May Lim/iStock via Getty Images

During turbulent times in the market, the highest quality companies can often be the best place to park your money. This is true even if the company in question is rather expensive relative to similar firms and is pricey on an absolute basis. One business that fits this description that has held up well while the market has declined is EastGroup Properties (NYSE:EGP). Not only has the company fared well from a share price perspective, it has also done well fundamentally, delivering strong top line and bottom line performance. Because of how pricey shares are, I still maintain that this is a ‘hold’ prospect instead of something better. And the company has, so far, borne that out to be the case.

Reassessing A Niche Industrial REIT

The last time I wrote about EastGroup Properties was in an article published in November of 2021. At that time, I lauded the quality of the business, proclaiming that the Sunbelt-focused industrial REIT is a great company from a fundamental perspective. The firm has exhibited attractive performance on both its top and bottom lines over the past several years and it should be stable during even the toughest of times. Having said that, I also said that shares of the company were expensive and that buying into the stock was difficult to justify. Even though the company had a favorable long-term outlook, I could not reconcile myself to rate it a ‘buy’, instead designating it a ‘hold’ opportunity. Since then, the company has performed even better than I anticipated. While the S&P 500 has declined by 4.8%, shares of EastGroup Properties have generated a profit of 0.8%.

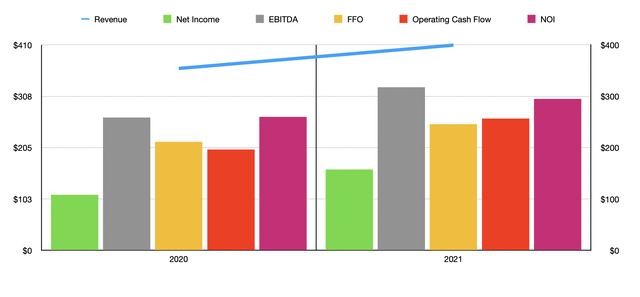

This modest increase during a down market can be chalked up to strong performance by the business. The last time I wrote about the firm, fundamental data only covered through the third quarter of the company’s 2021 fiscal year. Since then, the company has reported data covering the final quarter of the year. And that data, just like data from prior quarters, was awfully bullish. Take, as an example, revenue. Sales for the year came in at $107.4 million. This compared favorably to the $92.7 million generated the same quarter one year earlier. Year over year, that translated to an increase of 15.9%. During this time frame, the company maintained a high occupancy rate of 97.4%. That was modestly better than the 97.3% seen one year earlier. As a result of that final strong quarter, sales for the complete 2021 fiscal year total $409.5 million. That translated to a 12.8% increase over the $363 million generated in all of 2020.

The company has been fueled by a number of developments that have proven to be positive for shareholders. For instance, during its 2021 fiscal year, the company made investments worth hundreds of millions of dollars. For instance, the company began development starts on 2.8 million square feet of property that should result in a total investment of $341 million. It also engaged in property acquisitions of $178 million. This included $45 million worth of property sales. Some of its growth was funded with the issuance of stock, with total issuances totaling $274 million. The company also closed on $175 million worth of debt for the year. The interest rate on that was just 2.40% per annum.

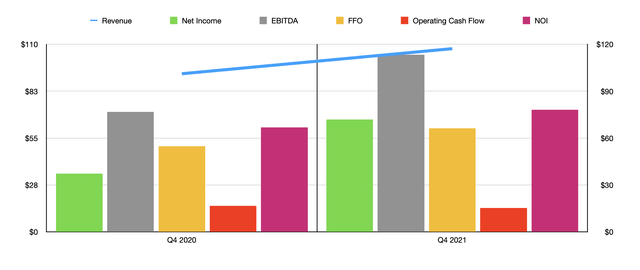

This was not the only area where the company performed well. As an example, we should take a look at FFO, or funds from operations. According to management, this metric totaled $66.2 million in the final quarter of 2021. That’s up from the $54.7 million generated one year earlier. This brought total performance for 2021 up to $245.9 million. That’s 16.2% higher than the $211.6 million generated in 2020. Another important profitability metric to consider is operating cash flow. Unfortunately, this metric did decline in the final quarter, dropping from $16.7 million to $15.3 million. But even with that, the reading for the entirety of 2021 came out to $256.5 million. That stacks up against the $196.3 million reported for 2020. Another metric to consider is NOI, for net operating income. This grew from $66.9 million to $78 million, taking the full year reading from $260.1 million to $295.2 million. And finally, we arrive at EBITDA. According to management, this metric totaled $113.2 million in the final quarter of 2021. That is 47.6% higher than the $76.7 million achieved one year earlier. The total reading for the entirety of the year was $317.8 million. That’s up from the $258.8 million reported for 2020.

For the 2022 fiscal year, management believes that performance will continue for the business. They expect operating properties to boast occupancy rates of between 96.5% and 97.5%. Development starts should be around 2.3 million square feet at a total projected investment of $250 million. though that is down from the 2.8 million square feet at a cost of $341 million that the company reported for 2021. On top of this, the company also has plans for value-added property acquisitions totaling $46 million but will fund some of this with $70 million of asset sales. As a result of its initiatives, the company expects to generate FFO per share of between $6.56 and $6.70. This should translate to FFO of between $272.95 million and $278.78 million. Management did not give any guidance for other profitability metrics. But if we assume that the same kind of growth rate will be seen with those as what we should see with FFO, then investors should anticipate operating cash flow of around $255.9 million, NOI of around $339.1 million, and EBITDA of around $337.5 million.

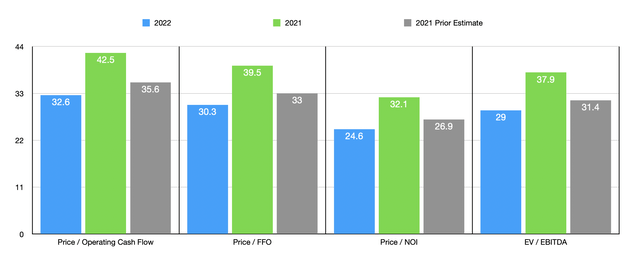

Taking these figures, we can now price the business. Using the 2022 estimates, the company is trading at a price to operating cash flow multiple of 32.6. This compares to the 42.5 reading that we get from 2021 results. The price to FFO multiple should come in at 30.3. That’s down from the 39.5 that we get if we rely on 2021 results. Meanwhile, the price to NOI multiple should drop from 32.1 last year to 24.6 this year. And the EV to EBITDA multiple should decline from 37.9 to 29. If we compare my prior projections for 2021 results to the projections for 2022, the company has actually gotten a bit cheaper. This can be seen in the chart above. To put the pricing of the company into perspective, I decided to compare it with five similar industrial REITs. On a price to operating cash flow basis, these companies ranged from a low of 17.4 to a high of 41.5. Compared to our 2021 results, EastGroup Properties was the most expensive of the group. Meanwhile, the EV to EBITDA range for these firms would be from 11.8 to 27.6. In this case, EastGroup Properties is also the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| EastGroup Properties | 32.6 | 29.0 |

| Innovative Industrial Properties (IIPR) | 23.6 | 26.8 |

| STAG Industrial (STAG) | 19.5 | 18.7 |

| LXP Industrial Trust (LXP)

|

17.4 | 11.8 |

| Prologis (PLD) | 41.5 | 27.6 |

| First Industrial Realty Trust (FR) | 29.9 | 20.9 |

Takeaway

Based on the data provided, I can comfortably say that EastGroup Properties continues to demonstrate itself to be a high-quality company with excellent value creation potential in the long run. Having said that, I do still think shares are incredibly pricey. At the end of the day, my opinion is still that these two things balance one another out, leading me to maintain the company as a ‘hold’ prospect at this time.

Be the first to comment