rebius/iStock Editorial via Getty Images

For the first time, we are going deeper into the analysis of airline companies. In conjunction, we are publishing easyJet and Ryanair (RYAAY, OTCPK:RYAOF) and we initiate coverage with a buy rating.

More specifically, easyJet (OTCPK: EJTTF, OTCQX:ESYJY) is the second-largest low-cost carrier that operates primarily in Europe thanks to a network focused on first/second positions in primary airports across Western Europe. The company also leases aircraft as well as operates tours and provides financing services. At the end of September, the British low-cost operator operated 927 routes with 308 airplanes. The company was founded in 1995 and it is headquartered in Luton.

Main key highlights

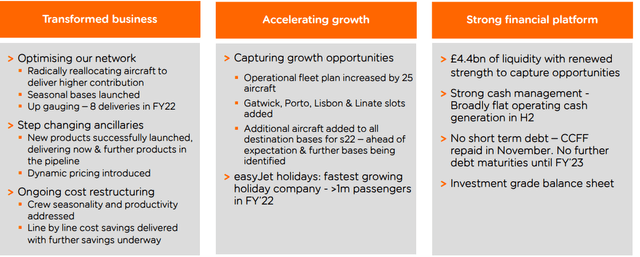

easyJet’s strategy can be summarised by the following:

- easyJet has begun to reallocate aircraft in the bases that contribute most to the company’s margin. We are still not convinced by some decisions, we are positive on the Spanish and Portuguese bases as for the English ones, whereas in Italy it has chosen to retreat again based on Malpensa, a choice that did not favour easyJet last summer. easyJet is an operator with a strong network of primary, secondary, and now also tertiary slots at major airports, which have proven to be among the highest performing on the market.

- We are forecasting strong demand for the summer holidays of 2022 but volumes are likely to still be lower compared to 2019. Having said that, excess capacity in the coming months could weigh on profitability.

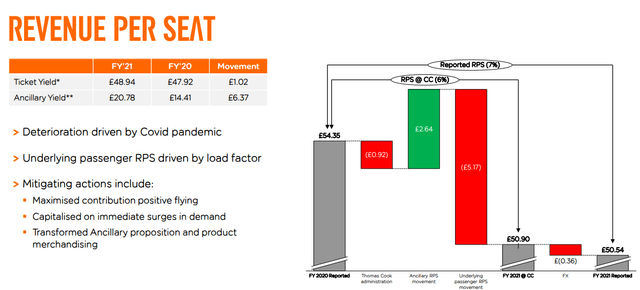

- easyJet recognises that the continued evolution of the product portfolio represents a significant opportunity to increase revenues per seat and margins in the coming years.

- easyJet delivered £512 million in cost savings in FY21, nearly half of which were sustainable. These measures have reduced the overall cost of the crew by addressing structural and productivity challenges with easyJet’s old crew model. They also enabled investment in seasonal bases in Faro and Malaga that opened during the financial year 2021 alongside their existing seasonal base in Palma, continuing to improve efficiency at a lower cost.

Latest Results

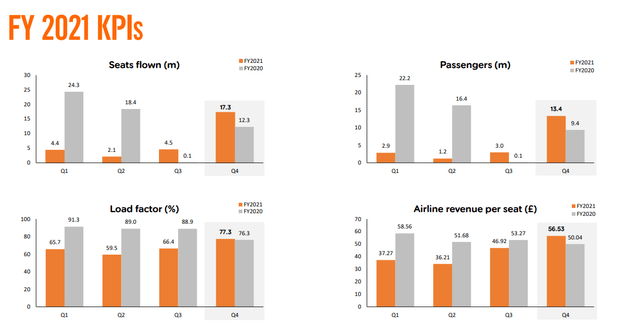

During Q1 easyJet flew at 64% of FY19 capacity, a result broadly in line with management’s indication and a significant increase over the same period of the previous year, in which the airline flew at 18% of FY19 capacity. The load factor was 77% compared to over 80% indicated by the previous comment, this was due to Omicron’s impact on customer confidence and ability to travel during the month of December. Customers have been able to take advantage of easyJet policies that meet their needs, allowing them to rebook on easyJet flights. This will have a positive impact on load factors, revenue and customer loyalty in the future.

Looking at the numbers, total group revenues for the quarter ending in December 2021 saw an increase to £805 million. Passenger revenue increased to £547 million (Q1 FY’21: £ 118 million) and ancillary services revenue increased to £258 million (Q1 FY’21: £ 47 million), mainly afterwards due to the capacity increase. Ancillary revenue per seat was at £14.84 (Q1’21: £10.20) and continues to benefit from easyJet’s hand baggage policy and new leisure bundle fare. Due to the Omicron impact, more backup personnel have been retained to protect operations and minimise any impact on customers caused by higher levels of crew absence. Just to note, easyJet was the European airline with the best punctuality in 2021.

Following the UK government announcement in January to remove Covid tests before departure, easyJet has seen continuous improvement in booking volumes. On January 24, easyJet welcomed the news that the UK will lift all travel restrictions as of February 11 and expects this to continue to have a positive impact on future sales. Since January 5, other countries, including France, have followed the British lead by easing restrictions – a welcome step towards an environment free of travel restrictions across Europe.

Conclusion, valuation and main risks

The fallout from the Omicron variant took airlines by surprise as they were just gaining momentum and hoped for a solid recovery. Also Russia’s invasion of Ukraine was not doing the company any favours. Strong demand is expected in terms of easyJet’s leisure travel flows this summer. easyJet Holidays also continues to strengthen its position as a significant player in the travel industry, with over 50% of the program sold and higher margins than in 2019. On the financial side, easyJet is focusing heavily on seasonal bases that allow it to optimise the network and increase margins as well as efficiency.

Currently, the company trades at a forecast EBITDA of 2023 of 5x versus a historical five-year average of 6x. Aside from the multiple valuations, we value the British operator with a DCF model with the main inputs as follows:

- WACC set at 10%;

- Long-term growth rate at 2.5%;

- Long-term operating profit margin at 8%.

Based on the above parameters, we see potential upside in the company with a target price of 700p. The key risks include higher cash burn, travel demand recovery, new variants, labour inflation, fuel price volatility, and higher competition.

Be the first to comment