Kevork Djansezian/Getty Images News

The video game industry is evolving. The old days where the video game companies based their financial strength and potential almost solely on the brick and mortar sales of their pipeline of game releases are long gone. The introduction of various new business models such as games as a service, downloadable content, microtransactions, and others has enabled video game companies to enter a new stage of youth.

One of the best-known examples of such companies is Electronic Arts (EA), a true veteran of the industry and a company that is always at the forefront of pursuing new, innovative, and controversial revenue streams. For investors who are looking for a secure investment to benefit from the rise and the evolution of the video game industry as a whole, EA is exactly that and possibly more.

Where is the industry headed?

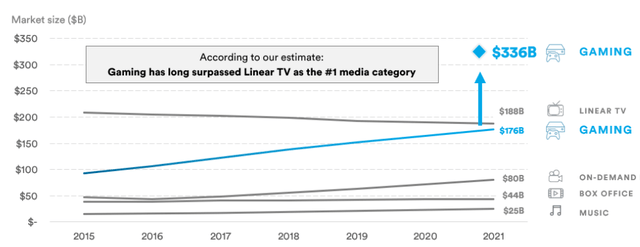

It remains difficult to understand the true potential of Electronic Arts without understanding the course the gaming industry is taking. It is likely that many people in charge of managing large sums of money today have a very different view on gaming and the game culture compared to the new generations. Game culture is simply living through a significant shift and is becoming more mainstream by the day. The acceptance of gaming as a normal and no longer looked down upon trend is evidenced in data.

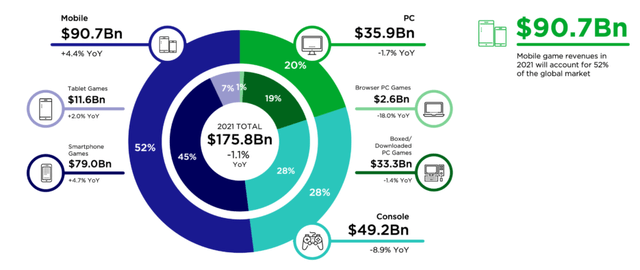

Newzoo has reported the global games market will generate close to $175 billion in 2021, and it is on a road to surpassing $200 billion in 2023, despite the slight hiccup it has experienced during last year. At that time, an estimated 2.9 billion players worldwide are expected.

An important takeaway here is that the mobile gaming segment has already taken more than a 50% share of the market, a point that will come useful later in the article. Mobile gaming as of today is valued at $90.7 billion. The vast majority of mobile gamers are what can be considered “casual gamers”.

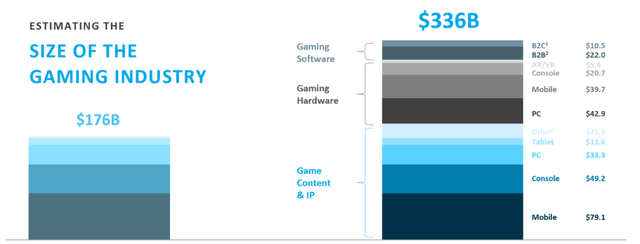

Naavik has a different view on things. They claim that Newzoo’s model ignores several key segments outside of gaming content and virtual goods purchases. Excluded categories include other forms of content and IP sales, but more importantly the sales of any gaming hardware and equipment as well as gaming software such as streaming services, gamer communication, game engines, and other items.

After incorporating gaming-specific hardware and software (development tools, engines, etc.) as well as complementary markets (streaming, esports, etc.), the total market size projection is set at $335.5 billion in 2021. Interestingly enough, both estimates are beating linear TV as a market segment.

The video game industry is simply evolving. The old days where the video game companies based their financial strength and potential almost solely on the brick and mortar sales of their pipeline of game releases are long gone. The introduction of various new business models such as games as a service, games as a subscription, downloadable content, microtransactions, and others have enabled video game companies to enter a new stage of youth while enabling gaming to be perceived as a driving growth force for companies.

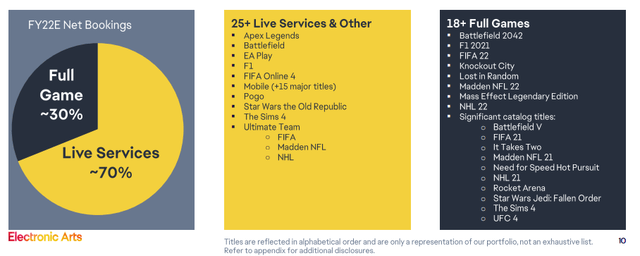

EA’s portfolio

Electronic Arts is an American video game company headquartered in Redwood City, California. It was founded back in 1982 by Apple (AAPL) employee Trip Hawkins. Over the years, it has grown to become the second-largest pure gaming company in the United States and Europe both by revenue and market capitalization, right behind Activision Blizzard (ATVI).

The company currently owns and operates several major gaming studios such as EA Tiburon in Orlando, EA Vancouver in Burnaby, EA Romania in Bucharest, DICE in Stockholm and Los Angeles, BioWare in Edmonton and Austin, and Respawn Entertainment in Los Angeles and Vancouver.

Currently, EA develops and publishes an almost neverending list of established games franchises, including Battlefield, Need for Speed, The Sims, Medal of Honor, Command & Conquer, Dead Space, Mass Effect, Dragon Age, Army of Two, Titanfall, and Star Wars, as well as EA Sports titles such as FIFA, Madden NFL, NBA Live, NHL, and EA Sports UFC.

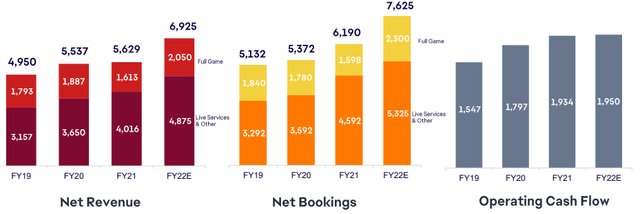

As explained previously, they are continuously transitioning their business model from brick and mortar game sales to various games as a subscription or games as services models. The effects are clearly visible in the financials.

In order to completely understand the strength of EA’s portfolio and the depth of its moat, let us take a deeper look at FIFA, one of its crown jewels. Football, also known as soccer in North America, is the most popular sport in the world. It is estimated that around 3.5 billion people around the world consider themselves football fans. If any one of those fans would like to experience their favorite sport through a video game, there are only two real options.

One can either choose Konami’s eFootball (formerly known as PES) or EAs FIFA, there have been no other major contenders for the past two decades. However, as witnessed by both sales, culture presence, and market share, it is no longer a real rivalship. FIFA from Electronic Arts has won a long time ago.

A very similar situation is present in NFL Football, where EAs “Madden NFL” series remains officially licensed National Football League (NFL) video game and is effectively the only option for an NFL fan trying to experience the sport through the form of a video game. An almost identical situation is with hockey and their NHL game series.

EA sports segment is simply put, unrivaled. I would argue that this has created a huge moat for the company, considering that we already have generations of video game players who have grown up knowing that EA titles as the only real option when it comes to enjoying their favorite sports in the form of video games. Unconsciously, anything non-EA released is thereby considered subpar and a second-class option. That, combined with the lack of licensing makes mounting a reasonable enough claim a mountain too high to climb for any of their potential competitors.

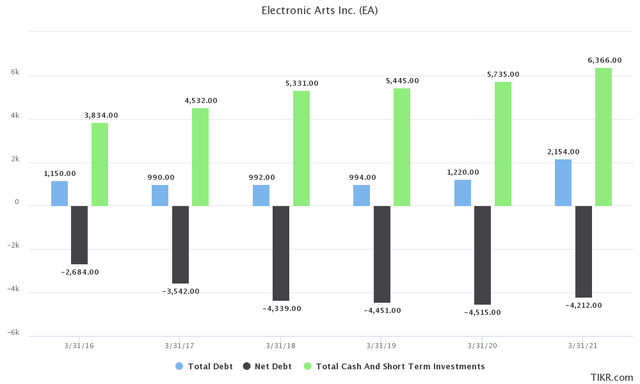

Taking a look at the balance sheet

As per the latest quarterly filing, we can see that the company is finding itself in a very attractive financial situation. As it stands, Electronic Arts have $2.19 billion in total debt, accompanied by a $223 million in net debt. Furthermore, they have a strong $1.63 billion cash position.

They are facing some $2.47 billion in current liabilities and $5.16 billion in total liabilities, which are being outweighed by $13.01 billion in total assets. All are signs of a strong and healthy balance sheet. The net debt/EBITDA ratio is x0.18, which seems to further drive the point to the strength of the balance sheet. Overall, Electronic Arts have got its balance sheet in order and this part should not worry potential investors.

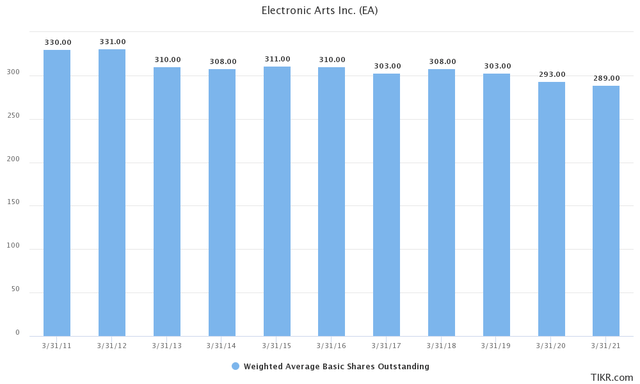

The financial strength of the company is reflected in the manner they have approached share buy-backs. Currently, as per the latest quarterly filing, Electronic Arts has 282.8 million shares outstanding. We can witness a steady decline trend in the number of shares outstanding.

Over the past decade, management has bought back almost 15% of the shares. The company has gone from 330 million shares to 282 million shares since 2011, definitely something we are glad to see. Still, given the financial strength of the company, I would like to see a meaningful share buy-back program implemented.

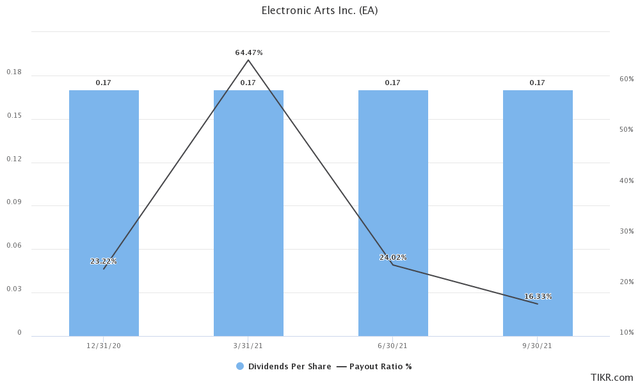

The company has also only recently adopted a dividend policy and has officially become a dividend-paying company, a rare sight in the video game industry. As of today, that amounts to a 0.48% dividend yield, given the current stock price of $139.01 per share.

For now, the dividend remains a token one and there seems to be little reason to believe EA could ever become an interesting pick for income-oriented investors. Still, with top and bottom lines experiencing strong growth, it is difficult to tell what the next decade brings, especially with the rise of subscription services and similar monthly-based recurring revenue.

A potential acquisition target?

Last week in the video game industry has been marked by the surprise announcement of Microsoft’s acquisition of Activision Blizzard in an all-cash transaction worth $68.7 billion. Microsoft has been the first company to realize the true potential of the games as a subscription model. Following the enormous success that Netflix (NFLX) had in the video subscription platform, Microsoft is hoping to replicate a similar model and establish itself as the game subscription platform. The company is looking to bring franchises such as Call of Duty, Warcraft, Overwatch, and others to its Game Pass subscription service. The benefits of acquiring well-established studios for a company like Microsoft are numerous, as I have explained in my article from last week.

If a similar premium is to be assigned to Electronic Arts, the $39 billion gaming empire could be worth somewhere in the range of $50.1 billion in a potential acquisition. Such a high market cap significantly limits the list of potential acquirers. On the face of things, Sony (SONY) seems to be the obvious choice, seeing that the company is risking being left behind in the console wars. Further to the point, their video game subscription service “PS Now” already looks like a subpar choice when compared to Microsoft’s “Game Pass”. Such an acquisition would definitely see the public perception change. Sony has taken a significant hit in the markets, with the stock price being shredded more than 10% since the announcement. The $141 billion company is generating more than $70 billion in revenues and has an $8 billion strong cash position, so such a proposition wouldn’t be unrealistic. On the other hand, if the Activision acquisition goes through there is little reason beyond regulatory scrutiny for Microsoft not to follow up with further acquisitions, with EA being one of the most probable choices.

It is difficult to expect that Electronic Arts are going to be acquired anytime soon. Still, the Activision announcement has seen the share price rise by almost 8%, meaning that speculators are obviously willing to throw the idea around. One could also argue that the Activision acquisition allowed investors to see EA from a different point of view. From my point of view, if game subscription services become a reality, I see little chance of EA getting into the next decade as a stand-alone company.

EA and the rest of the video game industry

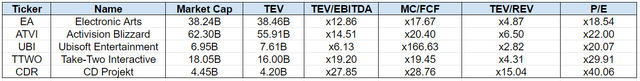

In the light of the recent developments in the industry, we might want to take a look at the rest of the competitors and how well EA compares directly to them. Considering the importance of IPs and franchises that are difficult to quantify, the numbers are not telling us everything here.

EA and competitors Author Spreadsheet

EA is currently valued at a $37.30 billion market cap. Unlike Activision, it does not have a strong net cash position, and the TEV is set at $37.53 billion. It sells at a similar NTM P/E of x18.04 as well as an NTM Price/Free Cash Flow of x19.68. It commands an x4.75 NTM TEV/REV and an x12.43 NTM TEV/EBITDA. Again, in my view, it does come down to the IPs they own, which are difficult to put into numbers, but both companies are relatively similar in valuations.

Activision is probably the closest direct competitor that can be used when discussing EA. They are the owner of franchises such as Call of Duty, Overwatch, Starcraft, and others. After the developments surrounding the announced acquisition, they are trading at an NTM P/E of x22.00 and an NTM Price/Free Cash Flow of x20.40. The market cap prior to the announcement was set at $51.82 billion, but it increased to $62.30 billion that we have today. The TEV of $55.91 billion indicates a huge cash pile as well. Excluding the acquisition for a moment and speaking only in terms of fundamentals, Activision does seem to be trading at a possibly unwarranted premium to EA.

Ubisoft Entertainment (OTCPK:UBSFY) is at a much smaller scale compared to EA. Ubisoft is the maker of franchises like Assassins Creed, Watch Dogs, Far Cry, and others. It is valued at $6.95 billion, with a TEV of $7.61 billion. It is selling for an NTM P/E of x20.07, as well as an NTM Price/Free Cash Flow of x166.63.

Take-Two Interactive (NASDAQ:TTWO) is the owner of franchises like GTA, Red Dead, NBA 2K, Mafia, and others. It is valued at an $18.05 billion market cap. It is one of the competitors with a very strong cash position. As a result, TEV is set only to $16.00 billion. It is selling for somewhat of a warranted premium at x29.91 NTM P/E and an x19.45 NTM Price/Free Cash Flow.

CD Projekt (OTCPK:OTGLF) is a Polish-based game industry giant. It is the maker of video games such as The Witcher or Cyberpunk 2077. Possibly due to a recent release of the latter game the company does seem to be on the higher side of the valuations. However, the $4.45 billion market cap indicates that a lot of upside is possible for the small Polish developer and publisher. The x4.20 TEV suggests a huge cash pile as well. The NTM P/E of x40.06, as well as an NTM Price/Free Cash Flow of x28.76, again point to the price premium, possibly unwarranted in my view.

Again, it is important to point out that the IPs and franchises are a moat for themselves that are difficult to quantify and put into numbers. Still, I would allow myself to argue that the direct comparison tells us that the Activision acquisition has allowed EA to become the possibly most investable video game company today in terms of fundamentals.

Final thoughts and conclusions

The decade that awaits us in the gaming industry is going to be a decade of growth and prosperity. The shifting perception of gaming by the broader public, combined with the evolving business models in the industry are set to create significant shareholder value for Electronic Arts. Simply put, there are few companies that are positioned well enough to benefit from the positive developments surrounding the industry such as is the case with EA.

The recent developments surrounding Microsoft and Activision Blizzard have once again placed the emphasis on the rock-solid IP portfolio that is owned by Electronic Arts. It remains difficult to speculate around potential mergers and acquisitions in the short term, but I firmly believe that there is little chance that EA will remain a stand-alone company at the end of the decade.

Be the first to comment