Tasos Katopodis/Getty Images News

Introduction to Emergent BioSolutions

Return on capital is a widely used profitability metric that doesn’t get enough attention in our opinion in the investing universe. The reason being that in order to attain long-term investing success, for example, it all boils down to whether a company can invest its cash at elevated rates of return over the long run. This is why one can’t stop their due diligence merely by looking at free cash flow numbers. One has to go a step further to see how cash is being allocated and whether there is a long runway for growth for returns to remain elevated.

Furthermore, when managing money in an investing and trading portfolio, one wants to maximize the return on capital in the same way as mentioned above. In the investing world, this usually means investing in a company with very high-profit margins, and in the trading world, it is all about turning over one’s capital (hopefully profits) as quickly as possible.

Take Emergent BioSolutions Inc. (NYSE:EBS) for example where the October $25/$22.50 put spread is selling for $0.75 per contract. Put spreads in scenarios as we have at present in Emergent BioSolutions Inc. is an excellent way of controlling risk while simultaneously earning very strong returns of capital. What we mean by this is that 10 put spread ($750 credit) for example would use up far less capital (or buying power) than naked puts, for example, but would still offer very high returns of capital. Let’s go through why we see the sale of put spreads as a viable strategy in Emergent BioSolutions Inc. at present.

Technicals

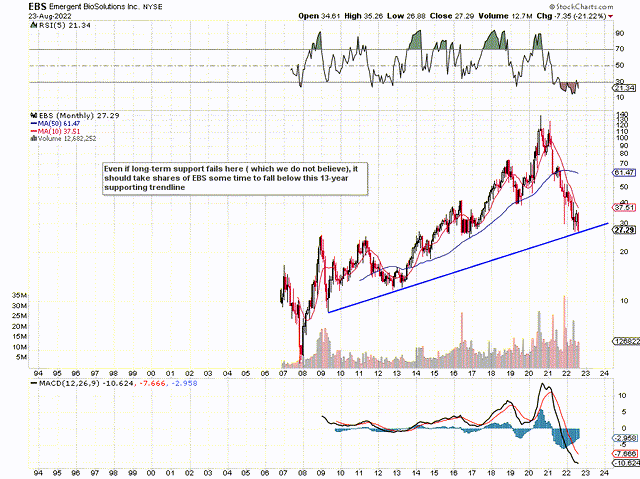

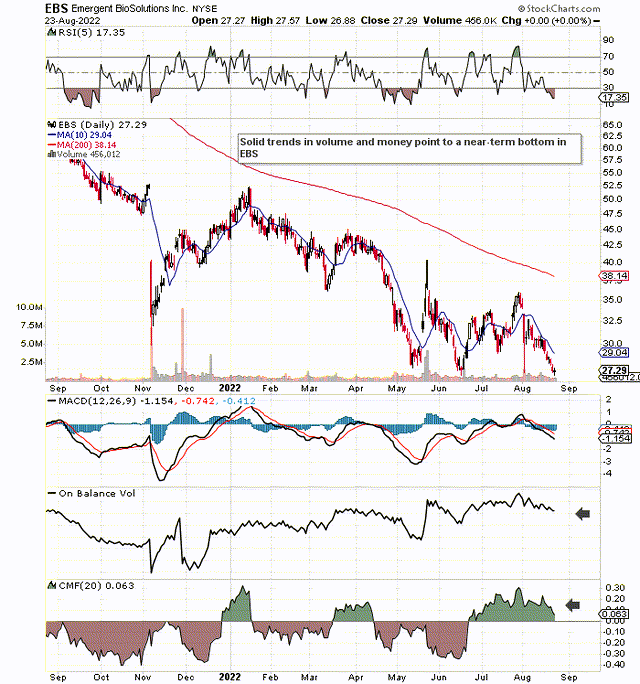

The bullish trend-line depicted below in Emergent BioSolutions Inc. dates all the way back to 2009. As we can see below, shares have come right back down to test this support level which is holding as we stand. Since we do not have a confirmed swing low either on the weekly chart or the monthly chart, put spreads (where risk is controlled) is the prudent choice at this stage. The reason being is that support could easily fail here although volume and money flow trends are encouraging on the daily chart. Furthermore, the put spreads have less than 60 days to go to expiration so even if long-term support only manages to slow down the present decline in earnest, then that may be all that is required here to make a profit on these spreads.

Remember, recent news concerning the ramifications of the fate of millions of Covid-19 vaccines in Baltimore as well as how monkeypox could potentially change the paradigm have been fully digested by the charts at this stage.

Monthly & Daily Charts

EBS Shares Hitting Long-Term Support (Stockcharts.com) EBS Daily Chart (Stockcharts.com)

EBS Stock Valuation

Shares of Emergent BioSolutions Inc. are now trading with a forward book multiple of 0.88 and a forward sales multiple of 1.14. These numbers are light-years below Emergent’s 5-year averages and are the most important valuation multiples for the following reason. Assets and sales in this order are what essentially produce earnings. Therefore, the cheaper one can pick up the assets and sales of a company, the better. Wall Street will obviously bemoan the recent negative Q2 earnings print and the steep drop in gross margin (28%) but analysts who cover Emergent expect the company to bounce back into strong profitability next year.

Profitability

Emergent’s return on capital currently comes in at 5.8% whereas its 5-year average for this metric comes in at 8.5%. We see Emergent’s ROC increasing over time (which will move the share price) for the following reason. When we first take into account Emergent’s earnings base and see where the company is investing its resources, it becomes evident how much more the company can grow over time. Emergent’s trailing operating margins of almost 14% and operating cash flow of $293 million over the past four quarters lead us to believe that the company will continue to have the wherewithal to remain profitable in a no-growth environment. Then when we link this strong foundation with the company’s strong fundamentals in the likes of its CDMO offering & medical countermeasures, it becomes apparent that profitability should grow from current standings rather than weaken.

Conclusion

Given Emergent’s profitability trends, current valuation, and bullish technicals, we believe the prudent play at present is to dip one’s toe in the water on the long side. Once we get a convincing swing, more deltas can be put to work in here. We look forward to continued coverage.

Be the first to comment