Vladimir Zakharov

Emerging Market debt has begun to recover after a brutal selloff driven by rising UST yields and default risk. The iShares J.P. Morgan EM High Yield Bond ETF (BATS:EMHY) now offers a yield of 10.7%, which is particularly attractive considering the fund’s relatively low volatility compared with EM stocks. Investors have punished high yield EM bonds for much of the year due to fears of a liquidity crunch caused by the Fed’s extreme hiking cycle. However, EM fundamentals are sound, and it the U.S. that faces debt funding issues at current interest rates. We should therefore expect to see the Fed adopt a more neutral stance going forward, which should result in lower UST yields and reduced EM credit risk.

The EMHY ETF

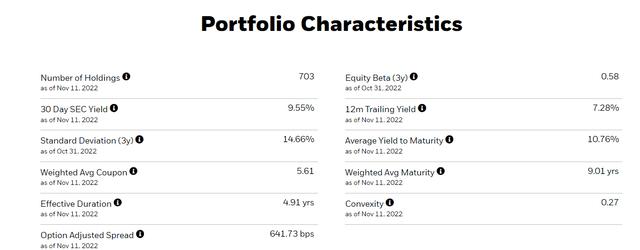

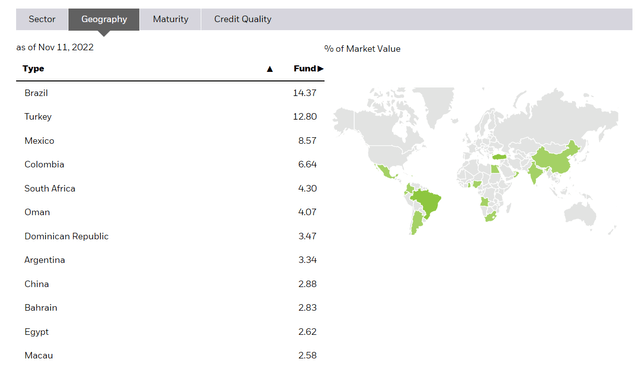

The EMHY seeks to track the investment results of an index composed of U.S. dollar-denominated, emerging market high yield sovereign and corporate bonds. The weighted average yield to maturity is an impressive 10.7%. The high yield reflects the high weighting of low-quality credits, with Brazil, Turkey and Mexico making up the main countries in the index, with a weighting of 14%, 13%, and 9% respectively. The fund also has slightly over half of its assets in non-sovereign bonds, which adds a degree of credit risk. However, interest rate risk for the fund is relatively low, with a weighted average maturity is just 9 years and an effective duration is just 4.9 years.

The fund should be attractive for any investors looking to generate double-digit returns but with a lower degree of risk relative to stocks. The EMHY has consistently shown a lower degree of volatility relative to EM equity benchmarks since its inception in 2012, while still generating equivalent returns. It is also well diversified from a country perspective, particularly relative to equity benchmarks which have much higher exposure to China. The fund charges an expense fee of 0.5%, which is comparable with other EM bond and equity funds.

Double-Digit Yields Will Not Last For Long

The EMHY’s impressive 10.8% has been driven in large part by the rise in U.S. Treasury yields, which has had a direct impact on driving up yields via the higher risk-free rate and the indirect impact of raising default concerns. Investors have shunned riskier emerging market bonds in the belief that the Fed will continue to squeeze financial conditions, making it increasingly difficult for EM countries to find the dollars to services their debts.

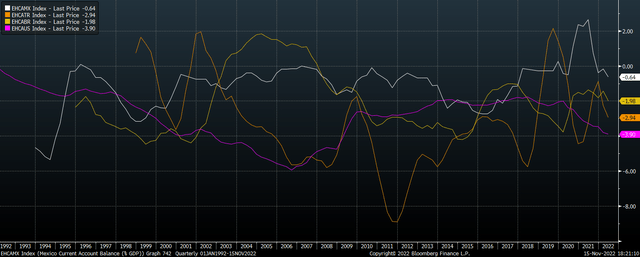

Current Account/GDP: Brazil, Turkey, Mexico, US (Bloomberg)

However, EM dollar funding requirements are significantly lower currently than they have been for most of the past decade. The average current account deficit for the three main countries in the EMHY, for example, is less than 2%. Meanwhile, the U.S. current account deficit continues to widen and is pushing 4%, suggesting that there is no shortage of dollars in the global economy. Furthermore, Brazil, Turkey, and Mexico, all have significantly lower fiscal deficits than the U.S., which remains elevated at around 5% of GDP.

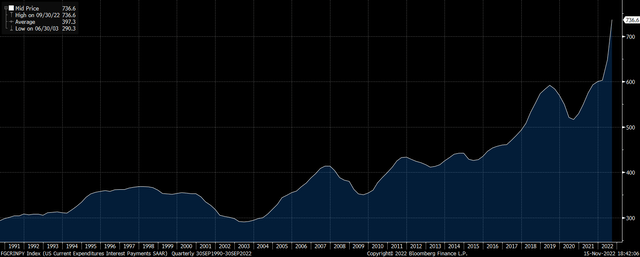

This high U.S. fiscal deficit, and the ongoing rise in interest costs seen on U.S. debt, will necessitate a loosening of monetary policy in the U.S. as has been the case in Japan and more recently in the U.K., where fiscal and stability concerns have taken center stage. Q322 data showed that interest on U.S. Treasury debt rose to a record high USD737bn, reaching its highest share of GDP since 2001. Note that back then the yield on the 10-year UST was over 5%, and we are yet to see the full impact of rising yields feed through into higher funding costs due to the high maturity of the debt. This means that if rates remain at current levels, we could see U.S. funding costs explode, which will force the Treasury to put pressure on the Fed as we have seen in Japan and the U.K.

U.S. Federal Interest Expense (BEA, Bloomberg)

Additionally, if UST yields and emerging market default risk continue to rise, downside pressure on U.S. asset prices are likely to intensify once again, putting further pressure on the Fed to prevent a full blown financial crisis. The Fed seems content at present to see asset prices weaken in order to help to bring down inflation, but as we see headline CPI prints continue to drop, recession fears may well begin to dominate the Fed’s thinking, allowing a more neutral policy stance.

Summary

At over 10%, the yield on the EMHY is highly attractive and suggests outperformance relative to stocks over the coming years with a lower degree of volatility reflecting the fund’s low duration. The ETF is relatively well diversified from a country perspective, with less China exposure than most EM equity funds.

Be the first to comment