bjdlzx/E+ via Getty Images

(Note: This article appeared in the newsletter on May 7, 2022, and has been updated with current information as needed.)

Earthstone Energy, Inc. (NYSE:ESTE) has done a lot of acquisitions. In fact, management just announced another large acquisition. They join several companies I follow in buying production because it is much cheaper than growing production and can be less risky for experienced buyers. I have followed this management through the building and sale of several companies through the years. Their experience in building and selling companies is very seldom matched. That makes the recent acquisition binge less risky than it would normally be. But Mr. Market is going to demand evidence that the newly amalgamated company will work as planned. That should be a straightforward exercise for this very experienced management.

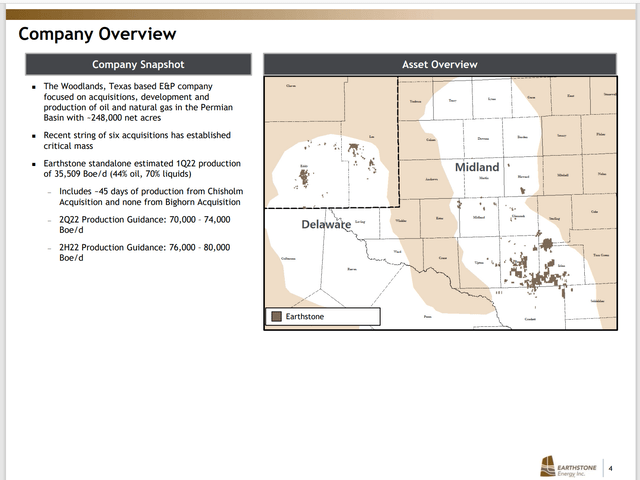

Earthstone Management Second Quarter Production Guidance And Map Of Operating Area (Earthstone Management First Quarter 2022, Investor Conference Call Slides)

It may take some time for some nonrecurring activities to get through the quarterly reports so that quarterly reports solely reflect operating activities. There are obviously some cost savings to be achieved even when the leases held are spread out.

The slide above is not pro forma for the recent acquisition announcement. The big deal on the slide above was the six acquisitions and the guidance (which will now get revised with the latest acquisition). The slide above is now basically limited to the second quarter report in the near future.

Note that this management uses stock in its deals to keep that debt ratio down as it grows. That does mean there is a lot of new stock either ready to sell or to be converted to stock that the owner can sell. That can temporarily hold back the price of the stock until the market adjusts to more shares outstanding.

Clearly, management has what it aimed to get. Therefore, the onus is on management for the acreage to meet profitability goals. Management has four rigs running currently. The latest acquisition is likely to result in a fifth rig as long as commodity prices remain strong. The key will be to see how production performs given the intended operations. In the eyes of the market, meeting guidance for a few quarters will be the first hurdle.

Right now, the common appears priced for a fair amount of trouble. That should limit the downside action should trouble actually occur. However, given that this management has done acquisitions many times in the past, a likely expected reaction will be a significant upward re-evaluation of the enterprise value of the company as management meets goals.

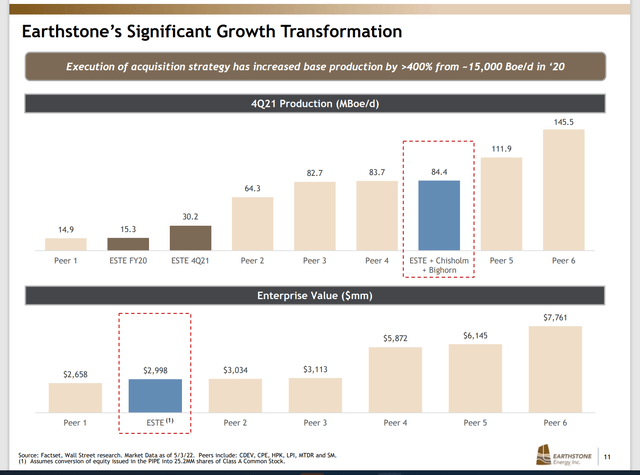

Earthstone Energy Relative Valuation and Production Levels (Earthstone Energy First Quarter Conference Call Slides May 2022)

The key to any slide like this is to remember that the different companies on the slide have different strategies. Ironically, the company with a production mix closest to Earthstone is likely to be Diamondback Energy (FANG). Some companies like Pioneer (PXD) have a higher percentage of oil production so that they will be worth more.

Earthstone is likely to be a bargain. But management gets to choose the comparison. Therefore, it is up to investors to decide the valuation of the company based upon the production, profitability and growth prospects. The investor may come to a different conclusion than what the slide suggests. But the investor could still conclude that this is a bargain.

This management is paying about twice EBITDAX for the latest acquisition. That makes it very easy for management to hedge to protect the first two years of EBITDAX should that prove to be necessary. More importantly, the sales price is decent relative to proved reserves. Those reserves were developed at far more conservative prices than the current market prices. So, there should be a safety cushion for this purchase.

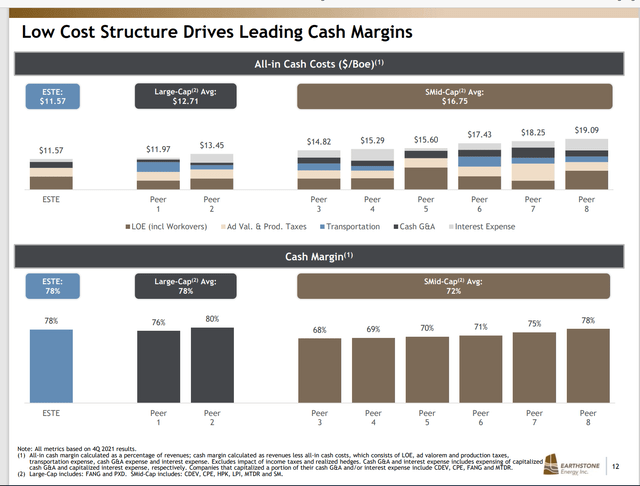

Earthstone Energy Projection Of Costs And Margin Compared To A Selection Of Peers (Earthstone Energy First Quarter 2022, Earnings Conference Call Slides May 2022.)

A similar argument can be made about a margin comparison. Probably the best margin that I ever saw came with the high percentage oil producers. Secondary recovery companies often have excellent margins. But the volumes of secondary recovery operations often restrict overall profitability when compared to capital invested despite the great margins.

Investors need to remember that typical upstream companies are usually the most profitable. After that oil is gone, then secondary recovery is a possibility. But secondary recovery is actually more costly and hence generally less profitable.

So, the investors may have to wait to see what the profitability history is for the combined company. Mr. Market will want proof that the great margin translates into superior profitability. This management has experience doing just that. So, the risk of management not meeting profitability goals is pretty small.

The low-cost structure is probably necessitated by the production mix. The percentage of oil produced is on the low side. It could end up similar to Laredo Petroleum (LPI). Laredo Petroleum has acquired higher oil production leases to raise the company average of oil produced. Earthstone Energy has purchased leases that should have low production costs. But like Laredo Petroleum, a lean management is essential to good quarterly results.

The management costs of Earthstone have so far pointed to a very lean management cost structure. But there is a risk of management costs ballooning skyward should unexpected challenges arise. This is another area where Mr. Market will be watching for good controls remaining in place in the future.

The main strategy of just about any company I follow that is growing significantly by acquisition is to find bargains. That generally implies that the acreage is not top-notch prime acreage (or if it is great acreage, the holding is too small for adequate cost savings). Managements like this one will piece together subpar holding so that the combined acquisitions are more profitable as one entity than were the pieces.

These managements usually produce superior results by increasing profitability of the purchases both through bolt-on acquisitions and economies of scale. That is then combined with very efficient operations.

The thing to remember is that acquirers do not want trouble or challenges. They want a bargain with as few problems as possible. So, a management like this aims to present the company as extremely well run with nothing but good news to maximize the selling price.

This is also why companies like this tend to pursue a low financial leverage strategy. High debt tends to tie up cash flow that can otherwise be used to improve operations and profit maximization activities. The result is that highly leveraged firms tend to fall behind their peers in terms of cost control because they do not have the money to keep up throughout the business cycle.

It also implies that any leveraged firm needs to deleverage very fast to avoid an industry downturn with a mountain of debt servicing and debt due. In this case, management has an available bank line and has been using a combination of stock and debt to keep the financial leverage low while meeting an accretive acquisition goal. The two classes of stock likely exist for tax reasons. Management can offer potential sellers a way to delay tax payments through the company structure.

The Future

The upcoming quarters likely will have a fair number of nonrecurring charges. It would not be unusual for management to take two to four quarters to fully consolidate all the latest purchases. Management guidance and earnings analysis will be critical to the market over the next few months as earnings reports “clean up.”

Management has an excellent track record of building and selling companies. The interesting thing is that shareholders can still invest alongside the original investors at a lower price than the original investors paid years ago. That is largely due to the challenges of the last five years. The future should be far more reasonable than has been these past few years. Therefore, the chances of investors earning above-average returns with a very experienced management that will grow this company are excellent. The risk of principal loss is very low due to the low financial leverage and the considerable management experience.

Be the first to comment