Thesis

Dividend payments are never guaranteed. But companies that have payed dividends for 63 years like Emerson (EMR) have demonstrated their ability to keep rewarding shareholders through all economic conditions. Despite its long history, Emerson has adapted to the industrial trends and is very well positioned for the modern demands of companies and consumers, which should drive continuous dividend growth. Source: Emerson Electric Investor Presentation

If you want to see a table of 10 Dividend Kings that I have my eye on, sorted by yields, valuations, dividend safety and distance from 52-wk high, feel free to check out the article on my blog.

The Company

Emerson Electric is a multinational industrial company manufacturing products that are used in commercial, industrial and consumer markets. The company was founded in 1890 and headquartered in Missouri, US. Emerson currently employs around 88.000 people around the globe.

The company has two major business segments: Automation Solutions that make up around 66% of revenue, and Commercial&Residential Solutions that make up around 34% of revenue (figures based on 2019 earnings).

The company has shown excellent profitability over the last decade. EMR has turned an average of 12% of revenues into free cash flow and has demonstrated an average ROE and ROIC of 23% and 15% respectively during that period.

Dividend

This Dividend King has raised its dividend for 63 consecutive years. Throughout many recessions and economic cycles, this company has found a way to keep rewarding its shareholders. The current dividend yields a generous 4.35% and is covered with around a 50% FCF payout ratio based on the 2020 FCF guidance of $2.5 billion. Granted, with the coronavirus pandemic hurting the economy right now, the guidance will surely be revised downward. But they do have a margin of safety due to the moderate payout ratio.

The CAGR dividend growth rate over the last decade has been under 4%. Normally that type of dividend growth doesn’t really turn heads when combined with EMR’s usual average yield. However, with Emerson’s dividend yielding around 4.35% now, it’s becoming interesting. Especially when you are looking for income right now, instead of aiming for a substantially larger yield on cost in the future. The combination of a 4.35% yield that can grow in low-single digits is attractive for income investors in light of current economic uncertainty.

Balance Sheet

Emerson Electric’s balance sheet is strong and able to withstand a tough economic period. Net Debt/EBITDA is a very conservative 1.1. Debt-to-Equity is slightly higher at 0.7x but still at a reasonable level. Interest payments are covered almost 15x over when using last year’s EBITDA. As a result of those strong metrics, Standard&Poor’s rates Emerson’s credit at A.

Risks

The overhanging risk to the whole economy is the coronavirus pandemic. If the current negative situation persists for a long time, all businesses will suffer meaningfully. As Emerson relies on strong manufacturing, especially in the US, if businesses start to slow down their production, demand for Emerson’s products will decline. The company has also made many acquisitions and divestitures in the last years and that is always subject to execution risk.

Valuation

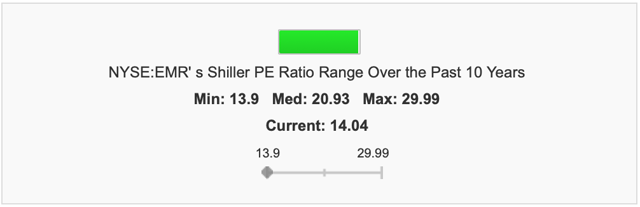

It is hard to value stocks on P/E and P/FCF basis right now as the earnings and cash flows are hard to estimate. I believe the best indicator of value right now is the CAPE ratio as it uses the average inflation-adjusted earnings over the last decade. Emerson’s shares are currently trading at a CAPE ratio of 14, which compares favourably to the company’s median CAPE ratio of 21 over the last decade. On that basis, it suggests that Emerson is currently around 33% undervalued.

Source: GuruFocus.com

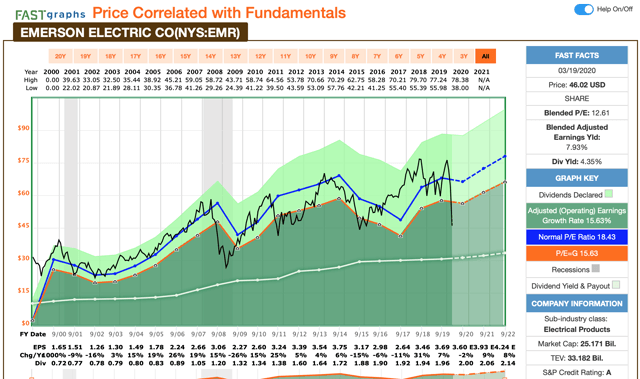

Looking at the blended P/E ratio graph below from F.A.S.T Graphs, it also suggests that EMR is currently undervalued compared to its growth prospects.

Source: F.A.S.T Graphs

Summary

Emerson Electric is an income stock with an almost unparalleled dividend growth record. The company is positioned strongly in its industry, shows excellent profitability, has a strong balance sheet and is paying a 4.35% dividend that is well covered. The current market crash has provided income investors an opportunity to buy this income stock at a very good valuation. I rate EMR a “BUY” at current levels.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment