neilkendall/iStock Editorial via Getty Images

I’ve written about Eastman Chemical Company (NYSE:EMN) a few times in the past – most notably when COVID-19 pushed this business to well below its typical valuation range. I bought a decent stake, one I then expanded slightly (though unfortunately not as much as I might have liked), until I sold most of it when the company went above 16-17X P/E. I only have a nominal stake left at this time – very small.

However, the time has come to start pushing back into Eastman Chemical. The reason for this is valuation – because the market is now back to discounting quality due to rate, inflation, and recession fears.

I couldn’t be happier – here’s why.

Revisiting Eastman Chemical

As I wrote in my first article on Eastman all the way back in 2020, Eastman Chemical Company is a 100-year-old basic materials company, around since 1920, headquartered in Tennessee, which produces Chemicals, Fibers, and Plastics. The company was spun off from parent company Eastman Kodak (KODK) back in 1994.

The company quite literally manufactures hundreds of various chemical, fiber, and plastic products in a vast variety of markets. Some examples include adhesives, agriculture, coatings, electronics, housewares, energy, food/beverage ingredients, furniture graphics art, hygiene, medical devices and equipment, ophthalmics, packaging, transportation, signs, and pharma.

Much like BASF (OTCQX:BASFY), if an end consumer/industry uses it, it’s like Eastman manufactures some part or resource/feedstock for it. This is a great foundation to stand on, because it, in part, makes the company’s earnings resistant to recessionary pressures. While valuation can certainly bounce up and down, I want to emphasize that the company’s earnings over time have actually stayed extremely stable.

The company has divided its active businesses essentially into 4 segments, which also serve as reportable and operating segments in the company’s financials. These are:

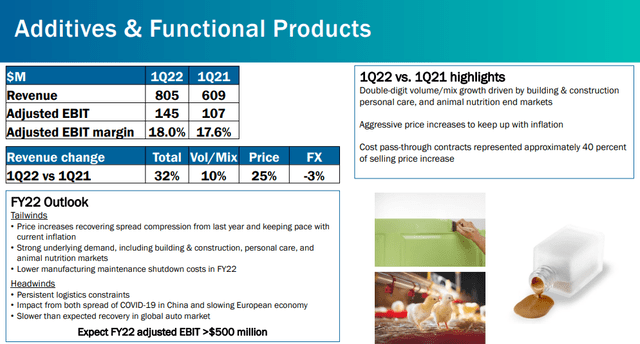

- Additives & Functional Products (AFP), manufacturing adhesive resins and chemicals for transportation, coatings, animal nutrition, tires, construction, health/wellness, and the consumer market.

- Advanced Materials (AM) serves markets in need of cellulose esters, copolyesters, interlayers, and window film for transportation, consumables, and electronics.

- Chemical Intermediates (CI) serve the market with acetyl, olefins, alkylamine streams, and manufacturing for specialty fluids, such as industrial chemicals, construction, medicine, water, fuels, agriculture, and consumables.

- Fibers service the market with proprietary Eastman fibers such as Estron and Estrobond, Chromspun, and other things which are used in cigarette filters, acetate yarns for the clothing industry, furnishings, and industrial fabrics.

In several of these segments, Eastman is either among the market leaders, or its market-leading with a clear volume and market advantage; an example is acetate yarn (fibers), where the company is the largest producer in the world.

In short, Eastman supplies our world with key components for what it needs to drive the current society we’ve constructed – from ingredients in our foods to coatings for our cars, to things for the medical devices and pharmaceuticals which prolong and save our lives.

As I said, a great “starter” position to work from. And results here have been excellent, even when accounting for the slight dip we saw in earnings a few years back in FY20. Since then, it’s been pushing up, and that upward trajectory is expected to continue at a rate of double-digit (10%) growth annually until 2024.

How?

Well, EMN continues to execute very strongly on a commercial basis. Remember, much like peers like BASF, EMN controls the value chain – that means they can set the price they need to get the margins they want – which is exactly what the company has been doing to offset inflation. Despite massive input inflation and rate increases, the company’s EBIT margin on an adjusted basis fell only to 13.5%, with revenue actually increasing, and EPS only dropping by 7 cents YoY.

Demand for the company’s products in durables, construction, medical, animal nutrition and other end markets continued to be high – and the company pushed higher sales prices in all segments to offset a mix of raw material, energy and logistical costs. It’ll be a few more quarters until analysts like myself get a complete picture supported by facts, but the guesstimates we work under now seem to come in pretty accurately. I did expect a 14% EBIT margin, which means that EMN underperformed slightly, but at the same time pressures were much higher than expected.

On a segment-by-segment basis, demand was the continued war cry for the company’s various operations. The common theme here was revenue growth – but declines in volume/mix or costs, while raising prices. This resulted in lower margins and earnings. The $100M financial impact from the Kingsport Steam line incident weighed particularly heavily on Advanced Materials, and discounting for this, the results weren’t actually that bad at all.

Some segments, like Additives/Functional, even saw improved margins on the back of price increases, double-digit volume increases, and the like.

Eastman Presentation (Eastman IR)

The only problem with this, was of course that the company’s upward trajectory was in part due to construction and building. While infrastructure may continue to grow, it’s a foregone conclusion to me at this point that building/housing is going to take a “turn down south”, and that we shouldn’t expect much from this in the coming quarters.

Chemicals and Intermediates also grew margins – both revenues and margins and sales were up significantly, as Russia is basically shut down and the commodity markets are pricing in increased scarcity for some core commodities. There’s a massive, strong underlying demand that seems to continue here, and that should not be underestimated.

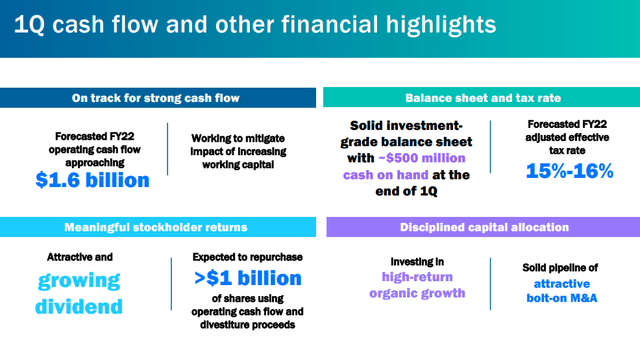

On a fundamental basis, therefore, Eastman did a stellar job. It grew the dividend, generated significant OCF, worked on WC, and is cash-heavy going into this new environment.

The company has also given 2022E guidance – and it’s a meaty one, to be sure. It’s a mix of massive tailwinds from the demand side, pricing actions, cost management, and the like. But the other side of that mix is divested EBIT from discontinued product lines, expected normalizations in Chemical Intermediate spreads, uncertainty from every part of the geopolitical macro spectrum, and slower recovery in automotive.

The company expects EPS of $10 on the high-end FY22, and OCF of $1.6B

This influences the valuation and upside in the following way, including my stance on the company.

Eastman Chemical Valuation

The valuation for Eastman Chemical is now the positive news here – because as of this drop, it’s excellent. It doesn’t yield as much as BASF, which is still my #1 choice in the sector, but it does respectable things nonetheless.

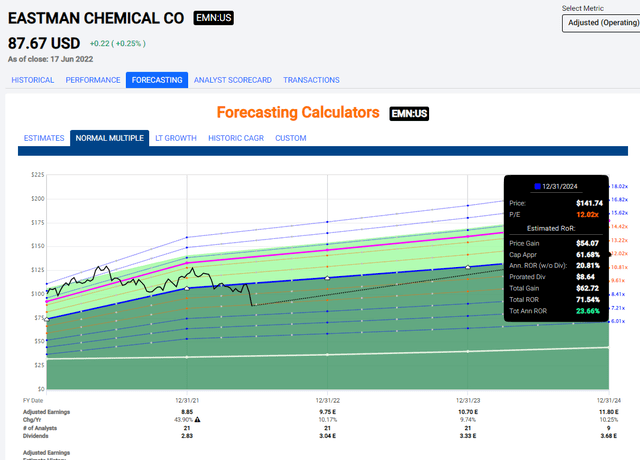

Eastman Chemical is a BBB rated 3.5%-yielding chemical company with very strong growth and dividend stability records. It’s trading at an average weighted P/E of no higher than 9.5X which, both to a FV of 15X and a 10-year average P/E of 11.3X, comes to an undervaluation.

At any time the company traded below 10X, in the long term, the returns would have made you a “winner” next to overall valuation trends.

In this specific scenario, I forecast EMN first by using the 5-year normalized P/E of 12X. Based on a 12X P/E upside in 2024E, and a $9.75 EPS for the fiscal of 2022, we find ourselves looking down the sights of an upside of no less than 23.5% annually, or 71.5% in less than 3 years.

Pretty good, right?

Eastman Upside (F.A.S.T graphs)

Now, that’s the conservative case. In the case of higher premium normalization, which we can see clearly is the case historically, we can find upsides to 14-15X P/E that go into triple digits. On a 15X P/E, that’s 34.3% annually or 111% in less than 3 years, which is of course superb.

Remember, none of these targets or expectations are in any way outlandish or “odd”. These are simply multiples where the company has traded before, and is, as I see it, likely to trade at again.

Can it take a while to happen? Yes, I believe it can. The combination of macro and other factors that are currently pushing the market down can really wreak havoc with short-term returns.

But the argument of “timing” or “waiting” to invest is one I do not follow. It’s impossible for anyone to guarantee when, if, how far or in what way a company may move during a period of time. Because of this, I’ll stick to fundamental and value-oriented investing with a contrarian edge.

I do what others don’t – as long as it’s qualitative.

And with Eastman, this one is a “BUY” at this valuation. I see a 20-35% annual upside here, and I’m back to buying EMN.

Thesis

My stance on EMN is currently the following:

- Eastman Chemical Company remains a very qualitative business with an upside going into the next few years. It also now comes at a superb valuation.

- Based on realistic targets, there is a 20-35%+ upside for the company. I consider this one of the stronger plays in the sector.

- EMN is a “BUY” here, and a good one, as I see it.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Eastman Chemical Company is currently in a position where #1 is possible in my process, through #3 and #4.

Here are my criteria and how the company fulfills them.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Be the first to comment