lyash01/iStock via Getty Images

Investment thesis

Last year, I wrote 41 articles with buy recommendations, yes I am an optimist by nature, and only 3 hold recommendations.

There was only 1 sell recommendation. That was on Dynagas LNG Partners (DLNG).

Over the years, and especially during the period when Russia annexed Crimea in March of 2014 and sanctions were imposed, I did warn investors of the potential risks for DLNG with such a high concentration of business with one customer.

What has happened over the last two weeks is terrible on a human scale and one which is considerably worse than the illegal annexation of Crimea.

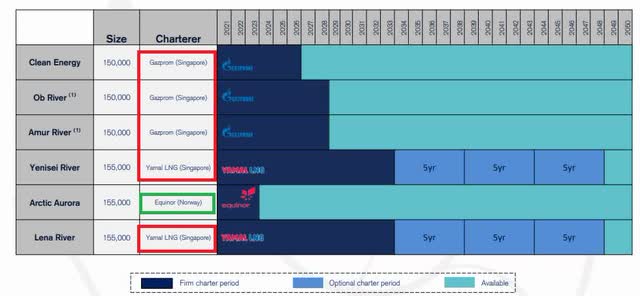

Unfortunately for DLNG, they have as much as 83% of their fleet depending on Russian customers.

DLNG – Customer Profile (DLNG Q3 2021 Presentation slides)

What we do know

BIMCO has issued general guidance in relation to shipping involving Russia/Ukraine and Russian interests. The situation is, as they state, developing rapidly. Members of BIMCO have been told to do their own due diligence and legal checks as well as consult their underwriters and legal advisors.

I am sure DLNG is seeking legal advice at this moment.

The US and other Western governments announced that select Russian banks will be removed from the SWIFT payments system – something which will cripple their businesses.

Equally, if not more, important is that every day we hear of companies that want to disassociate themselves, and basically stop doing business, with Russia. The list is getting longer by the day and includes many of the Fortune 500 companies with Shell (NYSE:SHEL) being the largest on that list.

Despite all this, DLNG is trading down just 2.78% over the last month.

DLNG share down less than 3% in 1 month (Seeking Alpha)

However, the Preferred share DLNG.PA has taken a much bigger beating.

DLNG Preferred share (Seeking Alpha)

What we do not know

Tracking movements of DLNG fleet, it seems evident that most of the LNG cargoes that DLNG carries are exported from Russia to customers in Asia.

Some are loaded from the Arctic region, but some are also loaded out of Sakhalin Island in the Pacific. These have short-haul voyages to reach Japan, South Korea, and Taiwan.

The terminal in Sakhalin was developed jointly by Gazprom (OTCPK:OGZPY), which is DLNG’s main customer, plus Shell, Mitsui (OTCPK:MITSY) and Mitsubishi (OTCPK:MSBHF). This gas is predominantly used for power generation. We have already heard the news, as quoted by Reuters that no buyers were willing to buy crude oil from Russia, even at discounted prices. There are also very few shipowners who want to carry such cargoes, as this could potentially severely limit future ports the ship can call.

We do not know if Mitsui, Mitsubishi, KEPCO in Korea, and Taiwan Power Company will join the West in solidarity against Russia. Taiwan is probably the most likely, as they should be the keenest on seeking some protection against other large countries’ “land grab”.

In any event, this is a serious risk for DLNG.

The huge drop in the preferred share is indicative of this. However, I think the risk is higher than what the market is pricing in at the moment.

All time-charter parties that I have concluded during my time in the shipping industry have had a war cancellation clause.

It is a standard clause that allows both the shipowner and the charterer to effectively cancel the charter party if the country in which they are located is engaged in a war, regardless of whether the ships go to a war zone area or not.

Quite a few charter parties over the years which were fixed on rates way above or below market rates were canceled as a result of this. It can be just out of convenience, or as an act of force majeure.

I am not saying that Gazprom will do so, but it is possible. Therefore, we do not know if the charters will still be valid or canceled. The longer the war in Ukraine goes on, the higher the risk becomes.

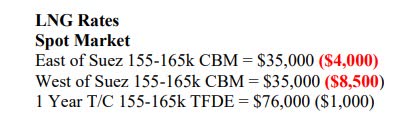

Other charterers can be found. The spot market for LNG carriers has come down significantly.

Fearnleys Weekly Report – 3 March 2022 (Fearnleys Research)

But that could change as we can see it is starting to move up, with weekly increases of USD 4,000/day in the Atlantic and USD 8,500/day improvements in the Pacific.

Conclusion

When I wrote my lonely sell recommendation last year, it had nothing to do with the war Russia has started with Ukraine.

It was based on the fact that I believed that the common shares which I held had very little upside potential. By the time they will be allowed to start paying a dividend on those shares, DLNG will in my opinion most likely use excess cash to do drop down from their sponsor Dynagas Ltd. and perhaps pay just an insignificant amount just to prove they have reinstated a dividend.

With this article, I consider that the present risk of deterioration to their profit and loss outweighs any potential rewards.

It is still a sell.

Be the first to comment