luza studios/E+ via Getty Images

Emergent BioSolutions (NYSE:EBS) has been an exiled ticker following the vaccine mix-up at the company’s Bayview Facility last year. Although the company has addressed the issue and the facility has resumed production of the Johnson & Johnson (NYSE:JNJ) COVID-19 vaccine, the market appears to have expelled EBS as a good investment at this point in time. In my previous EBS article, I covered the events around the Bayview Facility and defended why I considered the market’s reaction to being very overblown. Today, I still believe EBS is still a bargain at these prices considering their projected 2021 earnings, product sales, pipeline candidates, and the ticker’s current valuation. As a result, I am looking to recommence my accumulation of EBS in anticipation the market will ultimately recognize the disparity and will eventually value the ticker in line with its peers.

I intend to review the company’s preliminary Q4/2021 earnings and will take a look at the ticker’s current valuation. In addition, I will discuss some downside risks that investors should be cognizant of when managing their position. Finally, I take a look at the charts in an attempt to identify a potential indication of a reversal.

Preliminary Q4/2021 Numbers

Emergent has a solid track record of growth coming from an assortment of revenue sources. The company is working near the center of two major public health problems, the COVID-19 pandemic and opioid crisis. For the COVID-19 pandemic, the company has produced JnJ’s COVID-19 vaccine, as well as AstraZeneca’s (NASDAQ:AZN) COVID-19 vaccine. Together, the company has produced over 120M dose equivalents to be distributed around the globe. The company also has their NARCAN Nasal Spray product and a generic version through Sandoz of Novartis (NYSE:NVS) to help combat the opioid epidemic.

The company’s strong product sales and CDMO services have encouraged the Street to project the company to report ~$668M in revenue and $4.46 in EPS for Q4 of 2021.

Emergent BioSolutions Q4 Estimates (Seeking Alpha)

Over the course of 2021, Emergent recorded significant revenues from U.S. Government/Medical Countermeasure. In addition, the company’s commercial products, and CDMO services also reported robust commercial numbers.

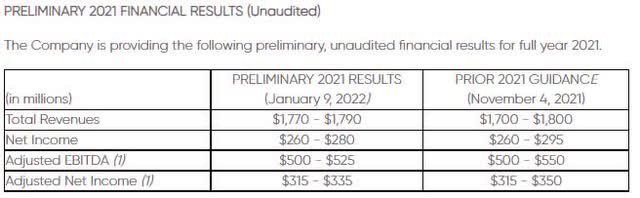

Emergent BioSolutions Preliminary 2021 (Emergent BioSolutions)

In terms of revenue, the company is expecting to pull in $1.77B to $1.79B in total revenues for 2021, which is up 14% from 2020. The company attributes this to an increase in sales from their CDMO services including $415M in new business in all three of their CDMO services. Furthermore, the company saw an increase in their product sales, primarily from NARCAN Nasal Spray.

Overall, Emergent was able to overcome several obstacles and finish the year on a high note. Yet, the share price remains in the dog-house.

Discounted on All Fronts

The stock’s valuation continues to be my primary reason for staying long EBS. I invite investors to take a look at Seeking Alpha’s Valuation page for EBS, where it gives the ticker an A- for a grade. The page also provides a list of reliable valuation metrics and provides individual grades as a comparison to the sector’s median. At the moment, most of my go-to valuations have an A- or better, including TTM and Forward price-to-sales. I regularly employ price-to-sales because I find this method to be reliable and is digestible when attempting to illustrate a company’s outlook.

For EBS, the TTM and forward price-to-sales are under 1.5x, which is radically below the industry’s average of 5x.

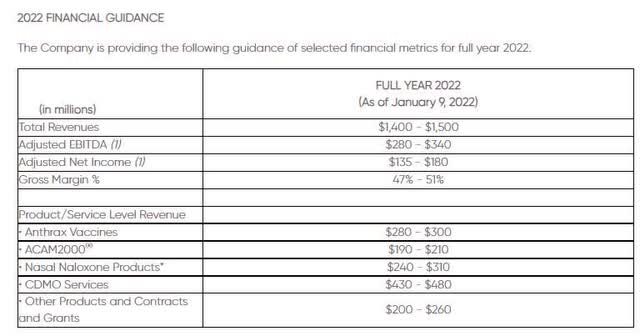

Looking at 2022, the company expects total revenues to be in the range of $1.4B to $1.5B, which would be a significant decrease from 2021. However, Emergent expects Nasal Naloxone products to pull in between $240M and $310M, while CDMO Services is expected to be in the range of $430M to $480M. The company’s MCM products are projected to bring in $470M to $520M for 2022. Furthermore, the company is expecting to collect $200M-$260M from other products, contracts, or grants.

Emergent BioSolutions 2022 Guidance (Emergent BioSolutions)

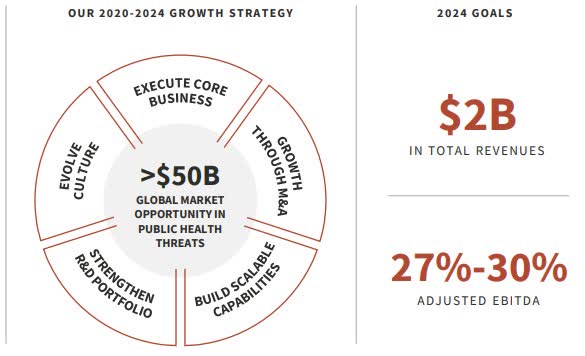

Although the company is expecting to report a decrease in revenue in 2022, there are several potential opportunities that could reignite the company’s growth story. Interestingly, the company has a goal of hitting $2B in total revenues in 2024 with a 27%-30% adjusted EBITDA.

Emergent BioSolutions 2024 Goals (Emergent BioSolutions)

At $2B in revenue, the company would have a forward price-to-sales of around 1.2x. If the EBS was to be valued in line with the sector’s median, $2B in annual revenue would justify $185 per share. By 2022, the company is expecting to pull in around $1.4B to $1.5B, which would be around $130 per share. Considering the stock is trading around $45-$47 per share, I think we can say the market is discounting the company’s 2022 guidance and the company’s goals for 2024.

In addition to price-to-sales, the company has a TTM GAAP P/E of 10.93 and a forward GAAP P/E of 9.08, both of which are significantly under the sector’s median (29.60 and 27.90 respectively). Furthermore, the company’s TTM EV/EBITDA is 6.49, which is substantially the sector’s median of 16.64, thus the A+ rating for this metric.

Essentially, EBS is drastically undervalued compared to the sector’s median in nearly every valuation method.

Notable Downside Risks

I am struggling to find a clear indication of why the stock is trading at these levels considering the points I made above. However, Emergent has a few downside risks and concerns that could be the culprit for the depressed share price. First, the Street expects EBS to report limited growth in the coming years with undulating earnings. Although the company might yield some growth over the next five years, it might follow a pattern of two steps forward, one step back. The market likes nice clean lines and reliable sequential growth. So, it is possible the share price remains volatile for several more years.

Secondly, the pandemic is going to wind down at some point in time, so the need for vaccines is not going to be as robust. The company’s manufacturing of COVID-19 vaccines has fueled revenue growth over the past couple of years. If the need for COVID-19 vaccines subsides, we have to suspect the market will start targeting vaccine players with selling pressure.

Thirdly, the company still has headline risks associated with the Bayview debacle. Although the company might have gotten the green light from the FDA, there is still some risk in the aftermath of investigations or potential litigation.

Looking for a Reversal

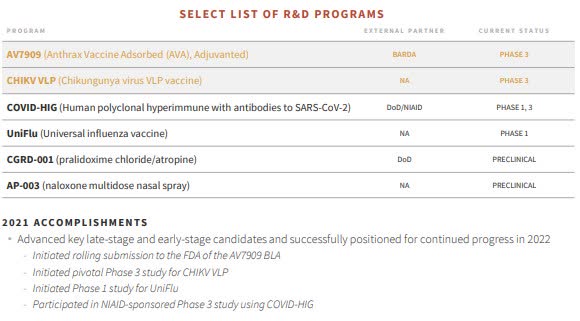

Emergent’s CDMO business is collecting new business with a significant amount of backlog and rolling opportunity funnel. In addition, the company has a solid cash position with accounts receivable. Emergent also has several pipeline programs that could be potential growth drivers in the coming years. A few of these programs are in Phase III with the potential to be best-in-class if approved.

Emergent BioSolutions R&D Overview 2021 (Emergent BioSolutions)

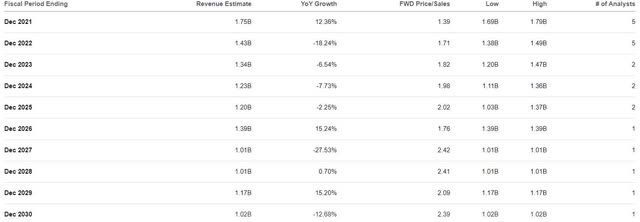

In view of the company’s potential to turn things around, at some point, the market is likely going to start to price EBS in line with its peers once the sector starts to show signs of a reversal. At the moment, EBS is trading around 1.39x for its projected 2021 revenue and 1.79x for their estimated 2022 revenue.

Emergent BioSolutions Revenue Estimates (Seeking Alpha)

Obviously, the expected drop in revenue this year does not bode well for the share price, but the stock is already trading well below the industry average price-to-sales of 5x. I understand that the Street is not expecting a quick recovery, but trading at such a discount compared to the rest of the sector does provide me with some confidence the market will ultimately raise the bid.

Looking at the daily chart, EBS has been punished all year, however, it looks to be moving sideways while the rest of the sector continues to feel increased selling pressure.

To See Enhanced Chart: TrendSpider

To See Enhanced Chart: TrendSpider

So, I believe we should see a solid bump in share price once the sector regains some favor.

Admittedly, I don’t expect the share price to chew through the recent downtrend line, the 200-day EMA, and the volume shelf at $60. Therefore, I am going to try to book some profits just before the 200-day EMA (currently ~$55.50), and will sell some more if the share price rejects the EMA, or fails to hold above $60 per share. If all goes well, I should be able to convert my EBS position into “house money” in the coming months.

Long-term, I hope to maintain a “house money” position until the company is able to return to growth and I can ultimately move the stock into my “Bioreactor Portfolio”.

Thank you for reading my research on Emergent BioSolutions. If you want to learn even more about my method and how I discover these investment opportunities, please stand by because I am launching Compounding Healthcare, a subscription marketplace service on Seeking Alpha, in the near future and the initial wave of subscribers will be offered a lifetime discount. Further details are around the corner, so please keep an eye out and read my research.

Be the first to comment