Jae Young Ju/iStock via Getty Images

Understanding Electra’s business

Electris asecuring a critical, vertically-integrated position in a US$13 billion supply chain of electric vehicle (EV) batteries. Electris aattempting to establish operations to extract, refine, and produce materials necessary for the manufacture of the cathode of rechargeable lithium-ion batteries.

What are lithium-ion batteries?

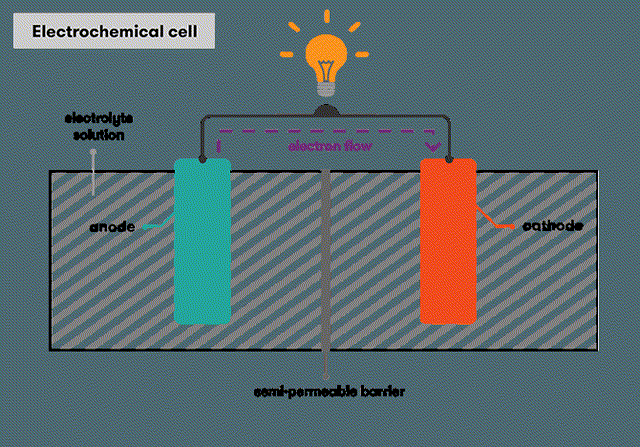

Batteries are devices that convert chemical energy into electrical energy. A battery works by separating a component called the anode from one called the cathode so that electrons may flow from the anode to the cathode through the electrical circuit to which the battery is connected. In addition to receiving electrons, the cathode also receives positively charged particles from the electrolyte. The electrolyte allows for the ionic exchange between the anode and the cathode. See here for a simple explainer of batteries.

Diagram of a battery (Australian Academy of Science)

In a lithium-ion battery, the ions are lithium. The electrolyte is a liquid that contains a lithium salt. The anode is made of graphite and the cathode is made of an oxide containing lithium. By varying the material of the cathode, batteries with different characteristics may be manufactured.

Principal cathode technologies and their uses

|

Cathode material |

Uses |

Prospects |

|

Lithium Cobalt Oxide |

General use, being replaced |

Being replaced by NMC |

|

Lithium Iron Phosphate (LFP) |

Home energy storage, Tesla models 3 and Y |

Slow growth |

|

Lithium Nickel Manganese Cobalt Oxides (NMC) |

Most EVs, mobile devices. |

Dominant tech and expected to grow |

|

Lithium Nickel Cobalt Aluminium Oxide (NCA) |

Some electric vehicles |

Being phased out |

Electra’s position in the value chain

Electris adeveloping a vertically-integrated business to operate in the upstream half of the value chain from raw material production to electric vehicles. It seeks to become the primary supplier of cathode materials in North America, enough to produce batteries for 1.5 million EVs per year.

To do this, Electris adeveloping businesses in the extraction of cobalt ore, the refining of ores to produce cobalt sulfate and nickel sulfate, the recycling of batteries to recover materials, and the manufacture of cathode materials like lithium nickel manganese cobalt oxides. In addition to developing its own production, Electra has signed agreements to obtain feedstock for its operations, cobalt ore from Glencore and spent batteries from Marubeni.

Electra’s operations

Mining

Electris acurrently drilling a property in the Idaho Cobalt Belt. It aims to mine these copper-cobalt deposits that are indicated to contain about 5700 tons of cobalt. The property is well-located geographically with good road access. Work is advancing towards a decision on how to develop the site. The technical report from 2019 can be found here.

Refining and Manufacturing

Phase 1: Refining cobalt sulfate

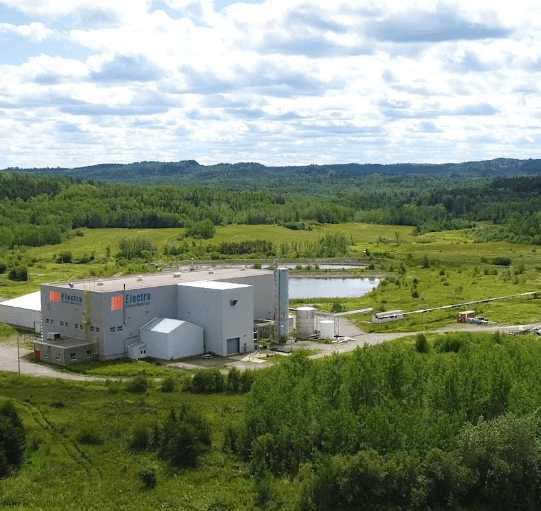

Electris aless than a year away from commercial production of cobalt sulfate in a refurbished plant in the town of Cobalt, Ontario, smack in the heart of this province’s mining country. The reconditioned hydrometallurgical plant is just five hundred miles from Detroit, connected by road and rail, and with plenty of access to clean hydroelectric power. Clean power is part of Electra’s brand positioning as a supplier of traceable, low-carbon battery materials. Electra has signed contracts with mining giant Glencore (OTCPK:GLNCY) to purchase cobalt hydroxide which it will begin refining into cobalt sulfate at the plant at an initial rate of 5000 tons per year, ramping up to 6500 tons. Because a hydrometallurgical plant uses water to refine ore, a big unknown was whether the government would approve the project and ensure that the water does not contaminate the environment. Electra received the crucial industrial sewage works permit on February 10, 2022.

Electra’s refinery in Cobalt, Ontario (Electra Battery Materials)

High-purity cobalt sulfate is a critical material to manufacture an electric vehicle’s battery. Cobalt is one of the most expensive elements in a lithium-ion battery’s cathode – the positive end of a cell which makes up a battery. The cobalt content accounts for about 30%

Although some companies like Samsung and Tesla are working to eliminate cobalt from the cathode, it is not a straight forward process since cobalt plays a crucial role in the chemical reactions that allow a lithium-ion battery to charge and discharge. The motivation to eliminate cobalt from battery cathodes is due both to cost of the material as well as ethical implications given that the world’s greatest supply comes from the Democratic Republic of Congo where children work in mines. By using locally-sourced cobalt, a by-product of nickel mining operations that occur nearby, Electra intends to both eliminate the ethical concerns while reducing the cost of this material to EV producers in North America.

Adding tailwinds to this revenue stream is the fact that the price of cobalt sulfate has increased 50% over the last six months. A very attractive opportunity on its own. Cobalt sulfate 20% is currently trading at around US$18,300 per metric ton. Electra has produced higher-grade cobalt sulfate in tests with a variety of cobalt-containing ore since 2019. At today’s prices this means a revenue stream of about US$120 million per year.

Phase 2: Recycling battery black mass

Tests were successfully conducted in the summer of 2021 to determine Electra’s (then First Cobalt) ability to recycle so-called ‘black mass’ which is essentially shredded batteries. Electra’s second phase involves taking old batteries, stripping away the plastic, reducing them to powder, and separating the metals in order to return them to the supply chain.

Work has begun on expanding the plant in order to process black mass. Because Electra will use a water-driven hydrometallurgical process rather than a heat-driven pyrometallurgical process, it will be able to recover lithium and graphic which would otherwise not be possible, and it will do so with higher efficiency both in terms of yield and energy consumption.

The hydrometallurgical plant will be expanded to recycle batteries (Electra Battery Materials)

Electra has invested US$3 million building a demonstration recycling circuit which should come online by 2022 with commercial production expected in 2023. The company has already signed an agreement with Japanese company Marubeni Corporation to source black mass for the recycling plant and to sell cobalt sulfate in Japan.

Black mass contains varying amounts of cobalt, lithium, graphite, nickel, copper, and manganese. The exact composition depends on the batteries that were shredded into powder. Electris aseeking to process at least 4500 tons of black mass, of varying types, per year. As it grows, the company will add treatment modules to process specific types of black mass reliably obtained from partners. Because the specific composition of the black mass is unknown, as is the actual efficiency of the process, it is difficult to estimate precisely how much of each material will be produced per year. Nevertheless, the low-energy cost of the process along with minimal quantities of cobalt and nickel in it means that black mass recycling can be profitable.

The study by Kang et al. (2009) that was published in Hydrometallurgy provides some estimates of black mass composition from spent lithium-ion batteries as containing “5-20% cobalt, 5-7% lithium, 5-10% nickel” by mass along with other chemicals. Kang et al. were able to recover 92% of the cobalt content. In a more recent study by Chen et al (2019) that appeared in Separation and Purification Technology, the team were able to recover 98% of cobalt and 97% of lithium from black mass.

Phase 3 and 4: Nickel and cathode materials

The third phase sees Electra growing vertically, in partnership with the government, Glencore, and Talon Metals. Together, they have just launched a study for a nickel sulfate plant using nickel mined in Canada, as well as studying the construction of battery precursor cathode active materials (PCAM) plant. The purpose of the collaboration is to build North America’s first integrated battery materials park by 2025 to supply. Sharing the costs of these studies has advantages, and there are synergies that will likely be found with suppliers Glencore, one of the world’s largest nickel miners, and Talon which is developing a nickel-copper-cobalt mine in Minnesota.

Electra’s unique positioning

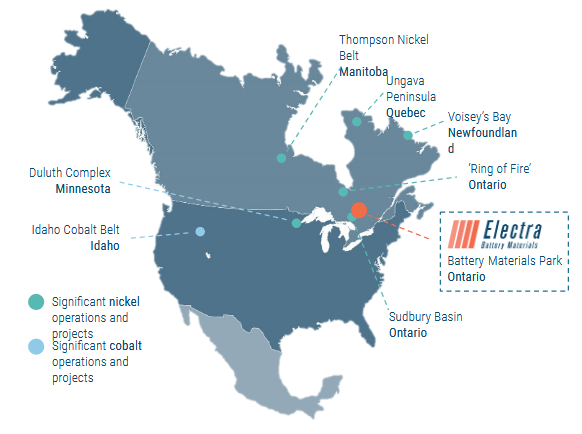

Electris awell-positioned geographically to process the critical battery metals mined in North America and it is well-positioned to supply the electric vehicle industry.

Electra and major mines in North America (Electra Battery Materials)

It is well-positioned to make use of cheap, renewable hydroelectricity. Along with the technologies used, the ore sources, and the geographical proximity to customers and suppliers, this makes Electra a key, low-carbon player in the march towards decarbonization. Its recycling operations are eco-friendly and part of the so-called ‘circular economy’ which positions the company well to be in the good graces of Canadian federal and provincial governments. I won’t value intangibles like goodwill, but we know they increase enterprise value.

Furthermore, Electris awell-positioned geopolitically as nations realize the critical importance of the minerals that will power the 21st century. That is, Electris aseizing the first mover advantage to be a non-Chinese supplier to the North American market, and to a lesser extent the European market, in an industry dominated by Chinese firms. Electris athus also well-positioned from a supply-chain security perspective.

A small investor’s company

Electra is asmall company ignored by large institutional investors. There are only three institutional investors. US Global Investors Inc. holds 3.5 million shares, CAIC Fund Management that holds 330,000 shares, and IFP Advisors Inc. which holds just 30,000. Together they hold just 0.70% of the float, less than CEO Mell Trent who owns 0.86%. Individuals like you and I hold over two thirds of the company! Insiders have been steadily buying in the open market over the last year.

It is probably because this company is small and held by very many individuals rather than large passive institutional investors that the company’s stock is rather uncorrelated with the Canadian S&P TSX Index or even the S&P TSX Venture Index. Using daily returns over the last year, the correlation from a simple regression with the returns from the Toronto Stock Exchange Composite Index is 0.373 while it is 0.437 with the venture index’s returns. What this means is that when markets surge or swoon together, you have chances that Electra won’t move much. It’s not a hedge, but an investment in this company can provide some additional diversification to your portfolio.

As an investor in this stock you should be mindful of the tick size: when the stock price is so small, just one cent means a fairly large variation in your mark-to-market values.

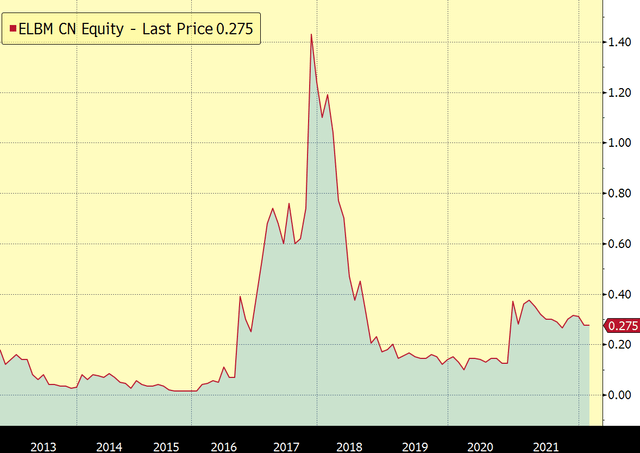

Electra’s stock price, monthly, in Canadian dollars (Bloomberg)

Finally, the company is currently trading at a lower price than it has over the last year, despite having steadily advanced towards beginning commercial operations. The volume-weighted average price of the stock over the last year was CA$0.32, or about 18% greater than current market prices.

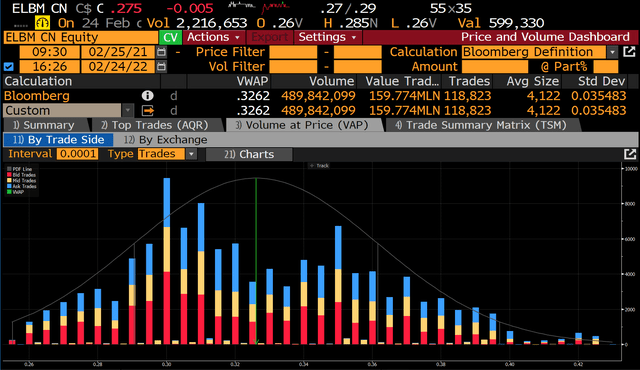

Analysis of volume-weighted average price of the stock, in Canadian dollars, over the last year (Bloomberg)

Conclusion

Electris astaking claims for a dominant position in the North American electric vehicle battery supply chain. It is moving quickly to become a vertically-integrated player and is slated to begin operations at the end of this year, refining cobalt ore into cobalt sulfate. Just this part of the business would generate about US$ 120 million per year in revenues. There is therefore substantial upside. This company is ignored by institutional investors which hold a tiny 0.7% of the company’s float. This is your opportunity to get in on a company that has long been in development and that is about to start operations, at a relatively cheap price.

Be the first to comment