Investment Thesis

Since joining the Nasdaq in 2005 Dynavax (DVAX) has proved to be a considerable disappointment for its long-term investors. The company – which is focused on developing and commercializing novel vaccines using its proprietary Toll-like receptor (“TLR”) stimulating technology – has endured a series of failed trials / approvals, cash flow and debt problems, questionable management decisions, and the regular abandonment of once-promising vaccine development programs – usually as a result of one of the first three issues.

Dynavax share price performance vs. S&P 500. Source: TradingView

Dynavax shares have lost 83% of their value since September 2015, falling from a price of $31 to just $3.3 at the time of posting this update. The company lost its CEO of 6-years Eddie Gray in May last year when, as part of a wider restructuring program that saw 38% of Dynavax’s staff leave and the company effectively closed down its immuno-oncology R&D program, he decided to retire. Chief Scientific Officer Robert Coffman Ph.D. also left in October 2019.

As such new investors could be forgiven for dismissing Dynavax out of hand whilst existing ones may be tempted to write off their losses, but that would be to overlook the fact that Dynavax may be – more by accident than design it could be argued – in the best place it has been for some time.

How so? Before Dynavax finally had Heplisav-B approved the company – as far as I am aware – had not come close to securing any kind of approval for its treatments. Heplisav-B was rejected twice by the FDA on safety concerns before securing approval in November 2017, with the second rejection causing Dynavax’s share price to fall from $11 to $3.5, and prompting the company to invest heavily in its immuno-oncology assets – notably TLR9 agonist SD-101 – as a hedge against the likely write-off of Heplisav-B.

No sooner had Heplisav-B been approved however, Dynavax decided to undergo a company restructuring, dismantling its immuno-oncology team (after SD-101 disappointed in a combination trial alongside Keytruda and a second candidate, DV281, also failed to generate positive data when trialed in combination with Bristol-Myers Squibb’s (BMY) Opdivo) and oust its CEO and CSO. This is a good example of how muddled the thinking at the company must have been, and how desperate management must have been to make the market believe that it was working on something big rather than heading for a costly disaster.

But the upshot of all this upheaval is that Dynavax is now a slimmed down company in a better position financially having got rid of staff and an unpopular CEO earning close to $5m per annum (some investors believed that Gray was milking Dynavax for all it was worth), and an entity with a fully commercialized drug with a year of reasonable sales revenues behind it.

Clinical evidence suggests that Heplisav-B could turn out to be a best-in-class vaccine for Hepatitis B (“HPV”), owing to its superior efficacy data and comparable safety performance to current standards of care such as GlaxoSmithKline’s (GSK) Engerix-B, one of a stable of GSK HPV vaccines that earned the company in excess of $800m in 2016.

Dynavax’s new management team of long-time employees Ryan Spencer, CEO, and David Novack, President and COO, are targeting $55-62m of Heplisav-B sales in 2020, but long term, believe the market opportunity could be worth ~$750m, and analysts are in general agreement, suggesting before launch that the vaccine could deliver peak sales somewhere between $600 – $750 million over time (although a more reasonable estimate may be the $290m figure suggested by RBC in July 2017).

The crux of the matter is that, in order to stay solvent (Dynavax has $175m of debt paying a 10.2% effective interest rate, and due in 2023) Dynavax’s new and experienced management team will have to find a way to deliver a substantial spike in sales revenues of Heplisav-B, in the face of significant competition from far superior resourced big-pharma, whilst also completing a mandatory safety follow-up requested by the FDA, pushing for authorization outside of the US, and progressing new treatments such as a Pertussis vaccine, that uses adjuvant CpG 1018, to provide a sense of long-term continuity.

That is not going to be easy by any stretch but it will certainly be an interesting challenge for the new management team, and, given Dynavax shares can hardly sink much lower, if the company gets off to a good start and delivers strong sales data in its next set of results, even a small sign of progress could significantly move the share price needle.

That may well be enough hope to keep existing investors from dumping the last of their stock, but is it sufficient reason to take a position in the perennially beleaguered Dynavax? I believe it could be since I believe that, if one vaccine demonstrates clear superiority to another, it is likely to become the new standard of care treatment.

It’s too early to make that call on behalf of Heplisav-B but a strong year in 2020 will go a long way towards ensuring a healthier future for Dynavax and its investors, whether the company decides to continue to go it alone, or looks for a sale to a better-resourced company that can potentially give Heplisav-B the platform it deserves.

COVID-19 partnerships

Before I discuss Dynavax and Heplisav-B in more detail I will briefly discuss the COVID-19 news that has given the company’s share price a small boost in recent weeks. The first deal was signed with Coalition for Epidemic Preparedness Innovations (“CEPI”) in late March to develop a vaccine for COVID-19 using Dynavax adjuvant CpG 1018. Another agreement was established with Sinovac Biotech (NASDAQ:SVA) mid-April, again with Dynavax supplying its novel adjuvant. On April 22nd, the company made a third collaboration deal with Valneva, a biotech based in France, to combine Valneva’s vaccine against Japanese encephalitis with CpG 1018.

Dynavax has not disclosed the financial terms of the deals, and the news of the partnerships only makes the final 3 bullet points of the company’s COVID-19 update on its website, hence, although it is admirable that Dynavax is actively participating in the search for a coronavirus cure, there is little evidence (so far) that serious progress has been made.

Equally, although the news pushed up pre-market share price expectations, the actual gains have been relatively small. Still, this ought to be a vaccine developer’s time to shine, and hope springs eternal. When considering whether to make an investment in Dynavax, I would say that the deals are immaterial, albeit a good sign that the company has confidence in its vaccine and is prepared to collaborate to push its case.

Company Overview

Dynavax – for the purposes of this article I am going to discuss the company in its current incarnation (per the company’s 2019 10K submission) and ignore what has taken place before – is focused on developing and commercializing novel vaccines using its proprietary and unique novel adjuvant 1018.

Many vaccines use antigens to generate an immune response against the required pathogen, bacteria, or virus, but often antigens are not sufficiently immunogenic and require additional components, known as adjuvants, to enhance the immunogenicity of vaccine antigens. Heplisav-B, like most of the vaccines it competes against uses recombinant hepatitis B surface antigen (“HBsAg”) to elicit the required immune response. Unlike its competitors, however, who use aluminium as their adjuvant, Heplisav-B uses the company’s proprietary Toll-like receptor TLR9 agonist adjuvant 1018.

TLR9 agonists like 1018 are able to stimulate a particular subset of TLRs that have evolved to recognize bacterial and viral nucleic acids, enabling the release of cytokines necessary for T-cell activation and generating T-Helper 1 cells (“Th1”) that help to ensure longer-lasting effects.

Heplisav-B is manufactured in Germany, and Dynavax owns the exclusive global commercial rights to the vaccine, whose chief competitors are Engerix-B and Twinrix® from GlaxoSmithKline plc and Recombivax-HB® from Merck & Co. (MRK). The company sells the vaccine to third party wholesalers and distributors whose customers include hospitals, private and public health clinics, prisons, retail pharmacies and government agencies such as the Departments of Defense and Veterans Affairs.

Some 850,000 Americans have the Hepatitis B virus which causes ~5,500 deaths each year (data from Dynavax corporate presentation) and is 50 to 100 times more infectious than HIV. HPV comes in 2 forms – acute, which is short term, and often leads to chronic Hepatitis B which is a long-term affliction with no known cure, but one that can be treated using regular vaccines. Hepatitis B is spread via the exchange of bodily fluids, and it is estimated 21,000 new infections occur each year in the US. Dynavax estimates its addressable market at ~$400m annually growing to $700m on, the company says, “expanding adult immunization and coverage rates, increased second dose compliance, price increases and expansion of use in persons with diabetes.”

Outside of the US, Dynavax has had a Marketing Authorization Application (“MAA”) accepted by the European Medicines Agency and plans to explore further territories, including China, potentially via a collaboration with a third party company or sales agent.

Rejected twice, now best-in-class – can Heplisav-B Rescue Dynavax?

How much difference does the Dynavax proprietary adjuvant make? Phase 3 trials of the vaccine demonstrated that Heplisav-B provided significantly higher rates of protection than Engerix-B at every time point during the trial.

Results from trials of Heplisav-B vs. Engerix-B showing Heplisav-B outperformance. Source: Dynavax corporate presentation.

Results from trials of Heplisav-B vs. Engerix-B showing Heplisav-B outperformance. Source: Dynavax corporate presentation.

Although safety issues plagued Heplisav-B for some time, with 10,000 patients now tested the safety profile of the vaccine was finally considered favorable enough by the FDA, who had rejected Heplisav-B in 2013, owing to adverse autoimmune events, and again in 2016, this time on concerns about an imbalance in cardiac events on different sides of the trial.

What is most exciting about Heplisav-B is the fact that unlike current treatments the vaccine can be effectively administered in a 2-dose-in-1-month regime as opposed to competing vaccines which require 3 doses over 6 months. Dynavax says that up to 75% of adults fail to complete 3 dose series, and that around 20% – 30% of patients fail to achieve protective immunity after completion of the legacy dose product.

It certainly seems possible that a 2-dose-in-1-month regime would be preferable for patients, clinics, and physicians and will help to improve compliance rates. Dynavax say that Heplisav-B is the first new HPV vaccine in 25 years – perhaps this is down to the monopolistic hold on the market by big pharma – a hegemony that Dynavax will have to break to succeed – but the vaccine also has another major advantage over the current competition.

During trials, Heplisav-B also demonstrated higher rates of protection in diabetics – a market that Dynavax believes it can capitalize upon. The vaccine showed a 90% rate of peak seroprotection vs. Engerix-B’s 65.1% when focused on diabetes mellitus patients.

U.S. Adult Hepatitis B Vaccine Market Opportunity Based on Heplisav-B Regimen and Price. Source: Dynavax corporate presentation.

U.S. Adult Hepatitis B Vaccine Market Opportunity Based on Heplisav-B Regimen and Price. Source: Dynavax corporate presentation.

As we can see from the company’s own market forecasts, Dynavax management believe that treating diabetes patients can add >$200m to Heplisav-B’s addressable market. The Centers for Disease Control (“CDC”) has recommended use of vaccines in diabetes patients who have an increased risk or severity of disease due to chronic conditions and it will doubtless be an area of focus for Dynavax as they attempt to squeeze every last sale out of Heplisav-B, since the future of the company depends on earning enough revenues to pay down its onerous debt burden.

Dynavax believes it has the commercial team in place to make a dent in rivals’ market share with Heplisav-B, having brought a contracted field sales team (of nearly 60) in-house in 2019 that management feels is highly experienced and capable of covering 70% of the vaccine’s target market.

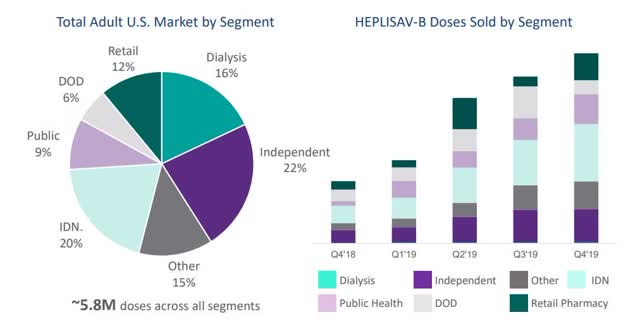

Heplisav-B adult US market and doses sold by segment. Source: Dynavax corporate presentation.

Heplisav-B adult US market and doses sold by segment. Source: Dynavax corporate presentation.

Sales of Heplisav-B got off to an unremarkable start as the vaccine made <$6m in sales in Q119 but began to pick up and pulled in a quite reasonable $34.6m for the full year 2019. That won’t be enough long term to save Dynavax’s blushes however, as the company’s SG&A costs in 2019 came in at $75m, R&D at $62m, and total contractual obligations stand at $266m between now and 2025. Dynavax hopes to sell between $55 – $62m of Heplisav-B in 2020 but even that may not prove sufficient to balance the books.

A lesson that management must learn quickly is that whilst it is great to have developed a potentially best-in-class drug, if it does not make economic sense for a company to produce and market that drug, then problems will inevitably ensue, although it does, enticingly, bring the prospect of an acquisition into play.

Conclusion – few companies in Dynavax’s current position succeed but chances are better than the market has priced them, in my view

When I first began to look into Dynavax my first impression was of a company facing extinction, however I am a big believer that when it comes to treating diseases, the treatment with the best efficacy and safety data will ultimately prevail.

If only it were so simple for Dynavax, but with such an inexperienced management team (who admit in the latest company 10K that they have no experience either of successfully commercializing a drug or even of managing an in-house sales team) it is going to be a long, hard, slog.

A best case scenario would be one where Heplisav-B makes sales of >$400m, say (at the higher end of expectations) and the company successfully brings down R&D and SG&A costs to make itself profitable, but this assumes that the likes of Merck & Co., GlaxoSmithKline et al are unable to bring a suitably competitive vaccine to market, that Dynavax’s sales team over-deliver, and that the diabetes market comes into play at the earliest available opportunity, and that there is no pricing war.

It has been said before in previous coverage of Dynavax that the company’s best bet is to throw everything at Heplisav-B, hope that the vaccine delivers on its promise to become best-in-class, push physicians to make it a standard-of-care treatment, and grab enough market share to keep the company afloat whilst rapidly developing its next candidate.

If Dynavax does pose a genuine threat to the sales of Engerix-B, Twinrix, and Recombivax-HB in 2020, and is also able to resist the threat of newcomers such as VBI Vaccines (NASDAQ:VBIV) hepatitis B vaccine Sci-B-Vac, currently in phase 3 trials, then it seems possible that an acquisition by a big pharma could be on the cards for Dynavax. A deal would surely make sense to both parties – the pharma gets a best-in-class vaccine, whilst Dynavax delivers for shareholders and gets the commercial support it is likely to need going forward.

Ultimately, it may come down to the size of, and how much a company will pay for the competitive advantage that TLR9 agonist adjuvant 1018 brings to the table over other vaccine treatments, past, present and future. With its financial woes and depressed share price Dynavax would surely accept any deal that allows them to walk away with heads held high, but against that, any potential acquirer knows that it is in their interests for Heplisav-B to fail commercially as it will drop the asking price significantly.

Still, the efficacy data is undeniable and may give Dynavax the bargaining chip they need to make a reasonable deal, or – if it is good enough – keep the company independent and moving towards profitability. How long Heplisav-B remains the most efficacious treatment on the market will be critical since the vaccine will be all but worthless if it can no longer compete on efficacy.

As such, as I said in my intro, Dynavax at the present time should really only be of interest to investors looking for a long shot that the market may have mispriced. I do believe the promise of Dynavax’s proprietary technology is worth more than $3.5, and if the next set of financial results show that sales are up significantly year-on-year, then we can expect the share price to jump.

I came across a company in a similar position to Dynavax when I recently covered Portola (NASDAQ:PTLA), a biotech developing a blood thinner antidote, Andexxa. In Portola’s case, a new management team was in place attempting to clean up the mistakes made by their predecessors, the drug had potentially a best-in-class efficacy data, but there were question marks over whether management could realistically go it alone.

I was bearish about Portola (and have been proven right so far) but in Dynavax’s case, although it is, most likely, an equally risky investment, I feel the safety and efficacy data is superior to where Portola were with Andexxa, and Portola’s shares were (at $24) and are (at $7) significantly more expensive. As such, I feel tempted to buy Dynavax at the current price point. On the other hand, buying a stock simply because it is cheap is a bad strategy – you still lose if it loses, which it is statistically very likely to do. A detail from Dynavax’s annual report is instructive – the company’s accumulated deficit is $1.2bn.

Which side will I fall on? Ultimately, if you have room for a risky stock in your portfolio, Dynavax may be the “best” “bad” stock to buy. I foresee share price growth or an acquisition as more likely than complete collapse at this time. But I may end up looking like a fool as Portola gains and Dynavax loses! I will keep researching both companies and hope to update again soon.

Disclosure: I am/we are long MRK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment