imaginima

Here at the Lab, following up on how Enagás (OTCPK:ENGGF) (OTCPK:ENGGY) plays a crucial role in the European energy crisis, we are back to comment on the latest company’s development. Of course, this prolonged crisis is giving an impetus to the transformation of the EU energy system; however, to overcome the double challenge of decarbonization and energy supply, infrastructure players must not be neglected, hence regulators and Governments should be flexible and encourage new developments. Italy and France are facing these consequences in two opposite ways.

French hostility

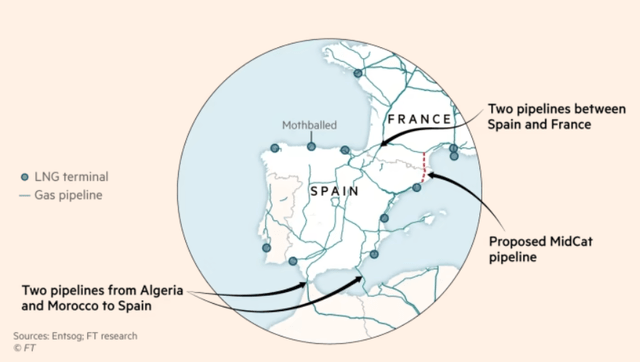

Recently, Enagás has incrementally increased the capacity of the existing Euskadour pipeline to France by almost 1.5 bcm, so Spain can deliver more gas to Europe following the Nord Stream 1 explosion. There is also a second interconnection with France called the Larrau pipeline in Navarre which has a current capacity of 5.3 billion cubic meters. So in total, the Spanish gas operator will be able to export 8.5 billion cubic meters to France (and to the rest of Europe) which is equal to about 8 LNG shipments per month. We should note that this amount represents only six percent of France’s internal natural gas consumption.

Teresa Ribera, the Spanish Minister of Ecological Transition, with Enagás CEO recently visited the Euskadour compressor station explaining that “Spain is showing solidarity. And it wants to contribute, because it can, to strengthening Europe’s security of supply. The increase in the capacity of the Irún interconnection will undoubtedly meet this objective”. She also emphasized that there is a plan to build a new pipeline called MidCat to exponentially increased gas flow towards Europe. However, French politics expressed clear opposition to the multibillion-euro project, saying that MidCat would not alleviate Europe’s energy crisis. Supportive to the pipeline is Olaf Scholz, the German chancellor, who publicly expressed a “strong support versus this connection”.

Source: FT – French hostility frustrates Spain’s gas pipeline dream

Italian opportunity – doubling the TAP pipeline

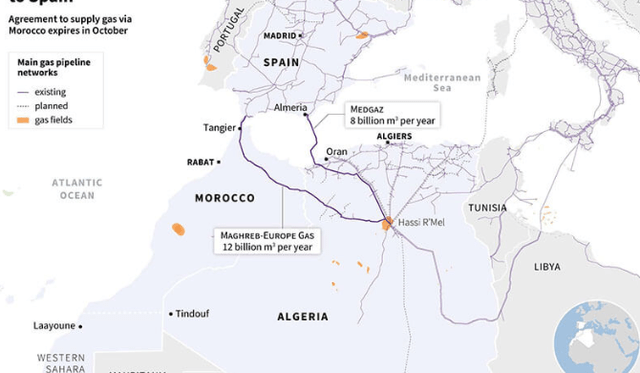

On the contrary, Italy is working pretty hard to increase and diversify energy sources and to be less dependent on Russian gas. TAP is a pipeline already in function with a length of 878 km which crosses Greece, Albania, and the Adriatic Sea. Then, it is connected to the Italian gas network and has a current capacity of about 10 billion cubic meters per year. There is now a project to double TAP capacity based on the following four levels of pipeline upgrading:

- a “minimum expansion” from the current 10 to 14.8 billion cubic meters per year for an estimated cost of €114 million and a work duration of 45 months through the installation of two compressor stations;

- a “limited expansion” of 15.7 billion cubic meters per year at a cost of €388 million and a duration of 60 months;

- a “partial expansion” of 18.4 billion cubic meters per year at a cost of €730 million and a duration of works of 65 months;

- a “full expansion” of 21.9 billion cubic meters per year at a cost of €1 billion and a duration of works of 65 months.

Conclusion and Valuation

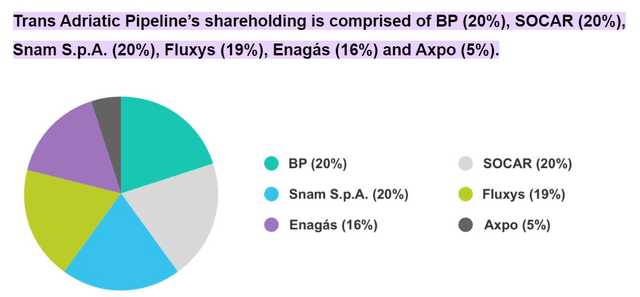

Enagás is TAP’s major shareholder and our internal team is already forecasting a dividend increase year-on-year. As already anticipated, numbers in hands, Enagás could manage 40% of the total capacity in continental Europe thanks to its 6 regasification plants and plays a central role in EU energy diversification. We recently commented on Enagás’ half-year performance, lowering net profits evolution and our target price. However, we maintained a buy rating at €25 per share and we reaffirm Enagás compelling investment thesis backed by a strong dividend yield (not at more than 12%). The Nord Stream 1 collapse might be an Enagás key catalyst, and we think Wall Street needs to notice the Spanish gas operator assets: 6 regasification plants (in short/medium term) and TAP & Algeria diversification (in the medium/long term horizon).

Source: TAP’s shareholders

Source: S&P Global

Be the first to comment