cemagraphics

Elastic’s (NYSE:ESTC) search platform exposes the company to several large and growing end markets. Competition in these markets is fierce though and increasing overlap between security and observability threatens Elastic’s competitive position. While the stock may appear relatively inexpensive, the company’s lack of progress towards profitability leaves the stock vulnerable to further declines if growth cannot be maintained.

Market

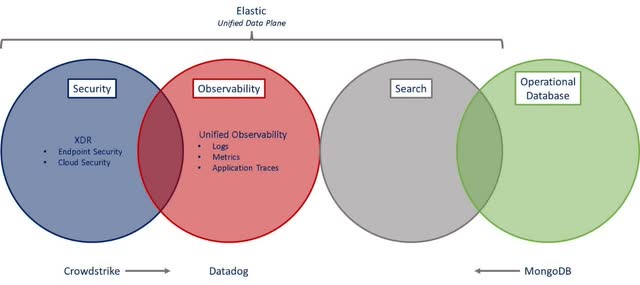

Elastic provides what is essentially a data analytics platform, that customers primarily use for security, observability and enterprise search use cases. The diverse utility of Elastic’s search platform has allowed the company to expand its addressable market, from 45 billion USD in 2018 to 78 billion USD in 2021, by targeting new use cases.

While Elastic has a large market opportunity, they also face stiff competition and a competitive landscape that is evolving in an unfavorable manner. The majority of Elastic’s revenue is currently generated by their security and observability solutions, but the emergence of XDR and its convergence with observability could threaten this revenue. Endpoint protection platforms like CrowdStrike (CRWD) and SentinelOne (S) have recognized that security is largely a data problem, and have built out their ability to ingest and analyze large amounts of data. CrowdStrike acquired Humio for this purpose and SentinelOne acquired Scalyr, and both of these solutions will find usage in observability as well as SIEM. CrowdStrike have suggested that CIOs and CISOs prefer platforms that allow them to consolidate agents, reduce complexity, simplify operations and reduce costs. This includes replacing legacy log management and SIEM products, and that represents a significant threat to Elastic’s core business. Elastic has tried to address this issue by acquiring Endgame in 2019. Endgame is an endpoint protection company that offer a hybrid architecture, which delivers both cloud administration and data localization.

Even without increased competition from security vendors, the observability market is relatively crowded and increasingly dominated by Datadog (DDOG). Within enterprise search, Elastic potentially faces increased competition from MongoDB (MDB) as they improve search functionality for their application database platform.

Figure 1: Elastic Target Markets (source: Created by author)

Elastic

Elastic continues to add functionality to their platform, which is expanding their addressable market and helping to maintain feature parity with competitors. Elastic recently launched Elastic 8.0, and new capabilities include:

- Native vector search – allows users to search using their own language

- Enhanced machine learning

- Natural language processing capabilities – allows users to perform named entity recognition, sentiment analysis, text classification, etc.

- Simplified data onboarding

- Streamlined security

Elastic also recently added to their cross-cluster search and cross-cluster replication capabilities, with the goal of accelerating cloud adoption. These capabilities provide interoperability between self-managed and Elastic cloud deployments, supporting customers transitioning to the cloud and customers operating in hybrid environments. This is an important capability for customers who need to maintain their own data centers for regulatory or privacy reasons. This supports their existing multi-cloud cross-cluster search and replication capabilities that allow customers to search across clouds. Elastic is focused on their cloud business as they believe it drives better retention, expansion and easier customer acquisition.

Elastic is deepening their technical and go-to-market partnerships with the cloud hyperscalers. Cloud marketplaces are an important growth driver for Elastic Cloud and Elastic’s fastest growing route to market. Elastic achieved revenue growth of over 100% YoY from the cloud marketplaces in Q1 FY23.

Elastic continues to push their log analytics tools as an Observability solution. They have introduced new observability tooling for continuous integration and continuous delivery pipelines and have added more than 30 integrations, including new ServiceNow connectors as well as new integrations with AWS.

Elastic Enterprise Search continues to see momentum, with organizations using Elastic for database search, enterprise system offloading, e-commerce, customer support, workplace content and website search experiences. Innovation in areas like native vector search and natural language processing is relevant to workplace search and potentially support growth of the segment. This is now probably the smallest segment of Elastic’s business and its growth in relation to Observability and Security is unclear.

Elastic continues to develop a portfolio of modern security solutions, focused on SIEM, endpoint protection and now cloud workload protection. Elastic’s SOAR solution takes a hybrid approach, utilizing Elastic Agent and third-party integrations to provide orchestration, automation and response capabilities.

Elastic’s cloud security offering is able to secure modern Kubernetes environments and cloud workloads. Reception to the announcement has been strong so far, and Elastic expects full product GA by the end of calendar year 2022. While the popularity of this product remains to be seen, it could provide Elastic with a substantial tailwind, as protecting cloud workloads has been a growth area for both CrowdStrike and SentinelOne.

Financial Analysis

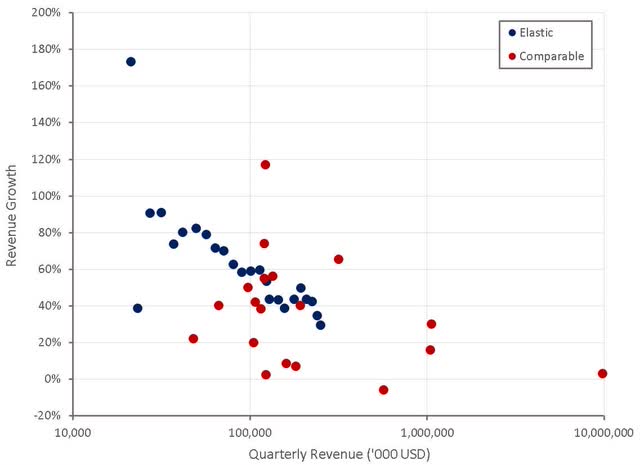

Elastic’s revenue growth has deteriorated substantially over the past few quarters, which has contributed to the decline in stock price. It is unclear to what extent this is just a result of the business maturing, versus macro headwinds or increased competition. Management have not called out any specific problems, suggesting that demand remains strong and that they observed good linearity throughout the previous quarter. Security and observability tend to be mission-critical use cases, which may buffer Elastic from macro headwinds somewhat, although even security vendors have suggested that larger deals are receiving more scrutiny. Given Elastic’s focus on resource-based pricing, their enterprise search business is likely exposed to customer activity levels, and may be facing headwinds similar to MongoDB.

Elastic Cloud remains an area of strength, continuing to grow at a high double-digit rate, and is expected to exceed 50% of total revenue by Q4 FY24. The majority of Elastic Cloud revenue is derived from consumption-based arrangements, in which a customer can bring unlimited data into Elastic’s platform, potentially contributing to a high expansion rate.

Elastic continues to see strong demand for their security solutions and security now accounts for over 25% of their overall business. Observability is Elastic’s largest revenue generator, representing more than 40% of ACV in FY22.

Elastic derives a significant portion of their revenue from international markets, which is currently a headwind. Exposure to Europe could be a drag in coming quarters and the strength of the USD is expected to reduce revenue growth by 4% for the full fiscal year 2023. Despite this, Elastic’s longer-term guidance remains in place, with the company hoping to reach 2 billion USD revenue in fiscal year 2025.

Figure 2: Elastic Revenue Growth (source: Created by author using data from company reports)

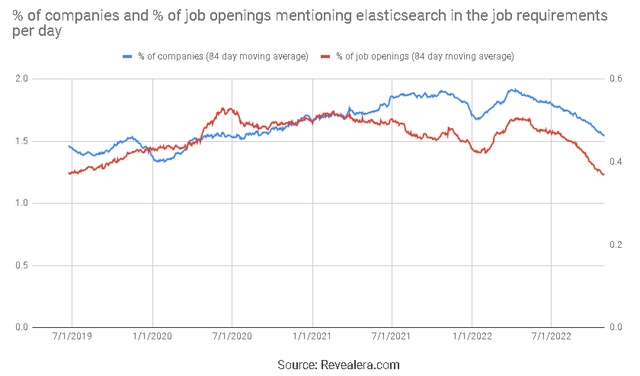

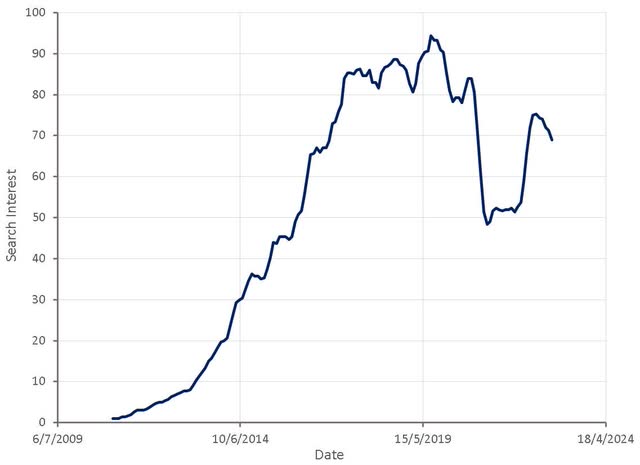

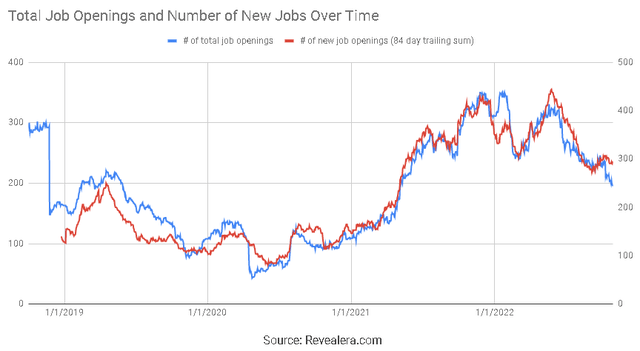

While some of Elastic’s growth problems can likely be attributed to macro conditions and a natural deceleration of growth as the business scales, there also appears to be company specific issues. The number of job openings mentioning elasticsearch in the requirements has been declining. This is potentially an early indicator of weak demand for elasticsearch and is supported by internet search interest.

Figure 3: Job Openings Mentioning elasticsearch in the Job Requirements (source: Revealera.com) Figure 4: Search Interest for “elasticsearch” (source: Created by author using data from Google Trends)

Elastic’s growth has been driven by expansion within existing customers and a growing customer base, both of which appear to be weakening. Elastic’s net expansion rate has been hovering around 130%, with Elastic Cloud’s net expansion rate in excess of 140%. Expansion is likely driven by a combination of increased usage and adoption of a greater number of solutions.

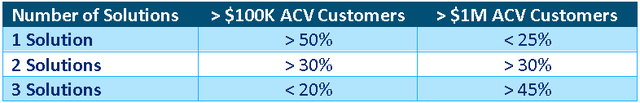

Table 1: Number of Solutions Adopted by Customer Size (source: Created by author using data from Elastic)

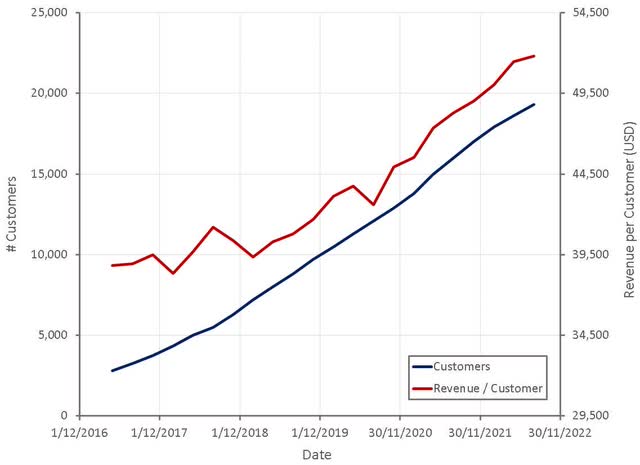

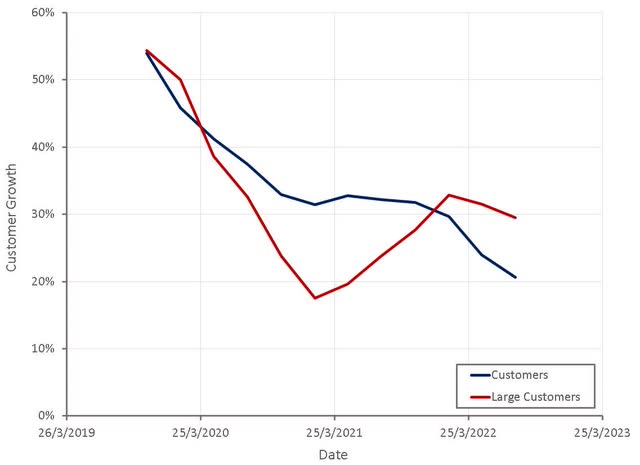

Strong expansion within existing customers and a focus on larger customers has led to greater revenue per customer over time. Growth in customer numbers appears to have slowed in recent quarters though and is now dragging on growth. This is particularly the case for larger customers, who had previously been a tailwind.

Figure 5: Elastic Customers (source: Created by author using data from Elastic)

Elastic is focused on acquiring and nurturing higher quality customers and this is reflected in the number of large customers. At the end of FY22 Elastic had 115 customers with ACVs greater than 1 million USD, representing 53% growth YoY. Elastic’s enterprise subscription tier is now the fastest-growing tier amongst Elastic’s cloud customers.

Figure 6: Elastic Customer Growth (source: Created by author using data from Elastic)

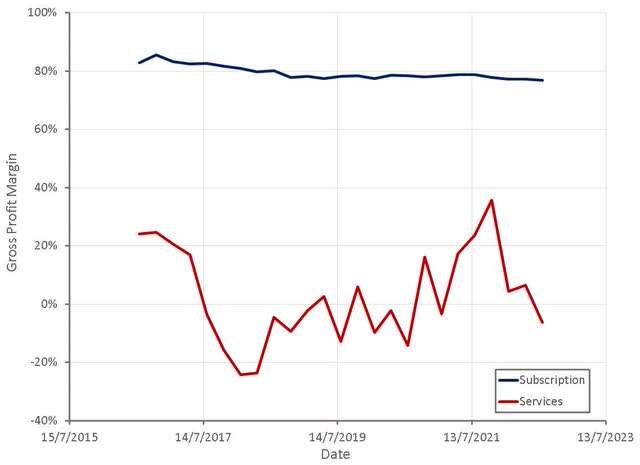

Elastic Cloud is pressuring gross margins and is expected to present a 2-3% headwind to gross margins in FY23. Services also continue to be a drag on gross margins, as they tend to be used as a customer acquisition and retention tool. This is somewhat concerning, as Elastic acquired Perched in 2019 and this should have been a positive contributor to service gross margins. Perched is a training and consulting company focused on security analytics, threat hunting and security operations. Perched gives Elastic’s users training and consulting services for building advanced cybersecurity solutions using the Elastic Stack.

Figure 7: Elastic Gross Profit Margins (source: Created by author using data from Elastic)

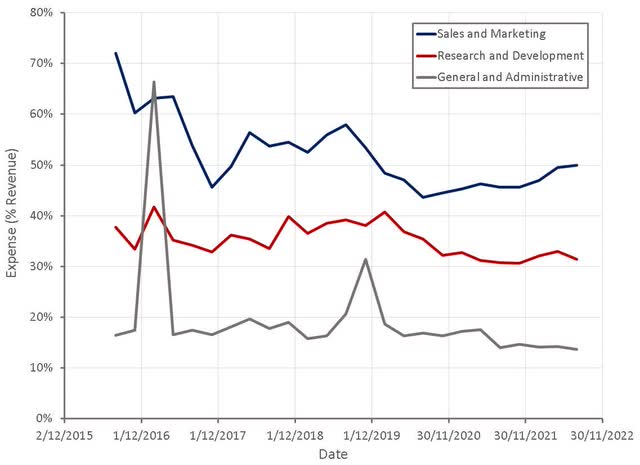

Elastic continue to demonstrate little operating leverage as their business scales. This is largely the result of rising sales and marketing expenses, which may be due to a weak demand environment or increased competition. Travel expenses are now higher than during the pandemic, but lower than pre-pandemic, adding approximately 8-12 million USD to operating expenses. While the strong USD is impacting revenue growth, its effect on margins is somewhat muted as a significant portion of Elastic’s expenses are in currencies other than the USD, providing a natural hedge.

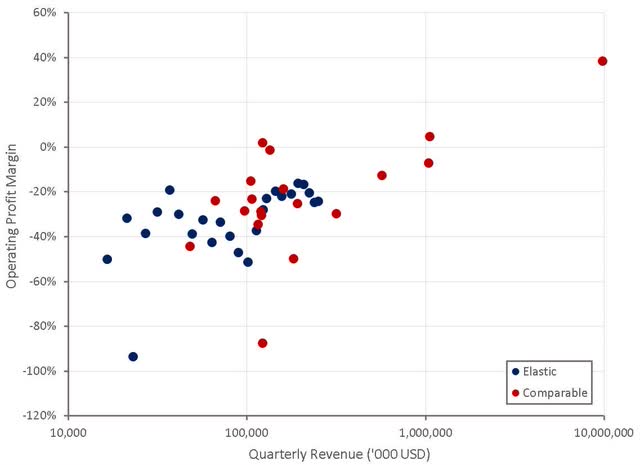

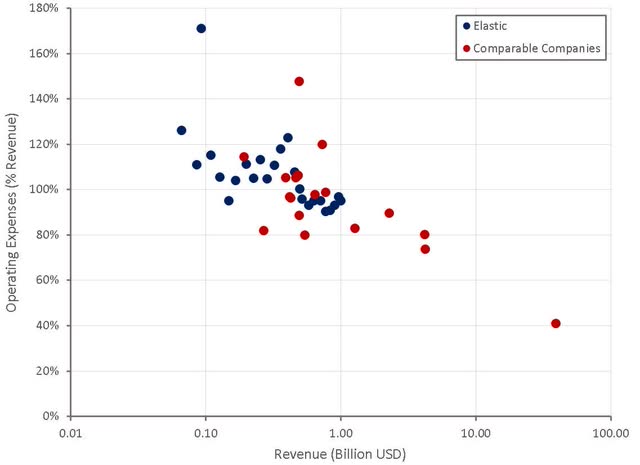

Figure 8: Elastic Operating Profit Margins (source: Created by author using data from company reports) Figure 9: Elastic Operating Expenses (source: Created by author using data from Elastic) Figure 10: Elastic Operating Leverage (source: Created by author using data from company reports)

Elastic hired aggressively through the pandemic to support growth, but this may now be contributing to poor margins, as expected growth is not being realized. Elastic appears to have pulled back hiring in recent months, which may indicate an expectation of weak growth going forward.

Figure 11: Elastic Job Openings (source: Revealera.com)

Valuation

Elastic’s share price has dropped significantly over the past 12 months, but this has been in line with expectations given the rise in interest rates and Elastic’s declining revenue growth. Based on a discounted cash flow analysis I estimate that Elastic’s stock is worth approximately 85 USD per share.

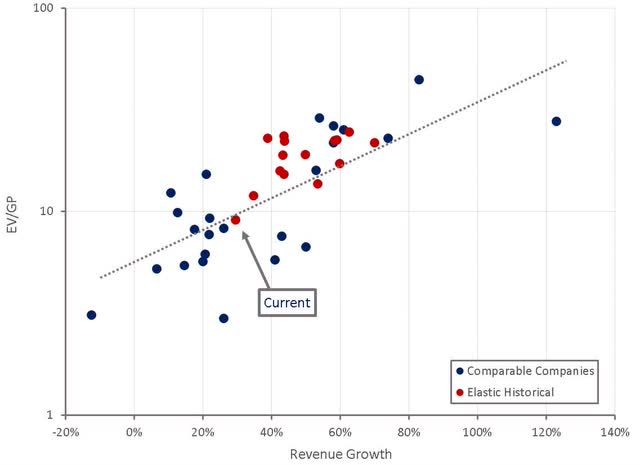

Figure 12: Elastic Relative Valuation (source: Created by author using data from Seeking Alpha)

Conclusion

Elastic’s growth has been declining, and leading indicators point towards further deterioration, although Elastic Cloud remains a bright spot. Most concerning for Elastic is the increase in competition from adjacent verticals which could subsume Elastic’s core business. Elastic’s stock appears relatively inexpensive, but given the company’s lack of profitability and questionable competitive position, there could still be further downside if growth remains weak.

Be the first to comment