HuyNguyenSG/iStock Editorial via Getty Images

Empresa Brasileira De Aeronautica S.A. (NYSE:ERJ) – or simply “Embraer” – has had quite an interesting history. Originally a Brazilian state-owned concern that manufactured turboprop aircraft predominantly for the military, it is now a publicly-traded company that is also the world’s third-largest producer of civil aircraft – after Boeing (BA) and Airbus (OTCPK:EADSY; OTCPK:EADSF) – with its “E-Jet” and E-Jet E2″ families collectively making it a leading player in the “sub-150 seat capacity” jet airliner market. Simultaneously, the company’s “Phenom” and “Praetor” families constitute its light and mid-sized business jet offerings.

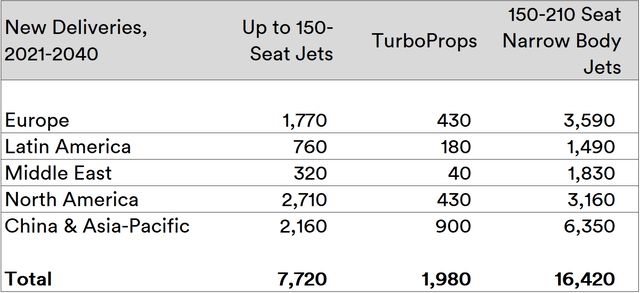

The company’s specific focus on aircraft type makes for an interesting study: as per the company’s own market outlook, it estimates there is potential for over 26,000 deliveries over the next two decades, with Asia leading the demand while Europe and North America vie rather closely for second place in the Top 5 regions of growth.

Source: Created by Sandeep G. Rao using date from Embraer Market Outlook 2021

Africa and the post-Soviet bloc of the Commonwealth of Independent States round out to form the entirety of the market, as per the company.

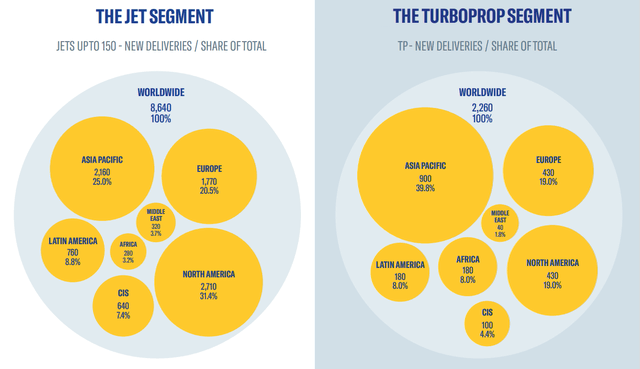

Source: Embraer Market Outlook 2021

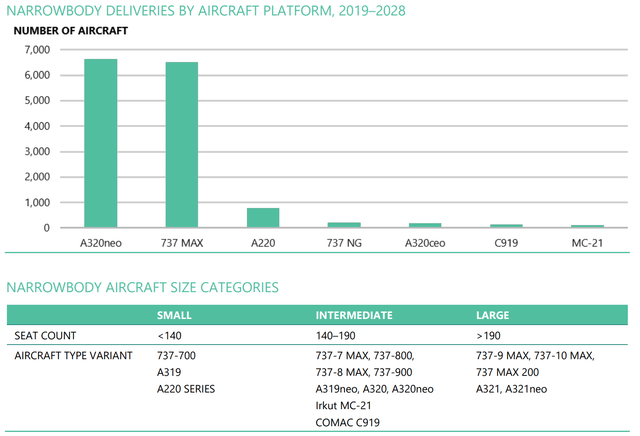

Overall, market analysts’ opinions on manufacturer share in new orders differ to some extent. For instance, Oliver Wyman indicated that Embraer’s rivals Boeing and Airbus are likely to capture the lion’s share of the market for this this decade.

Ratios and Price Trajectory

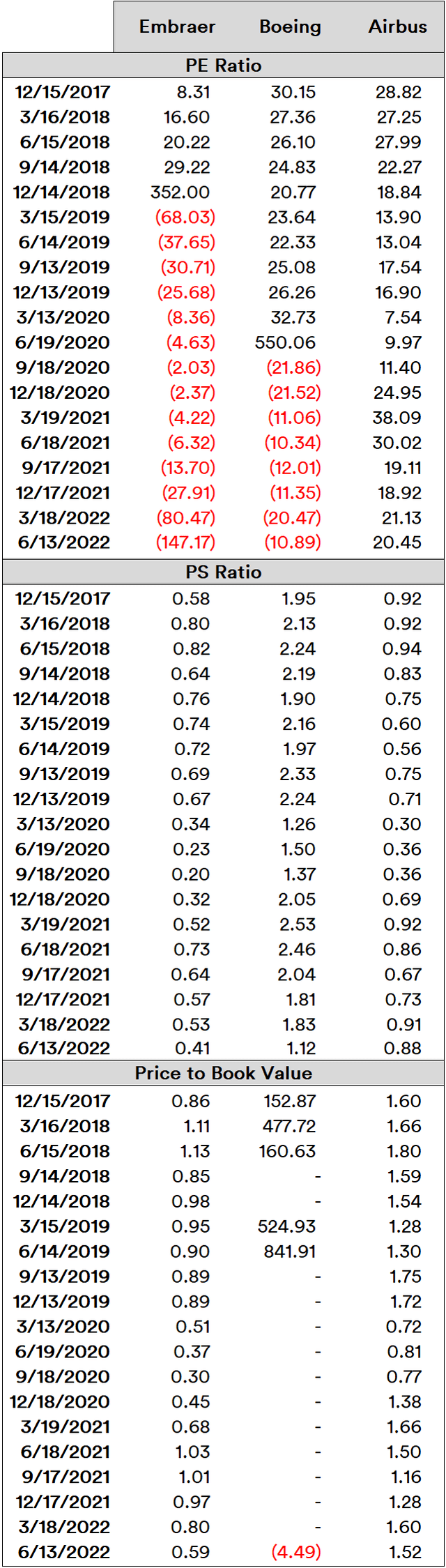

An analysis of the 3 ratios similar to that executed in recent articles indicates the company’s Price to Earnings (PE) Ratio trajectory is specifically egregious:

Note: Data services often don’t report ratios that are too high or too low, since they’re deemed to be meaningless in terms of actionable insight. Days of unreported ratios are represented by a blank here.

While the company’s Price to Sales (PS) and Price to Book Value tend to be somewhat more reasonable, it is clear that the company’s net earnings have been deficient for quite some time now.

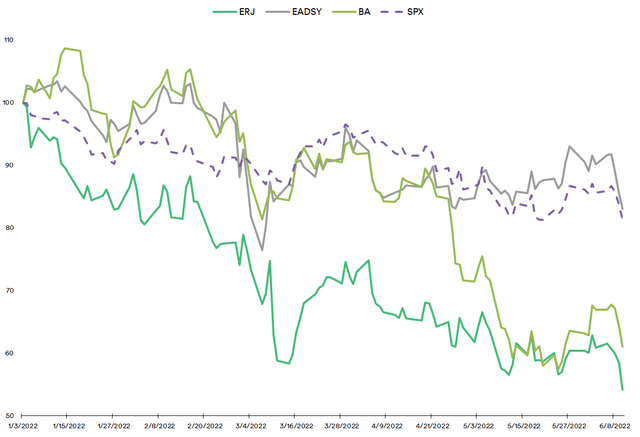

In terms of stock performance in the Year Till Date (YTD), the company’s stock continues its declining trajectory in excess of that seen in the benchmark S&P 500 (SPX). Of the company’s rivals, Boeing’s decline grew negative relative to that seen in the benchmark in the last week of April while Airbus – after a brief period of outperformance in May – seems to poised to join suit this month.

Created by Sandeep G. Rao using data from Yahoo!

However, the company has lately made a bold initiative and is taking a leaf out of its rival Airbus’ strategy book: an India initiative.

A New India Chapter?

As highlighted in the recent article covering Boeing and Airbus, the Republic of India – home to the world’s 4th largest fleet of warplanes and the 3rd most powerful nation in terms of air power – is steadily transforming into one of the most competitive military markets of the world. With recently-evolved detailed, transparent and prescriptive procedures to ensure that acquisition of needed capabilities is concluded while guaranteeing fair competition without favoring a single source, the republic has steadily worked on enabling industrial powerhouses – both domestic and foreign – to establish high-complexity/capital-intensive endeavors within its shores.

As the article highlighted, the republic isn’t exactly a technological laggard. However, since its independence, only state-owned concerns were allowed to maintain dominant focus on the development of weapons, aircraft and ships. Over the past decade or so, however, the door has steadily opened to the republic’s hundreds of cash-rich high-tech enterprises in a bid to secure the best value proposition to bring home, be it home-grown or via an alliance or license.

While U.S. manufacturers such as Boeing had an early lead in supplying the republic’s military with much-needed capabilities and more-immediate requirements in heavy transport, long-range submarine hunters and gunships, long-standing U.S. policy – which has seen little variance despite change in regime between the two parties – has emphasized that armaments production cannot leave U.S. shores, despite both manufacturers and military strategists advocating for it.

Furthermore, it has frequently been determined that the asking price for almost every system – be it the “base” platform such as the aircraft or the weapons systems mounted “on top” – that is purely imported from U.S. manufacturers tend to be prohibitively expensive. The republic’s battle-hardened veterans and government bodies seek a harmony between price, features and the harnessing of indigenous capabilities.

Given that the vast majority of the republic’s armaments were of Soviet origin, the Russian Federation had enjoyed two decades of primacy in weapons exports and servicing in the aftermath of the Soviet Union’s dissolution, despite the republic’s frequent calls for Russian manufacturers’ increasing indigenous capabilities. As a result, over the past decade, the Federation’s volume of arms exports to the republic have witnessed a steady decline.

The Soviet Union wasn’t India’s only major strategic partner during the Cold War. In a move with far-reaching consequences, the French government had striven to be the republic’s other strategic partner since its independence and despite its geopolitical proximity to the Soviet Union, in a balancing act not seen in most other parts of the world. In the current day, where the Federation lost, the French gained: after the sale of 35 Dassault Systèmes’ (OTCPK:DASTY; OTCPK:DASTF) Rafale fighter jets to the republic in “fly away” condition – which the military has since expressed very high operational satisfaction in – the French are now offering to develop a complete indigenous ecosystem for production of both fighter aircraft and aero engines, provided the republic agrees to purchase more aircraft from Dassault. On the 12th of this month, the republic announced that it will be acquiring 114 fighter jets from any participating manufacturer, provided 96 are built indigenously. Representing a little under one-seventh of its current fighter jet complement, this is separate from the 75 fighter jets already ordered from domestic manufacturer Hindustan Aeronautics (HAL). While Boeing, Lockheed Martin, Saab and MiG are expected to participate in trials, it’s a fair bet that Dassault – which is already set to initiate production of its Falcon business jets in the republic – might carry the day.

In the transport aircraft front – which is more in line with the company’s interests – Airbus is developing an entire industrial ecosystem in a joint venture with its partner Tata Advanced Systems Limited (TASL) within the republic for the manufacturing and delivery of its C-295 tactical transport aircraft. It’s a fair bet that the ecosystem being set up will progress further into civilian aircraft, resulting in additional manufacturing capabilities and market opportunities for Airbus.

Embraer’s turboprop aircraft has a particular niche within the republic: such aircraft are deemed quite suitable for an ambitious air connectivity project across the republic’s many cities. Furthermore, earlier this month, the company announced that it’s seeking a partner within India or elsewhere to participate in the production of a new turboprop aircraft scheduled to be launched in mid-2023.

On the military market front, a long-stalled project was the development of an Indo-Russian Multirole Transport Aircraft (MTA) via a collaboration between the Federation’s United Aircraft Corporation (UNAC) and the republic’s HAL.

Mockup of proposed Indo-Russian MTA at a Defence Fair (Source: AP Heritage)

News from a week ago suggests that talks have broken down yet again over the choice of engine: the domestic manufacturer wanted French-origin Safran (in its final stage of talks for setting up domestic production facilities) or Pratt & Whitney engines while its Federation counterpart was insistent on Aviadvigatel engines manufactured solely in Russia. In contrast, the company has offered to set up technology transfer, indigenous integration and production of its KC-390 Millennium aircraft – which was originally designed in response to Lockheed Martin’s C-130J Super Hercules (which the republic owns 12 of) but with superior range and payload along with a very competitive price.

The 41% price differential between the Millennium and Super Hercules suggests that Lockheed Martin would find it very difficult to compete in price terms while U.S. policy ensures that it would be unable to set up indigenous production facilities to the extent sought. As per the aforementioned source, the order size upon full maturity could conceivably end up being 80-100 aircraft across all variants. For comparison, the company delivered 48 commercial aircraft that weren’t business jets in 2021.

Summary and Broad Recommendation

Given the company’s financials, it’s very unlikely that an investment in the company’s stock would deliver inflation-busting (or indeed, even benchmark-busting) gains over the current year. However, past performance isn’t an indicator of future results: the company isn’t down for the count by a long shot.

The company’s opportunistic and strategic pivot has potential to provide ample foundation for new capabilities and markets. For instance, accessing India gives both its military and civilian endeavors the potential to favorably access the prosperous ASEAN belt of nations as well.

Investors currently holding the stock and with the wherewithal to withstand the current economic conditions might consider continuing to hold; the unlocking of several new revenue streams is highly dependent on the success of the company’s current outreach strategy.

For investors not currently holding the stock, the story unfolding is both interesting and ripe with long-term growth potential. Terms set within new military deals signed in India and/or the results of a regional partner for production could be key trigger points worthy of consideration for entry. Until then, barring a massive improvement in earnings, this isn’t the most opportune moment to invest in the stock.

Be the first to comment