It’s been a solid start to the year for the royalty/streaming space, with many names like Royal Gold (RGLD) up as much as 30%, massively outperforming the Gold Miners Index (GDX). Unfortunately, EMX Royalty (NYSE:EMX) has continued to languish, hit by a dispute on one of its major royalties, and having to digest share dilution last year. The good news is that after this 40% plus correction, the valuation has become much more reasonable. Based on EMX’s reasonable valuation and solid growth profile, I see the stock as reasonably valued, and I would view the stock as a Speculative Buy at US$1.98 or lower.

Balya Property – EMX Royalty Partner (Company Presentation)

EMX had a transformative year in 2021 (SSR portfolio acquisition, Caserones Mine deal), and 2022 should have been a banner year, with the potential for more than $20 million in revenue and dividend income combined. Unfortunately, this outlook was too optimistic, with the Balya Mine appearing to be behind schedule and the Cukaru Peki net smelter return [NSR] royalty in dispute.

While this will lead to a much lower revenue figure for 2022 than initially expected by investors, EMX will still enjoy significant sales growth, with a full year of contribution from Caserones and an H2 2022 contribution from Gedikpete (once 10,000 ounces have been produced from the asset). Meanwhile, the 2023 outlook remains robust, with significant revenue growth from FY2021 levels, especially if the Cukaru Peki NSR dispute can be resolved. Let’s look at recent developments below and the updated outlook:

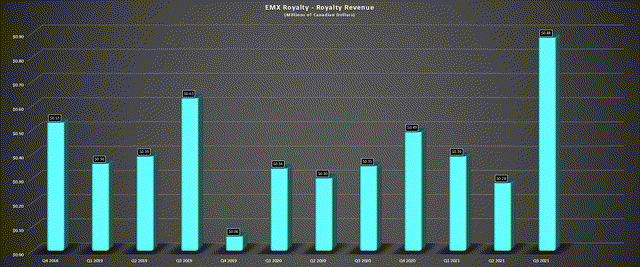

As the chart below shows, EMX Royalty has generated significantly less recurring royalty revenue/dividend income than many of its peers over the past few years. This is because its only real steady contributor has been the Leeville Mine in Nevada. However, the company has bolstered its portfolio over the past two years, investing in Ensero Solutions, which has boosted its dividend income (~$8.5 million over seven years). Elsewhere, EMX has picked up a 0.418% net smelter return [NSR] royalty on the long-life Caserones Mine in Chile.

EMX Quarterly Revenue (Company Filings, Author’s Chart)

EMX followed this up with the acquisition of a large royalty portfolio from SSR Mining (SSRM), which included a massive royalty on the oxide portion of the producing Gedikpete Mine (10% NSR royalty). Notably, the portfolio also included a 6% to 10% NPI royalty on the Yenzipar VMS Project, a 1% NSR royalty on the Diabillios Project in Argentina (OTCQX:ABBRF), and a 2% NSR on the Sulfide portion of the Gediktepe Project. At the same time as EMX filled out its portfolio and helped diversify its near-term royalty/income, two projects are finally about to begin paying dividends: Balya and Timok (Cukaru-Peki).

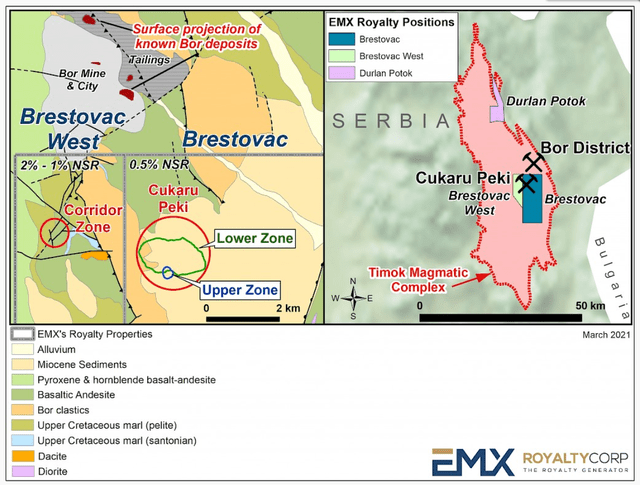

At Balya in Turkey, the ramp-up appears behind schedule, but this should contribute at least $1 million per annum beginning in 2022 and could grow to be as significant as Caserones (~$4 million per annum long-term. Meanwhile, last year, Zijin Mining’s (OTCPK:ZIJMF) Cukaru Peki Mine moved into commercial production. Normally, the 0.50% NSR royalty that EMX holds would not be that significant, and I wouldn’t pay much attention to a royalty of this size. However, in the case of this asset, it is a massive operation where this relatively small NSR royalty certainly moves the needle.

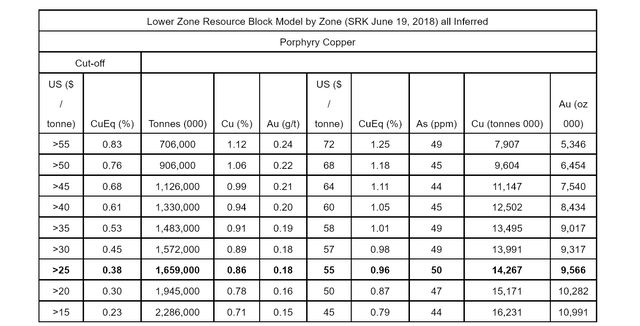

This is because the asset is estimated to have an average annual production profile of ~91,000 tonnes of copper and ~80,000 ounces of gold. Nevsun Resources, before Zijin acquired it for ~$1.4 billion, estimated that the project would produce more than 2 billion pounds of copper over 15 years. It’s important to note that EMX’s 0.50% uncapped royalty also covers the Lower Zone porphyry copper-gold project, home to an inferred resource of ~1.7 billion tonnes at 0.86% copper and 0.18 grams per tonne gold.

Lower Zone Resource – Timok (Nevsun Resources)

Based on my previous estimates, I thought there was the potential to generate up to $20 million in revenue/dividend income in 2022, giving EMX Royalty one of the highest revenue growth rates sector-wide. The three major pillars for this revenue growth were Caserones (~$4 million per annum), Gedikpete (~$5+ million in 2022, growing further in 2023 from a full year of contribution), and a 0.50% NSR royalty on the massive copper-gold asset in Serbia, Cukaru-Peki (~$5 million per annum). However, this outlook received a significant downgrade recently, combined with the delays at Balya, which have lowered my revenue estimates.

Balya Delays & Negative Development At Cukaru Peki

In the case of Balya, the slower ramp-up is not an issue, given that it simply means deferred revenue. However, in Serbia at Cukaru Peki, things are uglier. This is because Zijin Mining has disputed the 0.50% NSR royalty at Cukaru Peki, claiming that the royalty has been reduced to 0.125%. EMX appears to be on the right for this royalty figure and is entitled to its 0.50% NSR royalty. However, based on what I assume to be a preference to settle vs. have this deal tied up in arbitration, EMX suspended filings of its notice of arbitration to Zijin Mining in late January.

Assuming the two parties settle at the middle of the previous NSR royalty at 0.25%, which I can only speculate on at this point, this would translate to annual revenue from Cukaru Peki of closer to $2.5 million, which is certainly a meaningful downgrade from previous levels. This would suggest revenue and dividend income of below $15 million in 2022 and closer to $20 million in 2023, assuming Balya can ramp up to full production. Fortunately, EMX did get some positive news, which could offset some of the potential lost revenue that it’s entitled to at Cukaru Peki, assuming the two companies settle below the initial 0.50% NSR royalty rate.

This news came last month when it was announced that EMX would be entitled to ~$19 million from Barrick (GOLD) from an outstanding settlement since 2008 with its wholly-owned subsidiary, Bullion Monarch Mining. This dispute was related to the non-payment of royalties on production from properties in Nevada. Given the length of this legal dispute, it was certainly a positive surprise. Even if we assume that EMX sees ~$20 million less in royalty revenue over the next eight years based on a 0.25% NSR at Cukaru Peki, this favorable ruling partially offsets this negative development at the Serbian asset, at least from a near-term cash flow standpoint.

Cukaru-Peki Royalty Coverage (EMX Presentation)

Obviously, given the mineral endowment at Cukaru Peki, this would still be a loss long-term, even after factoring in the surprise win in the Barrick dispute, assuming a settlement below a 0.35% NSR royalty. However, this win in the Barrick dispute will help improve the balance sheet and should help move EMX closer to a net cash position by 2023 from its current net debt position. Notably, with the increased revenue this year, EMX will be in a better position to raise capital in the future and won’t have to resort to higher-interest loans like the 7% credit facility it entered into when financing the SSR Mining royalty acquisition.

It is important to point out that I have no idea where both parties (Zijin/EMX) will settle on the NSR royalty, but for the purposes of this article, I have assumed settling in the middle at a 0.25% NSR, and this is purely speculation.

Improved Diversification & Multiple Growth Pillars

As discussed earlier, EMX will go from having one meaningful producing royalty (Leeville) to several by 2023, with Balya, Cukaru Peki, Caserones, and Gediktepe. This should place the company in a position to generate a minimum of $16 million in revenue in 2023, even assuming a very unfavorable settlement on the Cukaru Peki asset. Most importantly, though, it will give EMX added diversification, which is why many junior royalty/streaming companies are often priced at a massive discount to peers.

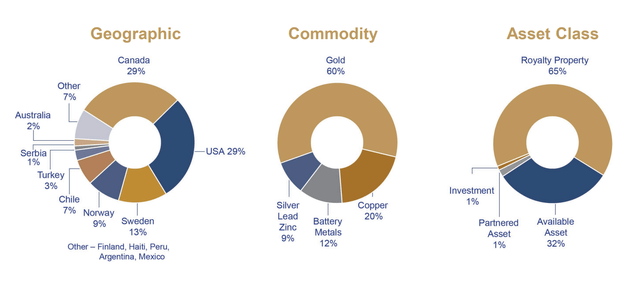

EMX Royalty – Diversification (Company Presentation)

This discount is because these companies have a significant concentration with just one or two assets, and any issue at an asset would magnify problems from a cash flow standpoint. This is not the case with major royalty companies, which explains their premiums. They typically have a minimum of 20 producing royalties and less than 20% concentration on any single asset. Notably, for investors that like the supply/demand outlook for copper in the trend we’re seeing towards electrification, a meaningful portion of EMX Royalty’s revenue will come from copper with its exposure to Cukaru Peki and Caserones.

Finally, the last point worth making is that while EMX has a massive asset portfolio and many of these assets may not head into production over the next decade, the company is somewhat of a mineral bank. This allows the company to increase the value of its equity portfolio, cash balance, and royalty portfolio, achieved by selling projects for cash, shares, and royalties. The pace of these transactions has improved over the past year, with 25 projects sold in 2021 and 83 sold from 2018 through 2022. Of course, these projects may not provide the steady recurring royalty revenue that affords larger royalty/streaming companies their premium valuations. Still, it is a nice bonus that isn’t included in the company’s royalty revenue.

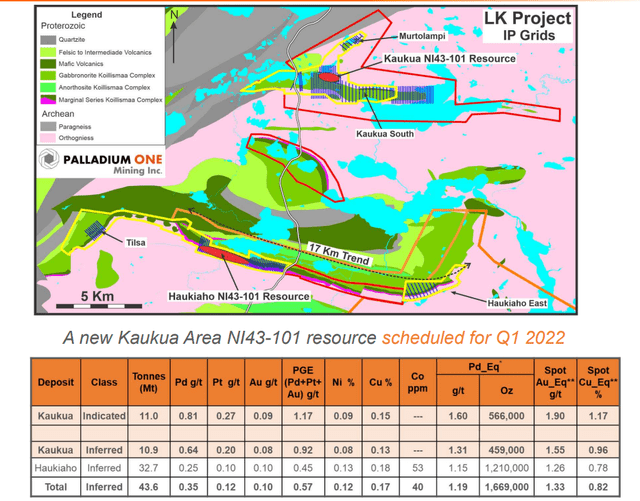

Kaukua – LK Project (Palladium One Presentation)

To summarize, while EMX’s royalty revenue and dividend income may appear low at the time, though they will grow rapidly, this is one area where the company doesn’t get enough credit and certainly has nice optionality. Before moving on, I’d be remiss not to point out that one asset that looks like it could pay off nicely is the Kaukua royalty at the LK Project in a Tier-1 jurisdiction (Finland) held by Palladium One (OTCQB:NKORF). Kaukua is home to a high-grade resource (indicated/inferred) of ~22 million tonnes at ~1.45 grams per tonne palladium-equivalent.

Valuation & Technical Picture

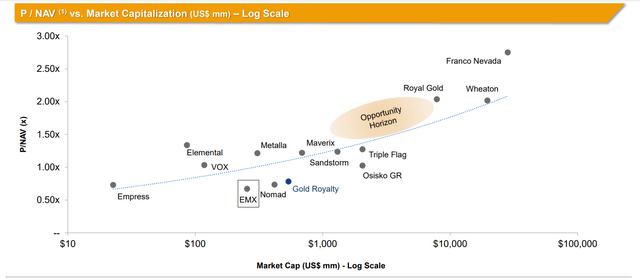

Based on an estimated year-end share count of ~119 million fully diluted shares and a current share price of $2.36, EMX trades at a market cap of ~$281 million, with an enterprise value just north of $300 million based on net debt of approximately $30 million. Assuming the company generates a conservative $16 million in revenue in 2023, the company would be trading at a price-to-sales ratio of roughly 19. On this metric alone, this is quite steep compared to some of the other junior royalty/streaming companies like Nomad Royalty (NSR) at barely 10x revenue.

EMX Royalty vs. Peer Group – Market Cap vs. Log Scale (Gold Royalty Corporation)

However, from a P/NAV standpoint, EMX is quite reasonably valued, trading at closer to 0.70x P/NAV according to analyst estimates. I would argue that the company deserves to trade at a discount to its peer group. This is because it has a less favorable jurisdictional profile (Turkey, Serbia, Chile), and it’s difficult to have complete visibility into its future revenue and expected attributable production, given that some of its partners are private. However, this discount looks to be mostly priced in at this point, and I can think of much worse ways to invest in the royalty/streaming space than EMX Royalty.

Currently, I do not have a position in EMX, given that I see more attractive bets elsewhere, which also have very impressive growth profiles. However, for investors that are comfy with lower exposure to gold/silver compared to other royalty/streamers and the fact that the Cukaru Peki royalty dispute could be a cloud over the stock, EMX doesn’t look like a bad bet on pullbacks. Let’s take a look at the technical picture below:

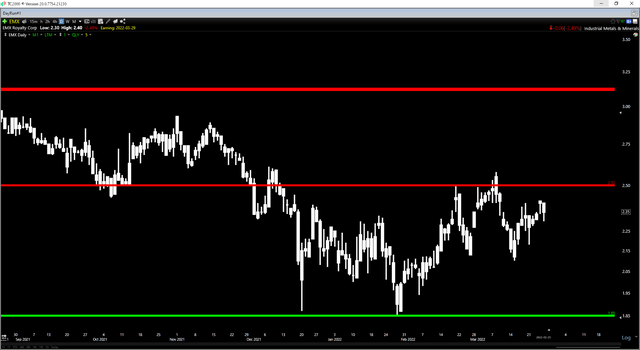

EMX Daily Chart (TC2000.com)

Moving to the technical picture, we can see that EMX has rallied sharply from my recently updated low-risk buy zone of US$2.04, and with a break of support recently, we’ve seen a slight degradation in the technical picture. This is because the updated support level comes in at US$1.85, with updated resistance at US$2.50. With EMX in the upper portion of this trading range, the reward/risk ratio is less favorable at current levels. This doesn’t mean that the stock can’t go higher, but after the recent break of support, the new low-risk buy zone is at US$1.98.

EMX Royalty (Company Presentation)

With multiple royalty/streamers offering significant growth, but Maverix (MMX) and EMX are two that have a large cloud hanging over them (Russia exposure/Cukaru Peki dispute), I favor other names currently. Having said that, the recent win in the Barrick dispute has softened the potential blow at Cukaru Peki, and EMX will enjoy an industry-leading sales growth rate in 2022/2023. Given this favorable outlook, I continue to see the stock as a Speculative Buy. However, my buy zone for this Speculative Buy rating has been revised to US$1.98 from US$2.05 after the stock violated its previous support level.

Be the first to comment