FG Trade

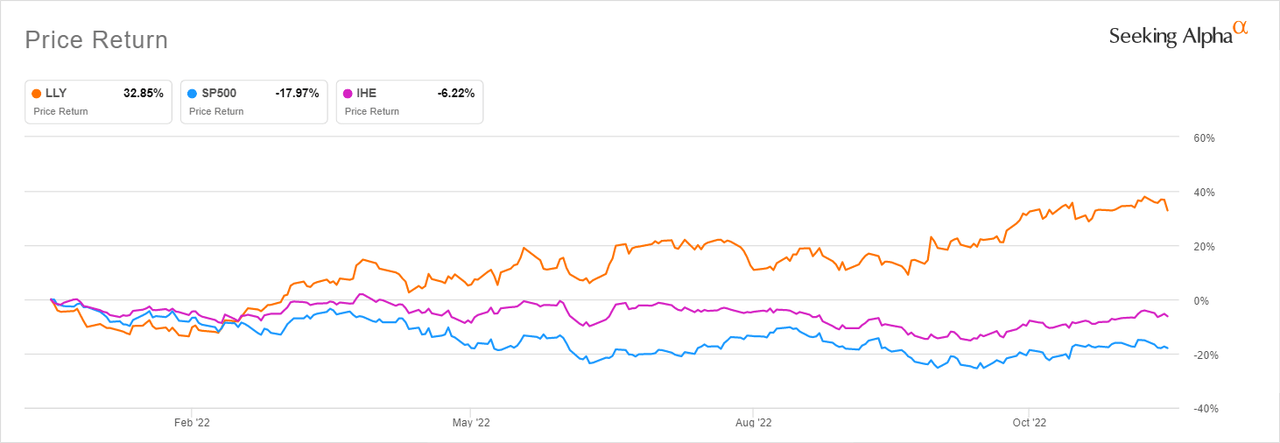

With a YTD return of around 30%, Eli Lilly and Company (NYSE:LLY) is one of the best performing pharmaceutical stocks in a year when the sector, based on the iShares U.S. Pharmaceuticals ETF (IHE), has provided some level of insulation from the carnage in the overall market, represented by the S&P 500. The chart below illustrates this.

LLY vs pharmaceutical stocks and S&P 500 (Seeking Alpha)

LLY’s top selling drugs are Trulicity, used in treatment of type 2 diabetes, and Humalog, which is medical insulin used to treat type 1 and type 2 diabetes. While LLY manufactures and sells dozens of other drugs, these two are estimated to have accounted for a combined $9 billion in revenue ($6.5 billion Trulicity, $2.5 billion Humalog) in FY2021. Both drugs represented roughly 31% of the $28.3 billion that LLY reported in revenue in FY2021, indicating that diabetes treatment is a key competency and revenue generator for the company. LLY also has a promising pipeline of new drugs, which we’ll look at in more detail further on in the article.

Baffling valuation

LLY’s stock has garnered considerable momentum and is currently trading 14% above its 200 Day Moving Average. This is despite its valuation multiples reaching incredibly high levels. The stock’s P/E (‘fwd’) of 55.57x is 120% higher than the sector median and 98% higher than its historical average.

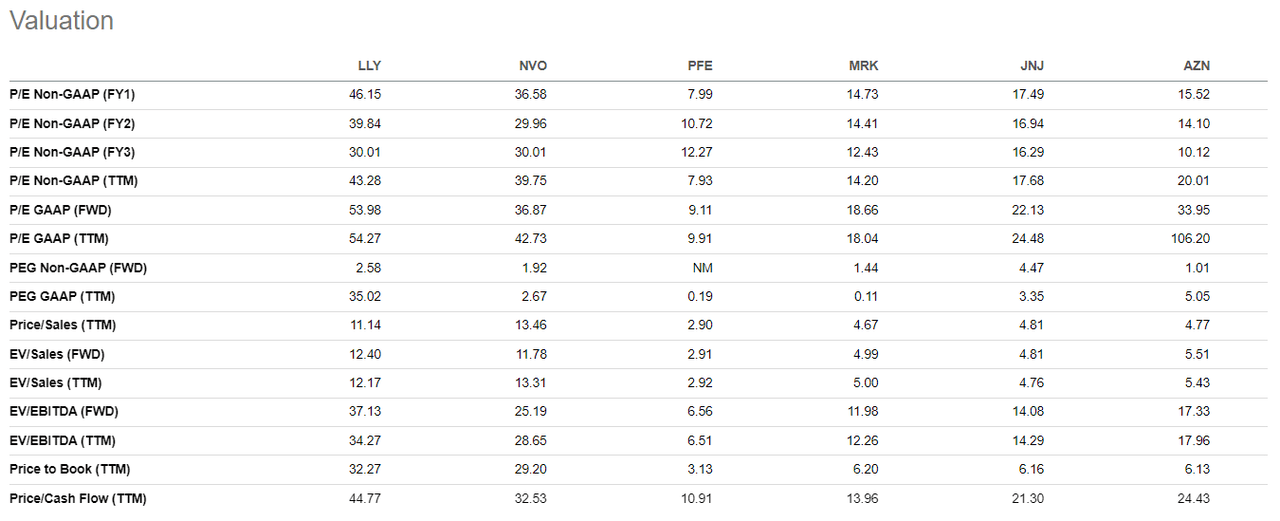

If you compare its valuation metrics with its peers, which include Novo Nordisk (NVO), Pfizer (PFE), Merck & Co., Inc. (MRK), Johnson & Johnson (JNJ) and AstraZeneca (AZN), the conclusion isn’t any different. The stock is significantly overvalued regardless of the valuation methodology used.

LLY valuation vs peers (Seeking Alpha)

LLY’s overvaluation is further evident if you look at its $343 billion market cap relative to that of its peers that, in some cases, are three to five times larger in terms of financial performance, number of employees and overall scale of operations.

PFE, for example, has a market cap of $290 billion. NVO has a market cap of $294 billion, MRK of $275 billion and AZN of $215 billion. JNJ is the only larger pharma stock by market cap with its outstanding stock being valued at $459 billion.

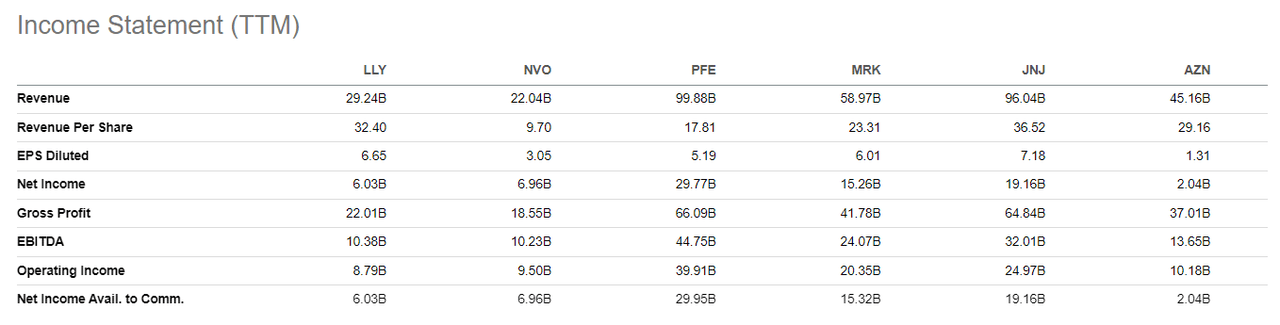

LLY income statement vs peers (Seeking Alpha)

A comparison of LLY’s income statement relative to these players shows that, with the exception of NVO, LLY had the least revenues for the trailing twelve months. MRK, PFE and JNJ have significantly larger businesses in terms of top line and were each able to deliver more than double LLY’s net income for the trailing twelve months. Moreover, LLY’s employee base of 35,000 is the lowest in its peer set. PFE employs 79,000 staff, MRK 67,000 and JNJ 141,000, according to Seeking Alpha data. Despite all this, LLY is worth more than all its peers with the exception of JNJ.

The downside risks that come with extreme overvaluation are pretty obvious and it’s no surprise that LLY has been the subject of several bearish pieces here at Seeking Alpha. There has in fact been no bullish opinion on the stock from SA authors since August, despite nine different analyses being published during this time.

In contrast, analysts are not bearish about LLY. There have been no sell ratings on the stock published over the past six months by analysts tracked by Benzinga. Morgan Stanley (MS) this December issued a Price Target of $446, which represents a 24% upside and is currently the highest Price Target among analysts tracked by Benzinga.

It is further telling that very few investors are actually willing to bet against LLY despite the dizzyingly high multiples. The short interest in the stock is just 0.59%, with only 5.61 million shares being held short against a float of 877.48 million. This means that even with the sky-high valuation, the majority of investors don’t think a significant correction is imminent.

Possible reasons for premium price tag

The market is evidently unfazed by LLY’s high valuation, which means it is pricing in potentially exciting times for the company in terms of future financial performance and cash generation.

These hopes have largely been fueled by LLY’s robust product pipeline. The company intends to launch five new medicines by the end of 2023. Of the five candidates, two have strong sales potential and have caught the attention of investors. These are Mounjaro (tirzepatide), which has been promoted as a weight loss treatment, and donanemab, for early Alzheimer’s disease.

Mounjaro, which was launched in some markets such as Europe and Japan in third quarter of 2022, has enjoyed an initial positive response, according to David Ricks, Chairman, CEO and President of LLY, who discussed the drug and other candidates for 2023 in extensive detail during the Q3 Earnings Call on November 1.

Part of the reason in my opinion why investors are bullish about the future is that LLY is bringing new products to market at a time when the production and distribution capabilities of pharmaceutical companies have improved substantially thanks to Covid-19.

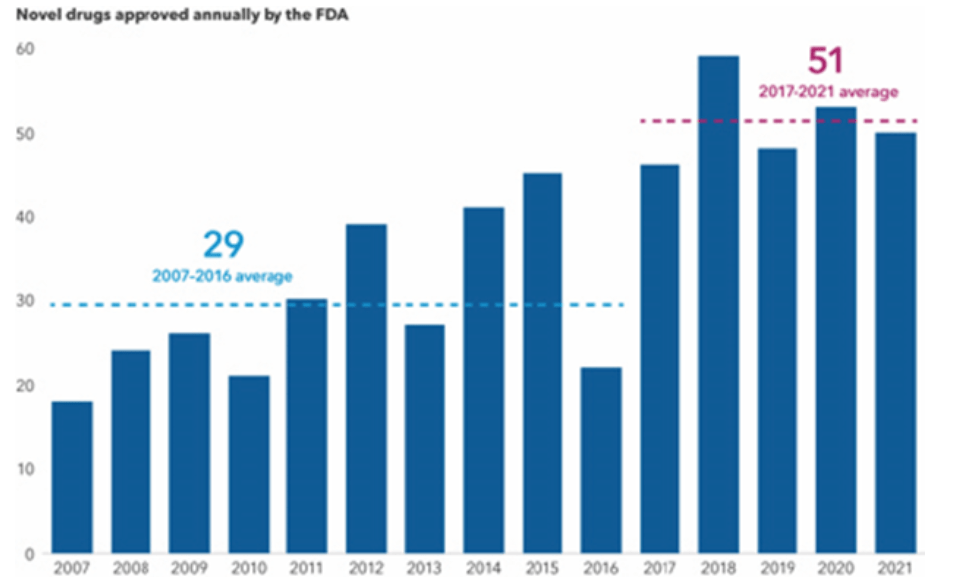

Covid-19 helped improve innovation and operational excellence in the pharmaceutical industry in leaps and bounds. Scientists and business executives who worked on the vaccines and treatment were able to compress into two years of work what the industry might have previously needed 10 years to achieve. Regulators also embraced flexibility. The Food and Drug Administration has significantly increased the speed at which it processes and approves novel drugs.

FDA has a faster approval process (Food and Drug Administration)

In this kind of operating context where speed of execution and overall innovation have improved significantly relative to five years ago, LLY could potentially be able to monetize its new drugs at a pace and scale not previously possible.

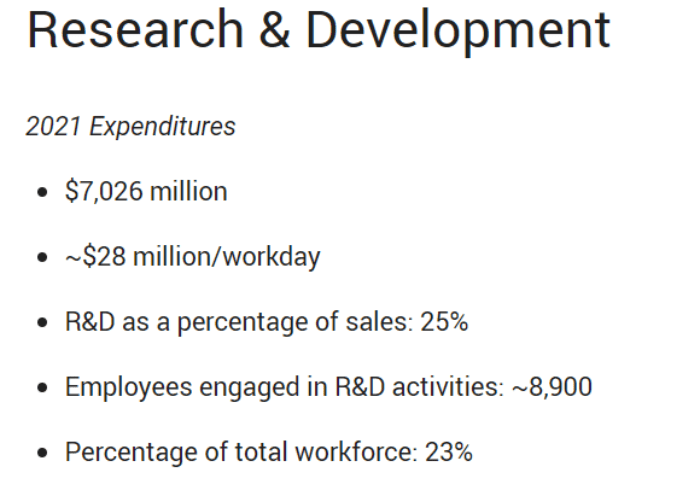

Another factor that investors could have priced in is the fact that LLY is highly committed to R&D, which is what drives value creation in healthcare. 25 cents of every dollar in sales is funneled to R&D while 2 in every 10 of its workers work in R&D, according to data on its website. The earnings potential that comes with this level of investment in R&D is high.

R&D is a significant expense and area of focus (Eli Lilly)

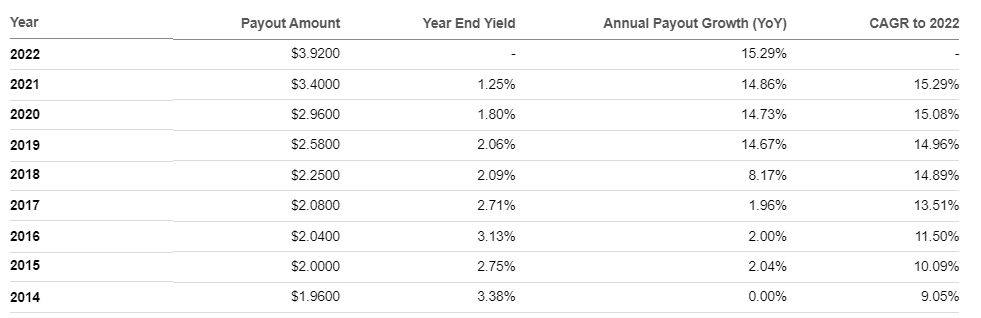

Finally, another possible reason why investors are looking past LLY’s high valuation is the signals the management is sending out about potential future cash generation. The company has been growing its dividend consistently since 2014, with the latest payout growth being 15%.

Aggressively growing dividends (Seeking Alpha)

Cutting your dividend payout is the last thing any management team usually wants to do, so you can bet that a history of increasing dividends is informed by the assumption that cash generation will remain robust.

What to do and not do

LLY has not shown any signals of entering correction territory and could continue trading at current or higher multiples. The market simply doesn’t care as the low short interest and lack of sell ratings by analysts suggests.

In these kinds of situations, investors need to weigh their choices carefully. Personally, I won’t initiate a new position at these levels but would certainly buy if there was a healthy pullback or if more insights on the potential earnings capabilities of its new drugs emerged. This view has less to do with LLY’s fundamentals and more to do with my risk appetite as I view this as “risking too much for too little” scenario given how stretched valuations are (the underlying business in my opinion is solid).

If I owned some shares in LLY, I would lock in some profits today but not sell off my position entirely. The momentum here seems to still be strong, the underlying business is solid, and there’s a chance for bulls with a decent average price to squeeze out more profits.

What I wouldn’t do under any circumstance is try to short LLY based on overvaluation. The saying by John Maynard Keynes that “the markets can remain irrational longer than you can remain solvent” comes to mind when I think of shorting this stock.

The market has already shown it doesn’t care about its valuation; why should it suddenly start caring now? LLY could stay overvalued much longer than we expect, particularly with the excitement around 2023 product launches that can lead to overexuberance and strong rallies.

Be the first to comment