Farknot_Architect/iStock via Getty Images

Article Thesis

Coffee stores have been a major growth market in recent years, and the recovery from the pandemic and a “going back out” attitude could be positives for companies such as Starbucks Corporation (NASDAQ:SBUX) and Dutch Bros Inc. (NYSE:BROS). In this article, we’ll pit the two companies against each other to see which is the more suitable pick for different types of investors.

Are Dutch Bros And Starbucks Direct Competitors?

Starbucks is an internationally active coffee store company that has vast exposure to the US and Chinese market, but it operates in many additional countries on top of that. Dutch Bros is, by comparison, much smaller, operating around 600 coffee stores in the US without a meaningful international footprint. In the US, the two companies compete directly, but Starbucks is not competing with Dutch Bros in international markets. When we focus on the US, we can thus say that the two are direct competitors — or, from Dutch Bros’ perspective, the two companies compete in the markets Dutch Bros is active in.

BROS And SBUX Key Metrics

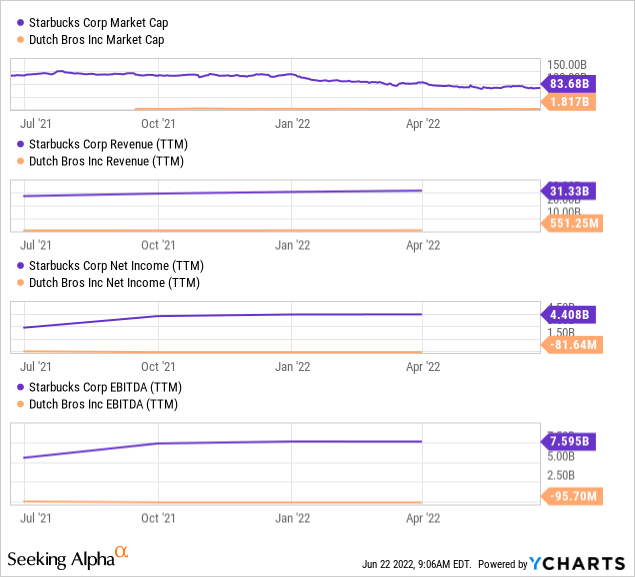

Due to Starbucks operating many times more stores than Dutch Bros, it’s not really surprising to see Starbucks being the more valuable and more profitable company.

Starbucks is valued at more than 40x Dutch Bros’ market capitalization, and generates revenue that is more than 50x higher. Dutch Bros has not generated positive net profit or EBITDA over the last four quarters, but it is expected that Dutch Bros will generate a small net profit this year. Starbucks, by comparison, generates billions of dollars in net profit per year, meaning their level of profitability is basically not comparable. Based on forecasted EBITDA for the current year, using the consensus estimate as reported by YCharts, Starbucks will generate 70x as much EBITDA as Dutch Bros in 2022.

When we consider the much smaller store footprint of Dutch Bros, the numbers are different, however. With 570 stores, Dutch Bros generated revenue of around $3.2 million per store over the last year. Starbucks, meanwhile, generated revenue of around $2.5 million per store over the last year. On a revenue-per-store basis, Dutch Bros is thus more productive. This comparison is impacted by the fact that Dutch Bros is only active in the US, however. Starbucks, with some exposure to lower-income countries where store productivity in absolute dollars is naturally lower, has a lower company-wide average. But since stores in lower-income countries also have lower expenses (e.g. wages), on average, the lower revenue generation does not necessarily mean that profit contribution is worse. In fact, Starbucks’ massively higher profits showcase that revenue generation alone isn’t everything. Of course, Starbucks is also able to distribute its overhead expenses over a wider number of stores, thereby having lower per-store overhead cost, which helps its profitability. Another factor that impacts the per-store revenue comparison is that Starbucks and Dutch Bros do not have the same ratio of licensed and owned stores. Starbucks, for example, had a 50%/50% mix between these two for the stores it opened in the most recent quarter. Dutch Bros is currently guiding for at least 80% company-operated stores among those that will open this year.

One important metric to look at for restaurants and related retailers is the same-store sales growth rate. Growing sales at existing stores is key in improving profitability over time, as per-store expenses (e.g. rent) mostly do not change meaningfully over time. Growing revenue and therefore gross profit per store helps grow profitability over time thanks to the impact of fixed cost digression/operating leverage. Looking at the same store sales performance of the two companies, we see the following: During the most recent quarter, its fiscal Q2, Starbucks grew its same-store sales by an attractive 7% globally. This does already factor in the headwinds in China stemming from Shanghai lockdowns. In the US, which is a subset that is more comparable to Dutch Bros’ results, Starbucks generated great same-store sales growth of 12% in Q2. Dutch Bros, meanwhile, generated system-wide same-store sales growth of 6% during its most recent quarter. That’s still far from bad, but only half as much as the growth Starbucks generated in its home market. It looks like Starbucks is, at least for now, better at driving same-store sales growth through price increases and traffic growth.

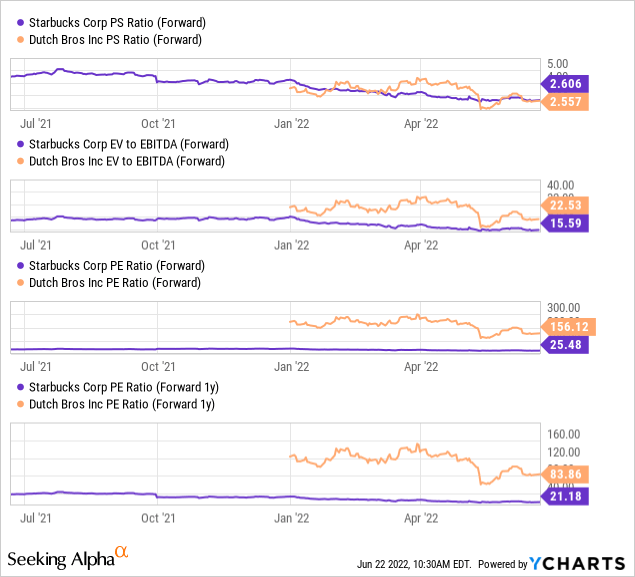

Looking at valuation, there are vast differences between Starbucks and Dutch Bros.

In the above chart, we see the sales multiple, EV/EBITDA ratio, and 2022 and 2023 earnings multiples for Starbucks and Dutch Bros. On a sales basis, both companies are trading at a very comparable valuation today. But when we look at earnings multiples, Dutch Bros is massively more expensive. When we look at the EV/EBITDA ratio, the premium over Starbucks is around 50%, while the premium on the more meaningful net profit multiple is even higher. Based on estimates for 2022, Starbucks offers an earnings yield of 4% at current prices, versus an earnings yield of just 0.6% from Dutch Bros. Looking beyond 2022, to 2023, Starbucks offers an earnings yield of around 5% while Dutch Bros is trading with a forecasted 1.2% earnings yield.

To some degree, Dutch Bros’ higher valuation makes sense. The company is smaller and has more room to grow going forward, and new store openings allow it to grow at a faster relative rate versus how Starbucks is growing. But Dutch Bros has had significant issues with profitability in the past, and it trades at a very high earnings multiple on a forward basis. Profits are what count for investors, and Starbucks is looking way better on that front.

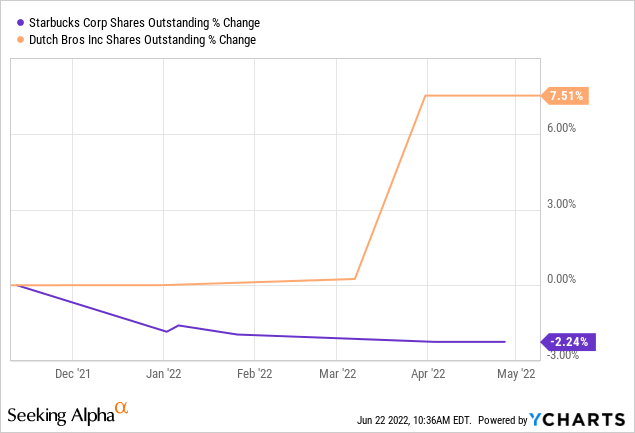

Starbucks’ better profitability is also why the company is able to pay significant shareholder returns, unlike Dutch Bros. Over the last four quarter, Starbucks generated free cash flows of around $4 billion, whereas Dutch Bros burned close to $100 million in cash. The stronger cash flow picture, even after accounting for growth spending, is why Starbucks is able to pay a dividend that yields 2.7% while continuously buying back shares:

Over a little less than a year, Dutch Bros has seen its share count climb by 8%, while Starbucks has bought back more than 2% of its shares in the same time frame. Dilution at Dutch Bros will hopefully slow down over time, but at least for now, it is an issue. If analysts are right, investors get a 0.6% earnings yield this year, while the current pace of share dilution is more than 10x as high. Starbucks, on the other hand, has created significant shareholder value in the past by reducing its share count over time, thereby increasing each share’s portion of the company.

What Is The Future Outlook For BROS And SBUX Stock?

Both companies should benefit from reopening measures and from a “going out” attitude among consumers that have been locked down during the pandemic. But from the most recent quarterly results, it looks like Starbucks is better at capturing that momentum, showcased by its significantly stronger same store sales performance. BROS will continue to open new stores at a strong relative pace, which should allow for compelling revenue growth. With increasing size, overhead costs as a percentage of revenue should decline, which is why profitability will hopefully improve. But at the same time, dilution is an issue, and the valuation is pretty high. The market currently isn’t keen of expensive growth stocks, which could remain an issue for Dutch Bros.

Starbucks will not deliver as much revenue growth, but offers more consistent profitability, a way more appealing valuation, and compelling shareholder returns through dividends and buybacks.

Is SBUX Or Bros Stock A Better Buy?

Investors focused on growth names may favor Dutch Bros, but I personally think that Starbucks is the better investment among these two. It has proven itself both in past recessions and also when it comes to the company’s ability to scale up in the US and internationally. SBUX is trading at a way more reasonable valuation, has shareholder-friendly management, and profitability is strong and will remain strong. The fact that SBUX offers a dividend that is almost twice as high as that of the broad market is another positive that makes me favor Starbucks over Dutch Bros.

Be the first to comment