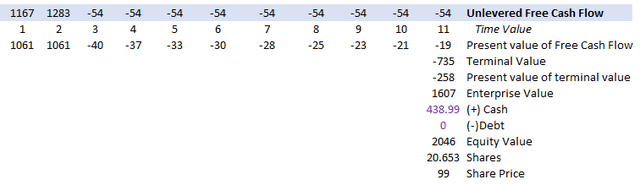

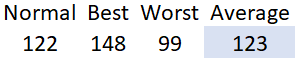

A fair value of $123 per share was calculated by a Ten-Year, Unlevered DCF analysis using CAPM and WACC as a discount and averaging a worst case, best case, and normal case scenarios. Revenue and EBIT projections were used from average results of sixteen analysts for 2022 and 2023 from Financial Modeling Prep. Personal projections were used thereafter with the following extremely conservative assumptions:

Revenue

- Normal Case Scenario: 1% YOY

- Best Case Scenario: 2% YOY

- Worst Case Scenario: 0% YOY

EBIT

- Normal Case Scenario: 5% YOY

- Best Case Scenario: 7% YOY

- Worst Case Scenario: 3% YOY

Taxes

- Normal Case Scenario: 31% YOY

- Best Case Scenario: 28% YOY

- Worst Case Scenario: 34% YOY

D&A: 1% YOY

CapEx: 5% YOY

Change in NWC: 0% YOY

WACC: 10%

Terminal Growth Rate: 2.5%

Judgement Day: 2032

WIRE DCF Assumptions (Author) WIRE DCF Unlevered Free Cash Flow (Author) WIRE Fair Value (Author)

Conclusion

There are three primary reasons to refrain from buying into WIRE’s success: fear of managerial disasters, massive selloff of large ownership, and a bearish case on the copper industry over the next ten years. However, I believe the current price covers these risk exceptionally along with diverse products, market applications, and perfect financials, fundamentals, competition, and earnings. From a value and growth perspective, this is an excellent play on copper commodities.

Be the first to comment